Marks & Spencer Group Bundle

Who Truly Owns Marks & Spencer?

Unraveling the Marks & Spencer Group SWOT Analysis is just the beginning; understanding its ownership structure is key to grasping its strategic moves. The evolution of M&S, from its humble beginnings to its current status, is a fascinating tale of retail innovation and financial maneuvering. Knowing who controls Marks and Spencer offers critical insights for investors and strategists alike. This exploration dives deep into the M&S owner landscape.

Understanding the Marks & Spencer ownership structure is crucial for anyone looking to invest in or analyze the company. From its origins as a penny bazaar to its current position as a FTSE 100 constituent, the M&S company structure has evolved significantly. This analysis will detail the major shareholders of Marks & Spencer, providing a comprehensive view of who is shaping the future of this iconic British retailer and answering the question: Who owns Marks and Spencer?

Who Founded Marks & Spencer Group?

The story of Marks & Spencer (M&S) began in 1884 with Michael Marks, a Polish immigrant, who started a penny bazaar stall in Leeds. This marked the initial venture into what would become a retail giant. His innovative approach and the slogan 'Don't ask the price. It's a penny' set the stage for rapid growth.

Seeking expansion, Marks partnered with Thomas Spencer, a cashier from the wholesale company Dewhirst. This collaboration led to the official formation of Marks & Spencer, combining Marks's marketing skills with Spencer's experience. By 1903, the company had grown to 36 branches and was incorporated as a limited company.

The early years saw the company quickly evolve, with both founders passing away relatively early. Michael Marks's son, Simon Marks, later took on a crucial role, becoming chairman in 1916 and playing a key role in modernizing the company. This transition was vital for the company's subsequent growth.

Michael Marks launched his business with a penny bazaar stall in Leeds in 1884. He used a £5 loan from Isaac Jowitt Dewhirst. This initial stall was the foundation of the future Marks & Spencer.

Thomas Spencer invested £300 for half ownership of the business. This partnership was crucial for the company's expansion and success. The company was officially named Marks & Spencer.

By 1894, Marks had a dozen market stalls. The company continued to expand rapidly. This early growth was fueled by innovative marketing strategies.

By 1903, the company had 36 branches. It was then incorporated as a limited company. This was a significant step in the company's development.

Simon Marks, Michael Marks's son, became chairman in 1916. He played a key role in the company's growth. His leadership was vital for the company's modernization.

Both founders died relatively early in the company's history. Thomas Spencer passed away in 1905, and Michael Marks in 1907. Their early vision laid the groundwork for future success.

Understanding the Marks & Spencer ownership structure starts with its founders, Michael Marks and Thomas Spencer. Their partnership, formed in the late 19th century, laid the groundwork for what would become a major player in the retail sector. The M&S owner has evolved over time, with the company transitioning from a private venture to a publicly traded entity. For more detailed insights into the current ownership and structure, you can refer to this article about the 0.

The early ownership of Marks & Spencer was defined by the partnership between Michael Marks and Thomas Spencer.

- Michael Marks started with a penny bazaar stall in 1884.

- Thomas Spencer joined as a partner, investing £300.

- The company expanded to 36 branches by 1903.

- Simon Marks became chairman in 1916, driving further growth.

