Haworth Bundle

Who Really Controls Haworth Company?

Understanding who owns a company is key to grasping its strategic direction and future prospects. Haworth, Inc., a global leader in workspace design, presents a fascinating case study in private ownership. This deep dive explores the Haworth SWOT Analysis and the evolution of its ownership, from its founding to its current structure.

Haworth's story, from its inception as Modern Products in 1948, to its current status, highlights the impact of private, family-owned control. This structure allows Haworth to prioritize long-term vision over short-term gains, influencing its approach to innovation and sustainability. Examining the Haworth ownership structure reveals a company shaped by its history and poised for continued influence in the commercial interiors market, with its headquarters located in Holland, Michigan.

Who Founded Haworth?

The story of the Haworth Company began in 1948 with G.W. Haworth, who established Modern Products. Initially, the company focused on manufacturing wood office partitions, marking the start of its journey in the furniture industry.

From its inception, the ownership of Haworth was firmly rooted in the Haworth family. G.W. Haworth held the primary stake, steering the company's early vision and setting the stage for its future growth. This family-centric approach defined the company's foundational structure.

Due to the company's private status, specific details regarding equity splits or the exact number of shares held by family members at the beginning are not publicly available. However, it's understood that the family maintained complete control and ownership from the start, shaping the company's direction and values.

G.W. Haworth founded Modern Products in 1948, later evolving into the Haworth Company.

The company's initial focus was on manufacturing wood office partitions, setting the stage for its future in the office furniture market.

The foundational ownership structure was entirely within the Haworth family, ensuring family control from the outset.

As a private company, specific details about equity splits and share distribution are not publicly disclosed.

There is no public record of early backers or external investors acquiring significant stakes during the initial phase.

The concentrated distribution of control allowed for a consistent, long-term strategic focus uninfluenced by external shareholder pressures.

There are no documented instances of early backers, angel investors, or friends and family acquiring significant stakes during the initial phase, reinforcing the image of a closely held family business. Early agreements such as vesting schedules or buy-sell clauses, typical in startups with external investors, would have been internal family arrangements, if they existed, designed to maintain family control and succession. The founding team's vision, centered on innovation in office environments, was directly reflected in this concentrated distribution of control, allowing for a consistent, long-term strategic focus uninfluenced by external shareholder pressures. For those interested in a deeper dive, you can explore the company's history and ownership details in more depth.

The Haworth Company's early years were marked by family ownership and a focus on office furniture.

- G.W. Haworth established the company in 1948.

- The Haworth family maintained complete control from the beginning.

- No external investors held significant stakes in the early stages.

- The company's private status means detailed financial information is not publicly available.

