Hecla Mining Bundle

How Does Hecla Mining Company Thrive in the Metals Market?

Hecla Mining Company, a key player in the precious metals sector, is a powerhouse in the exploration, development, acquisition, and production of silver, gold, lead, and zinc. As the largest silver producer in the United States and a significant gold producer, Hecla plays a pivotal role in supplying essential raw materials globally. Its strategic locations in Alaska, Idaho, and Quebec, Canada, highlight its broad geographic reach and diversified asset base.

Understanding Hecla's Hecla Mining SWOT Analysis is crucial for investors looking to navigate the complexities of Hecla Mining. This deep dive will explore its mining operations, revenue strategies, and competitive landscape, offering insights into the company's financial health and potential for growth within the volatile commodities market, especially considering the fluctuating Hecla Mining Company stock price and the impact of silver mining and gold mining.

What Are the Key Operations Driving Hecla Mining’s Success?

Hecla Mining Company, often referred to as Hecla, generates value by efficiently extracting precious and base metals. The company's core offerings include silver, gold, lead, and zinc, which cater to various customer segments. These segments range from industrial users who require base metals for manufacturing to investors and jewelers seeking precious metals.

The operational framework of Hecla is vertically integrated, covering exploration, mine development, extraction, processing, and reclamation. This comprehensive approach begins with extensive geological exploration to identify viable deposits. It then moves through the meticulous planning and construction of mining infrastructure.

Once operations are underway, ore is extracted using various mining methods. This ore is then transported to processing facilities where it is concentrated to separate the desired metals. Hecla’s supply chain involves specialized equipment providers, logistics partners for transporting concentrates, and refiners who further purify the metals.

Hecla's mining operations are centered around the extraction of precious and base metals. The company's main products are silver, gold, lead, and zinc. Their operations are vertically integrated, including exploration, mine development, extraction, processing, and reclamation.

Hecla's value proposition lies in its expertise in underground mining, commitment to safety, and environmental stewardship. The company focuses on high-grade, long-life assets and has a proven track record of reserve replacement. This results in consistent supply and stable returns for investors.

Hecla's operations are distinguished by their focus on high-grade, long-life assets. The Lucky Friday mine in Idaho is a significant silver producer. The Greens Creek mine in Alaska is one of the world's largest and lowest-cost silver mines, also producing gold, zinc, and lead.

- Hecla's strategic asset base and operational efficiency translate into reliable production.

- The company's focus on reserve replacement ensures long-term sustainability.

- Hecla's commitment to safety and environmental stewardship enhances its reputation.

- The company's financial performance is closely tied to silver and gold prices.

Hecla Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hecla Mining Make Money?

The primary revenue streams for the Hecla Mining Company (Hecla) are derived from the sale of silver, gold, lead, and zinc concentrates and doré. The company's financial performance is directly linked to the market prices of these commodities and the volume of production from its various mines. Understanding how Hecla generates revenue is crucial for investors and stakeholders assessing its financial health and strategic direction.

In the first quarter of 2024, Hecla reported sales of $187.3 million, with silver and gold sales being the major contributors. The average realized silver price in Q1 2024 was $23.63 per ounce, and the average realized gold price was $2,075 per ounce. These figures highlight the significance of precious metals in Hecla's revenue model and the impact of price fluctuations on its earnings.

Hecla's monetization strategy centers on extracting and processing ore to produce marketable metal concentrates, which are then sold on global commodity markets. This straightforward approach is complemented by strategies to optimize revenue and manage risks. For insights into the competitive environment, consider reviewing the Competitors Landscape of Hecla Mining.

Hecla employs several strategies to maximize revenue and maintain profitability. These include hedging a portion of its production to reduce price volatility and focusing on increasing output from its lowest-cost mines.

- Hedging: Hecla uses hedging to protect against price fluctuations, ensuring a degree of revenue stability.

- Cost Efficiency: The company prioritizes production from low-cost mines like Greens Creek, which consistently ranks among the lowest-cost silver producers globally.

- Mine Contributions: The revenue mix is significantly influenced by the performance of key mines such as Greens Creek and Lucky Friday for silver, and Casa Berardi for gold.

- Reserve Expansion: Hecla focuses on expanding its reserve base and increasing production capacity to ensure sustained revenue generation.

- Capital Allocation: The company strategically allocates capital to its most promising projects, adapting to market conditions to maximize returns.

Hecla Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hecla Mining’s Business Model?

Hecla Mining Company's journey is marked by significant milestones and strategic decisions that have shaped its current standing in the mining sector. The company's operational evolution includes continuous investment in core assets, such as the Lucky Friday mine, which has seen modernization and expansion to boost efficiency and extend its lifespan. A key move was the 2018 acquisition of Klondex Mines, which brought the Casa Berardi gold mine in Quebec into its portfolio, diversifying its precious metal production.

Operational challenges, including fluctuating commodity prices and regulatory complexities, have been addressed through adaptive strategies such as cost control and technological advancements. Hecla's competitive edge is multifaceted, built on a strong brand reputation earned over its long history. Its portfolio of long-life, high-grade mines, particularly Greens Creek and Lucky Friday, provides a significant advantage due to low operating costs and substantial reserves. The company's commitment to sustainable mining and community relations further strengthens its position.

The company continues to adapt to new trends by exploring advanced exploration technologies and maintaining a focus on environmental, social, and governance (ESG) principles. This ensures its relevance and sustainability in a changing global landscape. To learn more about the company's growth strategy, consider reading Growth Strategy of Hecla Mining.

