Healthpeak Properties Bundle

How Does Healthpeak Properties Navigate the Shifting Healthcare Landscape?

The healthcare real estate sector is undergoing a significant transformation, fueled by demographic shifts and advancements in medical technology. For a Real Estate Investment Trust (REIT) like Healthpeak Properties, understanding its customer demographics and target market is crucial for strategic success. Healthpeak Properties, founded in 1985, has strategically refined its focus to specialize in life science, medical office, and continuing care retirement communities (CCRC) sectors.

To truly grasp Healthpeak Properties' potential, it's essential to dissect its customer profile and geographic concentration. This Healthpeak Properties SWOT Analysis provides a comprehensive overview. This analysis will explore the specific types of tenants and end-users Healthpeak serves, their location, and the company's strategies to attract and retain these critical partners. A deep dive into Healthpeak's target market analysis offers valuable insights into its market positioning and long-term growth prospects within the healthcare properties sector.

Who Are Healthpeak Properties’s Main Customers?

Understanding the customer demographics and target market of Healthpeak Properties is crucial for investors and analysts. As a real estate investment trust (REIT) specializing in healthcare properties, Healthpeak's success hinges on its ability to cater to the needs of its diverse clientele. This analysis delves into the primary customer segments, highlighting their characteristics and the strategic focus of the company.

Healthpeak Properties operates primarily in the B2B space, serving businesses within the healthcare sector. These businesses, in turn, provide services to a broad consumer base. The company's portfolio is segmented into three main property types: life science, medical office, and continuing care retirement communities (CCRCs). Each segment has distinct customer profiles and market dynamics, influencing Healthpeak's investment strategy and financial performance.

This target market analysis reveals how Healthpeak adapts to evolving healthcare trends and demographic shifts. By understanding the specific needs of each customer segment, the company aims to maintain a robust and diversified portfolio, ensuring long-term value for its stakeholders. For more insights, check out the Revenue Streams & Business Model of Healthpeak Properties article.

Healthpeak's life science properties cater to biotechnology, pharmaceutical, and medical device companies, as well as research institutions. These customers require specialized lab spaces and R&D facilities. The end-users, like researchers and scientists, are highly educated, often with advanced degrees, and are typically located in urban or suburban innovation hubs. This segment benefits from increased R&D spending and venture capital investment in the biotech sector.

Medical office properties serve healthcare providers, including hospital systems, physician groups, and specialized clinics. The end-users are patients of all ages and demographics. Healthpeak focuses on properties near hospitals or in accessible community settings. This segment provides stable, long-term revenue streams due to the essential nature of healthcare services. The demand for outpatient services continues to grow, making this a key area for investment.

In the CCRC segment, Healthpeak's customers are the operators of these communities, serving seniors aged 75 and above. These residents often have higher income levels and require varying levels of care. Healthpeak's properties aim to meet the needs of this aging population, which is a significant demographic trend. The company has been re-evaluating its CCRC portfolio, focusing on high-quality assets and strong operator partnerships.

Healthpeak is shifting towards higher-growth segments like life science and medical office. These segments represent the largest share of revenue and the fastest growth. This strategic shift aligns with strong demand for specialized healthcare infrastructure and the demographic trends of an aging population. The company's focus on these areas is a response to market research indicating robust demand.

Healthpeak Properties targets distinct customer segments within the healthcare sector, each with unique characteristics and needs. The company's strategic focus on life science and medical office properties reflects its adaptation to market trends and demographic shifts. Understanding these segments is vital for assessing Healthpeak's investment potential and long-term growth prospects.

- Customer demographics drive Healthpeak's investment decisions.

- Market segmentation helps tailor property offerings.

- The healthcare real estate market analysis shows demand for specialized facilities.

- The company's growth strategy is focused on high-demand segments.

