Falabella Bundle

How Does the Falabella Company Thrive in Latin America?

Falabella, a retail giant, isn't just a company; it's a cornerstone of Latin American commerce, impacting millions of consumers. From department stores to financial services, the Falabella SWOT Analysis reveals the strategies behind its impressive market presence. Understanding the Falabella business model is key to grasping the dynamics of the region's retail landscape.

This comprehensive analysis explores how the Falabella company has become a dominant force. We'll examine its diverse operations, including Sodimac and its financial services, and how it adapts to the evolving retail environment. Whether you're interested in Falabella Chile, its e-commerce platform, or its financial performance, this exploration offers valuable insights.

What Are the Key Operations Driving Falabella’s Success?

The Falabella company operates as a comprehensive retail and financial services conglomerate, primarily serving customers across Latin America. Its core business model revolves around a synergistic ecosystem that integrates various retail formats with financial products. This approach allows for enhanced customer experiences and operational efficiencies, setting it apart in the competitive retail landscape.

The Falabella business model encompasses department stores, home improvement outlets (Sodimac), supermarkets (Tottus), and financial services (CMR Falabella, Banco Falabella). This diverse portfolio enables the company to cater to a broad range of consumer needs, from apparel and home goods to groceries and financial products. The integration of these segments is a key element of its strategy, fostering customer loyalty and driving sales.

The operational processes within the Falabella company are complex, involving sophisticated supply chain management, extensive logistics networks, and a growing emphasis on digital platforms. These elements work together to ensure efficient product delivery and a seamless customer experience. This includes leveraging physical store locations for services like click-and-collect, which enhances customer convenience and integrates online and offline shopping experiences.

Falabella's supply chain is optimized for efficiency, managing a diverse product range sourced globally and regionally. Strategic partnerships with various brands and suppliers expand its product assortment and market reach. This robust supply chain is critical for the timely delivery of products across its extensive network of stores and online platforms.

The integration of financial services, particularly the CMR credit card, is a key differentiator. This integration fosters customer loyalty and provides valuable data for personalized marketing and credit offerings. Customers using the CMR card benefit from exclusive discounts and financing options across Falabella's retail formats.

Falabella continues to invest heavily in technology, including e-commerce platforms and data analytics, to enhance its operational effectiveness and market differentiation. This digital focus supports both online sales and the optimization of in-store experiences. These investments are geared towards improving customer engagement and operational efficiency.

Falabella offers a comprehensive value proposition, including convenient financing, a wide product selection, and a seamless shopping experience. This approach differentiates it from single-format competitors by providing a more integrated and customer-centric experience. This integrated model drives customer loyalty and increases overall sales.

The Falabella company's success is underpinned by its integrated approach to retail and financial services. This strategy allows for customer loyalty and provides valuable data for personalized marketing and credit offerings. The company's continuous investment in technology, including e-commerce platforms and data analytics, further enhances its operational effectiveness and market differentiation.

- The company operates across multiple countries in Latin America, with a significant presence in Chile, Peru, and Colombia.

- Falabella's e-commerce platform has seen significant growth, reflecting the increasing importance of online retail.

- The CMR credit card plays a crucial role in customer loyalty and provides valuable data for personalized marketing.

- Strategic partnerships with various brands and suppliers expand its product assortment and market reach, bolstering its competitive advantage.

For a deeper dive into the marketing strategies that drive Falabella's success, consider exploring the Marketing Strategy of Falabella.

Falabella SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Falabella Make Money?

The Falabella company strategically diversifies its revenue streams to maintain financial stability. This approach includes multiple business segments, ensuring resilience against market fluctuations. The primary focus is on retail operations, which generate a significant portion of the company's total revenue.

The Falabella business model incorporates financial services, contributing substantially to overall revenue. These financial offerings, including credit cards, banking, and insurance, generate income through interest, fees, and commissions. This integrated strategy enhances customer engagement and drives sales across various channels.

Understanding the revenue streams and monetization strategies of Falabella is essential for investors and stakeholders. This knowledge provides insights into the company's financial health and operational efficiency. The following sections will delve into the specifics of these strategies.

