Marks & Spencer Group Bundle

Decoding Marks & Spencer: How Does This Retail Giant Thrive?

For over a century, Marks & Spencer (M&S) has been a cornerstone of the British retail scene, evolving through economic storms and consumer revolutions. From pioneering quality standards to its iconic own-brand products, Marks & Spencer Group SWOT Analysis reveals the secrets behind its enduring appeal. Understanding how M&S operates is crucial for anyone seeking to navigate the complexities of the retail industry.

This exploration will provide a detailed look at the Marks and Spencer company structure, its diverse operations, and the strategies that have kept it relevant. We'll uncover how M&S makes money, examining its core offerings, including clothing, home goods, and its renowned food division. Whether you're curious about M&S's supply chain process or its financial performance, this analysis will provide valuable insights into this retail powerhouse, helping you understand how Marks and Spencer competes with other retailers and its strategic vision for the future.

What Are the Key Operations Driving Marks & Spencer Group’s Success?

The Marks and Spencer Group (M&S) creates and delivers value through its integrated approach to product development, sourcing, and multi-channel retail. Its core offerings are in three main categories: Food, Clothing & Home. The company focuses on high-quality, innovative products and a commitment to ethical sourcing, serving a broad customer base seeking premium and everyday options.

Operational processes are complex and highly integrated, encompassing global sourcing, sophisticated logistics, and diverse sales channels. M&S emphasizes its supply chain, working closely with suppliers to ensure product quality and ethical standards. Sales channels include physical stores and a rapidly expanding e-commerce platform. Customer service is delivered through in-store staff and online support, aiming for a seamless shopping experience across all touchpoints.

M&S's unique operations stem from its long-standing supplier relationships, commitment to own-brand development, and investment in digital transformation. These core capabilities translate into customer benefits through consistent product quality, a distinctive product assortment, and convenient shopping options, differentiating M&S in a competitive retail landscape. The company's focus on these areas helps to define its M&S business model.

M&S primarily operates in Food, Clothing & Home. The Food division is known for premium groceries. Clothing & Home offers a wide range of apparel and homeware. These categories cater to a broad customer base, from everyday shoppers to those seeking specialized products.

M&S excels in its supply chain management, ensuring product quality and ethical standards. It invests in technology and automation. This includes digital transformation to integrate online and offline experiences. These efforts enhance efficiency and customer experience.

Customer service is a key focus, delivered through in-store staff and online support. M&S aims to provide a seamless shopping experience across all touchpoints. This includes its physical stores and e-commerce platform, enhancing customer loyalty and satisfaction.

M&S differentiates itself through long-standing supplier relationships. It also focuses on own-brand development and significant investment in digital transformation. These strategies provide consistent product quality and a distinctive product assortment.

M&S's operational model is built on several key elements that contribute to its market position. These include a robust supply chain, a focus on customer service, and a strong emphasis on its own-brand products. The company's ability to adapt to changing consumer demands is crucial.

- Supply Chain Management: M&S maintains close relationships with suppliers. This ensures product quality and ethical standards. This is part of the M&S supply chain process.

- Multi-Channel Retail: The company operates through a network of physical stores and a growing e-commerce platform. This provides customers with convenient shopping options.

- Digital Transformation: Investment in digital technologies integrates online and offline experiences. This enhances the customer journey and operational efficiency.

- Product Development: M&S focuses on developing and offering a wide range of own-brand products. This includes food, clothing, and home goods.

