ASE Technology Holding Bundle

Who Really Owns ASE Technology Holding Company?

Ever wondered who truly steers the ship at one of the world's leading semiconductor giants? Understanding the ASE Technology Holding SWOT Analysis is crucial in this complex landscape. Unraveling the ASE ownership structure reveals insights into its strategic direction and market influence. This exploration is essential for anyone seeking to understand the dynamics of the semiconductor industry.

Founded in 1984 by Jason Chang and Richard Chang as Advanced Semiconductor Engineering, ASE Technology Holding Company has grown into a global powerhouse. The 2018 consolidation with Siliconware Precision Industries Co., Ltd. (SPIL) marked a pivotal moment, creating the world's largest outsourced semiconductor assembly and test (OSAT) provider. As of April 1, 2025, with a market capitalization of approximately US$19.55 billion, the company's ASE stock performance and ownership structure are key indicators of its future trajectory, especially considering its relationship with companies like Taiwan Semiconductor Manufacturing Company (TSMC).

Who Founded ASE Technology Holding?

The foundation of ASE Technology Holding Company (ASE) traces back to 1984. It was established by brothers Jason Chang and Richard Chang in Kaohsiung, Taiwan. Their vision was to create a leading entity in the semiconductor industry, specifically focusing on assembly and test services.

While the initial equity distribution among the founders is not publicly detailed, Jason Chang's continued role as chairman and his inclusion on Forbes' 2024 list of billionaires underscore his significant and enduring stake in the company. The Chang family, as a whole, retains substantial ownership within ASE's structure, reflecting their long-term commitment to the business.

The early days of Advanced Semiconductor Engineering, Inc., the precursor to ASE, saw it quickly establish itself as a key player in the outsourced semiconductor assembly and test (OSAT) market. This strategic positioning was crucial for its future growth and influence within the semiconductor industry.

ASE Technology Holding Company was founded in 1984.

The company was founded by brothers Jason Chang and Richard Chang.

The initial focus was on outsourced semiconductor assembly and test (OSAT) services.

ASE listed on the Taiwan Stock Exchange (TWSE) and the New York Stock Exchange (NYSE) through ADRs.

ASE quickly became a key player in the OSAT market.

The Chang family continues to maintain substantial holdings.

Early financial backers beyond the founders are not extensively detailed in public records. The company's expansion through listings on the Taiwan Stock Exchange and the New York Stock Exchange, via American Depositary Receipts (ADRs), opened avenues to capital markets, attracting early public shareholders and institutional investors. Information regarding early agreements, such as vesting schedules or founder exits, is not readily available. The company's strategic focus on assembly and test services has remained consistent, as detailed in the growth strategy of ASE Technology Holding, and this continues to be a core element of its business model. The company's market capitalization as of early 2024 was approximately $20 billion, demonstrating its substantial presence in the semiconductor industry. The sustained focus on these core services and strategic consolidations highlights the founding team's vision.

Key aspects of the early ownership and structure of ASE Technology Holding Company include:

- Founders: Jason and Richard Chang.

- Initial Focus: Outsourced Semiconductor Assembly and Test (OSAT).

- Public Listing: Taiwan Stock Exchange (TWSE) and New York Stock Exchange (NYSE) through ADRs.

- Current Status: Jason Chang, the co-founder, remains a significant shareholder and the company's chairman.

- Family Involvement: The Chang family retains substantial ownership.

