Next Bundle

How Does Next Company Thrive in Today's Retail Landscape?

Next plc, a British retail giant, has consistently demonstrated its ability to adapt and flourish in a dynamic market. For the fiscal year ending January 2024, Next reported impressive financial results, highlighting its robust performance. This success underscores the importance of understanding Next SWOT Analysis and its operational strategies.

Delving into How Next Company Works reveals a multi-channel approach that seamlessly integrates retail stores, online platforms, and a catalog business. This strategy allows the Next Company platform to cater to a broad customer base, offering a diverse range of products. Understanding Next Company's features, services, and benefits is key to appreciating its enduring success and competitive advantages within the industry.

What Are the Key Operations Driving Next’s Success?

The Next Company operates on a multi-channel strategy, offering a wide array of products, including clothing, footwear, home goods, and beauty products. This approach allows the company to cater to a broad customer base, primarily fashion-conscious individuals and home product enthusiasts. Next Company focuses on providing high-quality, stylish, and affordable products to meet customer needs effectively.

Next Company's operational structure is vertically integrated, encompassing product design, sourcing, manufacturing, and distribution. This integrated model allows for greater control over quality and cost. The company also prioritizes responsible sourcing and ethical standards, which aligns with the values of customers who prioritize sustainability. For more details, you can read about the Brief History of Next.

A key aspect of Next Company's success lies in its omnichannel strategy, combining physical retail stores, an online platform, and a catalogue business. This diversified approach allows customers to shop through various channels, enhancing convenience and accessibility. Next Company's platform is designed to provide a user-friendly experience, personalized recommendations, and convenient delivery options.

Next Company utilizes an omnichannel strategy, integrating physical retail stores, an online platform (next.co.uk), and a catalogue business to reach customers. This approach allows customers to shop through various channels, enhancing convenience and accessibility. The company operates over 450 stores across the UK and Ireland.

The Next Company platform offers a user-friendly interface, personalized recommendations, and convenient delivery options. The online segment generated 55% of total sales. This allows the company to reach a wider customer base and generate significant online revenue.

Next Company has invested in 'exceptional infrastructure' for warehousing, fulfillment, and customer service. This infrastructure is also leveraged through its 'Total Platform' service. This enables partner brands to grow online with lower operational overheads.

Next Company's 'Total Platform' service provides full-service e-commerce capabilities to third-party brands. This includes website design, marketing, warehousing, delivery, returns, and contact centers. Partner brands include JoJo Maman Bébé, Joules, and FatFace.

Next Company's core capabilities include efficient product sourcing, stock management, and cost control. These capabilities translate into accessible product pricing and an outstanding customer experience. This includes quick and cost-effective delivery.

