Eiffage Bundle

How Does Eiffage, a Construction Giant, Thrive?

Eiffage, a European construction and concessions powerhouse, isn't just building structures; it's shaping the future. With a staggering €23.4 billion in revenue in 2024, the company showcases impressive growth across its diverse operations. But how does Eiffage, with its 84,400 employees and 8 business lines, orchestrate such success?

This exploration into Eiffage SWOT Analysis will uncover the intricacies of Eiffage operations, from its construction projects to its strategic acquisitions in the energy sector. Understanding the Eiffage business model, its revenue streams, and its competitive advantages is critical for anyone looking to understand the dynamics of the construction and infrastructure landscape. We'll dissect how Eiffage manages its vast portfolio of Eiffage services, providing insights into its financial performance and future outlook, including its sustainable development initiatives.

What Are the Key Operations Driving Eiffage’s Success?

The Eiffage Company generates and delivers value through its integrated approach to designing, building, and managing infrastructure and buildings. Its Eiffage operations are structured around four main divisions: Construction, Infrastructure, Energy Systems, and Concessions. This structure allows Eiffage to offer comprehensive services across various sectors, from new builds to long-term infrastructure management.

The Eiffage business model emphasizes a strong local presence and specialized expertise within each division. This approach facilitates efficient project execution and allows Eiffage to adapt to the specific needs of its clients. The company's commitment to innovation and sustainable development further distinguishes its operations.

The company's diverse portfolio of Eiffage projects showcases its capabilities in sectors like transport, energy, and urban development. This diversification helps mitigate risks and ensures a steady stream of projects. For more insights into the company's strategic direction, you can explore the Growth Strategy of Eiffage.

The Construction division provides comprehensive solutions for new builds and renovations. It serves both private and public sector clients, covering housing, offices, retail spaces, and public facilities. Eiffage handles projects of varying scales, demonstrating its versatility in the construction market.

This division focuses on civil engineering, metal construction, roads, and urban development. Eiffage Génie Civil is involved in major transport infrastructure projects, such as the HS2 high-speed railway in the UK. Eiffage Route specializes in road network construction and maintenance.

This division concentrates on electrical, industrial, climate, and energy engineering. It provides global turnkey services from design to operation and maintenance of multi-technical facilities. This division has a strong presence in renewable energy and connection projects.

The Concessions division finances, designs, builds, services, and operates infrastructure and public amenities. This includes transport systems like motorways and facilities such as solar power plants and stadiums. This division ensures long-term management of key infrastructure assets.

Eiffage emphasizes innovation and technological development, integrating advanced design and construction technologies. The company uses 3D modeling software and drones for inspections to optimize project execution and reduce costs. It also focuses on sustainability.

- Strong local presence and specialized expertise.

- Integration of advanced technologies for efficiency.

- Commitment to a low-carbon strategy and sustainable development.

- Involvement in major projects like the Lyon-Turin rail link.

Eiffage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Eiffage Make Money?

The Eiffage Company generates revenue through two primary segments: Contracting and Concessions. This diversified approach allows Eiffage to maintain a strong financial position and capitalize on various market opportunities. In 2024, consolidated revenue exceeded €23.4 billion, demonstrating the scale of Eiffage operations.

The Contracting segment encompasses Construction, Infrastructure, and Energy Systems divisions, each contributing significantly to the overall revenue. The Concessions segment focuses on operating transport infrastructure, such as motorways and airports, providing a steady stream of income through tolls and fees. This dual-segment strategy is crucial for Eiffage's business model.

The company's monetization strategies include long-term contracts and project-based engagements, ensuring sustained revenue streams. Strategic acquisitions, like those in the Energy Systems division, further boost revenue and expand market presence. The Eiffage Company continues to adapt and grow within the construction and concessions sectors.

In 2024, Eiffage's consolidated revenue reached over €23.4 billion. The Contracting segment contributed over €19.5 billion, while Concessions generated €3.89 billion. The first quarter of 2025 showed varied performances across divisions, with construction revenue at €912 million, infrastructure at €1,964 million, and energy systems at €1,836 million.

