CALIDA Group Bundle

How Does the CALIDA Group Thrive in a Global Market?

The CALIDA Group, a Swiss-based powerhouse, has carved a significant niche in the premium underwear and lingerie industry. From its humble beginnings in 1941, the CALIDA Group SWOT Analysis reveals a company that has expanded its reach to over 90 countries. This global presence, coupled with a portfolio of iconic brands like CALIDA and AUBADE, positions it as a key player in the fashion world.

Despite facing market challenges, the CALIDA company has demonstrated resilience, as seen in its 2024 performance. Understanding the CALIDA business model, including its revenue streams and strategic adaptations, is essential for anyone seeking insights into the company’s operations. This analysis will explore the CALIDA Group's structure, financial health, and future prospects, offering a comprehensive view of its market position and strategic direction.

What Are the Key Operations Driving CALIDA Group’s Success?

The CALIDA Group focuses on creating value by offering premium underwear, lingerie, and select outdoor apparel to a global customer base. This CALIDA company operates through a strategy centered on high-quality products, innovative materials, and sustainable production methods. The CALIDA business model emphasizes a commitment to both product excellence and responsible practices throughout its operations.

The core of the CALIDA Group's operations involves the design, manufacturing, and distribution of bodywear, sleepwear, and lingerie under brands such as CALIDA, AUBADE, and COSABELLA. While the Group previously included outdoor brands, its strategic focus has shifted towards its textile core. This strategic realignment allows the company to concentrate on its strengths and core competencies in the premium apparel market.

The CALIDA Group emphasizes an own-operated and local production strategy, with most fabrics sourced and finished goods produced within Europe. This approach aims to minimize supply chain disruptions and maintain stable prices and order volumes by concentrating on a small and stable supplier portfolio. The company's commitment to sustainability is deeply ingrained in its DNA, with circular economy principles, recyclability, and longevity considered at all stages of the supply chain. This includes using natural fibers predominantly and integrating recycled materials where synthetic fibers are used. Certifications like OEKO-TEX® STANDARD 100 and OEKO-TEX® MADE IN GREEN further underscore their commitment to international standards.

The CALIDA Group primarily focuses on bodywear, sleepwear, and lingerie. These products are offered under various brands, including CALIDA, AUBADE, and COSABELLA. The product range caters to a diverse customer base with a focus on quality and comfort.

The company emphasizes local production, with most fabrics sourced and finished goods produced within Europe. This strategy helps in managing supply chains and maintaining quality control. Sustainability is a key focus, with an emphasis on using natural fibers and integrating recycled materials.

The CALIDA Group utilizes an omni-channel distribution strategy. This includes both online and traditional retail and wholesale channels. Online sales have shown significant growth, reaching 33.7% of total sales in 2024, reflecting the company's adaptability to changing consumer behaviors.

Sustainability is a core value, integrating circular economy principles and recyclability. The use of natural fibers and recycled materials underscores the commitment to environmental responsibility. Certifications like OEKO-TEX® STANDARD 100 and OEKO-TEX® MADE IN GREEN are key.

The CALIDA Group distinguishes itself through its established brands, strong emphasis on sustainable production, and a balanced omni-channel distribution strategy. These elements contribute to the creation of high-quality, comfortable, and responsibly produced products.

- Focus on premium underwear, lingerie, and selected outdoor apparel.

- Emphasis on local and own-operated production, primarily in Europe.

- Strong commitment to sustainability, including the use of natural and recycled materials.

- Omni-channel distribution model with significant online sales growth.

- Brief History of CALIDA Group provides additional background.

CALIDA Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CALIDA Group Make Money?

The CALIDA Group's revenue streams are primarily centered around the sale of premium underwear, lingerie, and, historically, outdoor apparel. This CALIDA business model focuses on a multi-brand strategy, with sales generated through various channels. The company's financial performance reflects its strategic decisions and market dynamics.

In 2024, the CALIDA Group reported total sales from continuing operations of CHF 231.0 million. This figure represents a currency-adjusted decline of 8.5% compared to the previous year. The company's revenue streams are diversified across its brand portfolio, with each brand contributing differently to the overall sales.

