BJ's Wholesale Club Bundle

Unpacking BJ's Wholesale Club: How Does It Thrive?

BJ's Wholesale Club, a retail powerhouse, has carved a significant niche in the market, particularly along the East Coast. This wholesale club chain entices consumers with unbeatable discounts on everything from groceries to electronics, all accessible through a coveted BJ's membership. With over 7.5 million members in fiscal year 2024, BJ's demonstrates a compelling value proposition that keeps customers coming back for more.

Delving deeper into BJ's Wholesale Club reveals a robust financial performance, with revenues exceeding $20 billion in fiscal year 2024. The company's strategic focus on digital transformation, including BJ's Wholesale Club SWOT Analysis, has further fueled its expansion and customer engagement. Understanding the intricacies of BJ's operations, from its bulk buying model to its competitive pricing strategy, is key to appreciating its sustained success in the discount shopping arena and how a BJ's store provides value.

What Are the Key Operations Driving BJ's Wholesale Club’s Success?

BJ's Wholesale Club operates on a membership-based model, offering a curated selection of products at discounted prices. This wholesale club primarily caters to individual consumers and small businesses, providing bulk buying options and significant savings. The core offerings include groceries, electronics, home goods, and apparel, along with ancillary services like optical departments and tire installation.

The company's value proposition centers on providing competitive pricing and convenience through streamlined operations. BJ's focuses on direct sourcing and efficient distribution to maintain its low-price strategy. This approach allows the company to offer significant savings compared to traditional retailers, with claims of up to 25% better pricing than grocery competitors.

BJ's leverages both physical stores and digital platforms to enhance its offerings and customer experience. The company's operations are unique due to its regional focus on the East Coast, allowing for a tailored approach to local market needs while still benefiting from the economies of scale inherent in the warehouse club model. This operational efficiency translates into customer benefits through competitive pricing, convenience, and a focused product selection that meets everyday needs.

BJ's Wholesale Club offers a wide array of products, including groceries, electronics, home goods, and apparel. They also provide ancillary services such as optical departments, tire installation, and travel booking. These offerings are designed to meet the diverse needs of both individual consumers and small businesses.

BJ's minimizes the use of extensive distribution centers and stores large quantities of inventory directly on the sales floor. This approach, coupled with a limited assortment of approximately 7,000 stock-keeping units (SKUs) per store, enhances procurement scale and reduces operational complexities. The company's supply chain focuses on direct sourcing and efficient distribution.

BJ's has a robust digital ecosystem, including BJs.com, BerkleyJensen.com, and a mobile app. These platforms enable members to access digital coupons, place online orders, and utilize services like Buy Online, Pick Up In Club (BOPIC), curbside pickup, and same-day delivery. Partnerships with third-party delivery services like DoorDash and Instacart further expand its reach.

BJ's has a strategic regional focus on the East Coast, allowing for a more tailored approach to local market needs. This regional strategy enables the company to better understand and serve its customer base. This approach also helps in optimizing supply chain and distribution networks.

BJ's membership provides several advantages, including access to discounted prices, bulk buying options, and a wide range of products. Members can also take advantage of convenient services like online ordering, same-day delivery, and in-club pickup. The benefits of a BJ's membership extend to small businesses as well, offering cost-effective solutions for their purchasing needs.

- Competitive Pricing: Offers savings compared to traditional grocery stores.

- Convenience: Provides online ordering, same-day delivery, and in-club pickup options.

- Wide Assortment: Offers a variety of products, from groceries to electronics.

- Bulk Buying: Allows for cost-effective purchasing for both individuals and businesses.

BJ's Wholesale Club SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BJ's Wholesale Club Make Money?

Understanding the revenue streams and monetization strategies of BJ's Wholesale Club is key to grasping its financial health and business model. The company leverages a dual-pronged approach, focusing on product sales and membership fees to drive revenue and build customer loyalty. This strategy allows BJ's store to offer competitive pricing while maintaining a stable financial foundation.