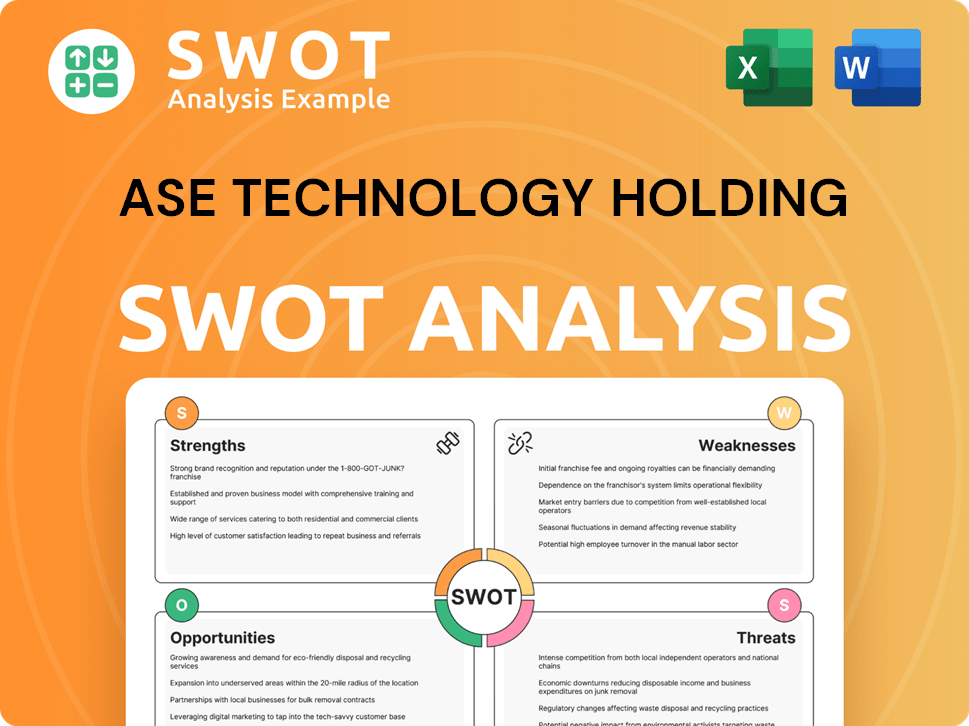

ASE Technology Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ASE Technology Holding’s Ownership Changed Over Time?

The evolution of ASE Technology Holding Company's (ASEH) ownership structure is marked by a significant merger. The company, a key player in the semiconductor industry, was formed through the combination of Advanced Semiconductor Engineering, Inc. (ASE) and Siliconware Precision Industries Co., Ltd. (SPIL). This strategic move, finalized under the new holding company structure, led to its public listing on the New York Stock Exchange (NYSE: ASX) and the Taiwan Stock Exchange (TWSE: 3711) on April 30, 2018. This event reshaped the landscape of ASE ownership, creating a larger entity with a broader investor base.

The ownership dynamics of ASE Technology Holding have been shaped by the presence of institutional investors and the continued involvement of the founding Chang family. The initial public offerings and subsequent market activities have influenced the distribution of shares among various investor categories. The company's market capitalization as of April 1, 2025, was approximately US$19.55 billion, reflecting its substantial presence in the semiconductor market. Understanding the shareholder composition is crucial for assessing the company's stability and strategic direction, and how to buy ASE Technology Holding stock.

| Shareholder Type | Approximate Ownership (Late 2024) | Notes |

|---|---|---|

| Institutional Investors | Approximately 68% | Includes mutual funds, pension funds, and asset management companies. |

| Individual Insiders | Approximately 28.5% | Includes key executives and founding family members. |

| General Public | Approximately 27.5% | Represents shares held by individual investors. |

| Private Companies | Approximately 0.0813% | Smaller percentage held by private entities. |

The ownership structure of ASE Technology Holding Company is characterized by a significant presence of institutional investors, indicating a broad base of professional investment. The substantial stake held by the Chang family suggests continued influence over the company's strategic direction. As of March 31, 2025, the company had 2 institutional owners and shareholders that had filed 13D/G or 13F forms with the SEC, with Group One Trading, L.p. and Simplex Trading, Llc being among the largest shareholders. The company's history, as well as its current operations, are detailed in Target Market of ASE Technology Holding.

ASE Technology Holding Company's ownership structure is primarily influenced by institutional investors and the founding Chang family.

- Institutional investors hold a significant majority of the shares.

- The Chang family maintains a considerable stake, ensuring influence.

- The company is publicly traded on both the NYSE and TWSE.

- Market capitalization as of April 1, 2025, was approximately US$19.55 billion.

