Jamieson Wellness Bundle

How Does Jamieson Wellness Thrive in the Health Market?

For over a century, Jamieson Wellness SWOT Analysis has been a leading force in the health and wellness industry, evolving from its Canadian origins to a global powerhouse. With its flagship Jamieson brand and the acquisition of youtheory, the company has expanded its reach, especially in high-growth markets like China. In Q1 2025, Jamieson Wellness demonstrated strong performance, reporting a 14% increase in consolidated revenue, showcasing its resilience and strategic prowess.

This exploration will uncover the inner workings of this Wellness company, examining how Jamieson Wellness manufactures supplements and maintains its position among top vitamin brands. We'll delve into its business model, from its Jamieson supplements and Jamieson vitamins product range to its manufacturing processes, helping you understand if Jamieson Wellness is a reputable vitamin brand. This analysis is crucial for anyone interested in the Supplement manufacturer and the future of health and wellness.

What Are the Key Operations Driving Jamieson Wellness’s Success?

The core of Jamieson Wellness's operations revolves around the creation and distribution of natural health products. This includes a wide array of vitamins, minerals, and supplements (VMS), as well as over-the-counter remedies. The company focuses on serving consumers in Canada, the United States, and internationally, offering solutions for health and wellness needs.

The company's value proposition is centered on providing reliable and effective health solutions. This is achieved through a '360 Quality' program, ensuring products are manufactured to pharmaceutical standards. The operational processes are integral to this value delivery, from sourcing raw materials to a robust logistics network. Their commitment to quality and consumer trust is a key differentiator in the competitive industry.

The company's value proposition is enhanced by its strong brand equity, particularly with the Jamieson brand, which is Canada's #1 VMS brand. The acquisition of youtheory in 2022 further strengthened its presence in the U.S. market. This demonstrates its adaptability in meeting evolving consumer needs. The company's commitment to quality and consumer trust is a key differentiator in a competitive industry. You can learn more about the Growth Strategy of Jamieson Wellness.

Jamieson Wellness uses rigorous manufacturing processes to ensure product quality. This includes sourcing high-quality raw materials and adhering to pharmaceutical standards. The company's commitment to quality is a key factor in maintaining consumer trust and brand reputation.

The company utilizes a multi-channel distribution strategy. This includes traditional retail, club channels, and e-commerce platforms. In China, partnerships have been instrumental in expanding their reach and understanding the local market.

Jamieson Wellness benefits from a strong brand reputation, especially with the Jamieson brand. They focus on evidence-based research for product development. The acquisition of youtheory in 2022 added a lifestyle brand to its portfolio.

Jamieson Wellness has a global presence, with a focus on key markets like Canada, the United States, and China. Strategic partnerships support its global reach. The company's international expansion is supported by strong distribution networks.

Jamieson Wellness operates with a focus on quality, innovation, and consumer trust. The company's manufacturing processes adhere to stringent standards. The company's commitment to quality and consumer trust is a key differentiator in a competitive industry.

- Jamieson supplements are manufactured to pharmaceutical standards.

- The company leverages a multi-channel distribution strategy.

- The acquisition of youtheory expanded its U.S. market presence.

- Jamieson vitamins are available in numerous countries.

Jamieson Wellness SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Jamieson Wellness Make Money?

The revenue streams and monetization strategies of Jamieson Wellness are primarily centered around two key segments: Jamieson Brands and Strategic Partners. The company generates its income mainly through the sale of its branded products, including a variety of supplements and vitamins, to distributors, retailers, and wholesale customers. Additionally, the Strategic Partners segment contributes by offering contract manufacturing services and product sales to other companies.

In the first quarter of 2025, the consolidated revenue for Jamieson Wellness saw a notable increase. This growth was driven by strong performances in both the Jamieson Brands and Strategic Partners segments. The company continues to implement various strategies to expand its market presence and drive revenue growth.

For the full fiscal year 2024, consolidated revenue reached $733.8 million, demonstrating an 8.5% increase. Looking ahead to fiscal 2025, the company anticipates consolidated revenue to range between $800.0 million and $840.0 million, reflecting a growth of 9.0% to 14.5%. Jamieson Brands is projected to contribute significantly, with revenue expected to be between $685.0 million and $720.0 million in 2025, growing between 9.0% and 14.5%.