The primary revenue source for BJ's Wholesale Club comes from product sales. This is complemented by a significant contribution from membership fees, which provide a recurring revenue stream. These fees not only generate income but also foster customer loyalty, encouraging repeat business and providing valuable data on member shopping habits.

BJ's membership is a crucial element of its business model. The company strategically uses various methods to enhance its revenue streams and increase customer engagement, including private label brands, ancillary services, and digital initiatives.

Product sales form the backbone of BJ's Wholesale Club's revenue, contributing the majority of its income. The company's financial performance in this area is a key indicator of its overall success. In fiscal year 2024, net sales reached $20.045 billion. The first quarter of fiscal 2025 saw a 4.7% year-over-year increase in net sales, reaching $5.033 billion. This growth reflects the company's ability to attract and retain customers, as well as its effective pricing strategies, making it a popular destination for wholesale club shopping. The company's performance can be further understood by reading Growth Strategy of BJ's Wholesale Club.

- BJ's Wholesale Club offers a wide array of products, including groceries, electronics, and home goods, which are typically sold in bulk, attracting customers looking for bulk buying options.

- The company's ability to offer discount shopping is a significant draw, making it a competitive player in the retail market.

- The increase in net sales in the first quarter of 2025 highlights the company's strong position in the market and its ability to adapt to changing consumer demands.

- Understanding BJ's Wholesale Club hours and BJ's Wholesale Club locations near me are crucial for customers to plan their shopping trips effectively.

Membership fees are a critical component of BJ's monetization strategy, providing a stable, recurring revenue stream and fostering customer loyalty. In fiscal year 2024, membership fee income increased by 8.5% to $456.5 million. The first quarter of fiscal 2025 saw a further rise of 8.1% year-over-year, reaching $120.4 million. This growth is driven by strong membership acquisition and retention, as well as higher penetration of higher-tier memberships. The company's focus on customer retention and satisfaction is evident in its strategies.

- BJ's membership provides exclusive access to lower prices and special offers, encouraging repeat business and customer loyalty.

- In January 2025, BJ's implemented its first membership fee increase in seven years, with annual Club memberships rising from $55 to $60 and Club+ memberships increasing from $110 to $120, demonstrating the value members place on their memberships.

- The company's focus on membership renewal is essential for maintaining a steady revenue stream.

- Customers often compare BJ's vs Costco to determine which offers the best value for their needs.

In addition to product sales and membership fees, BJ's Wholesale Club employs several innovative monetization strategies. These include private label brands, ancillary services, and digital initiatives, all designed to enhance revenue and member value. The company's strategic approach to these elements strengthens its competitive position in the market.

- Private label brands, such as Berkley Jensen and Wellsley Farms, offer value to members and boost profitability. By 2025, BJ's private label sales are expected to reach $4 billion, aiming for a private label penetration rate of 30%.

- Ancillary services, including optical, tire installation, and fuel sales at its gas stations, provide additional revenue streams. BJ's gas prices are often competitive, attracting customers.

- Digital initiatives, such as BOPIC, curbside pickup, and same-day delivery, enhance member engagement and convenience. The 'Same-Day Select' program, where members pay an upfront fee for unlimited or a set number of same-day deliveries, diversifies revenue sources. BJ's online shopping and BJ's same-day delivery options are growing in popularity.

- Understanding the BJ's coupon policy and BJ's return policy helps members maximize their savings and ensure a positive shopping experience.

- Knowing what items are available at BJ's helps customers plan their purchases.

- Customers often inquire about how much does a BJ's membership cost and how does BJ's membership work to assess the value.

- Some customers also search for information on how to shop at BJ's without a membership, although this is limited.

- Consumers also compare if BJ's is cheaper than the grocery store.