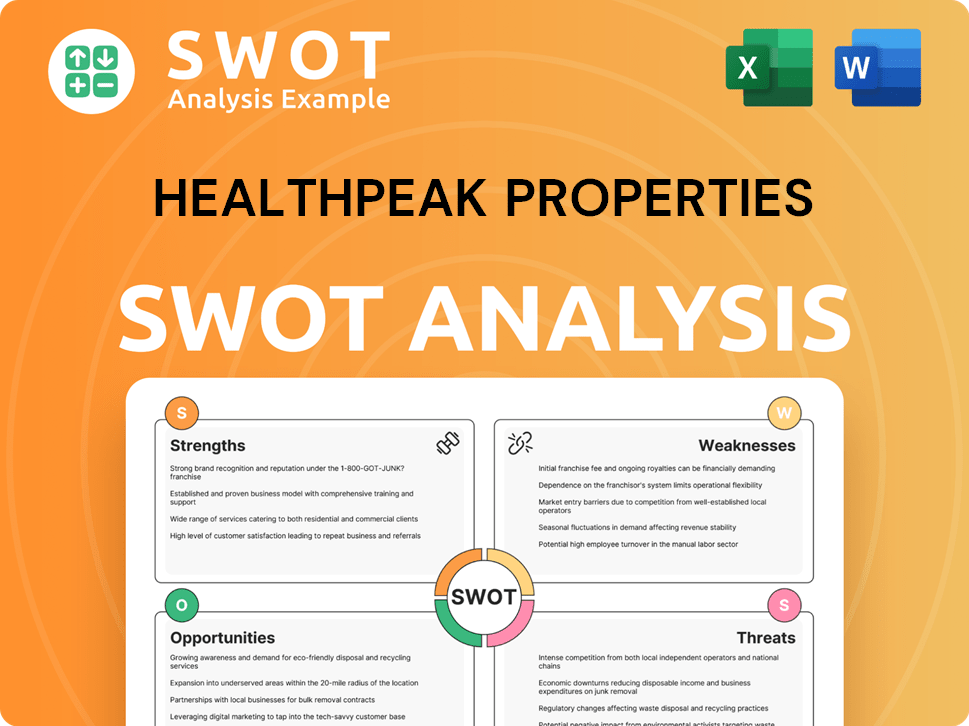

Healthpeak Properties SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Healthpeak Properties’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any real estate investment trust (REIT), and for Healthpeak Properties, this understanding is particularly complex due to the diverse nature of its tenants and the evolving healthcare landscape. A deep dive into customer demographics and target market analysis reveals the key drivers behind the choices of healthcare providers, life science companies, and senior living operators. This analysis informs Healthpeak's investment strategy and helps ensure its properties meet the specific demands of its tenants and, ultimately, the patients and residents they serve.

Healthpeak Properties' customer profile analysis indicates that the company's success hinges on its ability to provide tailored solutions for each segment of its target market. This involves not only understanding the functional requirements of each type of tenant but also anticipating future trends and adapting properties to meet those evolving needs. The company's focus on high-quality assets and strategic locations is a direct response to the preferences of its customers, ensuring long-term value for both tenants and investors.

Healthpeak Properties' customer base includes a variety of healthcare providers, life science companies, and senior living operators. Each segment has unique needs and preferences that influence their decisions regarding property selection and lease terms. The company's ability to address these diverse requirements is critical to its financial performance and growth strategy.

Life science tenants prioritize specialized infrastructure and adaptable spaces. They need properties that can support advanced research and development activities. These tenants often seek locations near talent pools and academic institutions.

Medical office tenants focus on patient accessibility and convenience. They require properties with ample parking, easy navigation, and a welcoming environment. Operational efficiency and modern facilities are also crucial.

CCRCs are influenced by the preferences of senior residents and their families. They seek communities that offer a continuum of care and a high quality of life. Amenities and social engagement opportunities are significant motivators.

Common needs across all segments include cost-effective and flexible lease terms. Responsive property management and buildings designed to meet sector-specific demands are also important. Healthpeak addresses these needs through strategic partnerships and purpose-built facilities.

Healthpeak continuously improves its properties by integrating technology and adapting to market trends. This includes focusing on sustainability and incorporating features that enhance patient and resident experiences. The company uses customer feedback to refine its offerings.

Healthpeak strategically focuses on key markets with high growth potential in healthcare and life sciences. This geographic focus allows the company to capitalize on specific demand drivers. The company's investments are aligned with these strategic priorities.

Healthpeak Properties actively addresses the needs of its diverse customer base by providing high-quality healthcare properties. This approach involves understanding the specific requirements of each tenant segment and adapting its properties to meet those needs. The company's focus on innovation and customer satisfaction is a key driver of its success. The company's commitment to its customers is evident in its strategic investments and operational practices. For more details, see Growth Strategy of Healthpeak Properties.

