ASE Technology Holding Bundle

Who Buys from ASE Technology Holding Company?

In the fast-paced world of semiconductors, understanding the ASE Technology Holding SWOT Analysis is critical for success. This global leader in semiconductor manufacturing services relies heavily on knowing its customer demographics and target market to stay ahead. Since its inception, ASE has adapted to industry shifts, making its customer base a key area of strategic focus.

This deep dive into ASE Technology Holding Company will uncover its customer profile, examining their geographic location and the industries they represent. We'll also explore how ASE strategically acquires and retains customers in a competitive market, providing valuable insights for investors and industry analysts alike. A thorough market analysis will reveal the intricacies of ASE's customer relationships and buying behaviors within the evolving semiconductor industry.

Who Are ASE Technology Holding’s Main Customers?

Understanding the customer demographics and target market of ASE Technology Holding Company is crucial for market analysis within the semiconductor industry. ASE operates primarily in the Business-to-Business (B2B) sector, providing services to a diverse range of clients. The company's customer segmentation is largely defined by the types of businesses it serves, which include fabless semiconductor companies, integrated device manufacturers (IDMs), and foundries.

The target market for ASE Technology Holding Company spans various end-use applications. These include communications, computing, consumer electronics, industrial, and automotive sectors. This broad reach highlights the company's ability to cater to different market segments, making it a key player in the global semiconductor landscape. In 2024, the company's revenue was split between its OSAT (Outsourced Semiconductor Assembly and Test) and EMS (Electronic Manufacturing Services) businesses.

ASE's strategic focus on advanced packaging technologies drives its customer acquisition strategy, catering to the increasing demand for sophisticated semiconductor solutions. The company's ability to offer comprehensive solutions, from chip fabrication to assembly and testing, provides a competitive advantage. This is further enhanced by strategic alliances, such as with TSMC, allowing ASE to meet the evolving needs of its target audience effectively. If you want to learn more about the company, you can check out Owners & Shareholders of ASE Technology Holding.

ASE Technology Holding Company's primary customer base consists of fabless semiconductor companies, integrated device manufacturers (IDMs), and foundries. These customers are crucial for the company's revenue streams. The company's focus on advanced packaging technologies is driven by the demands of these key customer groups.

The target market for ASE includes communications, computing, consumer electronics, industrial, and automotive sectors. These sectors drive the demand for advanced semiconductor solutions. The company's ability to serve these diverse sectors highlights its adaptability and market reach.

In 2024, net revenues from packaging operations represented approximately 44% of total net revenues, testing operations 9%, and EMS operations 46%. This breakdown shows the relative importance of each business segment. The even distribution of revenue across segments indicates a diversified customer base.

Advanced packaging technologies (Bumping, Flip Chip, WLP & SiP) now represent 46% of ATM segment revenues in Q1 2025, up from 43% year-over-year. This growth underscores the increasing demand for more sophisticated semiconductor solutions. The focus on these technologies is driven by AI, 5G, IoT devices, electric vehicles, and wearables.

ASE's strategic alliances, such as with TSMC, provide a significant competitive advantage. These partnerships enable ASE to offer comprehensive solutions from chip fabrication to assembly and testing. This integrated approach streamlines the supply chain and enhances customer value.

- Partnerships with leading foundries enable comprehensive solutions.

- Focus on advanced packaging technologies.

- Diverse customer base across multiple industries.

- Strong revenue distribution across business segments.

