HCL Technologies Bundle

Unveiling HCL Technologies: How Does This IT Giant Thrive?

HCL Technologies, a leading HCL Technologies SWOT Analysis, stands as a global force in IT services and consulting. With a robust financial performance, including a $13.84 billion consolidated revenue in fiscal year 2025, HCLTech's influence in the technology sector is undeniable. This

This deep dive into

What Are the Key Operations Driving HCL Technologies’s Success?

HCL Technologies, a prominent Indian IT company, generates value through a comprehensive suite of technology solutions and consulting services. The company assists clients in transforming and modernizing their businesses. Its core operations are structured around three main segments that drive its HCL business.

The company's offerings are divided into IT and Business Services (ITBS), Engineering and R&D Services (ERS), and Products & Platforms (P&P), including HCLSoftware. This structure allows HCLTech to offer specialized services and solutions across various industries. The company's global presence, with over 220,000 employees and more than 200 delivery centers, supports its operations worldwide.

HCLTech focuses on building long-term partnerships with clients by acting as an extension of their internal IT departments. This client-centric approach, combined with co-creation of tailored solutions, enables the company to meet specific client needs effectively. The company's commitment to innovation and deep technical expertise helps it stand out in the competitive landscape.

ITBS is the largest segment, contributing approximately 70% of HCLTech's total revenue. This segment provides traditional IT services such as cloud migration, application modernization, and digital workplace solutions. HCLTech's CloudSMART strategy supports continuous modernization and improved operational efficiency for its clients.

ERS is a key differentiator, contributing around 16-17% of the revenue. This segment focuses on product engineering and R&D solutions across industries like automotive and telecom. HCLTech's expertise in software product engineering and AI/ML services allows it to accelerate product development and maximize innovation return.

This segment, including HCLSoftware, focuses on developing, marketing, and supporting software products. Notable products include HCL AppScan and HCL BigFix. The DRYiCE unit offers solutions for enterprise automation and AI-based transformation. This segment contributes to the overall HCL company strategy.

HCLTech operates in 60 countries with over 200 delivery centers and 150 innovation labs. This global network supports its client-centric approach, enabling long-term partnerships. The company's ability to co-create tailored solutions positions it as an extended arm of its clients' IT departments.

HCLTech's value proposition lies in its ability to deliver comprehensive technology solutions that drive business transformation. The company offers a wide range of services, from traditional IT to cutting-edge engineering and R&D solutions. A deeper understanding of the Competitors Landscape of HCL Technologies can provide further insights.

- Comprehensive IT and business services.

- Engineering and R&D expertise across various industries.

- Software products and platforms for digital solutions.

- A global network and client-centric approach.

HCL Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does HCL Technologies Make Money?

HCL Technologies, a prominent Indian IT company, employs a diversified revenue model. The company's financial success is driven by a mix of contract types, including fixed-price, time-and-material, and outcome-based arrangements, ensuring a consistent income stream. HCL's significant revenue comes from long-term outsourcing and managed services agreements.

As of December 2024, HCL Technologies reported consolidated revenues of approximately $13.8 billion. In fiscal year 2025, the company's INR revenue reached ₹117,055 Crores, reflecting a 6.5% increase, and USD revenue was US$13,840 million, up 4.3%.

The company's monetization strategies include leveraging intellectual property and proprietary platforms through subscription services and licensing models. HCLTech also explores data monetization, particularly in the telecommunications sector.

HCL Technologies generates revenue through three primary segments: IT and Business Services (ITBS), Engineering and R&D Services (ERS), and Products & Platforms (P&P). ITBS is the largest segment, contributing the majority of the revenue. ERS and P&P contribute to the remaining revenue streams.

ITBS is the largest revenue contributor, accounting for approximately 70% of total revenue. In fiscal year 2023, this segment generated ₹73,000 crore, representing about 85% of total revenue. Digital services within ITBS are a significant component, contributing 39.0% of services revenue in FY25.

ERS accounts for around 16-17% of the total revenue. This segment focuses on providing technology solutions and engineering services to various industries. The ERS segment plays a crucial role in HCL's overall strategy.