- Construction revenue, including property development, was €912 million in Q1 2025, although property development revenues saw a significant decline of 34.2% to €96 million in the same period.

- Infrastructure revenue reached €1,964 million in Q1 2025, up 12.0% year-on-year, driven by major projects in France, Europe (excluding France), and outside Europe.

- Energy Systems revenue demonstrated strong growth, increasing by 13.9% to €1,836 million in Q1 2025, bolstered by acquisitions and a focus on energy and digital transitions. For the full year 2024, the Energy Systems division's revenue rose by 21.3% to €7.21 billion.

- Revenue from the APRR and AREA motorway networks totaled €729 million in Q1 2025, a 4.0% increase compared to 2024.

- Other motorway concessions contributed €78 million in Q1 2025, while airport concessions (Lille and Toulouse) generated around €45 million, up 3.4%. PPPs and equivalent projects generated €55 million in Q1 2025.

Eiffage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Eiffage’s Business Model?

The Eiffage Company has a rich history marked by significant milestones and strategic moves that have shaped its operations and financial performance. A key focus has been on expanding its geographical footprint and service offerings, particularly in the energy and infrastructure sectors. These strategic initiatives have been instrumental in driving revenue growth and enhancing its market position.

The company's approach involves a combination of organic growth and strategic acquisitions, allowing it to capitalize on emerging opportunities and strengthen its competitive edge. By securing major project wins and adapting to market challenges, Eiffage demonstrates its resilience and ability to maintain a solid financial position. The company's commitment to innovation and sustainable development further enhances its long-term prospects.

The Eiffage operations are characterized by a diversified business model that encompasses both contracting and concessions. This integrated approach allows the company to mitigate risks and generate multiple revenue streams. Its strong local presence, high-value specialties, and commitment to innovation are key differentiators in the market.

In 2024, Eiffage acquired Salvia and Eqos in Germany, expanding its presence in the industrial, manufacturing, infrastructure, and public services markets. This contributed to a 21.3% increase in the Energy Systems division's revenue, reaching €7.21 billion in 2024. Furthermore, the acquisition of HSM Offshore Energy, a specialist in offshore wind platforms, is set to strengthen its position in the European offshore wind power market.

Significant contracts secured in late 2023, including civil engineering works on the Penly EPR2 reactors and a section of the Line 15 East of the Grand Paris Express project, boosted the company's order book. The order book stood at €28.9 billion at the end of 2024, an 11% year-on-year increase. As of March 31, 2025, the contracting order book further increased to €29.7 billion, representing 17.8 months of contracting revenue.

The introduction of a new motorway tax in France reduced the operating profit of its concessions segment by €123 million in 2024. The real estate market posed challenges, with property development revenues falling by 34.2% in Q1 2025. Despite these hurdles, Eiffage maintained a robust financial position, achieving a record free cash flow of €2.6 billion in 2024 and refinancing its bank credit facilities to €4.4 billion by Q1 2025.

The company's integrated business model, encompassing contracting and concessions, allows for diverse revenue streams and risk mitigation. Strong local presence, high-value specialties, and a commitment to innovation, including the use of 3D modeling and drones, differentiate its operations. The employee ownership model fosters a unique corporate culture and commitment. For more insights, check out the Marketing Strategy of Eiffage.

Eiffage is actively investing in innovation and technological development to provide cutting-edge solutions and expand its presence in new markets. This includes a focus on sustainable development and low-carbon solutions, which enhances its competitive edge. The company is adapting to new trends and technology shifts to stay ahead in the industry.

- Emphasis on sustainable development and low-carbon solutions.

- Investment in innovation and technological development.

- Adaptation to new trends and technology shifts.

- Expansion into new markets.

Eiffage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Eiffage Positioning Itself for Continued Success?

The Eiffage Company holds a strong position in the European construction and concessions market. As of 2025, it ranks as the third-largest construction firm in France and the fifth-largest in Europe. With a presence in 70 countries, Eiffage demonstrates a significant global footprint, supported by a robust order book. The company's diverse activities across construction, real estate, and energy systems contribute to its market resilience.