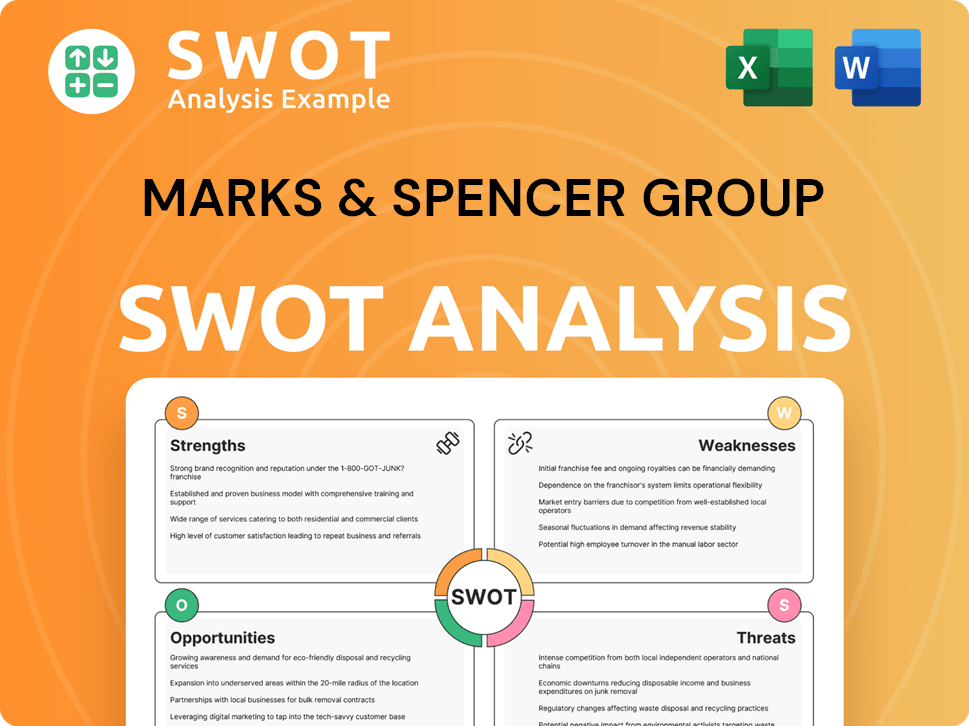

Marks & Spencer Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Marks & Spencer Group Make Money?

The primary revenue stream for Marks & Spencer (M&S) comes from selling its own-brand products. This includes food, clothing, and home goods. Product sales are the main driver of the company's financial performance.

For the financial year ending March 30, 2024, Marks and Spencer Group reported a significant revenue increase. This growth was fueled by strong performances in both its Food and Clothing & Home segments. The company's focus on quality and value, along with updated product ranges, contributed to this positive outcome.

The company's monetization strategies are centered on its retail model, both in-store and online. M&S uses tiered pricing to appeal to different customer segments while maintaining its brand image of quality. Cross-selling is a key strategy, particularly evident in its Food halls.

M&S uses a multifaceted approach to generate revenue and maximize profitability. This includes a blend of in-store and online sales, strategic pricing, and customer-focused initiatives.

- Product Sales: The core of M&S's revenue comes from selling its own-brand products across its Food, Clothing & Home divisions.

- Tiered Pricing: M&S employs tiered pricing strategies to cater to various customer segments, ensuring the brand maintains its quality image.

- Cross-selling: Encouraging customers to purchase multiple items, especially in Food halls, boosts revenue.

- Online Platform: Expanding its online presence and improving digital capabilities is a significant growth driver.

- Click-and-Collect: Integrating online and physical stores through services like click-and-collect enhances revenue.

- Franchise Operations and Financial Services: Additional revenue streams include franchise operations and financial services.

Over time, M&S has increased its focus on its online presence and digital capabilities, which has become a significant growth driver. The company also generates some revenue from other sources, such as franchise operations and financial services, though these contribute a smaller proportion to the overall revenue compared to core product sales. To understand how M&S competes, you can read about the Competitors Landscape of Marks & Spencer Group.