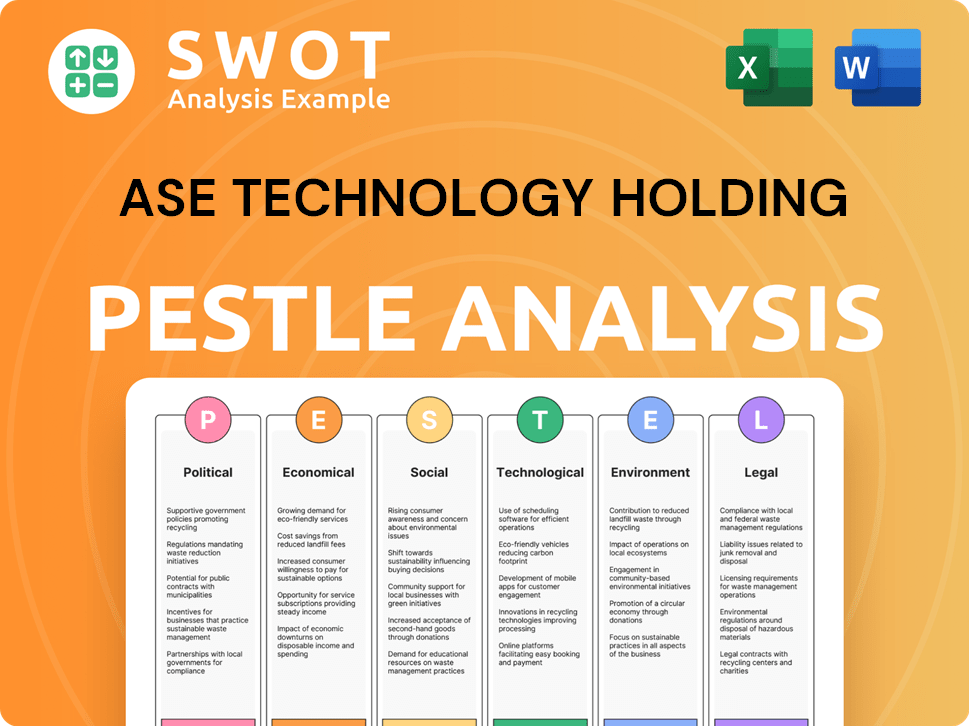

ASE Technology Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ASE Technology Holding’s Board?

The current board of directors of ASE Technology Holding Company oversees the company's operations and strategic direction. The board consists of nine directors, including three independent directors and six non-independent directors. These directors are elected by the general shareholders' meeting from qualified candidates. Each director serves a three-year term and is eligible for re-election. Jason Chang, the chairman of the board, also serves as the CEO, highlighting the leadership role of a founding family member within the company. This structure is crucial for navigating the complexities of the semiconductor industry.

The composition of the board reflects a balance between independent oversight and the influence of key stakeholders. The presence of independent directors is designed to ensure objective decision-making, while the non-independent directors likely represent major shareholders or have significant operational expertise. This balance is essential for maintaining investor confidence and guiding the company's strategic initiatives. Understanding the board's structure is key for anyone looking into ASE Technology Holding Company's ownership and its future direction.

| Board Role | Number | Term Length |

|---|---|---|

| Independent Directors | 3 | 3 years |

| Non-Independent Directors | 6 | 3 years |

| Total Directors | 9 | 3 years |

The voting structure at ASE Technology Holding generally follows a one-share-one-vote principle. However, exceptions exist, such as for shares prohibited from exercising voting rights under specific regulations. Shareholders unable to attend meetings can appoint a proxy, but there are limitations to prevent excessive control through proxy voting. The election of directors is conducted through a candidate nomination system, with voting available electronically or via ballots. Candidates with the most votes are elected as independent or non-independent directors. This system ensures that the shareholders have a direct say in the company's governance.

The board of directors at ASE Technology Holding Company is structured to balance independence and stakeholder representation.

- The board consists of nine directors, with a mix of independent and non-independent members.

- Voting rights are generally one share, one vote, with provisions for proxy voting.

- Director elections are conducted through a candidate nomination system.

- The leadership structure includes the chairman also serving as CEO.

