General Mills Bundle

How Does General Mills Thrive in the Food Industry?

General Mills, a culinary titan with over a century of experience, has become a household name, offering a diverse portfolio of products. From breakfast cereals like Cheerios and Lucky Charms to baking mixes and snacks, its presence in kitchens worldwide is undeniable. But how does this food manufacturing giant consistently deliver success?

The General Mills SWOT Analysis offers a deeper dive into the company's strategic positioning. Understanding the inner workings of the General Mills company is essential for anyone looking to understand the consumer packaged goods landscape. This exploration will uncover the strategies behind its enduring brand power and its ability to adapt to market changes, examining everything from General Mills's company history to its current financial performance.

What Are the Key Operations Driving General Mills’s Success?

The General Mills company creates value by offering a wide array of branded consumer foods. Its products cater to diverse consumer preferences and dietary needs, spanning families, individuals, and food service establishments globally. The company's core offerings include cereals, yogurt, convenient meals, baking products, and snacks, all designed to provide convenient and trusted food options.

The value proposition of General Mills centers on providing high-quality, convenient, and trusted food choices. This approach simplifies meal preparation and snacking for consumers. The company's operational processes are sophisticated and globally integrated, ensuring product consistency and adapting to regional tastes.

Its operational model includes sourcing raw materials, manufacturing, packaging, and distribution. General Mills maintains a robust supply chain, working with numerous farmers and suppliers to secure ingredients. Manufacturing facilities use advanced technology for efficiency and product consistency. Products are distributed through various channels, including retail grocery stores and e-commerce platforms. Marketing and sales efforts build brand loyalty and drive consumer demand.

The company's portfolio includes cereals like Cheerios, yogurt such as Yoplait, convenient meals such as Old El Paso, baking products like Pillsbury, and snacks such as Nature Valley. These products are designed to meet diverse consumer needs and preferences. This broad range allows General Mills to capture a significant share of the consumer packaged goods market.

Operational processes are globally integrated, encompassing sourcing, manufacturing, packaging, and distribution. The company uses advanced technology in its manufacturing facilities to ensure efficiency and product consistency. Logistics are critical, with products distributed through various channels, including retail grocery stores and e-commerce platforms.

The company maintains a robust supply chain, working with a vast network of farmers and suppliers to secure ingredients. Products are distributed through various channels, including retail grocery stores, mass merchandisers, club stores, and e-commerce platforms. Effective distribution ensures product availability and supports the company's market reach.

General Mills engages in extensive marketing and sales efforts to build brand loyalty and drive consumer demand. These efforts include advertising, promotions, and product innovation. Strong brand equity translates into customer benefits such as reliable product availability and consistent quality.

The company's core operations are centered around its extensive brand portfolio and efficient supply chain. General Mills focuses on providing convenient, trusted, and high-quality food options to a global consumer base. This integrated approach, coupled with strong brand equity, contributes to its success in the food manufacturing industry.

- Extensive Brand Portfolio: Includes cereals, yogurt, convenient meals, baking products, and snacks.

- Global Operations: Integrated supply chain and distribution network.

- Marketing and Sales: Efforts to build brand loyalty and drive consumer demand.

- Innovation: Continuous product development to meet evolving consumer preferences.