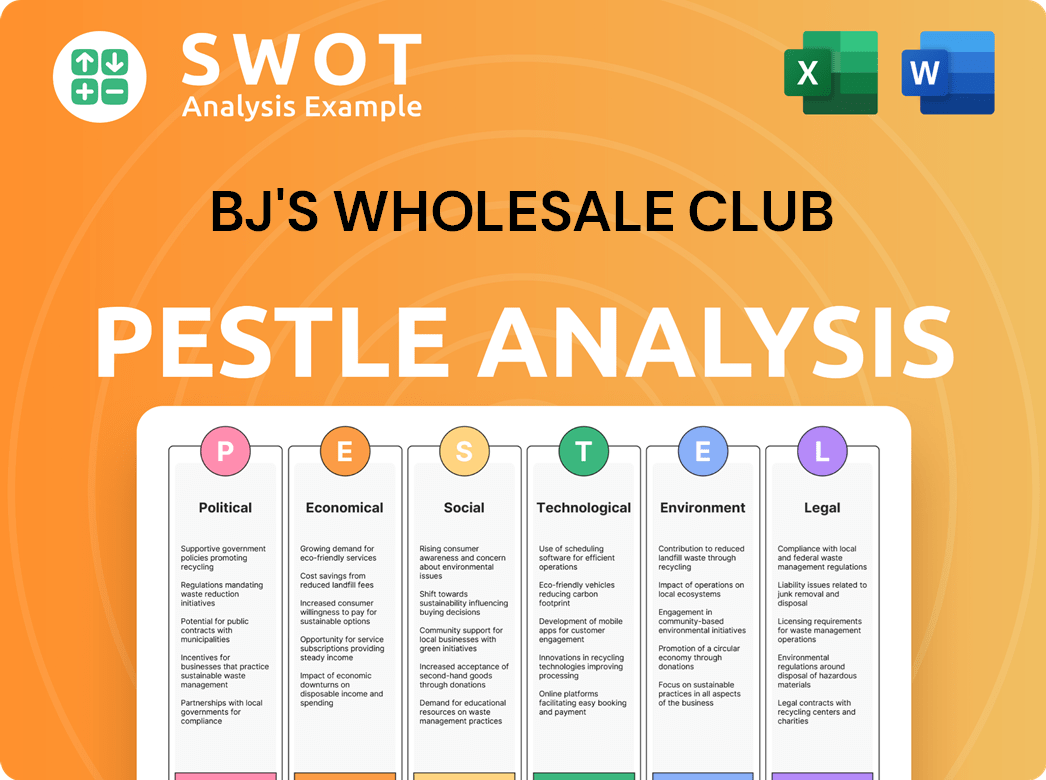

BJ's Wholesale Club PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BJ's Wholesale Club’s Business Model?

BJ's Wholesale Club has consistently pursued strategic initiatives to enhance its market position and financial performance. These moves include expanding its physical presence and investing heavily in digital and omnichannel capabilities. The company's focus on providing value through discounted prices and a membership model has been a cornerstone of its competitive strategy, driving customer loyalty and recurring revenue.

A key aspect of BJ's strategy involves continuous expansion of its physical footprint. The company's strategic moves have included significant investments in digital transformation and omnichannel capabilities. These efforts have driven a substantial shift towards online shopping among members, with digital sales comprising over 11% of BJ's business.

BJ's competitive advantages are rooted in its membership model, discounted prices, and operational efficiency. The company's strong private label program and focus on high-demand products further contribute to its success. Despite challenges, BJ's has demonstrated resilience through strong cost management and strategic pricing.

BJ's has opened new clubs and gas stations, expanding its physical presence. In fiscal year 2024, the company opened seven new clubs and 12 gas stations. The company plans to open 25 to 30 new warehouse clubs over the next two fiscal years.

The company's expansion includes new locations in Florida, Georgia, New Jersey, New York, North Carolina, Tennessee, and Kentucky. This expansion marks its entry into its 21st state.

Significant investment in digital transformation and omnichannel capabilities has been a strategic move. Digitally enabled comparable sales grew by 35% in the first quarter of fiscal 2025, reflecting a two-year stacked comparable growth of 56%.