The CALIDA company strategically uses an omni-channel approach, which includes online sales, retail, and wholesale channels. Online sales have become increasingly significant, reaching 33.7% of total sales in 2024, up from 30.8% in 2023. This growth highlights the importance of digital distribution in the company's monetization strategies.

The CALIDA brand contributed significantly to the revenue, with sales of CHF 150.2 million in 2024. This reflects a currency-adjusted decline of 3.2% year-on-year. The brand's performance is a key indicator of the company's overall health.

The AUBADE brand generated CHF 63.5 million in sales, experiencing a currency-adjusted decline of 6.1% year-on-year. This brand's performance is crucial to the overall portfolio.

COSABELLA brand sales were CHF 17.4 million, with a significant currency-adjusted decline of 21.5% due to ongoing repositioning. This highlights the dynamic nature of the brand's market position.

The omni-channel approach is central to the CALIDA Group's monetization strategy. Online sales are a growing segment, while retail and wholesale channels remain important. This integrated approach helps the company reach a wider customer base.

The disposal of LAFUMA MOBILIER in 2024 positively impacted the net profit, contributing CHF 14.9 million. This strategic move allowed the company to focus on its core textile business.

The company employs a dividend policy that includes both non-cash and cash dividends, with a non-cash dividend of CHF 0.66 per share proposed for 2024. Share buyback programs, funded by asset sales, aim to increase earnings per share and maintain a healthy balance sheet.

The CALIDA Group's monetization strategies are multifaceted, focusing on brand-specific sales, omni-channel distribution, and strategic financial decisions. These strategies are designed to optimize revenue generation and maintain financial health.

- Brand-Specific Sales: Revenue is generated through the sales of the CALIDA products under its various brands, with each brand contributing differently to overall sales.

- Omni-Channel Approach: The company leverages online sales, retail, and wholesale channels to maximize market reach and sales opportunities.

- Strategic Asset Management: The disposal of non-core assets, such as LAFUMA MOBILIER, allows the company to focus on its core business and improve profitability.

- Dividend and Share Buyback Programs: These programs are used to return value to shareholders and improve financial metrics.

- Digital Sales Growth: The increasing contribution of online sales demonstrates the importance of digital channels in the CALIDA business model.

For a deeper understanding of the CALIDA Group's target market, you can read more in this article: Target Market of CALIDA Group.

CALIDA Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CALIDA Group’s Business Model?

The CALIDA Group has strategically navigated the apparel market, marked by key milestones and strategic shifts. A significant move in 2023 involved a strategic realignment, focusing on its core business of bodywear, sleepwear, and lingerie. This realignment, which shaped the 2024 financial year, followed the disposal of LAFUMA MOBILIER, allowing the

Operational challenges, including subdued consumer sentiment in its core markets, particularly impacted brick-and-mortar retail sales in 2024. Despite these headwinds, the

The

The disposal of LAFUMA MOBILIER in 2023 allowed the

The acquisition and subsequent repositioning of the COSABELLA brand in 2022, though initially challenging, presents future growth opportunities. The expiration of the transitional agreement in May 2025 will give the

The

Despite challenges in the market, the

The

- Established brand strength with loyal customer bases for brands like CALIDA and AUBADE.

- Pioneering sustainability initiatives, such as the '100% Nature' compostable collection.

- A resilient omni-channel strategy, with online sales contributing significantly to total sales.

- Focus on resource-friendly production and a transparent, European-centric supply chain.

CALIDA Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CALIDA Group Positioning Itself for Continued Success?

The CALIDA Group maintains a strong position in the premium underwear and lingerie sector. This is evident through its globally recognized brands, including CALIDA and AUBADE. The company's performance, even amidst challenging market conditions, demonstrates resilience. In 2024, the CALIDA company generated over CHF 230 million in sales and operated in more than 90 countries, employing around 2,000 people.

