Next Bundle

Who Truly Owns Next?

Understanding the ownership structure of Next is paramount for anyone seeking to grasp its strategic trajectory in the ever-evolving retail landscape. From its humble beginnings as a tailor in 1864 to its current status as a retail giant, Next's ownership narrative is a compelling story of adaptation and influence. Delving into the question of "Who owns Next?" unveils the forces shaping this iconic brand.

The ownership of Next, a publicly traded company, is a complex interplay of institutional investors and individual shareholders, each with their own vested interests. Exploring the Next SWOT Analysis offers a deeper dive into its competitive positioning. This analysis will examine the evolution of Next Group's ownership, including founder stakes, key investors, and the impact of public shareholders on its strategic decisions. Understanding Next's ownership is essential for anyone analyzing its financial performance and long-term prospects.

Who Founded Next?

The origins of the company, now known as Next plc, began in 1864 with the founding of J. Hepworth & Son by Joseph Hepworth in Leeds. Initially, the business focused on tailoring, and its early ownership structure reflected a typical family-run enterprise.

Joseph Hepworth was at the helm, guiding the company through its initial stages. While specific equity splits from the company's inception are not readily available in public records, the Hepworth family maintained control for many years, overseeing the company's early growth and expansion.

Early financial backing likely came from the founder's own capital, along with potential support from local investors or lenders. There is no widely publicized information regarding significant early ownership disputes or buyouts during the nascent stages of J. Hepworth & Son. The founding team's vision, centered on quality tailoring, was reflected in a concentrated ownership structure that allowed for focused, long-term strategic decisions in its formative years.

The initial ownership of J. Hepworth & Son was primarily held by Joseph Hepworth and his family.

Early funding came from the founder's capital and potentially local investors.

There is no readily available information about significant early ownership disputes.

Concentrated ownership allowed for focused, long-term strategic decisions.

The initial focus was on quality tailoring, reflecting the founders' vision.

Specific equity splits from the company's inception are not readily available in public records.

Understanding the early ownership of the Next Group provides context for its evolution into a major retail player. The Hepworth family's initial control and the company's focus on quality tailoring set the stage for its future growth. As the company expanded, the ownership structure likely evolved, eventually leading to its current status as a publicly traded company. The early years were crucial in establishing the company's foundation, influencing its later strategies and market position. For more insights into the competitive landscape, including how the company stacks up against its rivals, consider exploring the broader market analysis.

The early ownership of the company was primarily held by the Hepworth family, with Joseph Hepworth leading the company. The initial funding came from the founder's capital and local investors. The company's early focus on quality tailoring shaped its strategic direction.

- Early ownership was concentrated, allowing for focused decision-making.

- The company's initial focus on tailoring influenced its early growth.

- Public records don't provide detailed information on early equity splits.

- The Hepworth family's control was central to the company's formative years.