Several monetization strategies are in place to boost revenue. Expansion of distribution channels is a key focus, with emphasis on cross-border e-commerce and club channels in China, alongside broadening reach in domestic Chinese retail and e-commerce. In the U.S., the company is growing the youtheory brand through new e-commerce partnerships and brick-and-mortar retailers. In Canada, in-market pricing and new marketing campaigns are used to drive consumption growth. These strategies are designed to increase the availability of Jamieson vitamins and other products to a wider audience.

- Expansion in China: Focusing on cross-border e-commerce and club channels.

- U.S. Market Growth: Expanding the youtheory brand through new e-commerce partnerships and retailers.

- Canadian Market Strategies: Utilizing in-market pricing and new marketing campaigns.

- Marketing Investments: Investments in digital and traditional marketing have driven growth in China and for the youtheory brand, leading to global market share gains.

Jamieson Wellness PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Jamieson Wellness’s Business Model?

The evolution of Jamieson Wellness has been marked by significant milestones and strategic maneuvers that have shaped its market position and financial performance. Key strategic moves, such as the acquisition of youtheory in 2022, have been instrumental in accelerating its global expansion, particularly within the U.S. market. This acquisition is a key component of the company’s long-term strategy, which aims to achieve over $1 billion in net revenue.

A crucial aspect of Jamieson Wellness's growth strategy involves strengthening its presence in key international markets. The company has focused on taking ownership of its full value chain in China and making strategic investments in the region. This has led to substantial revenue growth, with Jamieson China experiencing exceptional gains. The company has also increased consumer engagement in the Middle East and Europe.

Operational challenges, including evolving tariff frameworks, have been addressed by the company. While navigating these complexities, Jamieson Wellness anticipates minimal impact in 2025 based on current frameworks. The company has responded to market dynamics by emphasizing brand contribution, improving operational efficiency, and continuing to invest in marketing and innovation for its Jamieson and youtheory brands across its primary geographies.

Jamieson Wellness has achieved several significant milestones that have shaped its operations and financial performance. The acquisition of youtheory in 2022 was a pivotal strategic move, accelerating global expansion, especially in the U.S. market. This acquisition supports the company's long-term goal of exceeding $1 billion in net revenue.

Strategic moves include taking ownership of the full value chain in China and making strategic investments, leading to exceptional revenue growth. Jamieson China saw nearly an 80% increase in revenue in 2024, and over 50% in Q1 2025. The company has also focused on increasing consumer engagement in the Middle East and Europe.

Jamieson Wellness's competitive advantages are multifaceted, including brand strength, particularly the Jamieson brand's #1 position in the Canadian VMS market. The '360 Quality' program and manufacturing to pharmaceutical standards underscore its commitment to product quality and consumer trust. Strategic partnerships, such as the one with DCP Capital in China, provide local expertise.

Operational challenges include navigating evolving tariff frameworks, though the company expects no material impact in 2025. The company has responded to market downturns and competitive pressures by focusing on brand contribution, driving operating efficiency, and continuing to invest in marketing and innovation for its Jamieson and youtheory brands.

Jamieson Wellness's competitive advantages are rooted in its brand strength, particularly the Jamieson brand's leading position in the Canadian Vitamin and Mineral Supplement (VMS) market. The company's '360 Quality' program and adherence to pharmaceutical manufacturing standards enhance product quality and consumer trust, setting it apart in the supplement manufacturer industry. Strategic partnerships, such as the one with DCP Capital in China, provide local expertise and market understanding, enabling effective scaling in complex international markets.

- Brand Strength: The Jamieson brand holds the #1 position in the Canadian VMS market.

- Quality Assurance: The '360 Quality' program and pharmaceutical-grade manufacturing processes.

- Strategic Partnerships: Collaborations like the one with DCP Capital in China.

- Innovation: Ongoing innovation roadmap, including GLP-1 support products launched in Q4 2024.

Jamieson Wellness Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Jamieson Wellness Positioning Itself for Continued Success?

The industry position of Jamieson Wellness is strong, especially as Canada's leading vitamins, minerals, and supplements (VMS) brand. The company has shown consistent market share gains in key markets, with branded revenue growth outperforming record shipment growth reported in 2024. The company's global reach extends to over 50 countries, significantly boosted by its expansion in the U.S. and China. Customer loyalty is built on the brand's century-long reputation for quality and trust.

