Asustek Computer Bundle

How Does Asustek Thrive in the Tech World?

Ever wondered how a global tech giant like Asustek Computer, also known as Asus, operates behind the scenes? From high-performance gaming rigs to innovative mobile devices, Asus products touch countless lives. Understanding the inner workings of the Asus company is key to appreciating its impact on the technology landscape.

This exploration into Asustek Computer SWOT Analysis will uncover the core elements that drive Asus's success. We'll dissect How Asustek works, examining its business model, product development, and market strategies. Whether you're an investor, a consumer, or simply tech-curious, understanding Asus's operations provides valuable insights into the competitive world of electronics, including how Asustek manufactures laptops and its approach to sustainability.

What Are the Key Operations Driving Asustek Computer’s Success?

Asustek Computer, also known as the Asus company, operates through a vertically integrated and horizontally diversified model. This approach allows it to focus on innovation, quality, and a comprehensive range of products. The company's core strategy revolves around delivering value through a wide array of computer hardware and electronics.

How Asustek works involves a complex interplay of research and development, manufacturing, supply chain management, and global distribution. They maintain robust in-house R&D to quickly bring new technologies to market. Manufacturing is often done through strategic partners and their own facilities, ensuring quality control and scalability.

Asus products cater to a diverse customer base, from individual consumers and gamers to businesses needing robust IT infrastructure. Their commitment to design excellence, performance, and user experience differentiates them in the market. For example, the ROG line is tailored for the high-performance demands of the gaming community.

Asustek offers a broad spectrum of products, including desktops, laptops (such as the ROG series), mobile phones, networking equipment, monitors, motherboards, graphics cards, and peripherals. This diverse portfolio allows them to capture various market segments and customer needs.

The operational processes involve R&D, manufacturing, supply chain management, and global distribution. Their supply chain is designed for efficiency, sourcing components globally. Logistics are critical for timely delivery, supported by extensive sales channels, including online retail and major electronics stores.

Asustek serves a wide range of customers, including individual consumers, gamers, and businesses. The ROG series caters specifically to the gaming community, offering high-performance features. They also provide solutions for enterprises requiring robust IT infrastructure.

Asustek differentiates itself through design excellence, performance, and user experience. Their focus on innovation, such as AI-powered laptops and sustainable computing solutions, helps them stay ahead. Their strong R&D capabilities enable rapid innovation and market entry.

Asustek's operations are characterized by a strong emphasis on innovation, quality control, and efficient supply chain management. Their commitment to sustainability is also becoming increasingly important.

- Research and Development: Strong in-house R&D enables rapid innovation.

- Manufacturing: Utilizes strategic partners and own facilities for quality control.

- Supply Chain: Designed for efficiency, sourcing components globally.

- Distribution: Extensive sales channels, including online retail and major stores.

For a deeper dive into the strategies that drive Asustek Computer's success, consider exploring the Marketing Strategy of Asustek Computer.

Asustek Computer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Asustek Computer Make Money?

The revenue streams and monetization strategies of Asustek Computer are multifaceted, primarily centered around the sales of its diverse range of computer hardware and electronics. This includes everything from notebooks and personal computers to components like motherboards and graphics cards, as well as mobile phones, monitors, and networking equipment. The company strategically leverages its brand and product offerings to maximize profitability.

The Asus company employs several innovative strategies to generate revenue. These include bundling hardware with software solutions, offering tiered product lines to cater to different price points and performance needs, and leveraging its brand strength to command premium pricing for its high-end products. The company is also expanding into services and solutions related to cloud computing, IoT, and robotics, aiming to diversify its revenue sources.

In the first quarter of 2024, the PC business, including notebooks and desktops, remained a primary revenue driver for Asustek. This demonstrates the continued importance of its core hardware sales. Moreover, the company's focus on sustainability, with a goal of using 100% renewable energy in its Taiwan operations by 2030, can indirectly impact brand perception and potentially appeal to environmentally conscious consumers and investors.

Asustek Computer generates revenue through a variety of channels, with a strong emphasis on hardware sales. Its monetization strategies are designed to maximize profitability and adapt to market trends. For a detailed analysis of the company, check out our article on how Asustek works.