The company's e-commerce sales share reached 33.7% in 2024, highlighting strong customer engagement in digital channels. However, several factors pose risks to the CALIDA business, including subdued consumer sentiment in core markets, which impacted sales in 2024. The ongoing repositioning of the COSABELLA brand also presents challenges, along with broader geopolitical and economic uncertainties.

The CALIDA Group operates in the premium underwear and lingerie market, focusing on brands like CALIDA and AUBADE. The CALIDA brand benefits from its established reputation. The company's global presence and brand recognition are key strengths.

Key risks include subdued consumer sentiment and geopolitical uncertainties. The repositioning of the COSABELLA brand presents ongoing challenges. Inflation and changes in purchasing power also pose threats to business development.

The CALIDA Group aims to enhance profitability and expand COSABELLA. Full control over COSABELLA's non-US operations is expected by May 2025. The company targets a 10% EBIT margin by 2026, driven by operational improvements.

The Group's strong balance sheet supports future growth. In 2024, CALIDA Group reported net liquidity of CHF 17.4 million. The company is debt-free, providing a solid financial foundation.

The CALIDA Group is focusing on enhancing the profitability of its core brands and exploiting the growth potential of COSABELLA. A new CEO, Thomas Stöcklin, will take over on June 1, 2025, ensuring strategic continuity. The company's strong financial position supports its strategic initiatives.

- Enhancing core brand profitability.

- Expanding the COSABELLA brand.

- Operational excellence to achieve a 10% EBIT margin.

- Leveraging a debt-free balance sheet for growth.

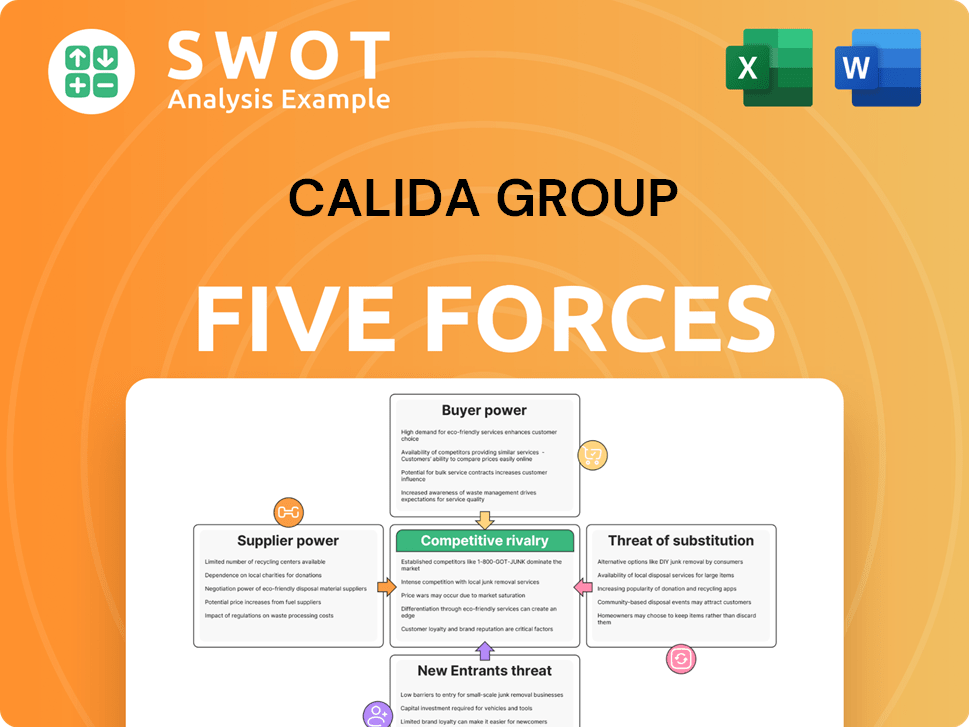

CALIDA Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CALIDA Group Company?

- What is Competitive Landscape of CALIDA Group Company?

- What is Growth Strategy and Future Prospects of CALIDA Group Company?

- What is Sales and Marketing Strategy of CALIDA Group Company?

- What is Brief History of CALIDA Group Company?

- Who Owns CALIDA Group Company?

- What is Customer Demographics and Target Market of CALIDA Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.