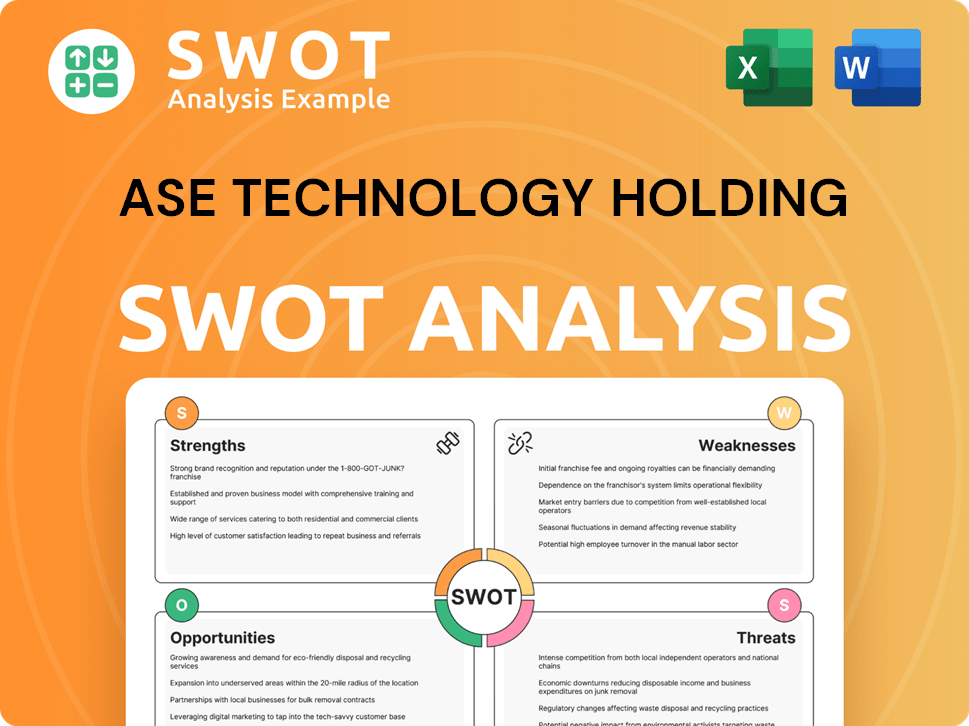

ASE Technology Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do ASE Technology Holding’s Customers Want?

Understanding the customer needs and preferences is crucial for businesses like ASE Technology Holding Company. ASE's primary customer demographics consist of business-to-business (B2B) entities operating within the semiconductor and electronics sectors. These customers have specific demands that drive their purchasing decisions, heavily influenced by technological advancements and market dynamics.

The target market for ASE Technology Holding Company is defined by the need for advanced packaging and testing solutions. These solutions are essential for high-performance applications in areas like 5G, artificial intelligence (AI), and automotive electronics. ASE's focus on innovation helps them meet the evolving needs of their customer base.

The ASE Technology Holding Company customer profile is characterized by a demand for cutting-edge technologies and reliable supply chain solutions. The company’s ability to address complex chip designs and reduce power consumption is critical for its success. They are always looking for ways to improve their products and services.

Customers seek the latest packaging and testing technologies to enable next-generation applications. This includes solutions for 5G, AI, and automotive electronics. ASE's investment in R&D is crucial to meeting these demands.

Rapid time-to-market for new products is a key requirement, especially in fast-paced industries. ASE's efficient processes and advanced technologies help customers bring their products to market quickly. This is a vital factor in today's competitive landscape.

A robust and resilient supply chain is essential to ensure consistent product availability. ASE focuses on maintaining a strong supply chain to meet customer needs. This helps to avoid disruptions and maintain customer satisfaction.

The need for advanced packaging solutions, such as System-in-Package (SiP), Fan-Out, and Chiplets, is increasing. These technologies are vital for high-performance applications. ASE's focus on advanced packaging meets these demands.

Customers require solutions that reduce power consumption while improving performance. ASE's FOCoS-Bridge with TSV technology aims to reduce power loss. This is crucial for next-generation AI and HPC applications.

Tailoring offerings to specific segments is essential for meeting diverse customer needs. ASE expands its facilities to support advanced packages. This helps to address the specific requirements of different segments.

ASE addresses common pain points such as the increasing complexity of chip designs and the need for advanced integration. They invest heavily in R&D to offer advanced packaging solutions, like SiP, Fan-Out, and Chiplets, crucial for high-performance applications in 5G, AI, and automotive electronics. For example, ASE's FOCoS-Bridge with TSV technology aims to reduce power loss by three times for next-generation AI and high-performance computing (HPC) applications. The company also customizes its offerings to specific segments, as seen in its expansion of packaging and testing facilities in Penang, Malaysia, designed for advanced packages. Market trends, particularly the growing demand from AI, which is projected to drive the global semiconductor market to USD 1 trillion within the next decade, significantly influence ASE's product development and strategic vision. For more insights, you can also read about the Marketing Strategy of ASE Technology Holding.

ASE's customers prioritize high-performance, reliable, and cost-effective semiconductor solutions. Their needs are driven by technological advancements and market cycles.

- Performance: Customers require cutting-edge packaging and testing technologies.

- Time-to-Market: Rapid introduction of new products is crucial.

- Supply Chain: A robust and resilient supply chain is essential.

- Advanced Solutions: Demand for SiP, Fan-Out, and Chiplets is increasing.

- Power Efficiency: Customers need solutions that reduce power consumption.

- Customization: Tailored offerings for specific segments are important.

