John B. Sanfilippo & Son Bundle

How Does John B. Sanfilippo & Son Thrive in the Nut Industry?

John B. Sanfilippo & Son, Inc. (JBSS), a century-old leader in the nut and dried fruit sector, boasts a powerful presence in the consumer packaged goods market. With iconic brands like Fisher and Orchard Valley Harvest, the John B. Sanfilippo & Son SWOT Analysis reveals the company's strategic strengths. Its widespread distribution across various retail channels underscores its significant influence on consumer diets.

The Sanfilippo Company's consistent financial performance, exemplified by over $1 billion in net sales for the fiscal year ending June 2024, highlights its resilience. Understanding JBSS's operational model, from nut processing to distribution, is vital for investors and anyone interested in the food company's strategies. This deep dive will explore how John B Sanfilippo & Son creates value and maintains its competitive edge in the nut products market, offering insights into its future.

What Are the Key Operations Driving John B. Sanfilippo & Son’s Success?

John B. Sanfilippo & Son, Inc. (JBSS) centers its operations around the processing, packaging, marketing, and distribution of nuts and dried fruits. The company's value proposition lies in its ability to provide a wide array of high-quality nut products to diverse customer segments. JBSS's core business model focuses on delivering value through its extensive product offerings and efficient operational processes.

The company's primary focus is on the nut processing industry, offering a variety of products under its brands, including Fisher, Orchard Valley Harvest, and Squirrel Brand, as well as private-label options. JBSS sources raw nuts and dried fruits from global and domestic suppliers, processes them through shelling, roasting, blanching, and seasoning, and packages them for retail sale. This integrated approach allows JBSS to maintain control over quality and ensure product consistency.

JBSS's core operations involve a complex supply chain, from sourcing raw materials to delivering finished products to retail channels. Its ability to manage this supply chain efficiently, combined with its focus on food safety and quality, allows it to maintain a competitive edge in the nut products market. This operational excellence is crucial for meeting the demands of a broad customer base and maintaining strong relationships with both suppliers and retailers.

JBSS sources nuts and dried fruits from various suppliers globally and domestically. The processing includes shelling, roasting, blanching, and seasoning. The company's focus on quality and food safety is paramount throughout the manufacturing process.

Products are packaged in various formats suitable for retail, from small snack bags to bulk containers. JBSS utilizes a robust distribution network to reach supermarkets, mass merchandise stores, and other retail channels. This ensures product availability and accessibility for consumers.

JBSS offers a wide variety of nuts, including peanuts, pecans, almonds, walnuts, and cashews, as well as dried fruits. These products are sold under proprietary brands and private labels. The diverse product line caters to different consumer preferences and market demands.

The value proposition of JBSS lies in its ability to provide reliable availability, variety, and trusted product quality. The company's core capabilities in processing and distribution enable it to offer a wide range of products efficiently to a broad market. This creates a competitive advantage.

JBSS's operational strengths include significant scale, vertical integration in certain aspects of its supply chain, and long-standing relationships with suppliers and retailers. These factors contribute to the company's efficiency and market position. Managing complex supply chains for perishable goods and delivering consistent quality are also critical.

- Scale: JBSS operates at a significant scale, enabling efficient processing and distribution.

- Vertical Integration: Vertical integration in the supply chain helps control costs and quality.

- Relationships: Long-standing relationships with suppliers and retailers ensure a stable supply and distribution network.

- Quality Control: Consistent product quality is maintained through rigorous processing and food safety standards.

John B. Sanfilippo & Son SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does John B. Sanfilippo & Son Make Money?

The primary revenue stream for John B. Sanfilippo & Son, or JBSS, is the sale of processed and packaged nut and dried fruit products. This food company generates its income mainly from selling branded and private label products. For the fiscal year ending June 29, 2024, JBSS reported net sales of approximately $1.03 billion.

JBSS's revenue is categorized by sales of its branded products, such as Fisher, Orchard Valley Harvest, and Squirrel Brand, and private label products. Branded product sales generally yield higher margins due to brand recognition and consumer loyalty. The company's monetization strategies focus on volume sales, product diversification, and strategic pricing across various retail channels.