P&P, including HCLSoftware, contributes to the remaining revenue. HCLSoftware's revenue was ₹11,692 crore (US$1.4 billion) in fiscal year 2023–24. HCLSoftware's Annual Recurring Revenue (ARR) was $1.03 billion in FY25.

HCL Technologies uses various monetization strategies, including platform fees, bundled services, tiered pricing, and cross-selling. The company leverages its proprietary software tools and accelerators as standalone offerings or bundled with services. HCLTech also explores data monetization in the telecommunications sector.

The Americas region is the largest revenue contributor, representing 65.1% of total revenue in Q2 FY25. Europe contributes around 28-30%, and the rest of the world accounts for approximately 7% of the revenue.

HCL Technologies' financial performance demonstrates its strong position in the IT services market. The company's growth is driven by its diversified revenue streams and effective monetization strategies. For more insights into the company's marketing approach, read about the Marketing Strategy of HCL Technologies.

- Consolidated revenues for the 12 months ending December 2024 totaled $13.8 billion.

- In FY25, INR Revenue reached ₹117,055 Crores, up 6.5%.

- USD Revenue for FY25 was US$ 13,840M, up 4.3%.

- Digital services contributed 39.0% of services revenue in FY25, growing 8.6% in constant currency.

- HCLSoftware's Annual Recurring Revenue (ARR) was $1.03 billion in FY25, up 1.8% in constant currency.

HCL Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped HCL Technologies’s Business Model?

HCLTech, a prominent player in the IT services sector, has a rich history marked by significant milestones and strategic initiatives. The company's journey includes substantial growth, with key developments shaping its current operational landscape. Understanding these aspects is crucial for grasping how HCL Technologies operates and its position in the global market.

The company has consistently adapted to technological advancements and market demands. Through strategic acquisitions and partnerships, HCLTech has expanded its service offerings and strengthened its competitive position. Its focus on innovation and client-centric solutions has enabled it to secure major deals and maintain a strong global presence. This continuous evolution highlights the company's commitment to staying at the forefront of the IT industry.

HCLTech's financial performance reflects its strategic success and operational efficiency. The company's ability to secure large contracts and its focus on emerging technologies have contributed to its revenue growth and market expansion. The following sections delve into the key milestones, strategic moves, and competitive advantages that define HCLTech's operations and future prospects.

HCLTech reached a significant milestone by achieving $10 billion in revenue in 2021. In 2022, the company rebranded to HCLTech, reflecting its evolving identity. These achievements showcase HCLTech's growth and adaptability in the IT sector.

Strategic acquisitions have been a key part of HCLTech's growth, including Confinale AG in 2022 and ASAP Group in 2023. In May 2024, HCLTech acquired select assets of Communications Technology Group from HPE for $225 million. These moves have enhanced its service capabilities and expanded market reach.

HCLTech secured a $2.1 billion managed network services deal with Verizon Business in August 2023. In Q4 FY25, HCLTech saw strong new bookings of $3 billion, driven by its AI propositions. A significant partnership with Microsoft in January 2025 focused on transforming contact centers with generative AI and cloud-based solutions. In May 2025, a multi-year pact with Taylor Wimpey was announced for end-to-end IT services.

HCLTech faces intense competition within the IT services market. Managing growth effectively is also a key operational challenge. These challenges require continuous adaptation and strategic planning to maintain a competitive edge.

HCLTech's competitive advantages include a strong global network, extensive industry expertise, and continuous research and development. The 'Mode 1-2-3 Strategy' offers integrated end-to-end solutions. The company's commitment to innovation is evident in initiatives like 'Project Ascend' and its investments in AI and GenAI, such as the AI Force platform and AI Foundry.

- Mode 1: Focuses on core services.

- Mode 2: Concentrates on next-generation services.

- Mode 3: Centers on future-centric solutions and products.

- 'Project Ascend' aims at margin expansion.

HCL Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is HCL Technologies Positioning Itself for Continued Success?

As of 2024, HCLTech holds a strong position in the IT services market. It is the third-largest India-headquartered IT services company by revenue and market capitalization. HCLTech operates globally, serving clients across various industries, including financial services, manufacturing, and healthcare. The company's global presence and diverse service offerings solidify its standing in the competitive landscape of technology solutions.

