InterGlobe Aviation Bundle

How Does InterGlobe Aviation Soar?

InterGlobe Aviation, better known as IndiGo Airlines, dominates India's skies, but how does this airline giant actually work? From its impressive market share to its vast network, IndiGo has redefined air travel in India. Understanding the inner workings of InterGlobe Aviation SWOT Analysis is key to grasping its success.

This exploration of IndiGo Airlines dives deep into its core operations, revealing how it maintains its status as a leading low-cost carrier in the Indian aviation industry. We'll uncover the secrets behind its efficient airline operations, examining its business model and how it generates revenue. Whether you're curious about booking a flight or interested in InterGlobe Aviation's financial performance, this analysis provides valuable insights.

What Are the Key Operations Driving InterGlobe Aviation’s Success?

InterGlobe Aviation, operating primarily as IndiGo Airlines, centers its value proposition on providing affordable, reliable, and efficient air travel. This is achieved by focusing on the low-cost carrier (LCC) model, offering air transportation services to a broad customer base that includes leisure travelers, business commuters, and those seeking economical travel options. The airline's commitment to this model is evident in its operational strategies and customer-focused approach.

The core offering of IndiGo is air transportation services, which are designed to be accessible and convenient. The airline's business model is built around providing a streamlined travel experience, focusing on punctuality, and offering competitive pricing. This approach has made IndiGo a popular choice within the Indian aviation industry, allowing it to capture a significant market share.

IndiGo's operational efficiency is a key differentiator, enabling it to offer low fares while maintaining profitability. The airline's focus on operational excellence is crucial to its success in the competitive air travel market. This operational strategy has enabled the company to maintain a strong position in the market.

IndiGo operates a uniform fleet primarily consisting of Airbus A320 and A321 aircraft. This standardization simplifies maintenance, pilot training, and spare parts management. It also contributes to higher aircraft utilization rates, which is a key factor in cost efficiency and operational reliability. The fleet's uniformity supports streamlined operations.

IndiGo emphasizes quick turnarounds at airports to minimize ground time and maximize flying hours. This operational efficiency is critical for maximizing the utilization of its aircraft and improving overall productivity. Quick turnarounds are a core part of their strategy.

The airline employs robust route network planning to optimize connectivity and passenger load factors. This strategic approach ensures that flights are scheduled efficiently, maximizing the number of passengers carried on each flight. Effective route planning is crucial for profitability.

IndiGo's supply chain management focuses on direct procurement and long-term agreements with suppliers. This strategy secures favorable terms for aircraft, engines, and other components, contributing to cost savings. It ensures a stable supply chain.

IndiGo's operations are unique due to its unwavering commitment to the LCC model, which translates into a lean cost structure and high operational reliability. This operational discipline, combined with a focus on punctuality, is a key differentiator. This approach translates into tangible benefits for customers, solidifying its market leadership. For instance, in 2024, IndiGo maintained a high on-time performance rate, showcasing its commitment to reliable air travel.

- Cost Savings: The LCC model allows IndiGo to offer competitive fares.

- Reliable Travel: High on-time performance and low cancellation rates provide a dependable travel experience.

- Customer Satisfaction: These operational efficiencies contribute to high customer satisfaction levels.

- Market Leadership: These factors have solidified IndiGo's position as a leader in the Indian aviation industry.

InterGlobe Aviation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does InterGlobe Aviation Make Money?

InterGlobe Aviation, operating primarily as IndiGo Airlines, generates revenue through a combination of passenger ticket sales and ancillary services. The airline's financial success hinges on efficiently managing these revenue streams. Understanding these components is crucial for assessing the company's overall performance.

Passenger ticket sales form the core revenue stream for IndiGo, encompassing both domestic and international flights. However, the company has strategically expanded its revenue sources beyond ticket sales. This approach is critical for profitability in the competitive Indian aviation industry.

Ancillary revenues play a significant role in InterGlobe Aviation's financial strategy, contributing substantially to its overall income. As of the nine months ending December 31, 2023, ancillary revenues for IndiGo reached INR 5,744.7 crore, representing 17.6% of the total revenue. This highlights the importance of non-ticket revenue sources for the airline.