Retail sales are a cornerstone of Falabella's revenue. This includes sales from department stores, home improvement stores like Sodimac, and supermarkets. The retail sector consistently contributes a significant portion of the company's overall revenue.

Financial services are a crucial revenue stream for Falabella. These services encompass credit cards, banking products, and insurance offerings. Revenue is generated through interest, fees, and commissions associated with these financial products.

The CMR credit card is a key component of Falabella's financial strategy. It drives retail sales and generates revenue through interest charges and transaction fees. This card enhances customer loyalty and spending.

Falabella uses tiered pricing and loyalty programs to incentivize customer engagement. These strategies encourage increased spending and enhance customer retention. The programs are designed to reward frequent customers.

The digital marketplace is a growing revenue source for Falabella. It allows third-party sellers to list products, generating revenue through commissions and advertising fees. This expands the product offerings and customer reach.

Omnichannel retailing is a key strategy for Falabella. It integrates online and offline sales channels to maximize customer reach and spending. This approach adapts to evolving consumer shopping behaviors.

The Falabella company employs several innovative monetization strategies to boost its financial performance. These strategies focus on enhancing customer engagement, expanding market reach, and diversifying revenue sources. Recent expansions in digital offerings and logistics capabilities are designed to capture a larger share of the e-commerce market in Latin America, further diversifying its revenue mix beyond traditional brick-and-mortar sales. For more details on the company's structure, you can read about the Owners & Shareholders of Falabella.

- Integrated Financial Services: The CMR credit card drives retail sales and generates revenue through interest and fees.

- Tiered Pricing and Loyalty Programs: These programs incentivize customer engagement and spending.

- Digital Marketplace Expansion: Third-party sellers contribute to revenue through commissions and advertising.

- Omnichannel Retailing: Integration of online and offline channels maximizes customer reach and spending.

Falabella PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Falabella’s Business Model?

The Falabella company, a prominent retail company, has a rich history marked by significant milestones and strategic decisions. These moves have shaped its evolution and cemented its position in the competitive market. The company's journey reflects a commitment to growth, innovation, and adaptation to changing consumer behaviors and market dynamics.

A key strategic move for Falabella has been its aggressive expansion across Latin America. This expansion included entries into countries like Peru, Colombia, and Argentina. This broadened its geographical footprint and market access. Furthermore, the company has invested heavily in its financial services arm, CMR Falabella, transforming it into a key competitive advantage.

In recent years, the Falabella business has focused heavily on digital transformation, including the enhancement of its e-commerce platforms and logistics capabilities. This response to the global shift towards online shopping has been crucial. For instance, in 2024, the company continued to invest in improving its digital infrastructure to enhance the customer experience and operational efficiency.

The company's history is marked by strategic expansions and diversification. These include the establishment of Sodimac, and the growth of its financial services. These moves have been pivotal in expanding its market reach and service offerings.

Strategic moves include geographical expansion across Latin America. Investments in digital transformation and the financial services sector have also been critical. These moves have allowed the company to adapt to changing market conditions and customer preferences.

The company's strong brand reputation, economies of scale, and extensive store network contribute to its competitive edge. The integrated ecosystem of retail and financial services provides a unique advantage. This fosters customer loyalty and cross-segment growth.

The company has invested heavily in its e-commerce platform. This includes improvements in logistics and customer experience. These efforts reflect the company's commitment to adapting to the evolving digital landscape and meeting customer expectations.

The company's competitive advantages include a strong brand reputation and an integrated ecosystem of retail and financial services. This fosters customer loyalty and facilitates cross-segment growth. The company continues to adapt to new trends by investing in technology and sustainability initiatives.

- Strong Brand Reputation: Built over decades, fostering customer trust and loyalty.

- Economies of Scale: Allowing for competitive pricing and operational efficiency.

- Integrated Ecosystem: Combining retail and financial services for a unique customer experience.

- Digital Transformation: Enhancing e-commerce and logistics to meet evolving consumer demands.

Falabella Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Falabella Positioning Itself for Continued Success?