The company utilizes an extensive distribution network to maximize sales volume across supermarkets, mass merchandise stores, club stores, convenience stores, and drug stores. They offer a wide array of product sizes and varieties to meet different consumer needs and price points, from everyday snacking to baking ingredients. JBSS has expanded its product portfolio to include health-oriented options, capitalizing on consumer trends.

JBSS employs several strategies to generate revenue and maintain profitability in the nut processing industry. These strategies include:

- Volume Sales: Leveraging a broad distribution network to ensure product accessibility and drive high sales volumes.

- Product Diversification: Expanding the product line to include a variety of nuts, dried fruits, and health-oriented snacks to cater to diverse consumer preferences and mitigate risks.

- Strategic Pricing: Offering products at various price points and sizes to attract a wide range of consumers.

- Branding and Marketing: Promoting branded products through marketing campaigns to increase consumer demand and brand loyalty.

John B. Sanfilippo & Son PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped John B. Sanfilippo & Son’s Business Model?

John B. Sanfilippo & Son, also known as JBSS, has a rich history marked by strategic moves and key milestones. The company's evolution includes significant brand acquisitions, such as the Fisher brand, and continuous investments in processing and packaging capabilities. These actions have allowed JBSS to expand its market presence and improve operational efficiency within the competitive food industry.

A crucial aspect of JBSS's strategy has been its ability to adapt to market changes and consumer preferences. This includes responding to fluctuations in commodity prices, supply chain disruptions, and the growing demand for healthier snack options. The company's focus on product innovation and portfolio expansion has been key to maintaining its relevance and competitiveness.

Understanding the operational dynamics and strategic decisions of the Sanfilippo Company is essential for anyone interested in the food industry. From its early days to its current position, JBSS has demonstrated a commitment to growth and adaptation. A Brief History of John B. Sanfilippo & Son provides additional context on the company's journey.

JBSS's journey includes the acquisition of key brands and continuous investment in its infrastructure. These strategic moves have enabled the company to broaden its market reach and enhance operational efficiencies. The company has consistently adapted to industry changes.

JBSS has focused on brand building, operational improvements, and product innovation. Addressing challenges like commodity price volatility and supply chain issues has been crucial. These moves have positioned the company for sustained growth.

JBSS benefits from a strong brand portfolio, efficient operations, and a wide distribution network. The company's long-standing relationships with retailers are also a key advantage. JBSS continues to adapt to market trends.

JBSS has shown resilience by diversifying its sourcing and optimizing inventory management. The company's response to evolving consumer preferences has driven product innovation. These strategies have helped JBSS maintain its market position.

JBSS's competitive advantage lies in its strong brand recognition, efficient operations, and extensive distribution network. The company's focus on product innovation and adaptation to consumer trends further strengthens its position. JBSS continues to invest in its capabilities.

- Strong Brand Portfolio: The Fisher brand provides significant brand equity.

- Operational Efficiency: Economies of scale in sourcing, processing, and distribution.

- Extensive Distribution: Broad market penetration through various retail channels.

- Product Innovation: Expanding organic and better-for-you offerings.

John B. Sanfilippo & Son Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is John B. Sanfilippo & Son Positioning Itself for Continued Success?

John B. Sanfilippo & Son, Inc. (JBSS) holds a significant position in the nut and dried fruit processing industry. The company's portfolio of brands, including Fisher and Orchard Valley Harvest, combined with its private label business, gives it a strong presence in the North American market. JBSS's extensive distribution network across various retail channels supports its market share and consumer reach. Its history and consistent product quality have cultivated customer loyalty, solidifying its position as a leading food company.

However, JBSS faces risks, including raw material price volatility and agricultural challenges. Regulatory changes and intense competition also pose threats. Adapting to changing consumer preferences and maintaining operational efficiency are crucial for sustained success. Understanding these factors is critical for anyone looking into investing in the company or analyzing its performance. For more insights into the company's structure and ownership, you can explore Owners & Shareholders of John B. Sanfilippo & Son.

JBSS is a prominent player in the nut processing industry, particularly in North America. Its brands like Fisher and Orchard Valley Harvest, along with its private label business, contribute to its strong market presence. JBSS's wide distribution network and established brand recognition are key strengths.