IndiGo's ancillary revenue streams include a variety of services designed to enhance the passenger experience and boost profitability. These services are a key part of InterGlobe Aviation's growth strategy. These additional revenue sources provide flexibility in pricing and service offerings, allowing the airline to cater to different customer preferences.

- Charges for baggage exceeding the free allowance.

- Fees for seat selection.

- In-flight meals and beverage sales.

- Priority boarding fees.

- Revenue from cargo services.

- Fees for excess baggage, cancellations, and changes.

InterGlobe Aviation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped InterGlobe Aviation’s Business Model?

InterGlobe Aviation's (IndiGo) journey has been marked by significant milestones and strategic decisions that have solidified its position in the Indian aviation industry. The company's initial public offering (IPO) in 2015 was a pivotal event, providing capital for fleet expansion and network growth. This strategic move allowed IndiGo to invest heavily in modern aircraft and expand its reach across domestic and international routes.

The airline's success is rooted in its commitment to operational efficiency and cost management, key elements of its low-cost carrier (LCC) model. IndiGo has consistently focused on optimizing its operations, from fuel-efficient aircraft to streamlined processes, enabling it to offer competitive fares and maintain profitability. The airline has also demonstrated resilience in navigating market challenges, including the COVID-19 pandemic, by adapting its strategies to ensure sustained growth.

In 2023, IndiGo placed a historic order for 500 Airbus A320 Family aircraft, showcasing its commitment to long-term expansion. This move underscores the airline's confidence in the future of air travel and its plan to modernize its fleet. This strategic investment will further enhance its operational capabilities and expand its network, solidifying its market leadership.

The 2015 IPO was a major milestone, providing capital for fleet expansion. IndiGo has consistently expanded its fleet, including a massive order for 500 Airbus A320 Family aircraft in 2023. This expansion supports its growth strategy and enhances its operational capabilities.

IndiGo has focused on aggressive fleet expansion with fuel-efficient aircraft. The airline has adapted to market challenges, such as the COVID-19 pandemic, by optimizing its network and reducing costs. The company is exploring sustainable aviation fuels (SAF) and enhancing its digital platforms.

IndiGo's strong brand reputation for punctuality and affordability fosters high customer loyalty. Economies of scale, stemming from its large fleet and extensive network, allow for lower per-unit operating costs. The disciplined LCC business model provides a significant competitive edge.

IndiGo has navigated supply chain disruptions and engine issues through proactive communication with manufacturers and efficient maintenance planning. The airline has demonstrated resilience in responding to market downturns by optimizing its network and reducing costs. IndiGo's focus on domestic travel recovery has been a key strategy.

IndiGo's competitive advantages are built on several pillars, including its strong brand, operational efficiency, and extensive network. Its focus on punctuality and affordability has cultivated high customer loyalty, which is a key factor in its success. The airline's ability to maintain low operating costs, combined with a robust domestic and international presence, creates a powerful ecosystem.

- Strong Brand and Customer Loyalty: Built on punctuality and affordability.

- Economies of Scale: Large fleet and extensive network lead to lower costs.

- Disciplined LCC Model: Focus on cost control and operational efficiency.

- Extensive Network: A wide domestic and growing international reach.

IndiGo's focus on operational efficiency and cost management is central to its success. The airline's low-cost carrier model, combined with its extensive network and strong brand reputation, gives it a significant competitive edge in the Indian aviation industry. For more insights into the strategies employed by the company, you can explore the Marketing Strategy of InterGlobe Aviation.

InterGlobe Aviation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is InterGlobe Aviation Positioning Itself for Continued Success?

InterGlobe Aviation, operating primarily as IndiGo Airlines, holds a dominant position within the Indian aviation industry. The airline's strategic approach has allowed it to capture a significant market share, making it a key player in the air travel sector. Its success is built upon a low-cost carrier model combined with operational efficiency and a wide network.

The future for InterGlobe Aviation appears promising, with plans for fleet expansion and international route development. However, the company faces risks related to competition, regulatory changes, and technological advancements. Understanding these factors is crucial for evaluating the airline's long-term prospects.

