Healthpeak Properties Bundle

How Does Healthpeak Properties Company Thrive in Healthcare Real Estate?

Healthpeak Properties, Inc. (NYSE: PEAK) is a leading Real Estate Investment Trust (REIT) dominating the U.S. healthcare real estate landscape. This company strategically invests in, develops, and manages high-quality properties, including medical office buildings and life science facilities. As of early 2025, Healthpeak's extensive portfolio supports essential healthcare services, making it a critical player in the industry.

This examination of Healthpeak Properties SWOT Analysis will uncover the operational framework of Healthpeak Properties, exploring its diverse revenue streams, strategic initiatives, and competitive positioning. Understanding how Healthpeak, a prominent Healthcare REIT, operates is essential for investors, healthcare providers, and industry analysts. Delving into the company's financial performance, including its stock price and dividend history, provides valuable insights into its long-term viability and investment strategy.

What Are the Key Operations Driving Healthpeak Properties’s Success?

Healthpeak Properties, a prominent player in the healthcare real estate sector, focuses on owning, developing, and managing high-quality properties. Their primary focus includes life science facilities, medical office buildings, and continuing care retirement communities (CCRCs). The company aims to create value by providing modern, specialized spaces that meet the evolving needs of healthcare providers and life science companies.

The company's core operations involve strategic property acquisition, development, and asset management. They conduct rigorous due diligence when acquiring properties and focus on developing new facilities that meet the needs of their tenants. Their asset management includes managing leases, overseeing property maintenance, and implementing capital improvements to ensure properties remain competitive and valuable.

Healthpeak Properties serves a diverse customer base, including large academic medical centers, health systems, innovative life science companies, and established senior living operators. Their distribution network is centered around strategically located properties in key healthcare and life science clusters across the United States. This strategic positioning allows them to capitalize on market trends and tenant demands.

Healthpeak Properties offers state-of-the-art laboratory and office spaces for biotechnology and pharmaceutical companies. They also provide modern medical office buildings for healthcare providers and integrated living and care facilities for seniors. These diverse offerings cater to various needs within the healthcare sector.

Operational processes include rigorous due diligence in property acquisition and strategic development of new facilities. They focus on proactive asset management to meet the evolving needs of tenants, including lease management and property maintenance. The company partners with experienced developers and construction firms for efficient property development.

Healthpeak's value proposition lies in its deep specialization in healthcare real estate. This expertise allows them to understand tenant needs and regulatory environments. This specialization, combined with a focus on high-quality, modern facilities, translates into reliable infrastructure and access to prime locations.

Healthpeak serves a diverse customer base, ranging from academic medical centers and health systems to life science companies and senior living operators. This diversification helps mitigate risk and ensures a steady stream of revenue. Their focus on high-quality properties attracts and retains a strong tenant base.

Healthpeak Properties distinguishes itself through its deep specialization in healthcare real estate, providing a nuanced understanding of tenant needs. This specialization, combined with a focus on high-quality, modern facilities, offers reliable infrastructure and access to prime locations. This approach differentiates them in the competitive Marketing Strategy of Healthpeak Properties market.

- Specialization: Deep expertise in healthcare real estate.

- High-Quality Properties: Focus on modern and well-maintained facilities.

- Strategic Locations: Properties in key healthcare and life science clusters.

- Diverse Tenant Base: Reduces risk and ensures revenue stability.

Healthpeak Properties SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Healthpeak Properties Make Money?

Healthpeak Properties Company, a prominent healthcare Real Estate Investment Trust (REIT), primarily generates revenue through its diverse portfolio of healthcare properties. The company's financial performance is closely tied to its ability to lease and manage these properties effectively. Understanding the revenue streams and monetization strategies of Healthpeak is crucial for investors and stakeholders looking at the company's financial health and future prospects.

The company's revenue is largely derived from rental income, with significant contributions from its life science properties, medical office buildings (MOBs), and continuing care retirement communities (CCRCs). These segments each cater to different aspects of the healthcare industry, providing a diversified revenue base. Analyzing the performance of these segments helps to understand the overall financial health of the company. For example, in Q1 2024, the total revenues reported by Healthpeak were approximately $374.8 million.