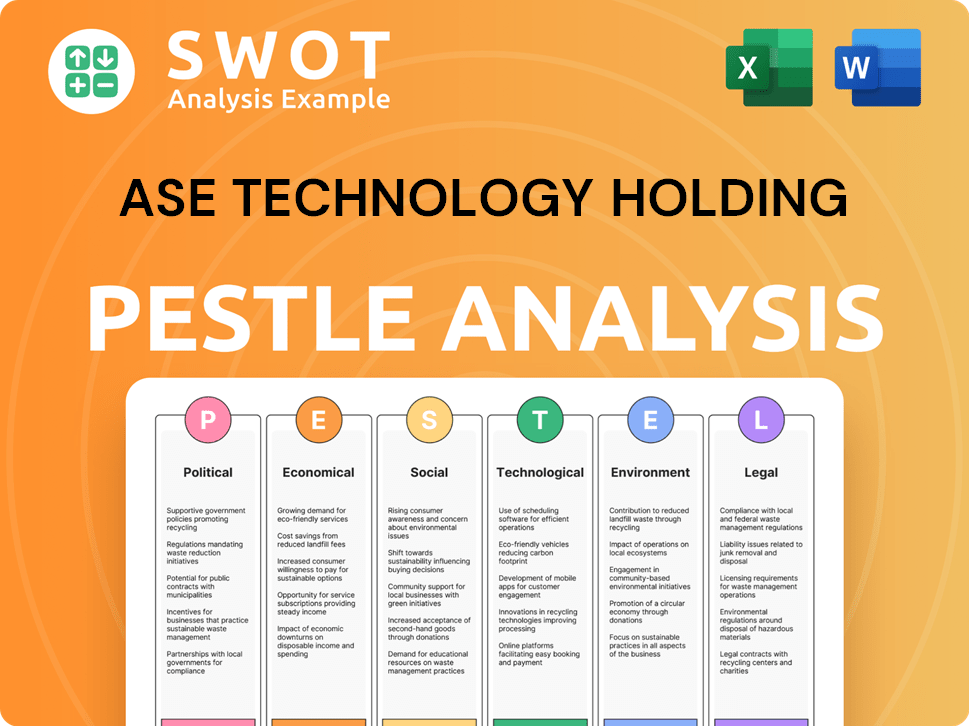

ASE Technology Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does ASE Technology Holding operate?

The geographical market presence of ASE Technology Holding Company is substantial, with its main operations based in Kaohsiung, Taiwan. The company's global footprint includes key regions such as Taiwan, China, South Korea, Japan, Singapore, Malaysia, Philippines, Vietnam, Mexico, and Tunisia. Additionally, it maintains a presence in the United States and Europe. This wide reach allows ASE to serve a diverse customer base across various industries.

Asia-Pacific is particularly significant for ASE, especially in the semiconductor assembly and testing services market. This region captures the largest revenue share, driven by the presence of numerous leading electronic device companies. ASE strategically localizes its offerings and operations to meet the specific needs of different regions, ensuring efficient service delivery and maintaining strong customer relationships. This customer-centric approach is crucial for its success.

ASE holds a significant market share as the world's largest OSAT provider. The company's market share consistently hovers around 30% of the global OSAT market. Recent strategic expansions include an investment by ISE Labs, part of ASE, to establish a new site for semiconductor packaging and test in Mexico in November 2024. This expansion supports its global growth strategy and commitment to serving its target market.

ASE's services are available in Taiwan, China, South Korea, Japan, Singapore, Malaysia, Philippines, Vietnam, Mexico, and Tunisia. The company also has a strong presence in the United States and Europe. This widespread presence helps ASE to cater to the diverse needs of its customers.

Asia-Pacific is a dominant region for ASE, especially in the semiconductor assembly and testing services market. The region's strong demand is driven by the presence of leading electronic device companies. This market concentration is a key factor in ASE's success.

ASE maintains a strong market share, consistently holding around 30% of the global OSAT market. This significant market share reflects the company's strong position in the semiconductor industry. ASE's focus on innovation and customer service supports its market leadership.

ASE continues to expand its operations strategically. The expansion of its Penang, Malaysia facility is a move to bolster packaging and testing capabilities. ISE Labs' investment in a new semiconductor packaging and test site in Mexico further supports its growth.

ASE's proximity to foundries and other semiconductor manufacturing services in Taiwan provides a significant advantage. This proximity is particularly beneficial for customers seeking efficient, total semiconductor manufacturing solutions. This strategic advantage helps ASE to meet the needs of its target market.

ASE garners over half its sales from firms in the United States. This highlights the importance of the US market to ASE's business. This significant revenue stream underscores the company's strong relationships with US-based companies.