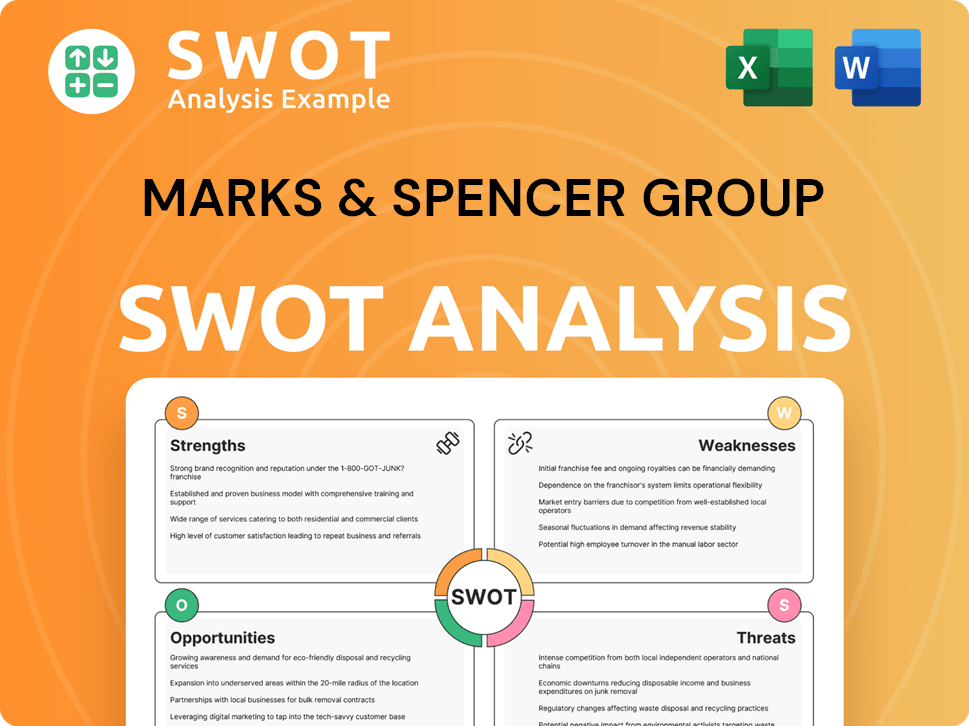

Marks & Spencer Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Marks & Spencer Group’s Ownership Changed Over Time?

The evolution of ownership for the Marks & Spencer Group plc, often referred to as M&S, began with its transition to a public company in 1926. This move was crucial, as it provided the necessary capital to fuel expansion and modernize stores. The company's formal listing on the London Stock Exchange occurred on March 19, 2002. This marked a significant step in its corporate journey, shaping its ownership structure and opening it up to a broader investor base. The company's market capitalization, as of June 13, 2025, is approximately £7.54 billion.

The current ownership structure of Marks & Spencer, a key aspect of understanding the M&S owner, is heavily influenced by institutional investors. These entities collectively hold a substantial majority of the shares. The company's stock is therefore significantly impacted by the trading activities of these major shareholders. The shift towards institutional ownership has been a defining trend in the company's history, reflecting broader changes in the financial markets and investment preferences. For more details, you can explore the Marketing Strategy of Marks & Spencer Group.

| Ownership Category | Percentage (as of February 10, 2025) | Notes |

|---|---|---|

| Institutional Investors | 76% | Significant influence on stock price. |

| General Public | 18% | Primarily individual investors. |

| Other | 6% | Includes various smaller holdings. |

As of October 2023, BlackRock, Inc. was the largest institutional shareholder, controlling around 8.3% of the shares. The Vanguard Group, Inc. held approximately 7.5% during the same period. Other significant institutional investors include Threadneedle Asset Management Ltd., RWC Asset Management LLP, and Schroder Investment Management Ltd. In January 31, 2025, Vanguard Total International Stock Index Fund held 28.55 million shares, which is 1.39% of the outstanding shares. Recent trends, observed in the last quarter leading up to October 2023, show BlackRock, Inc. increasing its stake by 1.5%, Vanguard reducing its shareholding by 0.7%, and Legal & General maintaining its stake. This highlights the dynamic nature of the M&S company structure and the ongoing adjustments in ownership among key players.

Marks & Spencer's ownership is primarily held by institutional investors, influencing its stock performance. The company's structure has evolved since becoming public in 1926, with a significant presence on the London Stock Exchange.

- Institutional investors hold the majority of shares.

- BlackRock and Vanguard are among the largest shareholders.

- The general public also holds a notable stake.

- Ownership dynamics are constantly evolving.