Healthpeak's monetization strategies focus on generating stable and predictable cash flows through long-term leases with creditworthy tenants. The use of triple-net leases, where tenants bear the majority of property expenses, helps to minimize operational costs and enhance net operating income. Strategic development projects and portfolio adjustments also play a key role in maximizing returns and adapting to market changes. You can learn more about the company's beginnings in a brief history of Healthpeak Properties.

Healthpeak Properties employs several strategies to generate revenue and maximize its financial performance. These strategies are designed to ensure long-term stability and growth within the healthcare real estate sector. The company's approach involves a combination of property management, strategic investments, and financial planning.

- Rental Income: The primary source of revenue comes from rental income derived from its portfolio of healthcare properties, including life science buildings, medical office buildings, and CCRCs.

- Long-Term Leases: Healthpeak focuses on securing long-term leases with high-quality tenants to ensure stable and predictable cash flows. This approach minimizes the risk associated with tenant turnover and market fluctuations.

- Triple-Net Leases: Utilizing triple-net leases, where tenants are responsible for property expenses, reduces Healthpeak's operational costs and enhances net operating income.

- Strategic Development: Investing in new developments and acquisitions allows Healthpeak to expand its portfolio and capitalize on market opportunities. This includes building new facilities to meet specific tenant demands.

- Portfolio Optimization: The company actively manages its portfolio through strategic acquisitions, dispositions, and redevelopments to maximize value and adapt to changing market conditions. This includes divesting certain assets to focus on higher-growth segments.

Healthpeak Properties PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Healthpeak Properties’s Business Model?

Healthpeak Properties Company has undergone significant strategic shifts, establishing its position as a key player in the healthcare real estate sector. These moves have been crucial in defining its operational focus and financial performance. The company's journey is marked by strategic decisions aimed at optimizing its portfolio and adapting to the evolving demands of the healthcare industry.

A notable strategic move was the company's transition to a pure-play healthcare REIT model. This involved a focused investment approach, particularly in life science, medical office buildings (MOBs), and continuing care retirement communities (CCRCs). The spin-off of its senior housing operating portfolio (SHOP) business in 2021 further streamlined its operations, allowing for a more specialized investment strategy. More recently, the merger with Physicians Realty Trust (DOC) in early 2024 was a significant milestone.

This merger expanded Healthpeak's medical office portfolio, reinforcing its status as a leading owner of MOBs. This strategic consolidation aimed to create a more diversified and robust portfolio, enhancing its scale and competitive advantage in the market. These strategic moves have been critical in shaping Healthpeak's current standing and future prospects.

The spin-off of the SHOP business in 2021 and the merger with Physicians Realty Trust (DOC) in early 2024 are key milestones. These moves have reshaped Healthpeak's portfolio and strategic direction. The merger with DOC significantly expanded its medical office holdings.

Healthpeak's strategic moves include focusing on a pure-play healthcare REIT model. This involves prioritizing life science, medical office, and CCRC segments. These moves aim to create a more streamlined and specialized investment approach.

Healthpeak's competitive advantages include a high-quality real estate portfolio and strong relationships. They have a deep understanding of healthcare real estate complexities. Economies of scale and access to capital further boost its edge.

Navigating interest rate fluctuations and industry changes are operational challenges. Adapting to advancements in life science and specialized lab spaces is crucial. Healthpeak focuses on modern facilities and strategic developments to address these.

Healthpeak's competitive edge stems from its high-quality assets and strong industry relationships. They have a deep understanding of the healthcare real estate market and access to capital. The company is adapting by focusing on sustainable building practices and incorporating technology to enhance property management.

- Extensive portfolio of well-located assets.

- Strong relationships with leading healthcare providers.

- Deep understanding of healthcare real estate complexities.

- Focus on sustainable building practices and technology integration.

Healthpeak Properties' strategic focus and operational adjustments are crucial for its long-term success. For more insights, see Owners & Shareholders of Healthpeak Properties. The company's ability to adapt to market dynamics and maintain a strong competitive position is key. In 2024, the company's financial performance and strategic initiatives will continue to shape its trajectory.

Healthpeak Properties Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Healthpeak Properties Positioning Itself for Continued Success?

