Kindred Group Bundle

How Does Kindred Group Thrive in the Online Gambling Arena?

Kindred Group Company, a powerhouse in the online gambling industry, operates across a diverse portfolio including online casinos, sports betting, and poker platforms. Its success hinges on a strategic focus on regulated markets, ensuring sustainable growth and a robust business model. This approach has allowed Kindred Group to build a significant presence and consistently adapt to the ever-changing regulatory landscape.

To truly understand Kindred Group's success, we'll explore its operational structure, revenue streams, and strategic initiatives. This deep dive will illuminate how Kindred Group not only competes but leads in the Kindred Group SWOT Analysis, offering valuable insights into its financial performance and future outlook within the competitive gambling industry. We'll examine its core offerings, such as Unibet, and how they contribute to the overall Kindred Group business model.

What Are the Key Operations Driving Kindred Group’s Success?

The Kindred Group operates primarily in the online gambling sector, offering a broad range of products including online casino games, sports betting, and online poker. Their business model focuses on providing these services through various digital platforms, catering to a diverse customer base. The company's core operations are designed to deliver a secure, engaging, and responsible gambling experience.

The Kindred Group Company generates value by offering a comprehensive suite of online gambling products, designed to attract and retain a wide range of customers. This is achieved through a combination of sophisticated technology, robust data analytics, and efficient customer service. Their commitment to responsible gambling and localized market strategies further enhances their value proposition, setting them apart in the competitive gambling industry.

The Kindred Group's operational structure includes technology development, data analytics, and customer service to ensure a smooth and engaging user experience. They secure licenses in regulated markets and partner with leading game developers and sports data providers. Distribution is primarily digital, reaching customers through websites and mobile applications. The company's focus on local market understanding and regulatory compliance, such as its re-entry into the Netherlands, allows it to tailor offerings and marketing strategies to specific regional requirements.

The company's primary offerings include online casino games, sports betting, and online poker. These products are accessible across various digital platforms, ensuring a wide reach to its customer base. The diversification of these offerings allows the company to cater to different player preferences and market trends.

Key operational processes involve technology development for platform stability and user experience, data analytics for personalized offerings and risk management, and customer service to ensure player satisfaction. These processes are crucial for maintaining a competitive edge in the market.

The supply chain involves securing licenses in regulated markets and partnering with game developers and sports data providers. Distribution is primarily digital, reaching customers through websites and mobile apps. This digital-first approach allows for efficient scalability and market penetration.

A strong emphasis on local market understanding and regulatory compliance, alongside a commitment to responsible gambling, differentiates the company. This approach builds customer trust and loyalty, crucial for success in a crowded market. The company's focus on markets like the Netherlands highlights its adaptable strategy.

The Kindred Group's commitment to responsible gambling is a core value, ensuring customer safety and long-term sustainability. The company's focus on the customer base, combined with its robust technology platform, allows it to offer a secure and engaging online gambling experience. For more insights into the company's ownership and structure, you can explore Owners & Shareholders of Kindred Group.

The Kindred Group differentiates itself through its strong emphasis on local market understanding, regulatory compliance, and a commitment to responsible gambling. These factors contribute to enhanced customer trust and loyalty, setting the company apart in the competitive online gambling market.

- Localized offerings and marketing strategies tailored to specific regional requirements.

- Robust technology platform providing a secure and engaging online gambling experience.

- Focus on responsible gambling initiatives to ensure customer safety and long-term sustainability.

- Strategic partnerships with leading game developers and sports data providers.

Kindred Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kindred Group Make Money?

The Kindred Group Company's revenue streams are primarily derived from customer wagers and gaming activities across its online platforms. These platforms include online casinos, sports betting, and online poker, all contributing to the company's financial performance. The Kindred Group business model focuses on maximizing revenue through diverse gaming options and strategic market expansion.

A significant portion of Kindred Group's revenue comes from sports betting and casino games. For instance, in Q4 2023, the company reported a gross winnings revenue of GBP 330.4 million, with substantial contributions from both sports betting and casino operations. The company's ability to attract and retain players through competitive offerings is crucial to its monetization strategy.

Kindred Group employs several innovative monetization strategies. These include tiered loyalty programs designed to reward frequent players, cross-selling opportunities to introduce casino players to sports betting, and targeted promotions based on player behavior. Dynamic pricing models for betting odds, adjusted in real-time, also play a key role. The company's expansion into new regulated markets, such as its re-entry into the Netherlands in 2024, further supports its revenue growth.