- Efficient product sourcing

- Effective stock management

- Cost control measures

- Outstanding customer experience

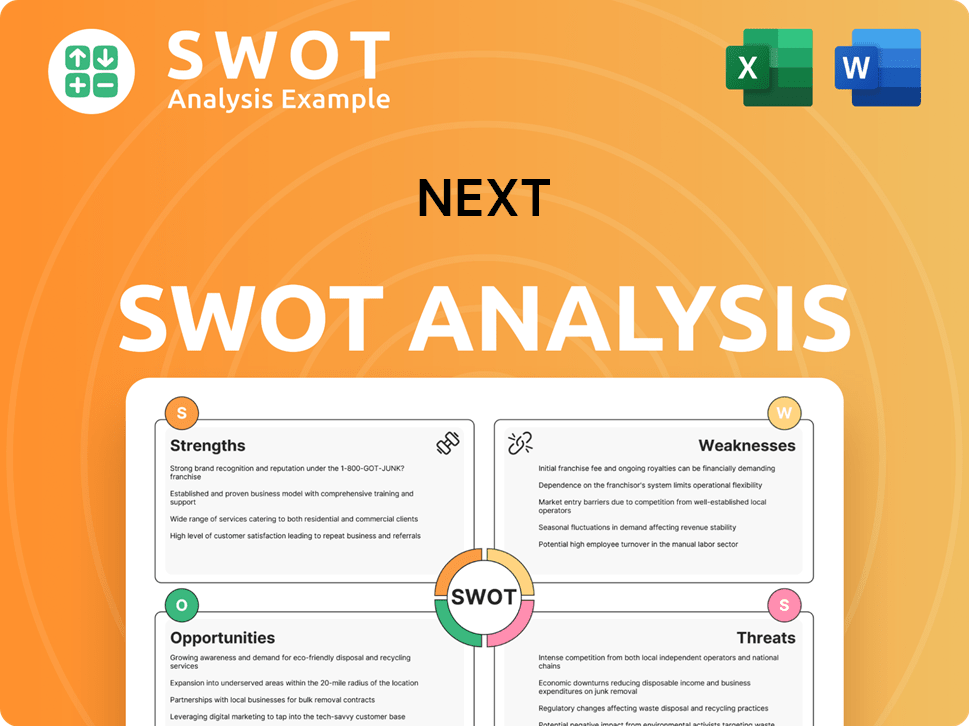

Next SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Next Make Money?

The revenue streams and monetization strategies of the Next Company are multifaceted, reflecting its diverse operations in the retail sector. The company generates income through multiple channels, including physical stores, online platforms, and financial services. This approach allows the company to adapt and respond to evolving market dynamics, ensuring sustained revenue growth.

For the fiscal year ending January 2024, the total group sales reached £6.321 billion, showcasing the company's significant market presence. The company's strategic focus on digital channels and expansion through its Total Platform and strategic investments further diversifies its revenue sources. This diversification supports the company's ability to navigate market fluctuations and capitalize on new opportunities.

The company's ability to generate revenue stems from several key areas. These include retail sales, online sales, financial services, and the Total Platform. The company also leverages licensing and franchising to expand its reach. These strategies are designed to maximize revenue generation and customer engagement.

The primary revenue streams for Next Company are varied, each contributing significantly to its financial performance. These streams include retail sales, online sales, financial services, and other ventures. The company's approach to revenue generation is designed to maximize profitability and customer engagement.

- Retail Sales (Physical Stores): Physical stores remain a key revenue source. In the last financial year, stores accounted for 37% of sales.

- Online Sales: The e-commerce platform is a major driver of revenue. Online sales generated 55% of total sales in the last financial year. UK online sales increased by 3.8%, with online overseas sales seeing a substantial 31.4% increase in the same period.

- Financial Services (Next Finance): Next Finance provides credit accounts, generating revenue through interest income. As of January 2024, Next Finance served 2.9 million customers in the UK and generated £293 million in interest income in fiscal 2024.

- Total Platform: This 'retail-as-a-service' model provides e-commerce solutions to third-party brands. Total Platform sales jumped 25% in the first half to July 2024.

- Licensing and Franchising: Next generates revenue by licensing its brand and entering into franchising agreements. This expands its global presence without significant capital investment.

Next Company employs several monetization strategies, including tiered pricing and cross-selling. The company uses its credit facilities to encourage higher spending. The company continuously adapts its revenue mix, with a notable shift towards digital channels and diversification through its Total Platform. To understand how Next Company compares to its competitors, you can explore the Competitors Landscape of Next.