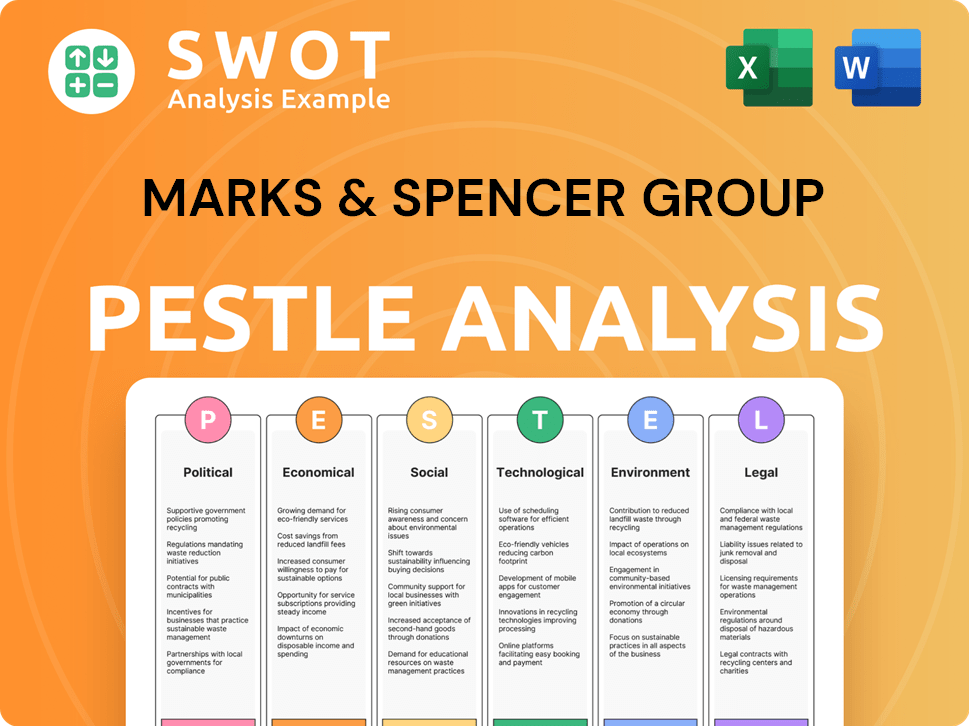

Marks & Spencer Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Marks & Spencer Group’s Business Model?

The evolution of Marks & Spencer (M&S) has been marked by strategic pivots designed to navigate the ever-changing retail landscape. Key to its recent transformation has been a focus on digital capabilities and supply chain optimization. The company's partnership with Ocado for online food delivery, initiated in 2020, showcases a significant adaptation to evolving consumer shopping behaviors and a drive to expand its market reach.

M&S has faced operational challenges, including supply chain disruptions and competition from fast-fashion retailers. Its response has involved streamlining its supply chain, leveraging data analytics for improved inventory management, and enhancing its product offerings to better meet consumer demands. The company's ability to adapt and innovate is crucial for sustaining its business model and maintaining its competitive edge.

The company's financial performance reflects these strategic shifts. For instance, in the fiscal year 2023, M&S reported a strong performance in its food division, with sales up significantly. This growth underscores the effectiveness of its strategic moves, particularly in online food delivery and product innovation. The company's ongoing focus on sustainability and customer experience further supports its long-term goals.

The Ocado partnership in 2020 was a pivotal move, boosting online food sales. The ongoing store rationalization and digital investment are central to its transformation. M&S has consistently adapted its business model to meet changing consumer demands and market dynamics.

Streamlining the supply chain and investing in data analytics have been key strategies. Enhancing product assortment to meet consumer demand is another critical move. The focus on sustainability and ethical sourcing reflects a commitment to evolving consumer preferences.

M&S benefits from a strong brand heritage and economies of scale. Its focus on quality and trust within the food segment is a key differentiator. The company's ability to adapt to new trends, such as sustainability, is crucial for its long-term success.

M&S's food division has shown strong sales growth in recent years, reflecting the success of its strategic initiatives. The company's overall financial performance is closely tied to its ability to execute its transformation plan. The focus on online sales and cost management is crucial for profitability.

M&S's strategy focuses on several key areas to maintain its competitive position. These include enhancing its online presence, optimizing its supply chain, and improving its product offerings to meet changing consumer demands. The company also emphasizes sustainability and ethical sourcing, which resonates with a growing number of consumers.

- Digital Transformation: Investing in online platforms and customer data analytics.

- Supply Chain Optimization: Streamlining processes and improving efficiency.

- Product Innovation: Enhancing product assortment to meet consumer needs.

- Sustainability: Focusing on ethical sourcing and reducing environmental impact.