Kindred Group's financial performance is heavily influenced by its ability to effectively monetize its diverse online gambling platforms. The company continually adapts its strategies to maintain its competitive edge within the gambling industry. The Unibet brand is a key component of this strategy. Here are some of the key strategies:

- Sports Betting and Casino Games: These are the primary revenue generators, with sports betting and casino games contributing significantly to the gross winnings revenue.

- Loyalty Programs: Tiered loyalty programs are used to reward and retain frequent players, encouraging continued engagement and wagering.

- Cross-Selling: The company cross-sells its products by introducing casino players to sports betting and vice versa, expanding their engagement across platforms.

- Dynamic Pricing: Dynamic pricing models are used for betting odds, adjusting them in real-time based on market movements and betting volumes to optimize profitability.

- Market Expansion: Entering new regulated markets, such as the Netherlands, is a key strategy for expanding revenue streams and increasing market share. You can read more about their history in Brief History of Kindred Group.

Kindred Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kindred Group’s Business Model?

The Kindred Group Company has experienced a series of key milestones, strategic moves, and competitive advantages that have shaped its trajectory in the online gambling sector. Its journey has been marked by strategic expansions, technological innovations, and a strong emphasis on regulatory compliance. These elements have been crucial in navigating the complexities of the global gambling industry and maintaining a competitive edge.

A significant strategic move for Kindred Group has been its consistent focus on entering regulated markets. This is exemplified by its re-entry into the Netherlands in 2024, after obtaining a Dutch license. This move is expected to boost its gross winnings revenue, showcasing its adaptability in dealing with complex regulatory environments. Another milestone includes ongoing product innovation and technological advancements, such as developing proprietary platforms to enhance user experience and operational efficiency across its diverse brand portfolio.

The company has faced operational and market challenges, including strict regulatory hurdles and intense competition. Kindred Group has responded by strengthening its compliance frameworks, investing in responsible gambling initiatives, and diversifying its brand offerings. Its competitive advantages include a strong brand portfolio, with Unibet being a widely recognized name, and a robust technological infrastructure that supports a seamless and secure gaming experience. Furthermore, its economies of scale, derived from its global operations, allow for efficient marketing and customer acquisition. For more information on Kindred Group's target market, check out Target Market of Kindred Group.

Kindred Group's key milestones include strategic market entries and technological advancements. The re-entry into the Netherlands in 2024 after obtaining a Dutch license is a prime example. Continuous product innovation and the development of proprietary platforms have also been pivotal.

Kindred Group's strategic moves focus on regulated market expansion and technological enhancements. Strengthening compliance frameworks and investing in responsible gambling are key strategies. Diversifying brand offerings to cater to different market segments is another important move.

Kindred Group maintains a competitive edge through its strong brand portfolio, including Unibet. A robust technological infrastructure supports a seamless gaming experience. Economies of scale from global operations allow for efficient marketing and customer acquisition.

The company faces strict regulatory hurdles and intense competition. Kindred Group responds by strengthening compliance and investing in responsible gambling. Diversifying brand offerings is also a key response to market challenges.

Kindred Group's financial performance is influenced by its strategic decisions and market conditions. The company's focus on regulated markets and technological advancements impacts its revenue generation and operational efficiency. The 2024 re-entry into the Netherlands is expected to positively affect its financial results.

- Revenue Growth: The company's revenue is significantly influenced by its expansion into regulated markets.

- Market Share: Kindred Group aims to maintain and grow its market share through strategic acquisitions and product innovation.

- Operational Efficiency: Technological advancements are key to improving operational efficiency and enhancing user experience.

- Regulatory Compliance: Investments in compliance and responsible gambling are critical for long-term sustainability.

Kindred Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kindred Group Positioning Itself for Continued Success?

Kindred Group maintains a strong position within the online gambling industry, operating as one of the leading global entities. Its diverse brand portfolio, including Unibet, contributes to significant customer loyalty and broad global reach, particularly in regulated European markets. The proposed acquisition by La Française des Jeux (FDJ) for approximately SEK 27.95 billion (EUR 2.5 billion) highlights its strategic importance in the sector. This deal, if finalized, will integrate Kindred Group into a larger, state-backed lottery and gaming operator.