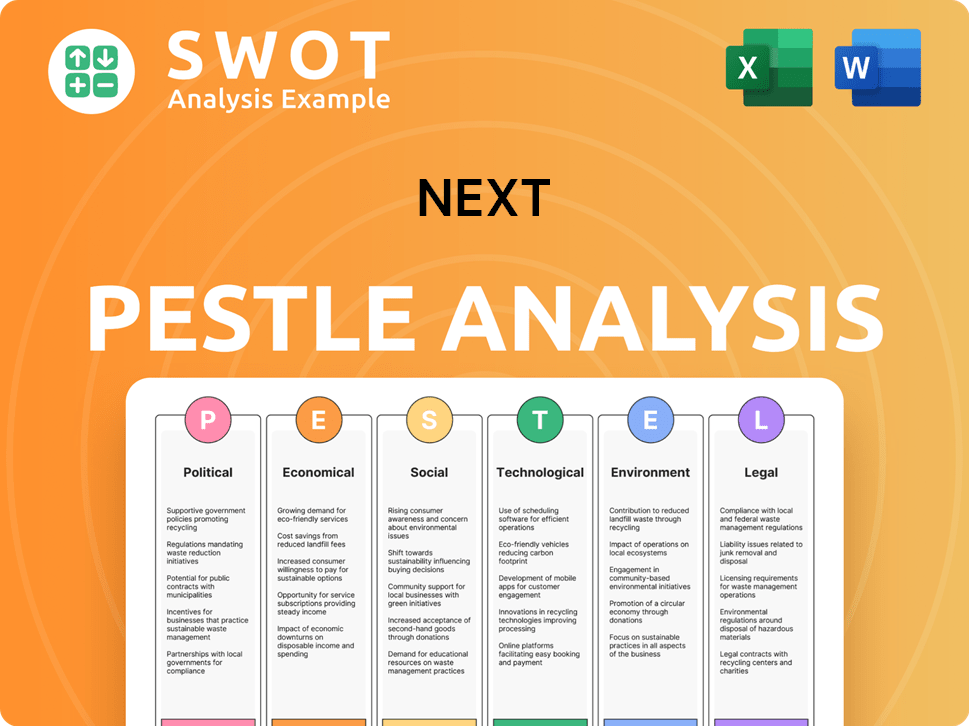

Next PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Next’s Business Model?

The evolution of Next plc from a traditional high street retailer to a multifaceted retail powerhouse marks a significant strategic journey. A key milestone has been the development and expansion of its 'Total Platform' service, which provides e-commerce and logistics solutions to third-party brands. This strategic move allows Next to generate revenue beyond its own product lines and scale without the same inventory or marketing risk.

Next has also strategically invested in and acquired various brands to broaden its portfolio and market reach. Notable moves include increasing its equity stake in Reiss to 72% and acquiring a 97% equity stake in FatFace, as well as the intellectual property of Cath Kidston. These acquisitions contribute to diversified product offerings and sales growth. The company continues to adapt to new trends and technology shifts by focusing on digital marketing, enhancing its website, and improving delivery services.

Next has faced operational challenges, including intense competition from both traditional and online retailers. Economic downturns and fluctuations in consumer spending also pose threats. Despite these hurdles, Next has consistently outperformed expectations, with its underlying pre-tax profits rising by 5% to £918 million for the year ending January 2024. For the nine weeks to December 28, 2024, full-price sales were up 5.7%, surpassing initial guidance. Understanding Owners & Shareholders of Next can provide further insights into the company's financial strategies.

The 'Total Platform' service is a key milestone, offering e-commerce and logistics solutions to third-party brands. By January 2024, Next had launched three new Total Platform clients, bringing the total to seven. This expansion allows Next to generate revenue beyond its own product lines.

Strategic investments and acquisitions have expanded the brand portfolio. Increasing the equity stake in Reiss to 72% and acquiring FatFace and Cath Kidston's intellectual property are key moves. These actions support diversified product offerings and sales growth.

Next's competitive advantages include a strong brand reputation and a diversified product portfolio. The company also benefits from an omnichannel model, exceptional infrastructure, and financial discipline. These factors contribute to its consistent outperformance.

Next continues to adapt to new trends and technology shifts. The company is focusing on digital marketing, website enhancements, and delivery improvements. Exploring alternative business models and continuously improving product ranges are also key strategies.

Next's competitive advantages are multi-faceted, contributing to its strong market position and financial performance. These advantages enable the company to navigate challenges and capitalize on opportunities in the retail sector. The company's focus on digital marketing and website enhancements further strengthens its position.

- Strong Brand Reputation: Next has built a strong brand known for quality and fashion-forward products.

- Diversified Product Portfolio: Offering a wide range of clothing, footwear, home furnishings, and beauty products caters to diverse customer preferences.

- Omnichannel Model: Its established omnichannel approach provides a seamless shopping experience and broad reach.

- Exceptional Infrastructure and Technology Leadership: Next's robust e-commerce infrastructure and distribution networks are significant differentiators.