Despite its strong position, Jamieson Wellness faces risks, including potential regulatory changes in its international markets, which could affect product approvals or marketing. Competition in the health and wellness industry is intense. Changes in trade policies or raw material costs could impact profitability. Evolving consumer preferences and technological disruptions in product development or distribution also pose challenges for the wellness company.

Jamieson vitamins and supplements hold a leading position in Canada. The company has a wide global presence, selling its products in over 50 countries. The company benefits from a long-standing reputation for quality and trust, which enhances customer loyalty.

Regulatory changes in international markets could affect product approvals. Intense competition within the health and wellness sector presents challenges. Changes in trade policies or raw material costs could impact profitability. Consumer preferences and technological advancements also pose risks.

The company aims to exceed $1 billion in net revenue, driven by expansion in key markets. For fiscal year 2025, revenue is projected to be between $800.0 million and $840.0 million, reflecting growth. Adjusted EBITDA is expected to range from $157.0 million to $163.0 million.

The company plans to continue investing in demand generation, innovation, and distribution, especially in the U.S. and China. It focuses on its '360 Quality' program and consumer-centric innovation to drive brand equity. These strategies are designed to support long-term share growth and profitability.

For fiscal year 2025, Jamieson Wellness anticipates consolidated revenue between $800.0 million and $840.0 million, representing a growth of 9.0% to 14.5%. Adjusted EBITDA is projected to range from $157.0 million to $163.0 million, reflecting an 11.0% to 15.5% growth.

- Expansion in the U.S., China, and other international markets.

- Continued investment in demand generation and innovation.

- Focus on consumer-centric innovation to boost brand equity.

- Maintaining the '360 Quality' program.

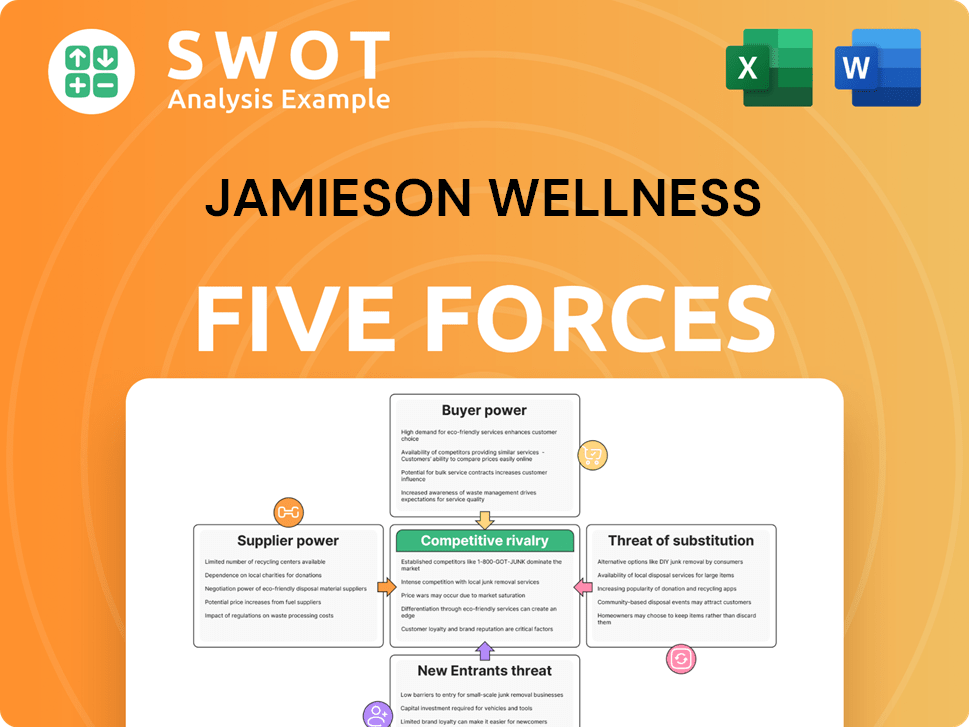

Jamieson Wellness Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Jamieson Wellness Company?

- What is Competitive Landscape of Jamieson Wellness Company?

- What is Growth Strategy and Future Prospects of Jamieson Wellness Company?

- What is Sales and Marketing Strategy of Jamieson Wellness Company?

- What is Brief History of Jamieson Wellness Company?

- Who Owns Jamieson Wellness Company?

- What is Customer Demographics and Target Market of Jamieson Wellness Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.