The online gambling market is highly competitive. Competitors Landscape of Kindred Group shows the challenges of evolving regulatory changes, intense competition, and technological disruptions. Consumer preferences and responsible gambling concerns also impact player engagement and revenue. Ongoing initiatives include expanding into regulated markets and investing in technology and product innovation.

Kindred Group holds a significant market share in the online gambling sector, particularly in Europe. Its brand, Unibet, is well-recognized and contributes to customer loyalty. The acquisition by FDJ aims to strengthen its position through a broader operational base and diversified market access.

Evolving regulations across different jurisdictions can increase compliance costs. Intense competition from established players and new entrants poses a challenge. Technological disruptions and changing consumer preferences also present risks. Responsible gambling concerns can impact revenue.

The proposed acquisition by FDJ signals a future focused on synergistic growth and strengthening its European footprint. Kindred Group is committed to sustainable growth, responsible gambling, and leveraging data analytics. The strategic move aims to sustain and expand its ability to generate revenue.

Kindred Group focuses on further expansion into regulated markets. The company continues to invest in technology and product innovation to enhance customer experience. Leadership emphasizes responsible gambling and data analytics to drive business decisions.

Kindred Group’s financial performance is influenced by its market share and operational efficiency. The acquisition by FDJ is valued at approximately SEK 27.95 billion (EUR 2.5 billion), reflecting its market value. The company's revenue generation depends on its ability to adapt to market changes and maintain customer engagement.

- Market share varies by region, with strong presence in Europe.

- Revenue is affected by regulatory changes and competition.

- The acquisition aims to boost financial performance through synergies.

- Investment in technology and product innovation are key.

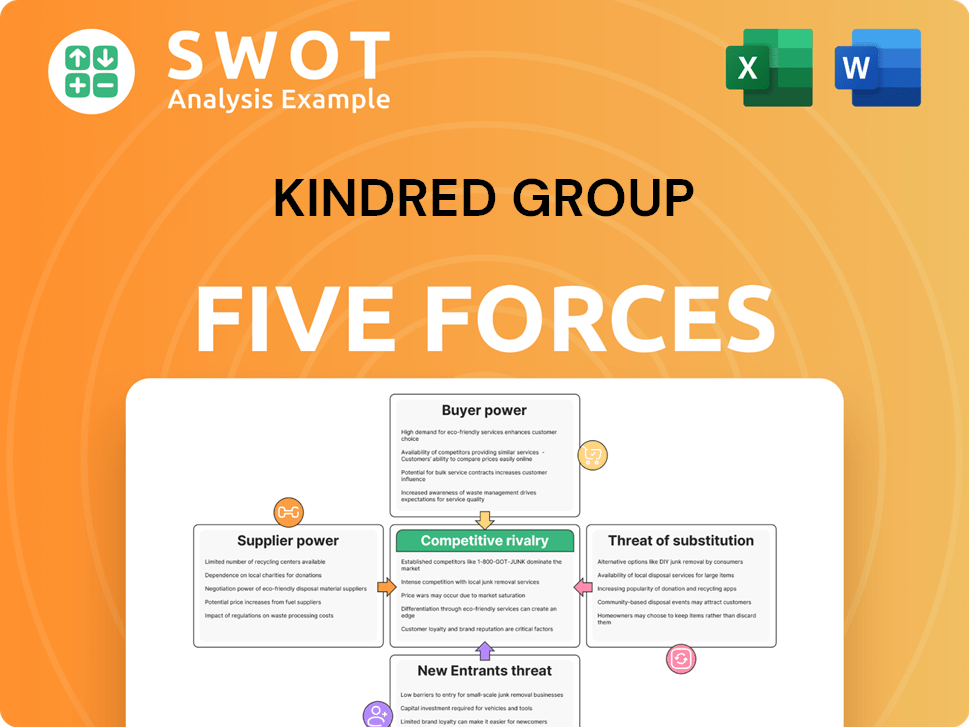

Kindred Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kindred Group Company?

- What is Competitive Landscape of Kindred Group Company?

- What is Growth Strategy and Future Prospects of Kindred Group Company?

- What is Sales and Marketing Strategy of Kindred Group Company?

- What is Brief History of Kindred Group Company?

- Who Owns Kindred Group Company?

- What is Customer Demographics and Target Market of Kindred Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.