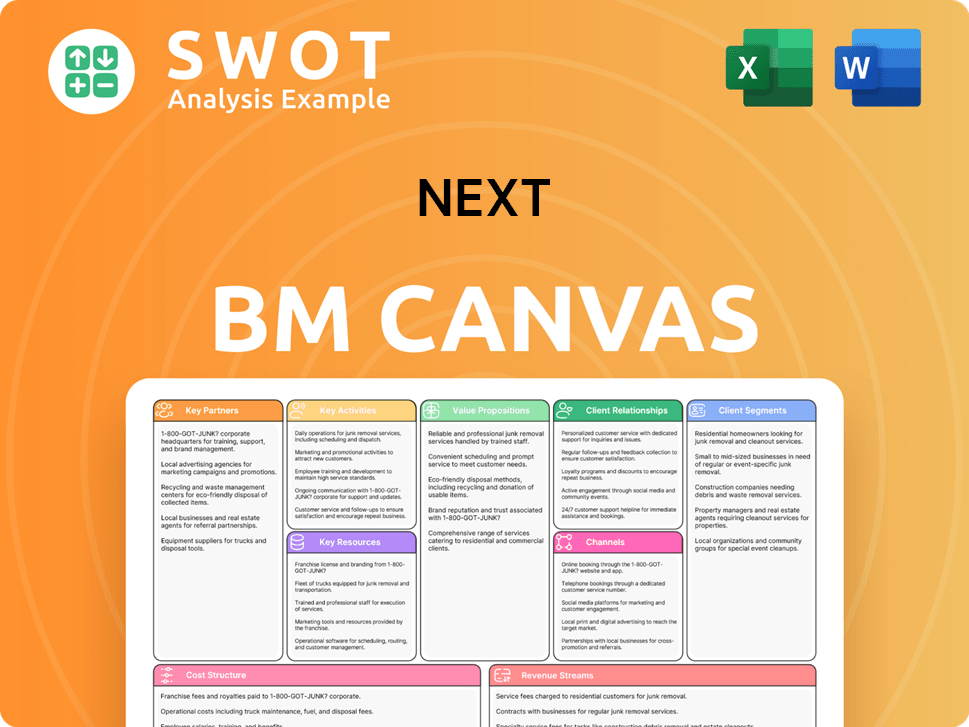

Next Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Next Positioning Itself for Continued Success?

The UK apparel, footwear, and home products retail sector is where the business of Next plc thrives, holding a solid market position. Next's operations are diversified, including retail stores, online channels, and a catalogue business. The company also has a financial services division, contributing to its robust financial standing.

Next consistently ranks among the leading retailers in the UK, demonstrating adaptability and strong financial outcomes. Its brand strength and customer loyalty are significant assets in a saturated market. Next has expanded its global reach through both its online presence and franchised stores in over 30 countries.

Next plc maintains a strong position within the UK retail market. The company's diversified business model, including retail stores, online channels, and a catalogue business, supports its market leadership. Next's adaptability and financial performance have consistently placed it among the top retailers in the UK.

Next faces intense competition from both traditional and online retailers. Economic downturns pose a risk to consumer spending, impacting sales. Inflationary pressures and operating costs, like wages, also affect profitability. Technological changes and shifting consumer preferences require continuous adaptation.

Next is focused on sustaining and expanding profitability through strategic initiatives. The company plans to strengthen its brand overseas and develop new brands. Digital marketing and website enhancements are key to driving online growth. Next also aims to continue its focus on cost management and shareholder returns.

Key initiatives include strengthening the Next brand internationally, developing new brands and licenses, and generating revenue from its Total Platform. Digital marketing and website enhancements are crucial for online growth. Additionally, the company emphasizes cost management and shareholder returns.

For the fiscal year 2025/26, Next anticipates full-price sales of £5.22 billion, a 3.5% increase year-over-year. Group profit before tax is expected to grow by 3.6% to £1.04 billion. The company plans to continue share buybacks, totaling £326 million for the year ending January 2025, with a reduction in net debt to around £625 million.

- Focus on creating product lines that resonate with global consumers.

- Building a sustainable structure for consistent profitability.

- Enhancing digital marketing and website improvements.

- Continued focus on cost management and shareholder returns.

Next Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Next Company?

- What is Competitive Landscape of Next Company?

- What is Growth Strategy and Future Prospects of Next Company?

- What is Sales and Marketing Strategy of Next Company?

- What is Brief History of Next Company?

- Who Owns Next Company?

- What is Customer Demographics and Target Market of Next Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.