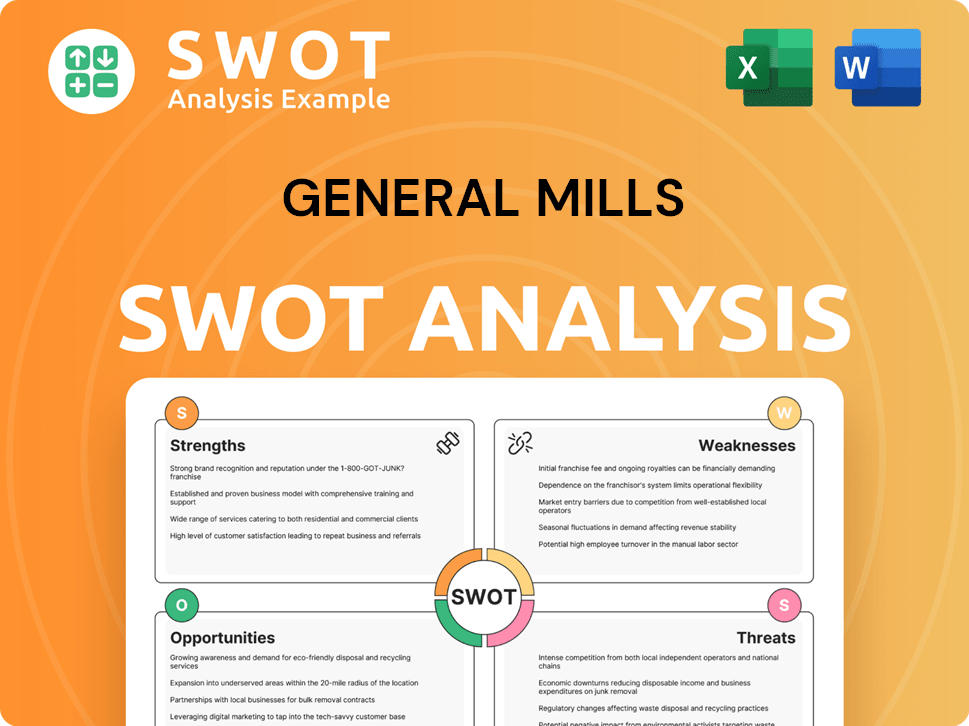

General Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does General Mills Make Money?

Understanding the revenue streams and monetization strategies of the General Mills company is crucial for investors and anyone interested in the food manufacturing industry. The company's success is built on a foundation of diverse product offerings and strategic market approaches. This chapter will explore how General Mills generates revenue and the methods it employs to sustain and grow its financial performance.

General Mills primarily earns its revenue through the sale of branded consumer food products. The company's ability to adapt to market trends, innovate, and expand its product lines has been key to its continued success. The following sections will delve into the specific revenue streams and monetization strategies that drive General Mills' financial results.

General Mills' revenue streams are segmented across various categories, each contributing significantly to the company's overall financial performance. These segments reflect the company's broad portfolio and its ability to cater to different consumer needs and market demands. The company's monetization strategies are centered on volume-driven product sales and strategic pricing.

This segment is the largest, encompassing cereals, yogurt, snacks, and baking products sold in the United States and Canada. In the third quarter of fiscal year 2024, this segment generated net sales of $3.3 billion.

Including brands like Blue Buffalo, this segment reflects the growing pet food market. Net sales for this segment were $592 million in the third quarter of fiscal year 2024.

This segment covers a wide range of products sold in various global markets. Net sales in the third quarter of fiscal year 2024 were $738 million.

Serving restaurants and other food service outlets, this segment contributed $486 million in net sales during the third quarter of fiscal year 2024.

General Mills focuses on volume-driven product sales and strategic pricing. They leverage strong brand recognition to command premium pricing and employ promotional activities to drive sales and market share. Further insights into the company's strategic growth can be found in the Growth Strategy of General Mills.

Acquisitions, such as the purchase of Blue Buffalo, have diversified the portfolio. Adapting product offerings and pricing to regional preferences ensures sustained revenue generation across its global footprint.

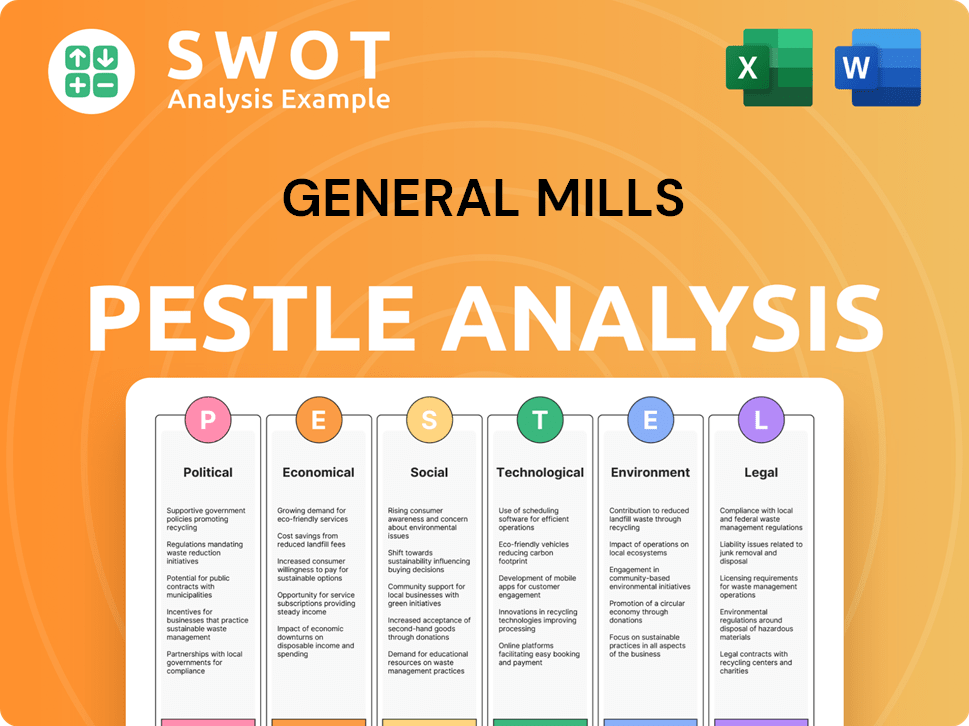

General Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped General Mills’s Business Model?