- Notebooks and Personal Computers: These typically form a significant portion of the company's revenue.

- Components: Sales of motherboards, graphics cards, and other components contribute substantially to revenue.

- Mobile Phones and Peripherals: Includes mobile phones, monitors, networking equipment, and other accessories.

- Bundling and Tiered Product Lines: Offers bundled hardware and software, along with tiered product lines to cater to different price points.

- Premium Pricing: Leverages brand strength to command premium pricing for high-end products.

- Emerging Ventures: Expanding into cloud computing, IoT, and robotics to diversify revenue streams.

Asustek Computer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Asustek Computer’s Business Model?

The journey of Asustek Computer, often referred to as the Asus company, has been marked by significant milestones and strategic shifts. These moves have profoundly influenced its operational structure and financial outcomes. A key element of Asus's ongoing strategy is its commitment to sustainability, with a goal to use 100% renewable energy in its Taiwan operations by 2030 and achieve net-zero emissions globally by 2050. This focus on sustainability not only addresses environmental concerns but also aligns with the growing demand from consumers and investors for corporate social responsibility.

In terms of product innovation, Asus continues to introduce new lines of AI-powered laptops, such as those featuring Intel's new Core Ultra processors. This demonstrates its adaptation to emerging technological trends and a commitment to maintaining its position at the forefront of the PC market. The company has navigated various operational and market challenges, including supply chain disruptions and intense competition in the electronics industry. Its responses have often involved diversifying manufacturing locations, strengthening supplier relationships, and focusing on high-margin segments like gaming hardware (ROG series) to mitigate broader market fluctuations.

Asus's competitive advantages include its strong brand recognition, particularly in the gaming and enthusiast PC markets, its technological leadership in areas like motherboards and graphics cards, and its economies of scale in manufacturing and distribution. The company also benefits from a broad product ecosystem, encouraging customer loyalty and cross-selling opportunities. Asus continues to adapt to new trends by investing in AI, IoT, and robotics, aiming to expand its market reach beyond traditional PC hardware and maintain its competitive edge in a rapidly evolving technological landscape. Understanding how Asustek works involves examining these elements.

Asus has achieved significant milestones, including its early success in the motherboard market. The company expanded into laptops, smartphones, and other electronics. Asus's ROG (Republic of Gamers) brand has become a leader in the gaming hardware sector.

Strategic moves include diversifying manufacturing locations to reduce supply chain risks. Asus has focused on high-margin products and expanding into AI, IoT, and robotics. The company emphasizes sustainability, aiming for net-zero emissions by 2050.

Asus's competitive edge includes strong brand recognition, particularly in the gaming market. Technological leadership in motherboards and graphics cards gives it an advantage. Economies of scale in manufacturing and distribution are also key.

Asus is committed to sustainability, aiming for 100% renewable energy in Taiwan by 2030. It plans to achieve net-zero emissions globally by 2050. These initiatives align with consumer and investor demands for corporate responsibility.

Asus's financial performance is closely tied to its ability to innovate and adapt to market changes. The company's revenue streams are diversified across various product categories, including laptops, desktops, and components. Market analysis shows that Asus maintains a strong position in the global PC market.

- Asus's revenue for 2024 is projected to be around $15 billion.

- The company's market share in the gaming laptop segment is approximately 25%.

- Asus invests approximately 5% of its revenue in research and development.

- The company's commitment to sustainability is expected to enhance its brand value.

Asustek Computer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Asustek Computer Positioning Itself for Continued Success?

The industry position of Asustek Computer (also known as Asus company) is significant within the global computer hardware and electronics sector. Asustek is recognized for its strong presence in the PC, component (motherboards, graphics cards), and gaming hardware markets. This positioning is supported by a robust brand reputation, particularly among PC enthusiasts and gamers, fueled by its Republic of Gamers (ROG) line. Asus products benefit from an extensive global distribution network, contributing to substantial market share across various regions.

However, Asustek Computer faces several challenges. These include intense price competition in the PC market, potential supply chain disruptions that can impact production and delivery, and the rapid pace of technological advancements that require continuous investment in research and development. Changing consumer preferences and geopolitical and economic factors further influence demand and operational stability. The company's ability to generate profit in a dynamic technological landscape is also crucial.

