Haworth Bundle

How Does the Haworth Company Shape the Future of Work?

In a world where office spaces are constantly evolving, Haworth Company is a key player in redefining how we work. With a rich history of innovation, Haworth offers adaptable Haworth SWOT Analysis and workspace solutions that boost both employee well-being and productivity. Their influence spans across various sectors, making them a global leader in the contract furniture industry.

Haworth's commitment to sustainability and cutting-edge design has earned them industry recognition and a strong position in the market. Understanding the Haworth company and its operations is crucial for anyone interested in the future of work. This examination will explore the core functions, revenue streams, and competitive advantages that drive the success of Haworth office furniture and its impact on the dynamic commercial interiors market, and its Haworth workplace solutions.

What Are the Key Operations Driving Haworth’s Success?

The core operations of the Haworth company center on designing, manufacturing, and delivering adaptable workspace solutions. These solutions are designed to boost employee well-being and productivity. Their value proposition focuses on creating high-performance environments through a wide range of products.

Haworth's offerings include systems furniture, ergonomic seating, intelligent storage, and flexible architectural interiors. These products are tailored to meet the diverse needs of corporate offices, healthcare facilities, educational institutions, and government agencies. The company's operational process is vertically integrated, which allows for stringent quality control and efficient production.

Haworth's commitment to sustainability is evident in its sourcing of raw materials, aligning with its environmental responsibility. Logistics and distribution are managed through a global network, ensuring timely delivery and installation. Customer service is a key part of Haworth's operations, offering ongoing support to help clients maximize their workspace investments.

Haworth's operations are vertically integrated, encompassing design, manufacturing, and a global supply chain. This allows for strict quality control and efficient production. The company focuses on research and development to meet the evolving demands of modern work environments.

The value proposition is creating high-performance environments. This is achieved through a comprehensive suite of products. These products include systems furniture, ergonomic seating, and flexible architectural interiors.

Haworth's focus on innovation translates into benefits for customers. These benefits include enhanced employee engagement, optimized space utilization, and improved organizational performance. They aim to provide solutions that meet the changing needs of modern workplaces.

Haworth prioritizes sustainable practices in its operations. This includes sourcing raw materials responsibly. Their commitment to environmental responsibility is a key part of their business model.

Haworth's operational effectiveness is enhanced by its focus on research and development. This allows them to continuously innovate and meet the changing needs of the market. This approach leads to better employee engagement and improved space utilization.

- Vertical Integration: In-house design, manufacturing, and global supply chain.

- Sustainability: Focus on sustainable practices in sourcing and operations.

- Customer Service: Ongoing support and consultation to maximize workspace investments.

- Innovation: Continuous research and development to meet evolving workplace demands.

Haworth SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Haworth Make Money?

Understanding the revenue streams and monetization strategies of the Haworth company is key to grasping its financial structure and operational approach. The company, a major player in the office furniture industry, generates revenue through a multifaceted approach that combines direct product sales with value-added services. This strategy allows it to cater to a broad range of clients, from small businesses to large corporations, offering comprehensive workplace solutions.

The primary revenue source for Haworth stems from the direct sale of its manufactured products. These include a diverse range of offerings, such as systems furniture, seating, storage solutions, and architectural interiors. While specific financial breakdowns for 2024-2025 are not publicly available, product sales consistently constitute the majority of its income. The company strategically complements its product offerings with an array of services, enhancing its value proposition and fostering client relationships.

The company's revenue model is built on a foundation of product sales, complemented by services and strategic partnerships. This approach allows Haworth to maintain a strong market presence and adapt to the evolving needs of its customers. By understanding these strategies, stakeholders can gain a clearer picture of how the company operates and generates value in the competitive office furniture market.

The core of Haworth's revenue generation lies in its direct sales of Haworth office furniture and related products. This is complemented by a range of services designed to provide comprehensive workplace solutions. The company employs various monetization strategies to maximize its revenue potential and maintain a competitive edge in the market. For more information, you can read about Owners & Shareholders of Haworth.