The company faces several challenges despite its strong market position. These include intense competition in IT services, business process outsourcing, and consulting. Other risks include fluctuations in earnings, wage increases in India, and client concentration. Also, global uncertainties and macroeconomic headwinds can impact IT spending, affecting its Engineering and R&D Services (ERS) and Products & Platforms (P&P) divisions. Cybersecurity threats and talent retention are also significant concerns for the company.

HCLTech is a leading Indian IT company, ranking as the third-largest in its sector. It has a significant global presence, operating in 60 countries and serving multiple industries. The Americas region is its largest market, contributing 65.1% of its total revenue in Q2 FY25.

HCLTech faces risks from intense competition and economic uncertainties. Fluctuations in earnings, wage increases, and client concentration pose challenges. Cybersecurity threats are a major concern, with 81% of security leaders anticipating cyberattacks. Talent retention is also a vulnerability, with a LTM attrition rate of 13.0% in FY25.

The company aims for double-digit growth in the medium term through strategic initiatives. HCLTech is investing in AI and GenAI capabilities, expanding partnerships, and increasing its client base. Setting up a factory with SAP for cloud operations and migration is also part of its future plans.

HCLTech's focus areas include AI and GenAI engineering, and expanding partnerships. The company is working with Google Cloud to create industry solutions. HCLTech is committed to digital transformation, cloud services, and engineering to address evolving technological needs. For more details on the company's structure, you can read about Owners & Shareholders of HCL Technologies.

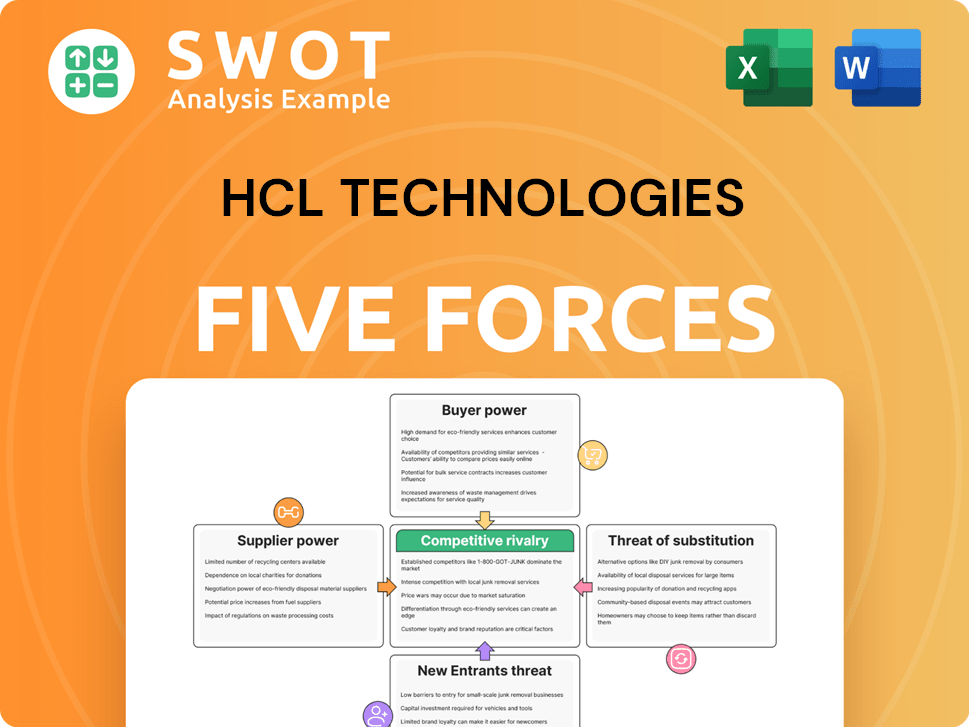

HCL Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of HCL Technologies Company?

- What is Competitive Landscape of HCL Technologies Company?

- What is Growth Strategy and Future Prospects of HCL Technologies Company?

- What is Sales and Marketing Strategy of HCL Technologies Company?

- What is Brief History of HCL Technologies Company?

- Who Owns HCL Technologies Company?

- What is Customer Demographics and Target Market of HCL Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.