Initiatives include digital coupons, online ordering, an improved mobile app, BOPIC, curbside pickup, and same-day delivery services. The company has partnered with DoorDash, Instacart, and Roadie.

BJ's competitive advantages include its membership model, which fosters loyalty and generates recurring revenue. The company offers discounted prices, often up to 25% lower than grocery competitors. The company focuses on a limited assortment of high-demand products in bulk quantities.

BJ's benefits from a strong private label program, with private label sales expected to reach $4 billion by 2025. The company has demonstrated resilience through strong cost management and strategic pricing. The tenured member renewal rate improved to 90% in fiscal 2024.

BJ's has shown strong financial performance, driven by its strategic initiatives and competitive advantages. The growth in digitally enabled sales and the high member renewal rate indicate a robust business model.

The company's focus on value and efficiency has helped it navigate challenges like inflation and supply chain disruptions. More details can be found in the Brief History of BJ's Wholesale Club.

BJ's Wholesale Club continues to expand its physical and digital presence, enhancing its competitive edge. The company's focus on value and efficiency drives customer loyalty and strong financial results.

- Expansion of physical locations and digital capabilities.

- Strong membership model and value proposition.

- Resilience through cost management and strategic pricing.

- Growth in digitally enabled sales.

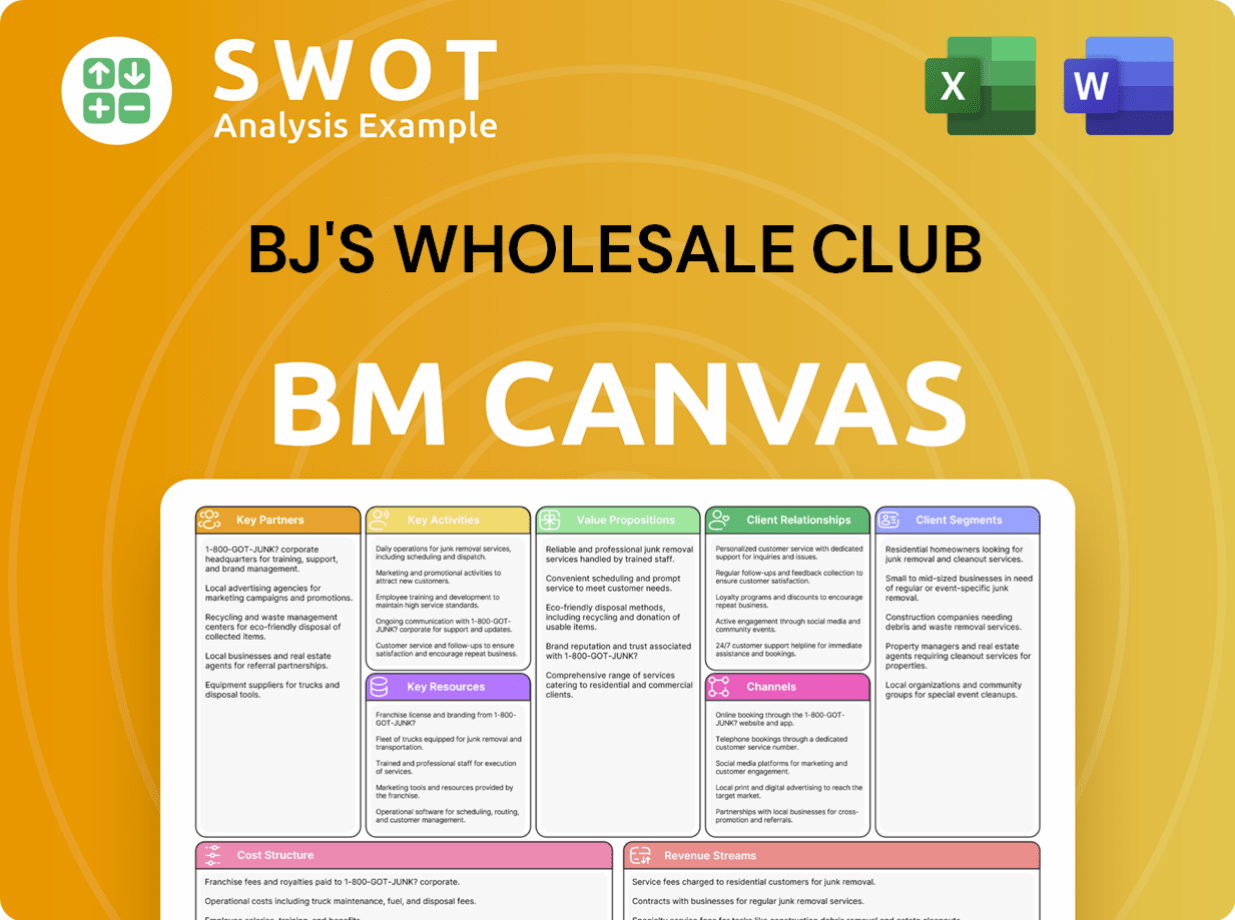

BJ's Wholesale Club Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BJ's Wholesale Club Positioning Itself for Continued Success?

operates as a regional leader in the membership-based retail sector, primarily concentrated on the East Coast of the United States. While it competes with national players like Costco and Sam's Club, it has successfully established its niche. The company's market share is supported by a strong membership base, which exceeded 7.5 million members in fiscal year 2024. Customer loyalty is demonstrated by a robust 90% member renewal rate during fiscal 2024.

Despite its strong position, faces several key risks. These include intense competition from established wholesale clubs and discount retailers. Economic uncertainties, such as inflationary pressures and changing consumer preferences, could impact membership growth and sales volumes. Supply chain disruptions also remain a potential risk. Furthermore, limited opportunities for new store openings in untapped markets could constrain geographic expansion.