- Product Sales: The primary revenue stream comes from selling systems furniture, seating, storage, and architectural interiors. While precise figures for 2024-2025 aren't available, product sales form the bulk of its revenue.

- Service Revenue: Additional revenue is generated through services like space planning, design consultation, installation, and maintenance. These services enhance the value of product offerings and foster client relationships.

- Project-Based Sales: For large corporate and institutional clients, Haworth designs and implements comprehensive workspace solutions, often involving tiered pricing based on project complexity and customization.

- Dealer Network: The company utilizes a global network of dealers and showrooms, operating on commission or wholesale models, which are crucial sales channels.

- Long-Term Client Relationships: By focusing on sustainable and adaptable solutions, Haworth encourages repeat business as organizations update and expand their workspaces, ensuring continuous demand.

- Strategic Acquisitions: Acquisitions, such as the 2014 purchase of Poltrona Frau Group, have expanded the revenue base into the high-end residential and luxury furniture markets, though the core focus remains on commercial interiors.

Haworth PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Haworth’s Business Model?

The journey of the Haworth company has been marked by significant milestones that have shaped its operations and financial performance. A key strategic move was its early recognition of the evolving nature of work and its shift towards adaptable, open-plan office systems, positioning it as a leader in flexible workspace solutions. The company's consistent investment in research and development has led to numerous product innovations, such as the introduction of its 'Places for People' philosophy, which emphasizes human-centered design and well-being in the workplace.

Strategic partnerships and acquisitions, notably the acquisition of the Poltrona Frau Group in 2014, expanded the company's global footprint and diversified its product portfolio into luxury furniture, enhancing its market reach and brand prestige. Operationally, the company has navigated challenges such as global supply chain disruptions and shifts in market demand, particularly during economic downturns and the recent pandemic-driven changes to work models. The company's competitive advantages are multifaceted, including strong brand recognition, a reputation for quality and design excellence, and a global distribution network.

The company continues to adapt to new trends, such as the rise of hybrid work, by innovating in areas like acoustic solutions, technology integration, and modular furniture systems. This ensures its continued relevance and competitive standing in the dynamic commercial interiors market. For instance, the company's focus on sustainability has led to the development of products with reduced environmental impact, aligning with the growing demand for eco-friendly workplace solutions. You can also read about the Competitors Landscape of Haworth.

Early adoption of flexible workspace solutions and human-centered design. Acquisition of Poltrona Frau Group in 2014 expanded its global presence. Continuous investment in R&D leading to innovative Haworth products.

Focus on agile manufacturing and digital integration to maintain efficiency. Expansion of product portfolio through acquisitions. Adaptation to hybrid work trends with innovative solutions.

Strong brand recognition and reputation for quality. Global distribution network providing widespread market access. Commitment to sustainability, appealing to environmentally conscious clients.

The company continues to adapt to new trends, such as the rise of hybrid work, by innovating in areas like acoustic solutions, technology integration, and modular furniture systems, ensuring its continued relevance and competitive standing in the dynamic commercial interiors market.

The company has faced challenges such as global supply chain disruptions and shifts in market demand. In response, the company accelerated its focus on agile manufacturing and digital integration to maintain efficiency and responsiveness. This included streamlining its supply chain and investing in technologies to improve operational agility.

- Agile manufacturing to maintain efficiency.

- Digital integration for improved responsiveness.

- Adaptation to changing market demands.

- Focus on sustainability for a competitive edge.

Haworth Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Haworth Positioning Itself for Continued Success?

The Haworth company holds a strong position in the global contract furniture market, competing with major players like Steelcase and MillerKnoll. While specific market share data for 2024-2025 is unavailable, the company is consistently recognized as a top manufacturer. Its global reach, diverse product portfolio, and customer loyalty contribute to its success. The Haworth workplace solutions are available across North America, Europe, and Asia, reflecting its extensive market penetration.