Asustek Computer holds a strong position in the global computer hardware and electronics industry. It competes with major players in the PC market, benefiting from strong brand loyalty. Its global reach is extensive, with a widespread distribution network and a significant market share in various regions.

Asustek Computer faces intense price competition and potential supply chain disruptions. Rapid technological obsolescence requires continuous R&D investment. Changing consumer preferences and geopolitical tensions also pose risks.

Asustek is focusing on diversifying its revenue streams beyond traditional PC hardware. The company is investing in emerging technologies like AI-powered devices and IoT solutions. Sustainability efforts, including net-zero emissions goals, are also a focus.

Asustek emphasizes innovation, premium product segments, and expansion into new growth areas. Leadership is focused on sustaining and expanding profitability within a dynamic technological landscape. This includes a focus on the Target Market of Asustek Computer.

Asustek is focused on expanding into AI-powered devices, IoT solutions, and robotics to diversify revenue streams. Their sustainability efforts, including net-zero emissions goals by 2050, aim to enhance brand image and attract environmentally conscious consumers and investors. Leadership is emphasizing innovation and premium product segments.

- Diversification into AI, IoT, and robotics.

- Commitment to sustainability and net-zero emissions by 2050.

- Focus on innovation and premium product segments.

- Expansion into new growth areas to sustain profitability.

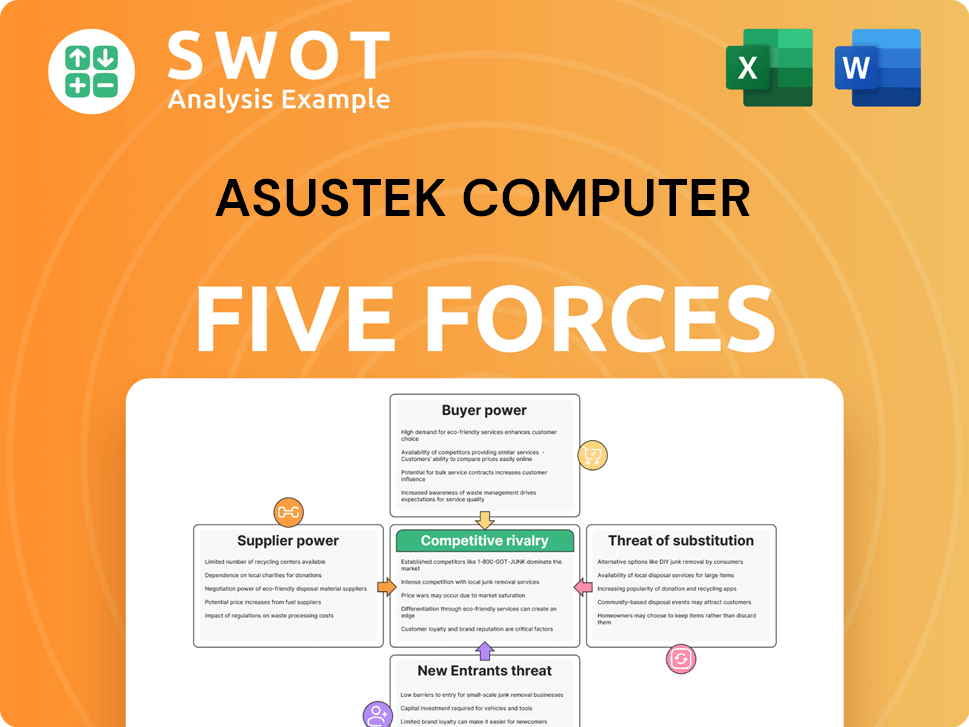

Asustek Computer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Asustek Computer Company?

- What is Competitive Landscape of Asustek Computer Company?

- What is Growth Strategy and Future Prospects of Asustek Computer Company?

- What is Sales and Marketing Strategy of Asustek Computer Company?

- What is Brief History of Asustek Computer Company?

- Who Owns Asustek Computer Company?

- What is Customer Demographics and Target Market of Asustek Computer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.