- Life Science: Properties designed to support advanced research, including specialized lab infrastructure and adaptable spaces.

- Medical Office: Facilities that prioritize patient accessibility, convenience, and operational efficiency, often located near hospitals.

- CCRCs: Communities offering a continuum of care with a focus on resident well-being and amenities.

- Strategic Partnerships: Collaborations with leading operators and developers to meet sector-specific demands.

- Continuous Improvement: Ongoing enhancements in facility design, technology integration, and service offerings based on customer feedback and market trends.

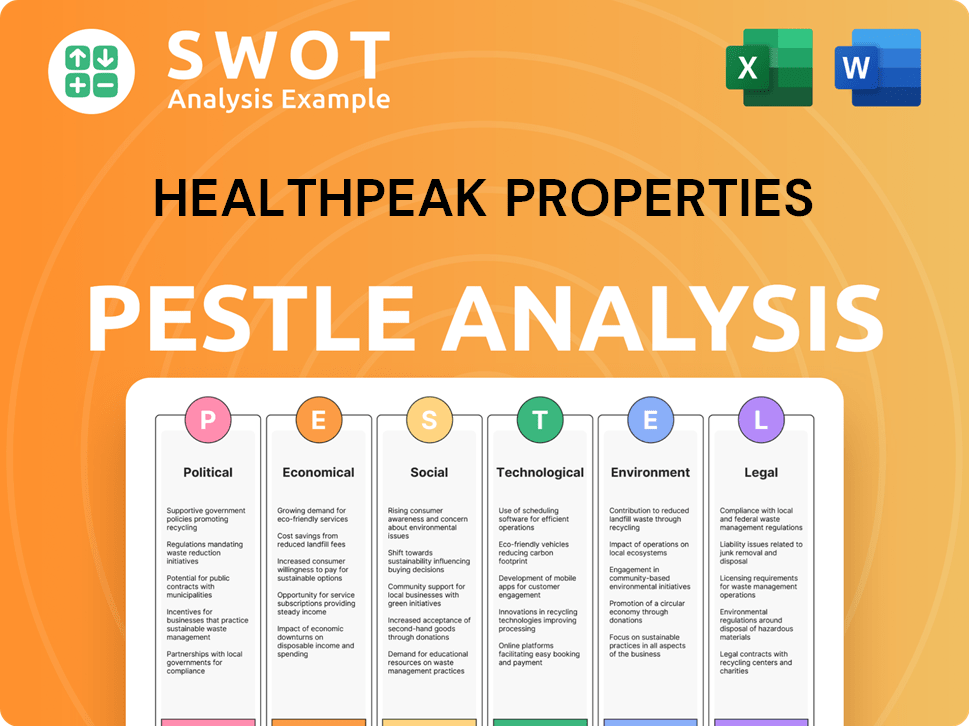

Healthpeak Properties PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Healthpeak Properties operate?

The geographical market presence of Healthpeak Properties is a key element of its investment strategy, focusing on areas with strong healthcare and life science clusters. This strategic approach allows the company to capitalize on demographic trends and robust healthcare infrastructure across the United States. Healthpeak's investments are specifically targeted to maximize returns and resilience within the healthcare real estate sector.

Healthpeak Properties strategically concentrates its investments in high-growth markets, particularly those with significant research and development activity and a skilled workforce. This targeted approach allows the company to effectively cater to the needs of its diverse tenant base. The company's focus on specific regions ensures it can adapt to local market dynamics and tenant preferences.

Healthpeak's geographic focus is essential for understanding its customer demographics and target market analysis. By strategically positioning its properties in key areas, the company aims to meet the evolving demands of the healthcare industry. This approach supports the company's long-term investment strategy and its ability to deliver value.

Healthpeak has a strong presence in major life science hubs such as Boston, the San Francisco Bay Area, and San Diego. These areas are characterized by a high concentration of biotechnology firms and research institutions. The company's investments in these locations reflect its commitment to innovation-driven sectors.

In the medical office segment, Healthpeak's properties are geographically diversified across various states. They are often located near hospital campuses or in areas with strong population growth. These locations are chosen to maximize patient accessibility and convenience, catering to the broad healthcare needs of local communities.