is a key player in the wholesale club industry, known for its focus on bulk buying and discount shopping. Its strategic location in the eastern U.S. allows it to serve a large customer base effectively. This regional focus helps to differentiate from national competitors.

faces risks from competition, economic conditions, and supply chain issues. The wholesale club market is competitive, requiring to constantly innovate and offer value to retain and attract members. Economic fluctuations and changing consumer behavior can affect sales.

plans to expand its physical presence and invest in digital capabilities. Capital expenditures of approximately $800 million are projected for fiscal 2025, mainly for new club openings and a distribution center. The company anticipates comparable club sales, excluding gasoline sales, to increase by 2.0% to 3.5% year-over-year in fiscal 2025.

Continued investment in its digital platform and mobile app are key to drive online sales and member engagement. The company aims to leverage its membership model and private label offerings to drive profitability and adapt to evolving consumer trends. For more information on the company's ownership and structure, you can read about Owners & Shareholders of BJ's Wholesale Club.

The company anticipates continued growth driven by strategic initiatives and market trends. The financial outlook for fiscal 2025 includes specific targets for sales and earnings. These projections reflect the company's confidence in its business model and expansion plans.

- Comparable club sales (excluding gasoline) are expected to increase by 2.0% to 3.5%.

- Adjusted earnings per share are projected to range from $4.10 to $4.30.

- Capital expenditures are planned at approximately $800 million.

- Focus on digital enhancements to drive online sales and member engagement.

BJ's Wholesale Club Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BJ's Wholesale Club Company?

- What is Competitive Landscape of BJ's Wholesale Club Company?

- What is Growth Strategy and Future Prospects of BJ's Wholesale Club Company?

- What is Sales and Marketing Strategy of BJ's Wholesale Club Company?

- What is Brief History of BJ's Wholesale Club Company?

- Who Owns BJ's Wholesale Club Company?

- What is Customer Demographics and Target Market of BJ's Wholesale Club Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.