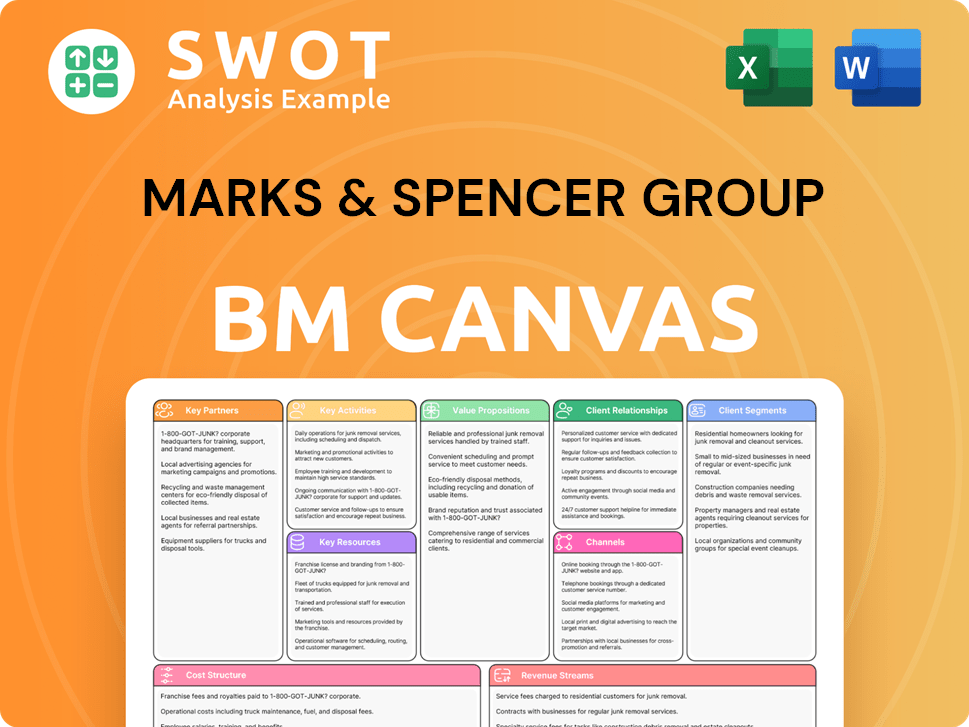

Marks & Spencer Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Marks & Spencer Group Positioning Itself for Continued Success?

The Marks & Spencer Group (M&S) holds a significant position within the UK retail landscape, especially in food and clothing. The company faces intense competition from both established retailers and online platforms. Despite this, M&S maintains strong brand recognition and a loyal customer base, particularly for its food offerings. Its global footprint extends through international stores and online presence, although the UK remains its primary market.

Key risks for M&S include inflationary pressures affecting consumer spending and operational expenses, intense competition in food and clothing, and potential supply chain disruptions. Changes in consumer preferences towards sustainable and value-oriented products also present challenges and opportunities. Regulatory changes related to labor, environmental standards, and international trade could also impact its operations. For detailed insights into the company's ownership structure, you can explore Owners & Shareholders of Marks & Spencer Group.

M&S is a major player in the UK retail sector, particularly in the food and clothing markets. Its brand recognition is high, supported by a loyal customer base. The company's market share remains significant in specific categories, such as premium ready meals, and it operates both physical stores and online platforms.

Key risks include inflation impacting consumer spending, intense competition, and potential supply chain issues. Consumer preferences for sustainable and value-oriented products also create both risks and opportunities. Regulatory changes could further impact operations.

M&S aims to strengthen its omni-channel capabilities, enhance product value, and improve operational efficiency. The future depends on successfully executing these strategies and adapting to market changes. The company's ability to maintain its value proposition is key.

M&S is investing in digital transformation, optimizing its store network, and innovating its product ranges, particularly in food. The focus is on omni-channel capabilities, product relevance, and operational efficiency. These initiatives are crucial for sustained growth.

In recent financial reports, M&S has shown progress in its strategic transformation. The company's focus on improving its food business and online presence has been a key driver. The ability to maintain profitability amid economic challenges is crucial.

- The company's strategy involves a focus on its core strengths in food and clothing.

- Digital transformation is a key priority, with significant investments in online platforms.

- Operational efficiency improvements are ongoing to reduce costs and improve margins.

- Sustainable practices and product innovation are also central to the strategy.

Marks & Spencer Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Marks & Spencer Group Company?

- What is Competitive Landscape of Marks & Spencer Group Company?

- What is Growth Strategy and Future Prospects of Marks & Spencer Group Company?

- What is Sales and Marketing Strategy of Marks & Spencer Group Company?

- What is Brief History of Marks & Spencer Group Company?

- Who Owns Marks & Spencer Group Company?

- What is Customer Demographics and Target Market of Marks & Spencer Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.