InterGlobe Aviation, or IndiGo Airlines, is the leader in the Indian aviation industry, holding the largest market share. As of March 2024, IndiGo's domestic market share reached 60.6%, significantly ahead of its competitors. This strong position reflects its extensive network, competitive pricing, and brand recognition, leading to high customer loyalty.

IndiGo faces several risks, including regulatory changes impacting airport slot allocations, aviation fuel taxes, and environmental regulations. Intense competition from domestic carriers and new entrants poses a constant threat to market share and pricing power. Technological disruptions and changing consumer preferences also present challenges to its low-cost carrier model.

The future outlook for IndiGo is positive, with ongoing strategic initiatives for expansion and efficiency. The airline plans to expand its fleet, indicated by substantial aircraft orders extending into the next decade. It is also focusing on enhancing its international network and exploring new markets, while maintaining its low-cost model.

The competitive landscape of InterGlobe Aviation is dynamic, with several other airlines vying for market share. Understanding its competitors is crucial for assessing IndiGo's position and strategies. For further insights, consider exploring the Competitors Landscape of InterGlobe Aviation.

IndiGo's strategic initiatives include fleet expansion, route network optimization, and exploring new revenue streams. The airline aims to sustain and expand its profitability by leveraging its scale and operational excellence. Digital innovations and exploring cargo opportunities are also part of its strategy.

- Fleet expansion with significant aircraft orders.

- Enhancement of international routes, particularly in the Middle East and Southeast Asia.

- Focus on operational efficiency and cost management.

- Exploration of new revenue streams and digital innovations.

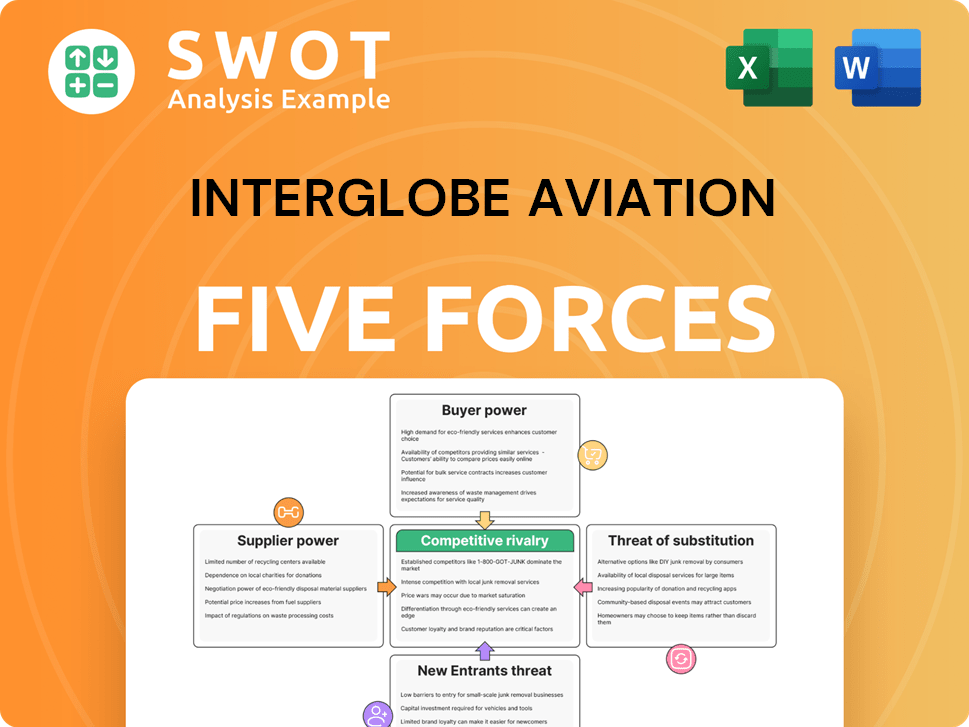

InterGlobe Aviation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of InterGlobe Aviation Company?

- What is Competitive Landscape of InterGlobe Aviation Company?

- What is Growth Strategy and Future Prospects of InterGlobe Aviation Company?

- What is Sales and Marketing Strategy of InterGlobe Aviation Company?

- What is Brief History of InterGlobe Aviation Company?

- Who Owns InterGlobe Aviation Company?

- What is Customer Demographics and Target Market of InterGlobe Aviation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.