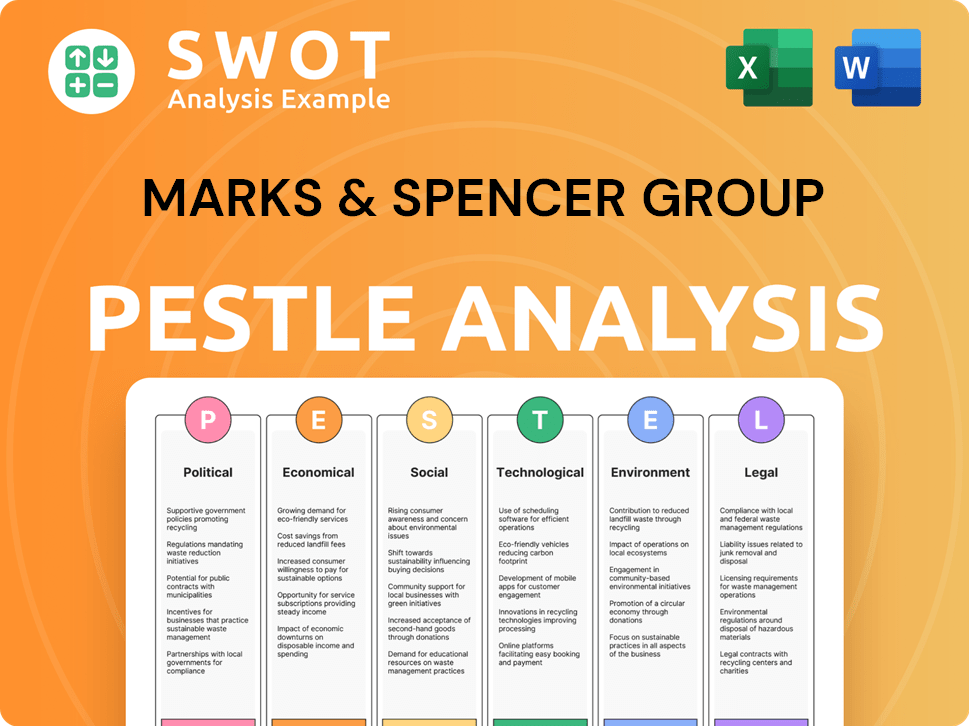

Marks & Spencer Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Marks & Spencer Group’s Board?

The current board of directors at Marks & Spencer Group plc includes key figures steering the company's strategic direction. Archie Norman serves as Chairman, a position he has held since September 2017. Stuart Machin, appointed in May 2022, is the Chief Executive Officer, and Alison Dolan holds the role of Chief Financial Officer. The board also benefits from the expertise of non-executive directors, including Evelyn Bourke, Fiona Dawson, Ronan Dunne, Justin King, Cheryl Potter, and Sapna Sood. Nicholas Folland serves as the General Counsel and Company Secretary.

This structure highlights the company's commitment to strong governance, with a clear separation of roles and a mix of executive and non-executive directors. The presence of a Senior Independent Director and an independent Audit Committee further reinforces the focus on accountability and transparency. Understanding the composition of the board is crucial for anyone interested in the Marks & Spencer ownership and its strategic direction.

| Role | Name | |

|---|---|---|

| Chairman | Archie Norman | |

| Chief Executive Officer | Stuart Machin | |

| Chief Financial Officer | Alison Dolan | |

| General Counsel and Company Secretary | Nicholas Folland |

As of June 2, 2025, the company's capital structure includes 2,056,226,735 ordinary shares with voting rights. This figure is essential for shareholders to understand their voting power and any disclosure obligations under the FCA's Disclosure and Transparency Rules. The voting structure generally follows a one-share-one-vote principle, which is standard for publicly traded companies. For those interested in the M&S owner and the company's financial health, understanding the share structure is vital. You can also explore the Competitors Landscape of Marks & Spencer Group for additional insights.

The board of directors includes a Chairman, CEO, CFO, and several non-executive directors, ensuring diverse perspectives and strong governance.

- The company has over 2 billion ordinary shares with voting rights, indicating a broad shareholder base.

- The separation of the Chair and CEO roles, along with a Senior Independent Director, promotes effective oversight.

- The Audit Committee is composed entirely of independent members, reinforcing financial transparency.

- The company is publicly traded, so the ownership is distributed among shareholders.