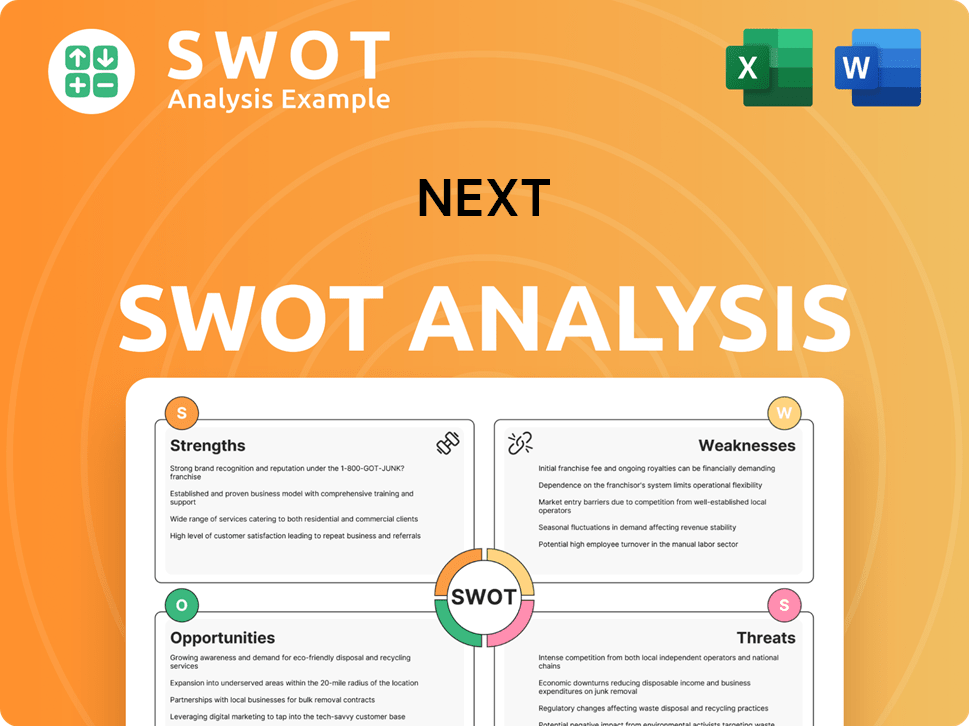

Next SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Next’s Ownership Changed Over Time?

The evolution of Next plc's ownership reflects its journey from a private entity to a publicly traded company. Originally known as J. Hepworth & Son, the company's transition to Next plc and its listing on the London Stock Exchange marked a significant change. This move opened up the ownership structure, making shares available to the public and subject to the dynamics of the stock market. This shift has been pivotal in shaping the company's strategic direction and financial performance over time.

The shift to public ownership has meant that institutional investors now hold a considerable stake in Next plc. These investors, including large asset management firms and investment funds, have a significant influence on the company's strategic decisions. Their focus on shareholder value, dividend payouts, and strategic acquisitions drives Next's business strategies. Moreover, Next's share buyback programs have further influenced the ownership structure by affecting the total number of outstanding shares.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Transition from private to public ownership; shares available on the London Stock Exchange. | 1980s |

| Institutional Investment | Increased holdings by large institutional investors, mutual funds, and index funds. | Ongoing |

| Share Buyback Programs | Reduction in the total number of outstanding shares, potentially increasing the percentage owned by existing shareholders. | Ongoing |

As of early 2024, the major shareholders of Next plc are primarily institutional investors. According to data from February 29, 2024, BlackRock, Inc. is a significant shareholder, holding 5.03% of the company. Other key institutional holders include The Vanguard Group (3.08%), Norges Bank Investment Management (2.64%), and Capital Research Global Investors (2.49%). These holdings collectively wield substantial influence over the company's strategic direction. Understanding the Target Market of Next is also crucial in evaluating the company's performance.

Next plc's ownership structure is dominated by institutional investors, reflecting its status as a publicly traded company. The major shareholders include BlackRock, The Vanguard Group, and Norges Bank Investment Management. These large stakes influence Next's strategic decisions and financial performance.

- Institutional investors hold a significant portion of the shares.

- Share buyback programs impact shareholder percentages.

- The company's focus is on shareholder value and dividends.

- The ownership structure is dynamic and subject to market forces.