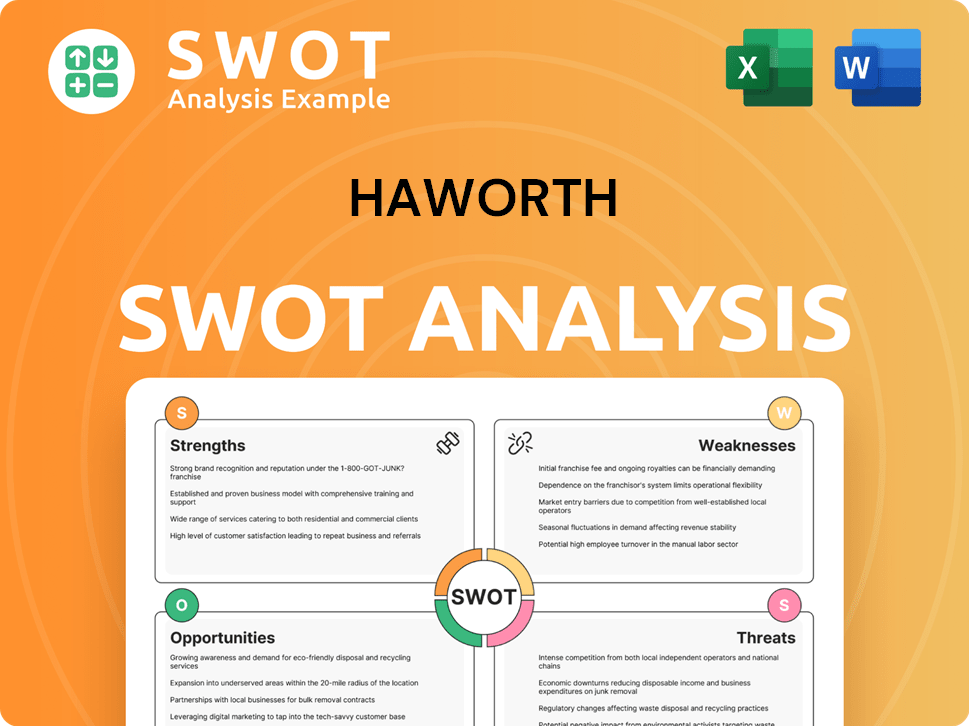

Haworth SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Haworth’s Ownership Changed Over Time?

The ownership structure of the Haworth Company, a privately held entity, has evolved differently compared to publicly traded corporations. Unlike companies with initial public offerings (IPOs) or significant institutional investor involvement, Haworth's ownership has primarily been shaped by internal family transitions. There have been no public stock offerings or shifts in major shareholding among external entities, maintaining its status as a family-owned business. This structure has allowed for a long-term strategic focus, with decisions often prioritizing sustainability and research and development over immediate financial returns.

The core of Haworth's ownership has remained within the Haworth family, with leadership and control passing through generations. Matthew Haworth, the current Chairman, exemplifies the family's ongoing influence in the company's governance and strategic direction. While specific ownership percentages for individual family members are not publicly disclosed, the family collectively retains full control. This contrasts with public companies that are required to disclose shareholder information through SEC filings. This structure has enabled Haworth to make sustained investments in areas like sustainable practices and global expansion, as detailed in the Growth Strategy of Haworth.

| Key Event | Impact on Ownership | Year |

|---|---|---|

| Founding of the Company | Establishment of family ownership | 1948 |

| Leadership Transitions | Transfer of control to subsequent generations of the Haworth family | Ongoing |

| Strategic Decisions | Focus on long-term investments and sustainability, influenced by family values | Ongoing |

The Haworth Company's structure reflects a commitment to long-term strategic goals, such as sustainability initiatives and global expansion, rather than being driven by the short-term financial pressures often associated with public ownership. This approach has allowed Haworth to cultivate a consistent company culture and values rooted in the founders' original vision. The company's focus on these areas has been a key factor in its continued success and ability to adapt to market changes.

Haworth is a privately held, family-owned company, with ownership primarily retained by the Haworth family.

- No IPO or public listing.

- Leadership and ownership are passed down through family generations.

- Focus on long-term investments and sustainable practices.

- Matthew Haworth, the current Chairman, represents the family's ongoing involvement.