The Falabella company holds a prominent position in Latin America's retail and financial services sectors. This position is marked by significant market share across its key operating countries and is supported by strong customer loyalty. Its diverse business model, encompassing department stores, home improvement, supermarkets, and financial services, provides a competitive edge.

However, the

Falabella maintains a leading market share in key Latin American countries. Its integrated ecosystem, including department stores, home improvement (such as

The company faces economic volatility in Latin America, intense competition from both local and international retailers, and the rapid evolution of e-commerce. Changes in consumer preferences and technological advancements also pose challenges. Regulatory changes in financial services and labor laws add further complexity.

Falabella is focused on digital transformation, aiming to integrate online and offline channels. This includes investing in its e-commerce platforms, logistics, and data analytics. The company plans to strengthen its financial services arm and leverage its customer base. Sustainability, innovation, and customer value are key priorities.

Falabella is working to improve its store network, boost digital sales, and capitalize on synergies between its retail and financial segments. These initiatives are designed to maintain its leadership position in the dynamic Latin American market. The company is committed to sustainable growth and enhancing customer value.

Falabella's strategy centers on digital transformation and omnichannel integration to enhance the customer experience. This involves significant investments in e-commerce, logistics, and data analytics. The company also aims to expand its financial services offerings.

- Enhancing e-commerce platforms and logistics.

- Leveraging data analytics for personalized offerings.

- Expanding financial services through its customer base.

- Focusing on sustainability and innovation.

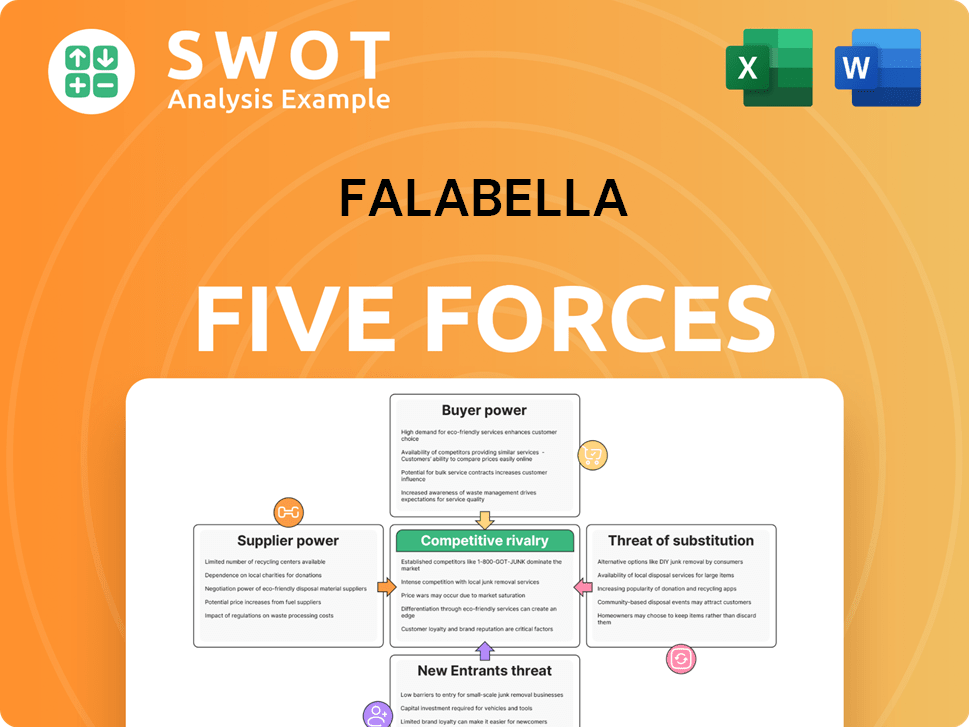

Falabella Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Falabella Company?

- What is Competitive Landscape of Falabella Company?

- What is Growth Strategy and Future Prospects of Falabella Company?

- What is Sales and Marketing Strategy of Falabella Company?

- What is Brief History of Falabella Company?

- Who Owns Falabella Company?

- What is Customer Demographics and Target Market of Falabella Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.