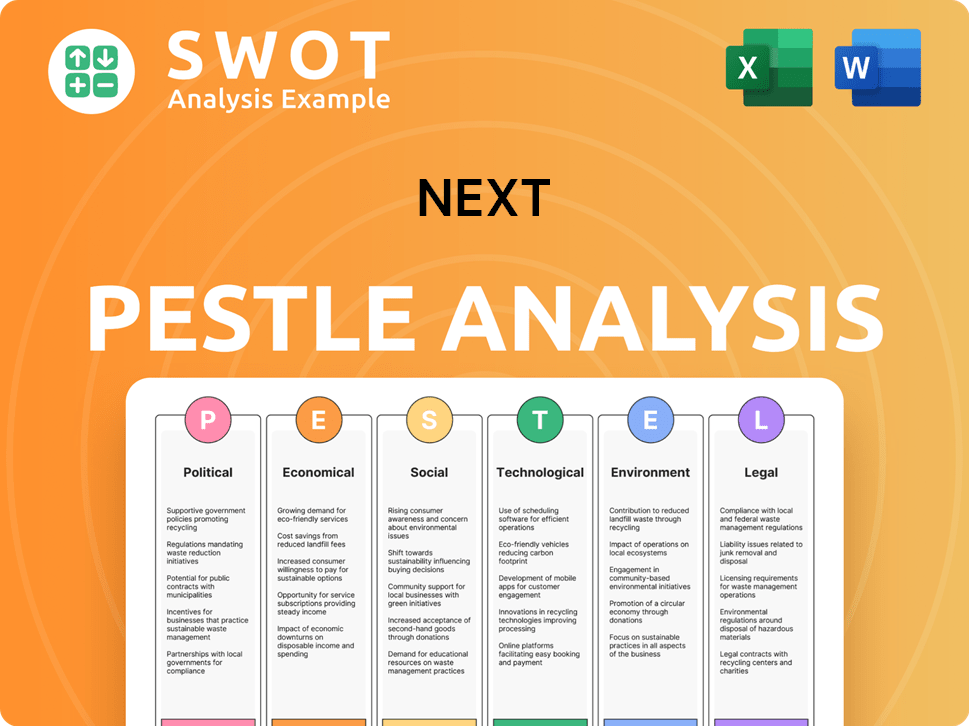

Next PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Next’s Board?

As of early 2025, the Board of Directors of Next plc is composed of individuals representing a blend of executive leadership, long-tenured members, and independent voices. This structure is designed to balance shareholder interests with strategic oversight. The current CEO, Lord Simon Wolfson, has been a key figure in the company's leadership for many years, significantly influencing the board's direction. The company's governance structure is designed to ensure a balance of power and accountability.

Specific shareholdings for individual board members are detailed in annual reports. Their primary influence often comes from their executive roles or independent oversight rather than outsized individual voting power through share ownership. The company operates under a one-share-one-vote structure for its ordinary shares, ensuring that all shareholders have equal voting rights. The board's focus is on long-term strategic initiatives, such as expanding its online presence and brand portfolio. The board's composition is designed to support the company's long-term growth and stability.

| Director | Role | Notes |

|---|---|---|

| Lord Simon Wolfson | CEO | Key figure in the company's leadership. |

| Michael Roney | Chairman | Oversees the board's activities. |

| Amanda James | Senior Independent Director | Provides independent oversight. |

There are no indications of dual-class shares or special voting rights that would grant disproportionate control to specific individuals or entities. Next has generally maintained a stable governance structure without significant public proxy battles or activist investor campaigns in recent years. This stability allows the board to focus on long-term strategic initiatives. The company's commitment to a stable governance structure is a key factor in its success.

The Board of Directors at Next plc includes key figures like the CEO and Chairman, ensuring strategic oversight. The company operates with a one-share-one-vote structure, promoting fair voting rights for all Next shareholders. This structure supports the company's long-term growth and stability.

- The board balances executive leadership with independent oversight.

- Shareholders have equal voting rights.

- The focus is on long-term strategic initiatives.

- Stable governance supports growth.