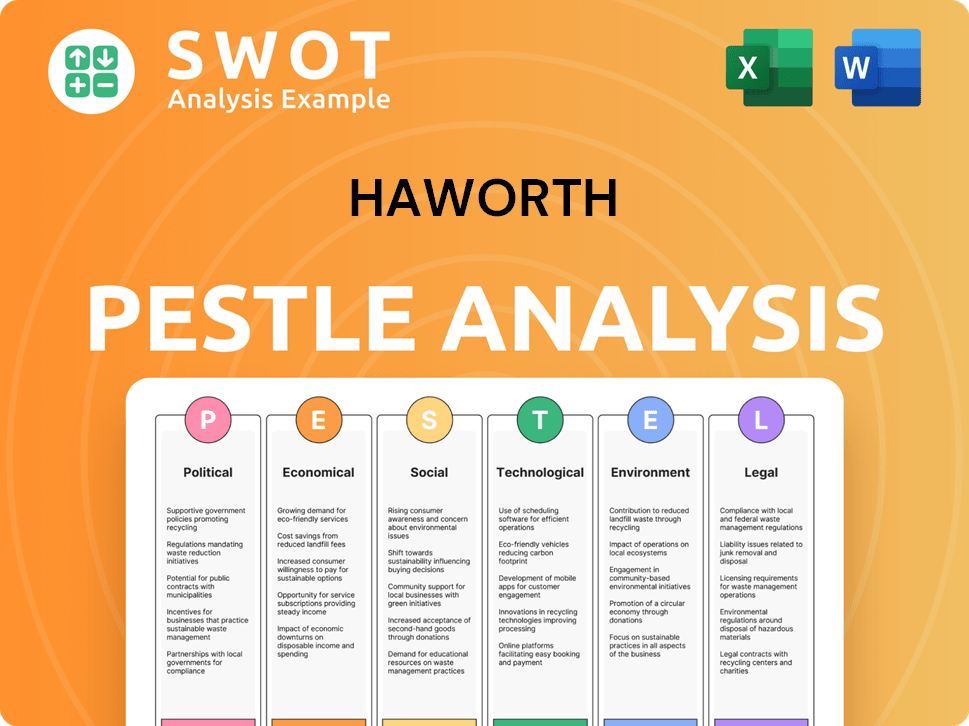

Haworth PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Haworth’s Board?

The current board of directors at the privately held Haworth Company includes a mix of family members and independent professionals. Matthew Haworth serves as Chairman of the Board, reflecting the continued leadership of the founding family. Due to the company's private status, a complete public list of all board members and their specific affiliations is not readily available. However, it is typical for privately held companies to include a blend of family owners, company executives, and a select number of independent directors who bring external expertise and oversight. For more information on the company's background, you can read a Brief History of Haworth.

The board likely includes individuals with extensive experience in the furniture industry, finance, and potentially, sustainability, given the increasing focus on environmental practices within the sector. The exact composition of the board and its committees (e.g., audit, compensation, and governance) is not publicly disclosed, as is common for private companies. This structure allows for a focused approach to long-term strategic goals without the pressures of public market scrutiny.

| Board Role | Details | Public Availability |

|---|---|---|

| Chairman | Matthew Haworth | Limited |

| Independent Directors | Mix of professionals | Limited |

| Family Members | Haworth family representation | Limited |

As a privately held, family-owned company, it is highly probable that the Haworth family retains ultimate voting control. This typically involves a 'one-share-one-vote' system among family shareholders, or potentially special arrangements that ensure the family's enduring control. There are no public records of dual-class shares or other mechanisms that grant disproportionate voting rights beyond the general family ownership. The absence of external shareholder pressure allows the board and management to focus on long-term strategic goals.

The Haworth family likely maintains ultimate voting control. This structure allows for long-term strategic planning. The company is not subject to proxy battles or activist investor campaigns.

- Family ownership ensures control.

- No public shareholder pressure.

- Focus on long-term goals.

- Decision-making shaped by family vision.