Healthpeak's geographical presence for CCRCs is focused on affluent coastal and Sun Belt markets. These areas have a higher concentration of seniors with the financial capacity to afford such communities. The company manages its CCRC portfolio in desirable locations to attract a stable resident base.

Healthpeak localizes its offerings by understanding the specific regulatory environments and market dynamics within each region. The company's strategic acquisitions and developments are carefully vetted based on local market supply and demand fundamentals. This approach ensures that Healthpeak can optimize its portfolio for maximum returns.

Healthpeak's geographic strategy involves focusing on key markets with strong demographic tailwinds and robust healthcare infrastructure. This approach supports the company's commitment to high-growth, innovation-driven sectors. The company's strategic acquisitions and developments are carefully vetted based on local market supply and demand fundamentals.

- Key Markets: Boston, San Francisco Bay Area, San Diego, and various states with favorable healthcare spending trends.

- Property Types: Life science buildings, medical office buildings, and CCRCs.

- Strategic Goals: Maximize returns, ensure resilience, and adapt to local market dynamics.

- Healthpeak's geographic distribution of sales and growth largely mirrors the economic vitality and healthcare investment trends in these key markets.

For more insights into how Healthpeak is growing, consider reading about the Growth Strategy of Healthpeak Properties.

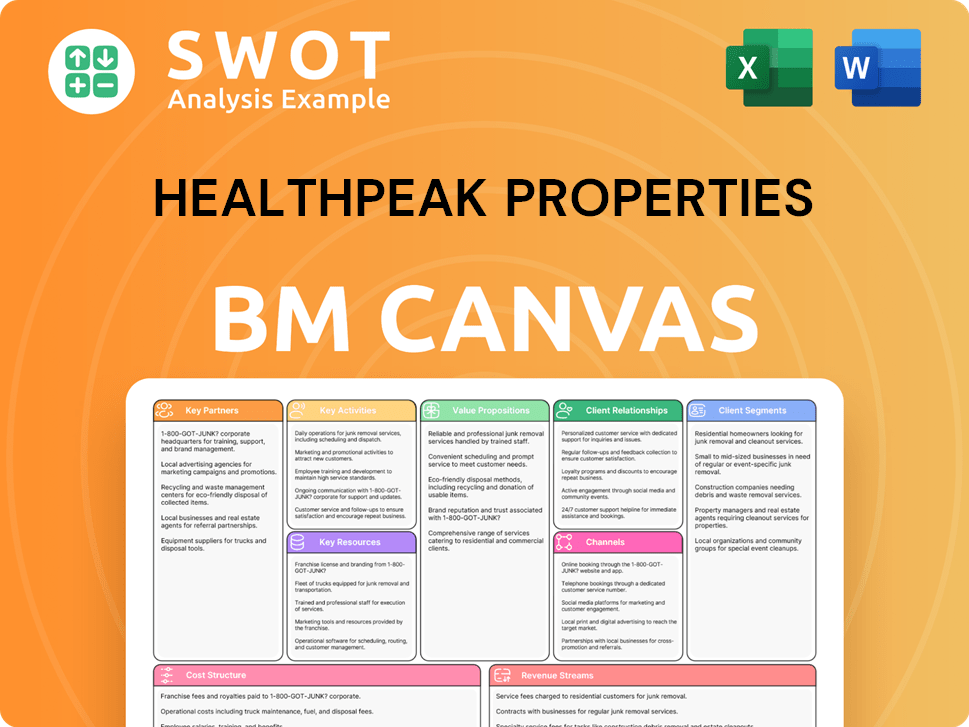

Healthpeak Properties Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Healthpeak Properties Win & Keep Customers?

focuses on acquiring and retaining customers within the healthcare real estate sector. Their strategy emphasizes building strong relationships with leading healthcare operators, life science companies, and medical groups. The company's success hinges on providing high-quality, strategically located properties tailored to the evolving needs of the healthcare industry.

The acquisition strategy involves direct outreach, industry conference participation, and leveraging broker networks. Offering flexible lease structures and build-to-suit options also attracts potential tenants. Strong tenant relationships and proactive property management are central to their retention efforts. This includes regular communication, exceptional property management services, and a focus on maintaining high-quality assets.