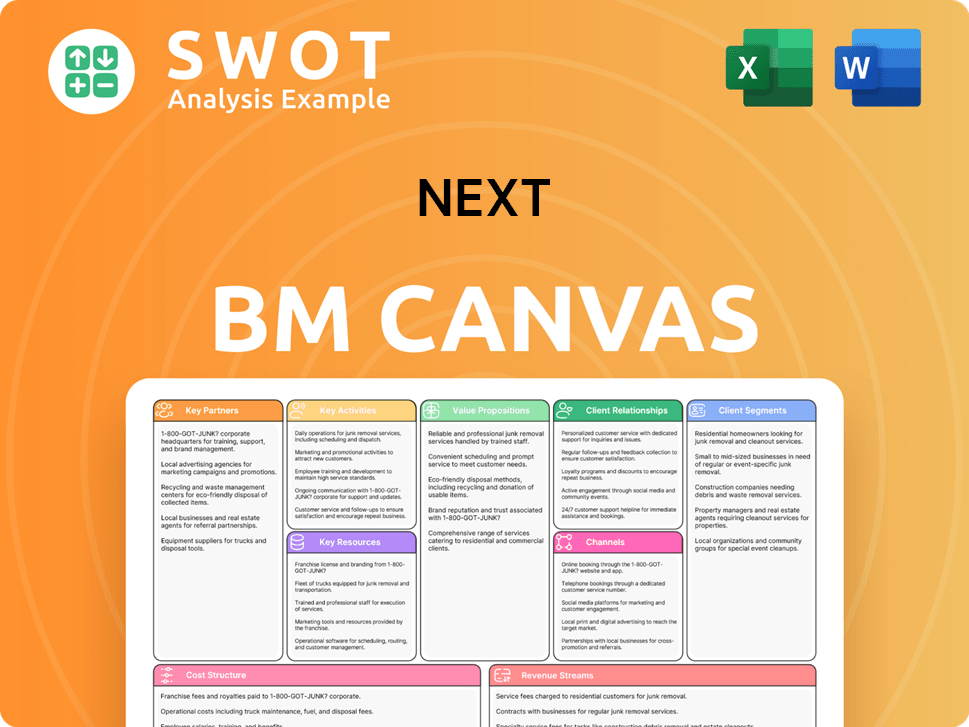

Next Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Next’s Ownership Landscape?

Over the past three to five years (2022-2025), the ownership structure of Next plc has shown interesting developments, mirroring broader trends in the retail sector. The company has actively engaged in share buyback programs, which can increase the proportional ownership of existing shareholders. For the 2024/2025 financial year, Next has announced intentions for share buybacks totaling approximately £200 million, signaling confidence in the company's valuation.

Next has strategically acquired stakes in other brands, such as Joules, which it fully acquired in early 2023, and a significant stake in Reiss. These acquisitions impact its overall corporate structure and capital allocation strategies, indicating a trend towards consolidation and diversification within its brand portfolio. The company's consistent performance and strategic acquisitions suggest a stable, yet evolving, ownership landscape driven by long-term growth objectives. To understand more about the company's origins, you can read the Brief History of Next.

| Metric | Details | Financial Year |

|---|---|---|

| Share Buybacks | Approximately £200 million | 2024/2025 |

| Acquisition of Joules | Full Acquisition | Early 2023 |

| Stake in Reiss | Significant stake acquired | Recent |

Industry trends, such as increased institutional ownership and the focus on ESG factors, continue to influence Next's investor base and corporate reporting. These factors play a crucial role in shaping the company's future strategies and investor relations.

Next plc's ownership structure reflects a mix of institutional and individual investors. The company's share buyback programs have the effect of increasing the ownership percentage of remaining shareholders. These buybacks are a key part of the company's strategy to return value to shareholders.

The company's strategic acquisitions, such as Joules and Reiss, have reshaped its brand portfolio. Institutional investors often hold a significant portion of shares in the company. ESG factors are becoming increasingly important in investment decisions, influencing the company's strategies.

Share buybacks reduce the number of outstanding shares, increasing earnings per share (EPS). This action can boost the stock price and enhance shareholder value. Next's buyback programs are a sign of financial health and confidence in the company.

Acquiring other brands can diversify the company's revenue streams and reduce risk. These acquisitions help Next expand its market presence and customer base. The full acquisition of Joules and investment in Reiss are examples of this strategy.

Next Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Next Company?

- What is Competitive Landscape of Next Company?

- What is Growth Strategy and Future Prospects of Next Company?

- How Does Next Company Work?

- What is Sales and Marketing Strategy of Next Company?

- What is Brief History of Next Company?

- What is Customer Demographics and Target Market of Next Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.