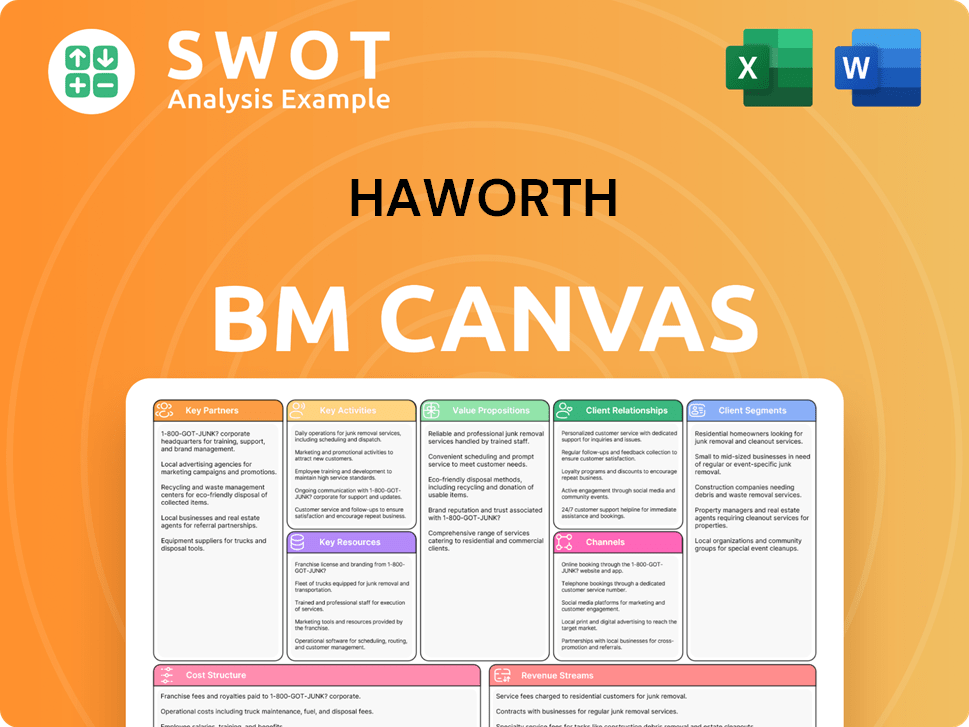

Haworth Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Haworth’s Ownership Landscape?

Over the past few years, the ownership structure of the Haworth Company has remained consistent. It's a privately held, family-owned business. This indicates a stable ownership profile, with no public announcements regarding significant changes like share buybacks or plans for an initial public offering. Haworth continues to focus on strategic acquisitions to strengthen its core business. For example, in January 2024, they acquired the remaining shares of their joint venture with Gan, which solidified their position in the European market. Matthew Haworth continues to serve as Chairman, reinforcing the family's enduring presence in the company's governance.

In the industry, ownership trends for public companies include increased institutional ownership and activist investing, along with mergers and acquisitions. However, for a privately held company like Haworth, the focus often stays on long-term growth and strategic partnerships. The company's long-standing family ownership has largely insulated it from the pressures of short-term market demands. There have been no public statements about future ownership changes or a potential public listing, suggesting a continued commitment to its current model. The 2024 acquisition shows a strategic move to consolidate ownership and control, aligning with its long-term, family-centric vision. To learn more about the company's financials, you can read Revenue Streams & Business Model of Haworth.

| Aspect | Details | Recent Data |

|---|---|---|

| Ownership Type | Private, Family-Owned | Consistent over the last 3-5 years |

| Acquisitions | Strategic for market position | Gan joint venture acquisition in January 2024 |

| Leadership | Stable, Family Leadership | Matthew Haworth as Chairman |

Haworth's ownership structure has remained stable, with no major changes in the last few years. The company continues to be privately held and family-owned. This stability is a key characteristic of the company's long-term strategy.

The company focuses on strategic acquisitions that complement its core business. The acquisition of the remaining shares of its joint venture with Gan in January 2024 is a good example. This demonstrates a commitment to strengthening its market position.

Leadership remains stable, with Matthew Haworth continuing as Chairman. This continuity reinforces the family's enduring presence and commitment to the company's long-term vision. This stability is important for future growth.

While public companies see trends like institutional ownership, Haworth, being private, focuses on long-term growth. This allows them to make decisions unburdened by short-term market pressures, maintaining their strategic focus.

Haworth Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haworth Company?

- What is Competitive Landscape of Haworth Company?

- What is Growth Strategy and Future Prospects of Haworth Company?

- How Does Haworth Company Work?

- What is Sales and Marketing Strategy of Haworth Company?

- What is Brief History of Haworth Company?

- What is Customer Demographics and Target Market of Haworth Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.