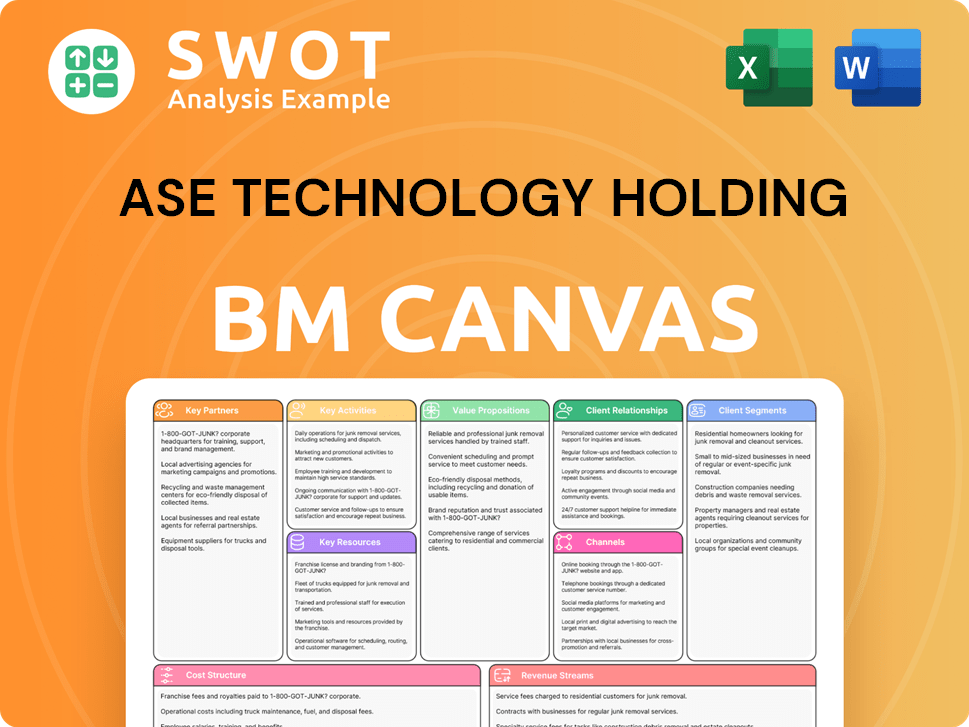

ASE Technology Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does ASE Technology Holding Win & Keep Customers?

ASE Technology Holding Company's approach to acquiring and retaining customers is centered on its technological leadership and comprehensive service offerings in the semiconductor industry. Their strategy focuses on attracting new clients through advanced packaging and testing technologies, which are crucial for high-performance computing, AI, and automotive sectors. Investments in research and development, along with expanding production capabilities, are key to drawing in customers seeking cutting-edge solutions.

The company's customer retention strategies involve building strong partnerships and providing complete turnkey solutions. Strategic alliances, such as the one with TSMC, enable seamless services from chip fabrication to assembly and testing, fostering customer loyalty. By prioritizing quality, innovation, and supply chain resilience, ASE aims to establish itself as a reliable and long-term partner for its clients.

ASE Technology Holding Company's commitment to sustainability, like its goal of using 100% renewable energy in Taiwan operations by 2030, also plays a role in retaining environmentally conscious clients. While specific details on CRM systems are not publicly available, the company's focus on advanced technologies and strong customer relationships, with two customers each accounting for over 10% of revenues in Q1 2025, highlights its dedication to long-term partnerships.

ASE leverages its advanced packaging and testing technologies to acquire new customers. These technologies meet the evolving needs of the semiconductor industry, especially in high-performance computing and AI. The company's investments in R&D and capacity expansion support its acquisition strategy.

Customer retention is heavily influenced by strategic alliances and comprehensive solutions. The partnership with TSMC enhances customer stickiness by offering seamless services. ASE focuses on quality and innovation to be a reliable partner, reducing time to market for its clients.

ASE anticipates a USD 1 billion increase in advanced packaging and testing revenues in 2025. This growth is driven by strong demand for leading-edge technologies and the adoption of edge AI. This revenue increase is a key indicator of market demand and acquisition success.

Commitment to sustainability, demonstrated by initiatives like using 100% renewable energy in Taiwan by 2030, aids in retaining environmentally conscious clients. This focus on sustainability is an increasingly important factor for customer loyalty and satisfaction.

ASE Technology Holding Company employs a multi-faceted approach to customer acquisition and retention. Their target market focuses on the semiconductor industry, particularly in high-performance computing, AI, and automotive sectors. The company's strategy is supported by investments in R&D and strategic partnerships.

- Technological Leadership: Advanced packaging and testing technologies attract new customers.

- Strategic Alliances: Partnerships, such as with TSMC, enhance customer retention.

- Sustainability Initiatives: Commitment to renewable energy by 2030 supports client loyalty.

- Market Analysis: Focus on high-growth sectors like AI and automotive drives revenue.

ASE Technology Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASE Technology Holding Company?

- What is Competitive Landscape of ASE Technology Holding Company?

- What is Growth Strategy and Future Prospects of ASE Technology Holding Company?

- How Does ASE Technology Holding Company Work?

- What is Sales and Marketing Strategy of ASE Technology Holding Company?

- What is Brief History of ASE Technology Holding Company?

- Who Owns ASE Technology Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.