Eiffage operations are subject to various risks, including regulatory changes and economic uncertainties. The new motorway tax in France, implemented in 2024, reduced the operating profit of its concessions segment. The real estate market presents challenges, particularly due to the new-housing crisis in Europe. The company also faces risks from increased corporate tax rates and competition in the construction and energy sectors.

Eiffage is a leading construction and concessions company in Europe. It's the third-largest construction firm in France and fifth-largest in Europe. With a global presence in 70 countries, Eiffage has a diversified portfolio.

Regulatory changes, such as the new motorway tax, impact operating profit. The real estate market's decline and economic uncertainty pose challenges. Increased corporate tax rates and competition in construction and energy sectors also create risks.

Eiffage anticipates revenue and operating profit growth in 2025. The Energy Systems division is expected to continue strong growth. Strategic initiatives include international expansion and acquisitions, particularly in Germany and offshore wind.

The order book stood at €29.7 billion as of March 31, 2025. The Energy Systems division is projected to reach nearly €8 billion in revenue. The operating margin in Energy Systems could improve to 6%.

Eiffage is committed to a low-carbon strategy and sustainable development, with ongoing investments in innovation. The company plans to expand its international presence and make selective acquisitions in growing markets. For more information, you can read about the Target Market of Eiffage.

- Continued international expansion, particularly in Germany.

- Focus on the offshore wind power sector.

- Emphasis on sustainable development and innovation.

- Adaptation to changing market demands through cutting-edge solutions.

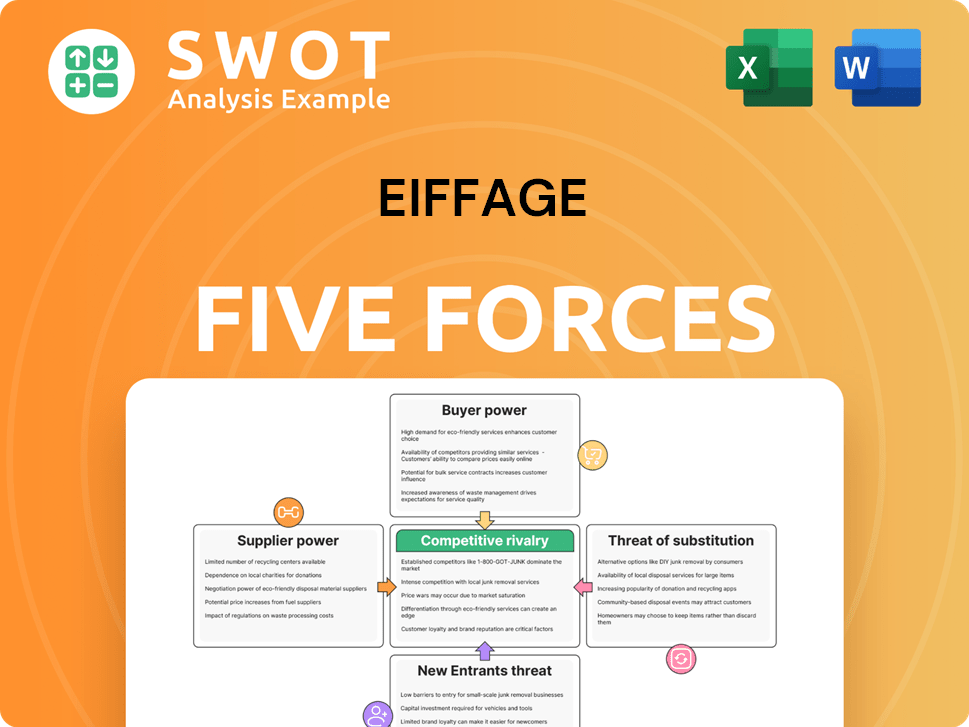

Eiffage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eiffage Company?

- What is Competitive Landscape of Eiffage Company?

- What is Growth Strategy and Future Prospects of Eiffage Company?

- What is Sales and Marketing Strategy of Eiffage Company?

- What is Brief History of Eiffage Company?

- Who Owns Eiffage Company?

- What is Customer Demographics and Target Market of Eiffage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.