The journey of the General Mills company is marked by significant milestones and strategic maneuvers that have shaped its current operational and financial standing. A pivotal strategic move was the acquisition of Pillsbury in 2001, which greatly expanded its baking and refrigerated dough portfolio. More recently, the 2018 acquisition of Blue Buffalo Pet Products for approximately $8 billion marked a significant diversification into the rapidly growing pet food market, showcasing the company's commitment to expanding beyond its traditional human food categories.

The General Mills company has navigated various challenges, including supply chain disruptions, inflationary pressures, and evolving consumer preferences for healthier and more sustainable options. In response, General Mills has focused on supply chain optimization, strategic pricing actions, and product innovation to meet changing demands. For instance, in fiscal year 2024, the company reported that its organic net sales were up 1% year-over-year, driven by positive net price realization and mix, partially offset by lower pound volume.

General Mills' competitive advantages include its immense brand strength, with many of its brands holding leading market positions. Its economies of scale in manufacturing and distribution provide a cost advantage, while its extensive research and development capabilities enable continuous product innovation. The company also leverages its vast distribution network and strong relationships with retailers to maintain a dominant presence on store shelves. For a deeper dive into the company's origins, consider reading a Brief History of General Mills.

General Mills has strategically expanded its portfolio through key acquisitions. The acquisition of Pillsbury in 2001 significantly boosted its presence in the baking and refrigerated dough sectors. The 2018 acquisition of Blue Buffalo Pet Products for approximately $8 billion marked a major move into the pet food market.

General Mills has adapted to changing market conditions by focusing on supply chain optimization and strategic pricing. The company is also investing in product innovation to meet evolving consumer demands for healthier and more sustainable options. These efforts are crucial for maintaining its competitive edge within the food manufacturing industry.

General Mills benefits from strong brand recognition and a vast distribution network. Economies of scale in manufacturing and distribution provide a cost advantage. Continuous product innovation and strong retailer relationships support its market dominance. The company's brand portfolio includes numerous leading cereal brands and other consumer packaged goods.

In fiscal year 2024, General Mills reported that its organic net sales were up 1% year-over-year. This growth was driven by positive net price realization and mix, partially offset by lower pound volume. The company's ability to manage pricing and adapt to market changes is key to its financial health.

General Mills is focused on several key strategies to maintain its competitive edge and drive growth. These include expanding its e-commerce capabilities and entering new product categories. Sustainability initiatives are also a priority, reflecting the growing demand for environmentally conscious products.

- Focus on supply chain optimization to improve efficiency.

- Strategic pricing actions to manage inflationary pressures.

- Product innovation to meet evolving consumer preferences.

- Investment in e-commerce and new product categories.

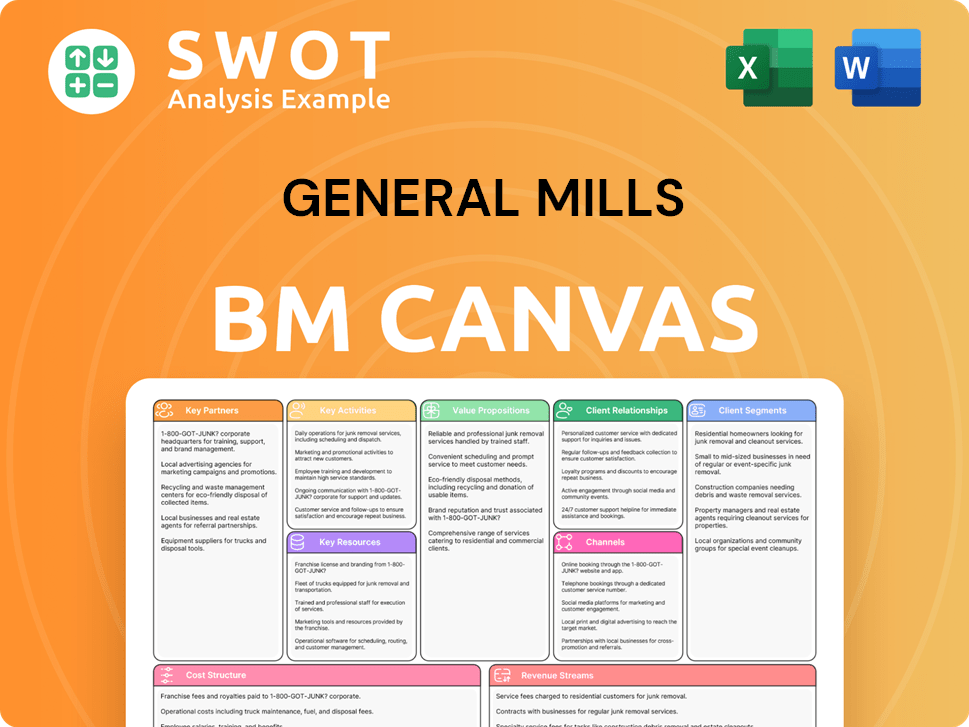

General Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is General Mills Positioning Itself for Continued Success?