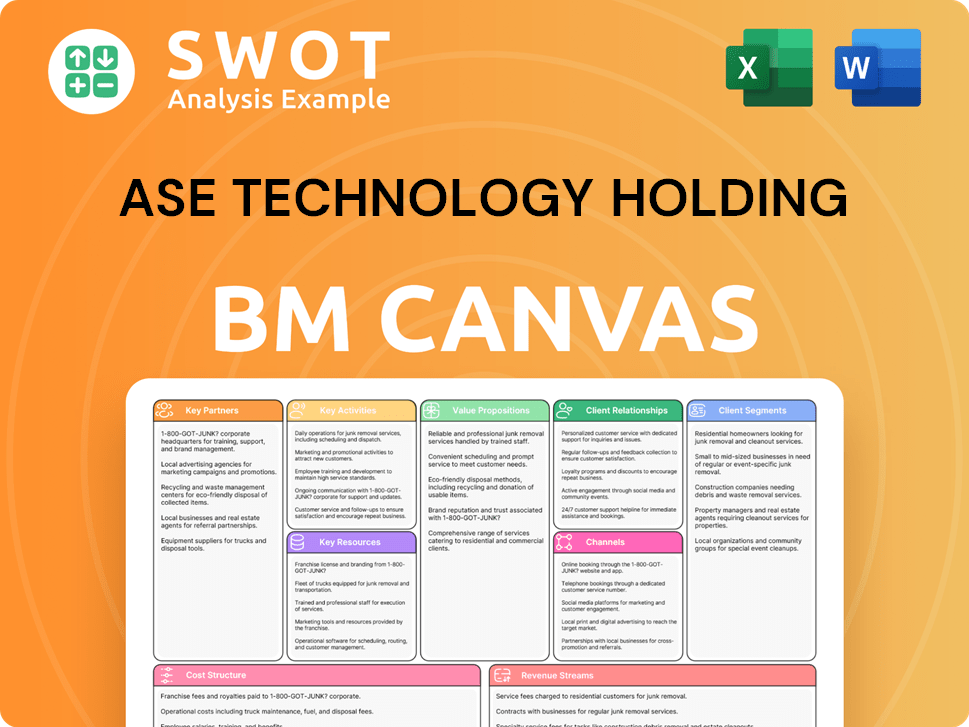

ASE Technology Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ASE Technology Holding’s Ownership Landscape?

Over the past few years, ASE Technology Holding Company has maintained a strong market position, adapting to the evolving semiconductor industry. In 2024, the company reported unaudited net revenues of approximately US$18.5 billion, with a net income attributable to shareholders of around US$1 billion. This reflects a 2.32% increase in revenue and a 2.39% increase in earnings compared to 2023. Capital expenditures in 2024 reached US$1,876 million, primarily focused on packaging and testing operations, indicating continued investment in technological advancements.

Institutional ownership remains a key factor in ASE Technology Holding's ownership structure, accounting for roughly 68% as of late 2024. While there hasn't been significant dilution, the company has utilized share-based compensation plans, such as the 2024 Restricted Stock Awards Plan and the 2023 Employee Stock Option Plan. Net acquisitions and divestitures for the twelve months ending March 31, 2025, were -$0.050 billion, a 274.74% decline from 2023, suggesting strategic adjustments in its portfolio. ASE continues to invest in advanced packaging technologies to capitalize on trends in AI, 5G, and high-performance computing, which could influence future partnerships and ownership dynamics.

The company's focus on advanced packaging technologies like Fan-Out and System-in-Package (SiP) is a strategic move to stay competitive in the semiconductor industry. These technologies are crucial for meeting the demands of AI, 5G, and high-performance computing applications. This strategic direction may influence future partnerships and ownership dynamics within the company, as it seeks to capitalize on these growing market segments. There have been no major public statements regarding planned succession or potential changes beyond its current dual listing.

In 2024, ASE Technology Holding reported unaudited net revenues of approximately US$18.5 billion. Net income attributable to shareholders was around US$1 billion. This indicates stable financial health and growth in the semiconductor market.

Institutional investors hold approximately 68% of ASE's shares as of late 2024. The company uses share-based compensation plans to manage employee incentives. This ownership structure reflects confidence in the company's long-term strategy.

ASE Technology Holding continues to invest in advanced packaging technologies. Capital expenditures in 2024 reached US$1,876 million, focused on packaging and testing operations. These investments support technological leadership.

ASE is focusing on AI, 5G, and high-performance computing. The company aims to capitalize on the increasing demand for advanced packaging solutions. This strategic focus aligns with industry growth.

ASE Technology Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASE Technology Holding Company?

- What is Competitive Landscape of ASE Technology Holding Company?

- What is Growth Strategy and Future Prospects of ASE Technology Holding Company?

- How Does ASE Technology Holding Company Work?

- What is Sales and Marketing Strategy of ASE Technology Holding Company?

- What is Brief History of ASE Technology Holding Company?

- What is Customer Demographics and Target Market of ASE Technology Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.