Hecla's history is punctuated by key milestones, including significant investments in its core assets. The modernization and expansion of the Lucky Friday mine are notable examples of these investments. The acquisition of Klondex Mines in 2018, including the Casa Berardi gold mine, was a strategic move to diversify its precious metal portfolio.

Strategic moves by Hecla include acquisitions and operational adjustments to navigate market challenges. The Klondex Mines acquisition expanded its gold production capabilities. The company also focuses on cost control and technological advancements in its mining operations to maintain profitability.

Hecla's competitive edge is derived from its long-standing brand reputation and portfolio of high-grade mines. The Greens Creek and Lucky Friday mines are particularly advantageous due to their low operating costs and substantial reserves. Commitment to sustainable practices and community relations also contribute to its competitive advantage.

Hecla adapts to new trends by exploring advanced exploration technologies and focusing on ESG principles. This ensures its relevance and sustainability. The company's focus on these areas demonstrates its commitment to long-term value creation and responsible mining practices.

In recent financial reports, Hecla has shown resilience in its operations. For example, in Q1 2024, Hecla reported silver production of approximately 3.3 million ounces and gold production of 48,819 ounces. The company's focus on cost management and operational efficiency is evident in its financial results.

- Silver production in Q1 2024 was approximately 3.3 million ounces.

- Gold production in Q1 2024 was approximately 48,819 ounces.

- The company continues to invest in its core assets to enhance production and efficiency.

- Hecla's commitment to ESG principles is reflected in its operational strategies.

Hecla Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hecla Mining Positioning Itself for Continued Success?

Hecla Mining Company holds a significant position in the mining industry, especially as the largest silver producer in the United States and a substantial gold producer. Its long-standing presence has cultivated strong customer relationships. The company's operations are mainly in North America, which allows for efficient management and regional expertise.

However, the company faces risks common in mining, such as commodity price fluctuations, operational challenges, and regulatory changes. Looking ahead, Hecla focuses on exploration, production optimization, and strategic acquisitions to boost revenue and shareholder value. A deeper understanding of the Marketing Strategy of Hecla Mining can provide additional insights into its market approach.

Hecla Mining is a leading silver and gold producer. It has a significant market share in silver production within the United States. Its operations in North America allow for efficient management and regional expertise.

The company faces commodity price volatility, which affects revenue. Operational risks include geological challenges and equipment failures. Regulatory changes, especially concerning environmental permits, also pose risks.

Hecla aims to grow mineral reserves through exploration. Optimizing production from existing mines is a key strategy. Strategic acquisitions could also play a role in its future expansion.

In 2024, Hecla reported a net loss of $35.6 million. Silver production in 2023 was approximately 11.7 million ounces. Gold production in 2023 was about 184,700 ounces.

Hecla's strategic focus includes maximizing the value of its high-grade assets and maintaining disciplined capital allocation. These initiatives are designed to ensure long-term profitability and increase shareholder value. The company continues to invest in exploration to expand its resource base and sustain future production.

- Exploration to increase mineral reserves.

- Optimizing production at existing mines.

- Potential strategic acquisitions.

- Disciplined capital allocation.

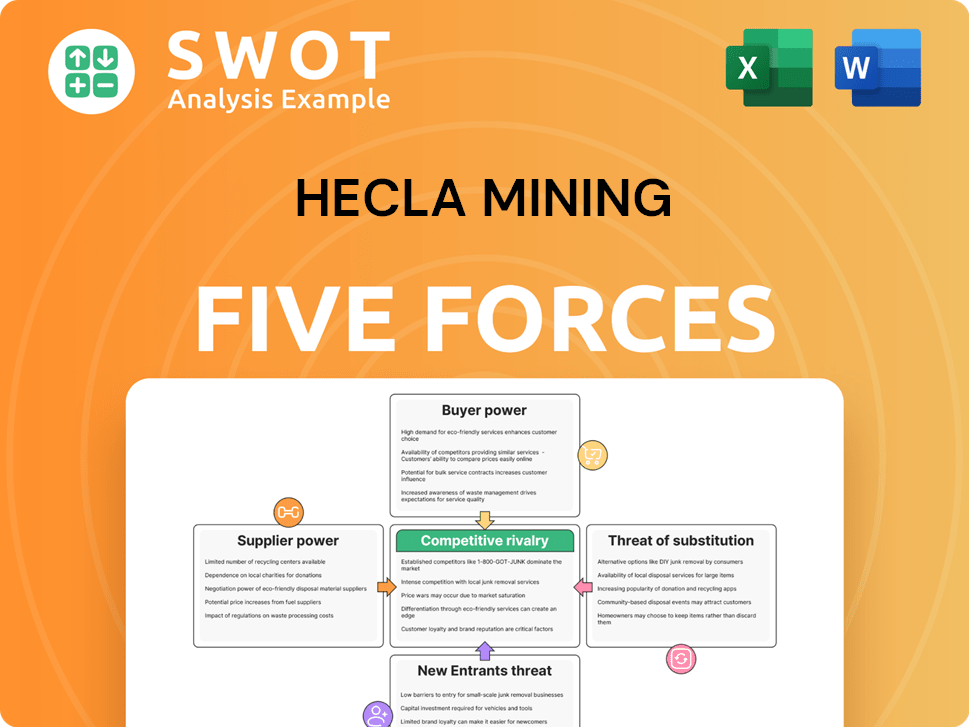

Hecla Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hecla Mining Company?

- What is Competitive Landscape of Hecla Mining Company?

- What is Growth Strategy and Future Prospects of Hecla Mining Company?

- What is Sales and Marketing Strategy of Hecla Mining Company?

- What is Brief History of Hecla Mining Company?

- Who Owns Hecla Mining Company?

- What is Customer Demographics and Target Market of Hecla Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.