By understanding market trends and tenant demands, proactively adapts its portfolio. Strategic partnerships and a solid financial foundation further strengthen retention. The company's brand reputation and financial stability provide confidence to tenants, ensuring a reliable partnership. You can learn more about the company's background in the Brief History of Healthpeak Properties.

The primary acquisition channels include direct outreach through leasing and development teams. Participation in industry conferences and leveraging broker networks are also critical. Build-to-suit options and flexible lease structures are significant draws.

Prioritizing strong tenant relationships is key to retention. Proactive property management, including maintenance and security, is essential. High-quality assets and anticipating market trends contribute to tenant loyalty.

The target market includes healthcare operators, life science companies, and medical groups. The company focuses on properties in prime life science clusters and medical office buildings. This targeted approach allows for specialized offerings.

The company adapts by understanding the growing demand for specialized lab space and outpatient facilities. Developing and redeveloping properties to meet these demands is a key strategy. This proactive approach ensures they remain attractive to their target customers.

The company's strategies focus on customer acquisition and retention within the healthcare real estate market. Key metrics include tenant retention rates, lease renewal rates, and the occupancy rates of their properties.

- Tenant Retention Rate: Maintaining a high tenant retention rate is crucial for stable revenue.

- Lease Renewal Rate: High lease renewal rates indicate tenant satisfaction and strong property performance.

- Occupancy Rates: High occupancy rates demonstrate the demand for their properties.

- Strategic Partnerships: Partnerships with leading operators and institutions are vital for long-term success.

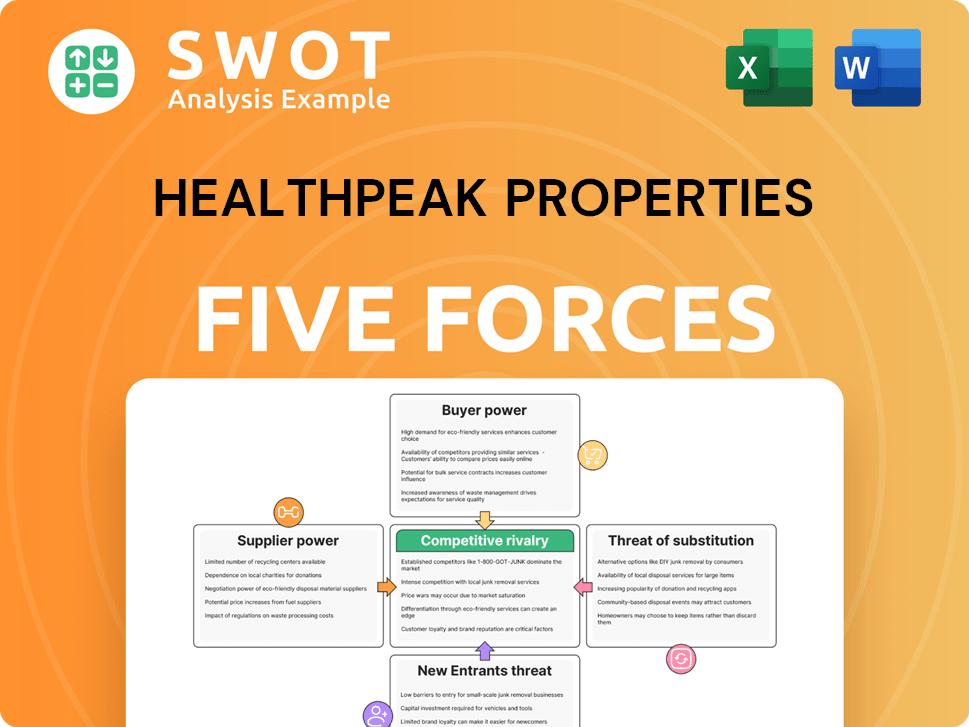

Healthpeak Properties Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Healthpeak Properties Company?

- What is Competitive Landscape of Healthpeak Properties Company?

- What is Growth Strategy and Future Prospects of Healthpeak Properties Company?

- How Does Healthpeak Properties Company Work?

- What is Sales and Marketing Strategy of Healthpeak Properties Company?

- What is Brief History of Healthpeak Properties Company?

- Who Owns Healthpeak Properties Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.