General Mills, a major player in the global packaged food industry, holds a strong position. It competes with companies like Kellogg's, PepsiCo, and Nestlé. It has a significant market share in key categories, including cereal and yogurt. Its products are sold in over 100 countries, benefiting from strong brand loyalty.

The General Mills company faces risks like supply chain disruptions and commodity price volatility. Consumer preferences are changing, and there's intense competition. Regulatory changes also pose challenges. In the third quarter of fiscal year 2024, the company saw a decline in pound volume, signaling a shift in consumer purchasing habits.

General Mills is a leading company in the food manufacturing sector. It competes with major players in the consumer packaged goods market. The company benefits from a strong brand portfolio.

General Mills faces risks related to supply chain disruptions and volatile commodity prices. Changing consumer preferences and intense competition also pose challenges. Regulatory changes are another factor.

General Mills focuses on strategic initiatives for sustainable growth. This includes investing in core brands and product innovation. The company is also expanding in emerging markets.

General Mills focuses on driving sustainable profitable growth. It leverages its strong brand portfolio and supply chain capabilities. The company aims to navigate future challenges and capitalize on new opportunities.

General Mills is focused on driving sustainable profitable growth. The company is leveraging its strong brand portfolio and supply chain capabilities. It aims to navigate future challenges and capitalize on new opportunities.

- Continued investment in its core brands.

- Product innovation to meet evolving consumer demands, such as healthier options.

- Expansion in emerging markets.

- Efficiency improvements and disciplined capital allocation.

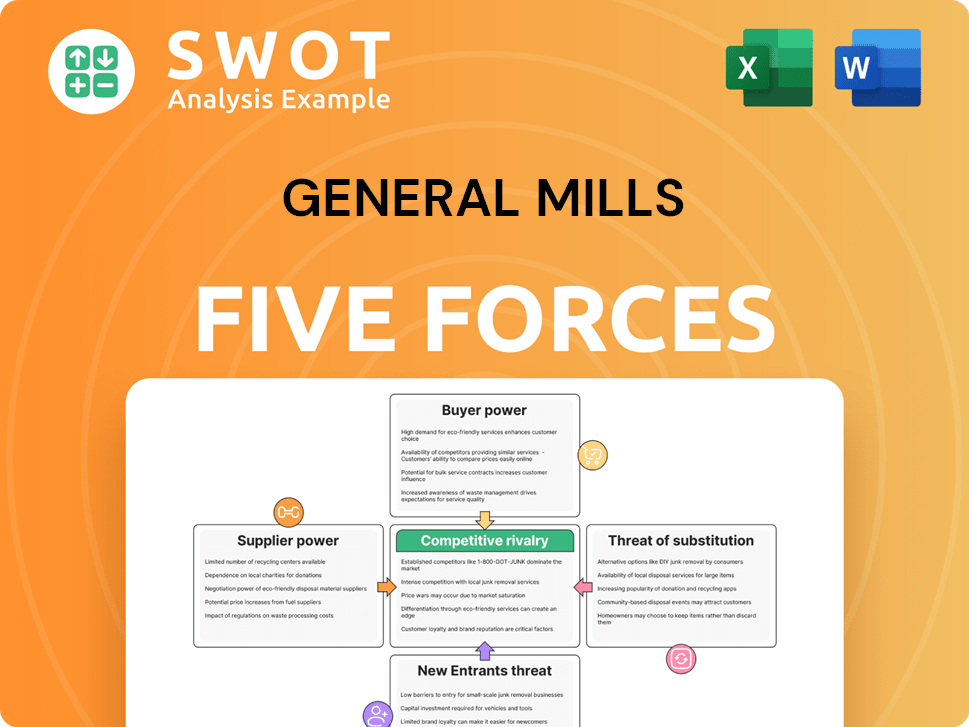

General Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of General Mills Company?

- What is Competitive Landscape of General Mills Company?

- What is Growth Strategy and Future Prospects of General Mills Company?

- What is Sales and Marketing Strategy of General Mills Company?

- What is Brief History of General Mills Company?

- Who Owns General Mills Company?

- What is Customer Demographics and Target Market of General Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.