Healthpeak Properties Company (Healthpeak) holds a strong position in the healthcare Real Estate Investment Trust (REIT) sector. The merger with Physicians Realty Trust enhanced its medical office portfolio. The company differentiates itself through high-quality, specialized assets and long-standing relationships with healthcare systems.

However, Healthpeak faces risks, including changes in healthcare reimbursement policies and rising interest rates. Technological advancements and competition from new entrants could also impact its market position. The company's future outlook hinges on strategic investments and adapting to evolving healthcare needs.

Healthpeak is a major player in the Healthcare REIT market. Its portfolio includes medical office buildings and life science properties. The company competes with other large healthcare REITs, focusing on high-quality assets.

Key risks include changes in healthcare reimbursement and rising interest rates. Vacancy rates and property maintenance also pose challenges. Competition and technological shifts in healthcare delivery could affect demand.

Healthpeak aims to expand revenue through strategic investments. The company focuses on life science campuses and modernizing medical office buildings. Demographic trends, such as an aging population, drive demand for healthcare services.

Healthpeak's relationships with healthcare systems provide a stable tenant base. It provides premier facilities supporting high-quality healthcare. This focus aims to ensure long-term growth and profitability.

Healthpeak's strategy involves portfolio optimization and disciplined capital allocation. The company leverages its expertise to capitalize on demographic trends. The company’s 2024 financial reports will provide updated data on the Healthpeak Properties stock price and financial performance.

- Focus on strategic investments in core segments.

- Developing cutting-edge life science campuses.

- Modernizing medical office buildings.

- Maintaining a competitive edge through premier facilities.

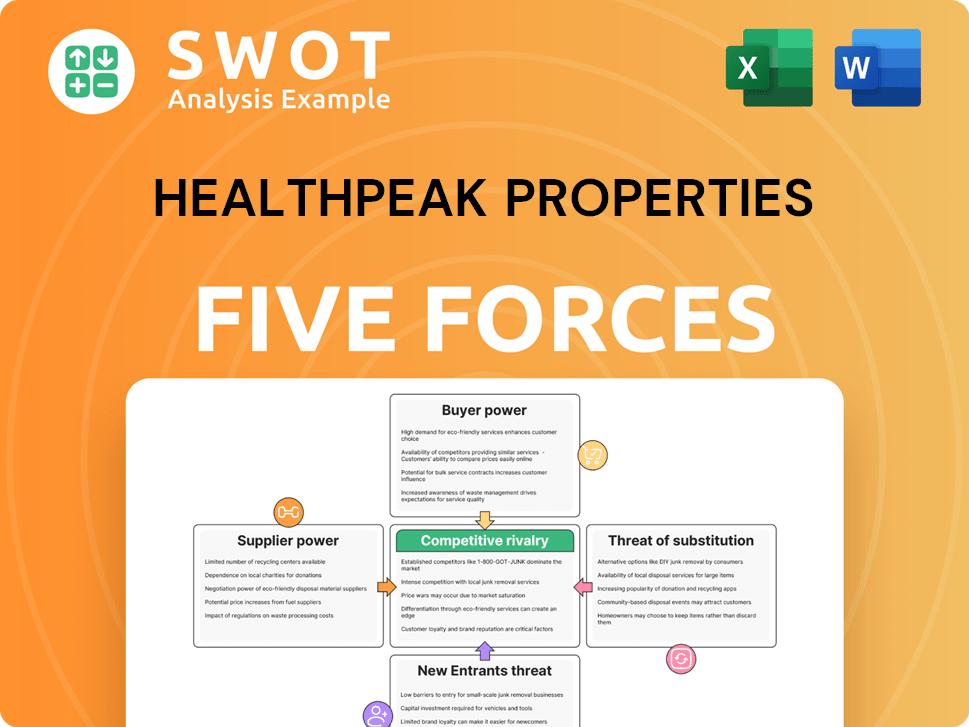

Healthpeak Properties Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Healthpeak Properties Company?

- What is Competitive Landscape of Healthpeak Properties Company?

- What is Growth Strategy and Future Prospects of Healthpeak Properties Company?

- What is Sales and Marketing Strategy of Healthpeak Properties Company?

- What is Brief History of Healthpeak Properties Company?

- Who Owns Healthpeak Properties Company?

- What is Customer Demographics and Target Market of Healthpeak Properties Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.