Several risks and opportunities shape Haworth's future. Economic downturns, raw material costs, and competition pose challenges. The evolution of work models, including hybrid and remote work, presents both a challenge and an opportunity. To continue its growth, the company focuses on product innovation, global expansion, and sustainability. For further insights into the Haworth's strategy, you can check out the Marketing Strategy of Haworth.

Haworth is a major player in the global contract furniture market. It competes with companies like Steelcase and MillerKnoll. The company has a strong global presence and diverse product offerings.

Economic downturns and fluctuations in material costs can affect Haworth. Intense competition from established and emerging market entrants is another risk. Changes in environmental standards and building codes could also require adjustments.

Haworth aims to sustain and expand revenue through product innovation and global expansion. The company focuses on workspace design that enhances productivity. Adapting to new work paradigms and investing in digital transformation are key strategies.

Haworth focuses on product innovation and expanding its global presence. The company is committed to sustainability and adapting to changing work models. Digital transformation enhances customer experience and operational efficiency.

The contract furniture market is influenced by economic cycles and shifts in workplace design. Competition is fierce, with established firms and new entrants vying for market share. Sustainability and technological integration are increasingly important.

- The global office furniture market was valued at approximately $61.3 billion in 2023.

- The market is projected to reach $79.9 billion by 2028, growing at a CAGR of around 5.5% from 2023 to 2028.

- Key trends include the demand for flexible and ergonomic furniture, and sustainable materials.

- Companies are investing in digital tools to enhance the customer experience.

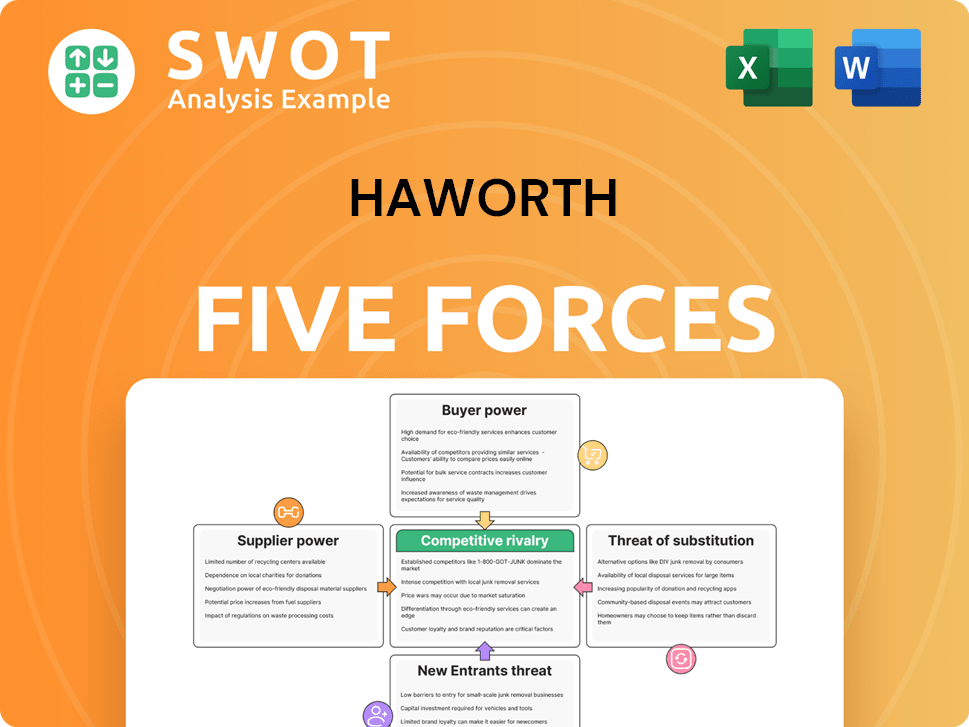

Haworth Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haworth Company?

- What is Competitive Landscape of Haworth Company?

- What is Growth Strategy and Future Prospects of Haworth Company?

- What is Sales and Marketing Strategy of Haworth Company?

- What is Brief History of Haworth Company?

- Who Owns Haworth Company?

- What is Customer Demographics and Target Market of Haworth Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.