The company faces risks from fluctuating nut prices and agricultural challenges. Regulatory changes in food safety and labeling, as well as intense competition, also pose challenges. Adapting to changing consumer preferences and managing operational costs are crucial for JBSS.

JBSS focuses on brand building, product innovation, and operational efficiency. The company aims to capitalize on the growing market for healthy snacks. Leadership emphasizes shareholder value through profitable growth and disciplined capital allocation. The future depends on adapting to market dynamics and maintaining its competitive edge.

In fiscal year 2024, JBSS reported net sales of approximately $1.1 billion. The company's gross profit margin was around 18%. JBSS's focus on cost management and strategic initiatives will be crucial for maintaining profitability. These figures highlight the importance of monitoring JBSS's financial health in a dynamic market.

JBSS focuses on several key strategies to drive growth and maintain its market position. These include brand building and product innovation to meet evolving consumer needs. Optimizing operational efficiencies and supply chain management is also a priority for JBSS.

- Expand product offerings to meet consumer demands for healthy and convenient snacks.

- Optimize supply chain management to mitigate cost pressures.

- Invest in marketing and brand development to strengthen brand recognition.

- Focus on operational efficiencies to improve profitability.

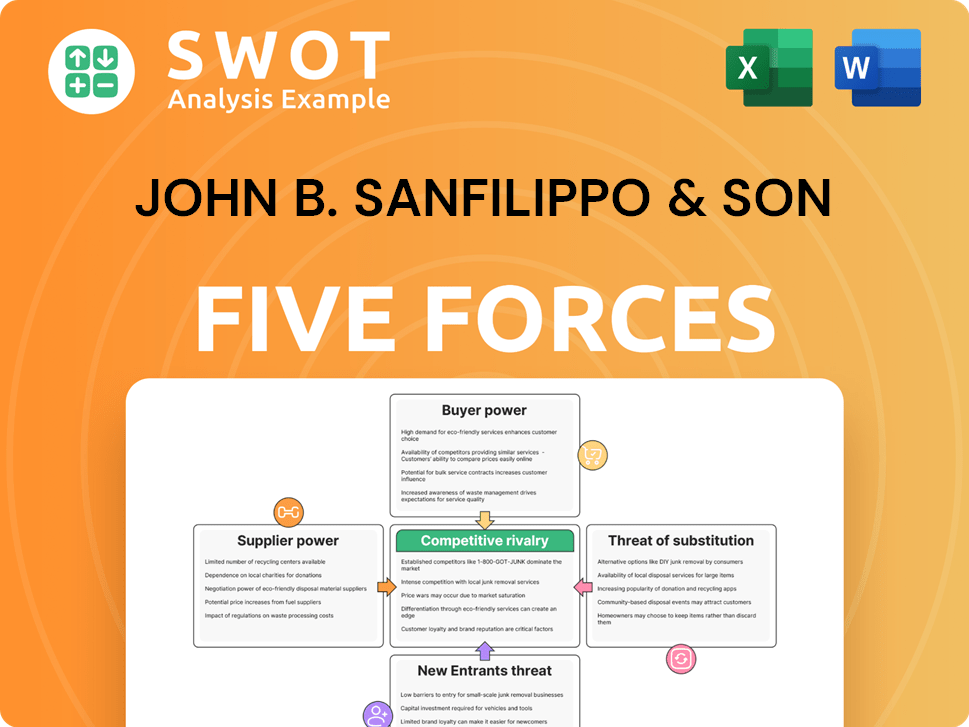

John B. Sanfilippo & Son Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of John B. Sanfilippo & Son Company?

- What is Competitive Landscape of John B. Sanfilippo & Son Company?

- What is Growth Strategy and Future Prospects of John B. Sanfilippo & Son Company?

- What is Sales and Marketing Strategy of John B. Sanfilippo & Son Company?

- What is Brief History of John B. Sanfilippo & Son Company?

- Who Owns John B. Sanfilippo & Son Company?

- What is Customer Demographics and Target Market of John B. Sanfilippo & Son Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.