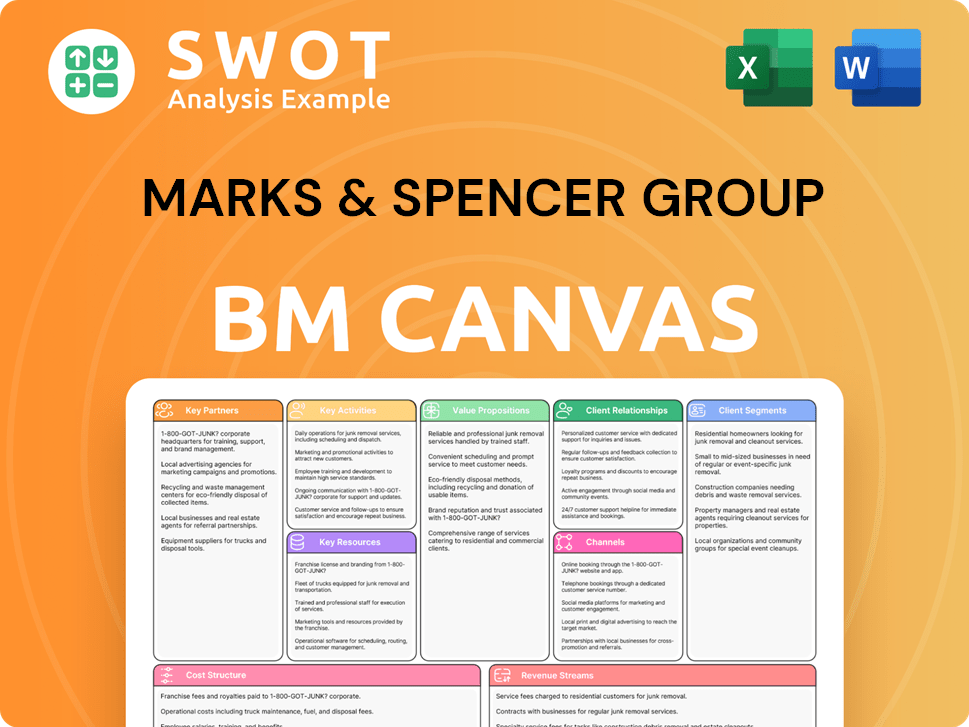

Marks & Spencer Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Marks & Spencer Group’s Ownership Landscape?

In the past few years, the company has seen significant shifts in its leadership. Katie Bickerstaffe, Co-Chief Executive Officer, announced her retirement in March 2024, which took effect after the July 2024 AGM. This was part of a planned leadership transition. Further changes occurred in February 2025, with John Lyttle taking over as the clothing and home director, replacing Richard Price. Rachel Higham joined M&S in June 2024 as the new Chief Digital and Technology Officer, and Mark Lemming was promoted to Managing Director of International in the new financial year (2024-2025). Higham and Lemming are now part of the Executive Committee.

The company's transformation strategy has been a key focus. Revenue for the 2024/25 fiscal year reached £13.9 billion, with group profit before tax and adjusting items at £875.5 million. Food sales saw an increase of 8.7%, and market share rose by 27 basis points to 3.9% in the 52 weeks ending March 23, 2025. The company also plans to reduce its UK store locations to 180 full-line and 420 food stores. To understand more about the company, you can read about the Revenue Streams & Business Model of Marks & Spencer Group.

| Metric | Value | Date |

|---|---|---|

| Revenue | £13.9 billion | Fiscal Year 2024/25 |

| Group Profit Before Tax | £875.5 million | Fiscal Year 2024/25 |

| Food Sales Increase | 8.7% | Fiscal Year 2024/25 |

| Institutional Ownership | 76% | February 10, 2025 |

Regarding ownership trends, institutional ownership remains high, standing at 76% as of February 10, 2025. This high percentage suggests that institutional investors significantly influence the company's stock price and strategic direction. The 2024 Annual Report and Financial Statements were released in June 2024, and the 2025 ESG Report and Annual Reports were made available on June 2, 2025.

The majority of Marks & Spencer ownership is held by institutional investors. These investors play a key role in the company's strategic decisions.

Recent changes include the retirement of a Co-CEO and appointments in non-food leadership. These changes are part of the company's evolution.

The company reported strong revenue and profit figures for the 2024/25 fiscal year. Food sales also saw significant growth.

The company is focused on its transformation strategy, including reducing UK store locations. This is a key part of its plan.

Marks & Spencer Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Marks & Spencer Group Company?

- What is Competitive Landscape of Marks & Spencer Group Company?

- What is Growth Strategy and Future Prospects of Marks & Spencer Group Company?

- How Does Marks & Spencer Group Company Work?

- What is Sales and Marketing Strategy of Marks & Spencer Group Company?

- What is Brief History of Marks & Spencer Group Company?

- What is Customer Demographics and Target Market of Marks & Spencer Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.