Samsara Bundle

How Does Samsara Revolutionize Industrial Operations?

Samsara is transforming how businesses operate, and its impact is undeniable. The company's innovative Samsara SWOT Analysis reveals a dynamic player in the Industrial Internet of Things (IIoT) sector. In Q1 2025, Samsara's impressive financial results, including a 37% year-over-year revenue surge, underscore its market dominance. Its connected operations cloud integrates IoT sensors, video, and AI, providing real-time visibility and actionable analytics.

With its focus on IoT solutions, Samsara is at the forefront of digital transformation, especially in fleet management and industrial operations. The Samsara platform empowers organizations to enhance safety, efficiency, and sustainability. Understanding how Samsara technology works, from its real-time GPS tracking features to its data analytics capabilities, is critical for anyone looking to understand the future of connected operations. Explore the benefits of using Samsara for fleet safety, and discover how Samsara's cloud-based platform explained is changing the game.

What Are the Key Operations Driving Samsara’s Success?

Samsara creates value through its Connected Operations Cloud, a unified platform that integrates IoT hardware, AI-powered software, and cloud-based analytics. The company's core offerings include vehicle telematics, video-based safety solutions, equipment monitoring, and site visibility. These solutions cater to various sectors that depend on physical operations, such as transportation, logistics, and construction.

The operational processes behind these offerings involve robust technology development, a strong supply chain for IoT devices, and extensive sales and customer service channels. The Samsara platform integrates data from its proprietary IoT devices with a growing ecosystem of connected assets and third-party systems. This data is processed and analyzed using AI to provide real-time insights, custom alerts, reports, and automated workflows.

The company's AI-first strategy and its ability to create a 'data moat' set Samsara apart. Its AI platform, trained on over 14 trillion data points, enables advanced analytics across all products, supporting features like predictive maintenance and carbon footprint tracking. This extensive data collection and analysis capability provides a significant competitive advantage, improving algorithmic accuracy and reinforcing customer lock-in.

Samsara offers a range of products and services designed to improve operational efficiency and safety. These include vehicle telematics for fleet management, video-based safety solutions with dash cams, equipment monitoring for asset tracking, and site visibility tools. These offerings are tailored to meet the needs of various industries.

Customers benefit from reduced safety incidents, lower fuel consumption, minimized downtime, and streamlined compliance. The platform provides real-time visibility into all aspects of a business's operations, enabling data-driven decisions. This leads to a clear return on investment, often measured in months.

Samsara's AI-first approach and extensive data collection create a significant competitive advantage. The AI platform, trained on vast datasets, enables advanced analytics and predictive capabilities. This data advantage improves algorithmic accuracy and strengthens customer relationships.

The platform provides real-time visibility into all aspects of a business's operations, allowing for data-driven decisions that optimize processes for maximum efficiency. This translates into customer benefits such as reduced safety incidents, lower fuel consumption, and streamlined compliance.

Samsara's platform offers a comprehensive suite of features designed to enhance operational efficiency and safety. These include real-time GPS tracking, dash cam video review, and data analytics capabilities for industrial operations. These features provide actionable insights, helping businesses optimize their processes and achieve significant cost savings.

- Real-time GPS tracking for accurate vehicle location.

- Dash cam video review for enhanced safety and incident analysis.

- Data analytics capabilities for predictive maintenance and fuel efficiency.

- Integration with existing systems for seamless data flow.

Samsara SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samsara Make Money?

The company's revenue model centers on subscription services, which constitute the vast majority of its income. This approach allows for scalable growth as clients adopt more products and integrate additional assets into the platform.

The monetization strategy is based on a 'per asset, per application' subscription model, enabling the company to organically increase revenue as customers expand their use of the platform. This model is key to the company's financial performance.

In fiscal year 2025, the company's total annual revenue reached $1.249 billion, reflecting a significant increase from the previous year. The company's Annual Recurring Revenue (ARR) reached $1.46 billion in Q4 FY25.

The primary revenue stream for the company is through subscription services. This model provides a predictable and recurring revenue base.

The company employs a 'per asset, per application' subscription model. This allows for scalable revenue growth as customers integrate more assets.

The company's total annual revenue was $1.249 billion in fiscal year 2025, with ARR reaching $1.46 billion in Q4 FY25. The company has shown strong improvements in profitability.

The company focuses on large enterprise customers, which drives significant growth. This segment is crucial for cross-selling and revenue expansion.

Non-GAAP operating margins turned positive at 2% in Q1 2025, and gross margins reached 77%. The company achieved positive adjusted free cash flow for the first time in Q4 2024.

The large enterprise customer segment (with $100K+ ARR) grew by 36% year-over-year to 2,506 customers in Q4 FY25. These customers account for a significant portion of the company's total ARR.

The company's focus on large enterprise customers is a key driver of its revenue growth. This segment, which includes customers with $100K+ ARR, grew by 36% year-over-year to 2,506 customers in Q4 FY25. This segment accounted for 53% of total ARR in Q1 2025. This concentration on high-value accounts encourages cross-selling, with 62% of large customers using three or more offerings in Q1 2025, up from 54% two years prior. The company also achieved positive adjusted free cash flow for the first time in Q4 2024.

The company's financial performance highlights its strong growth and improving profitability. The 'per asset, per application' subscription model supports scalable revenue, while the focus on large enterprise customers drives expansion.

- Total Annual Revenue in FY25: $1.249 billion

- ARR in Q4 FY25: $1.46 billion

- Non-GAAP Operating Margin in Q1 2025: Positive at 2%

- Gross Margin: 77%

- Large Enterprise Customer Growth (YoY): 36%

Samsara PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Samsara’s Business Model?

Let's explore the key milestones, strategic moves, and competitive advantages of the company. This analysis will delve into how the company has established itself in the connected operations space. We'll examine its financial performance, product innovations, and strategic partnerships that have shaped its trajectory.

The company's journey is marked by significant achievements and strategic decisions. From surpassing major revenue targets to expanding its product offerings, the company continues to evolve. Understanding these elements is crucial for assessing its market position and future prospects.

The company's approach combines technological innovation with strategic market positioning. It is a leader in the industrial IoT sector. The following sections will provide a detailed look at these aspects.

The company achieved a significant milestone by exceeding $1 billion in Annual Recurring Revenue (ARR) in fiscal year 2024, demonstrating strong financial growth. The company also reported its first year of positive adjusted free cash flow in FY2024. The company's growth is further highlighted by a 49% year-over-year increase in customers spending over $100k annually in FY2024.

Strategic moves include continuous product innovation, especially in AI-driven solutions. New product launches in 2024 and 2025, such as Connected Workflows, Intelligent Safety Inbox, and Asset Tags, showcase the company's commitment to expanding its 'connected operations' stack. A partnership with Stellantis, announced in January 2025, expands its reach.

The company's competitive advantages lie in its AI-first strategy and proprietary data. Its AI platform, trained on a vast 14 trillion data points, allows for advanced analytics integration. The company's comprehensive platform offers user-friendly interfaces and customizable solutions. The company's significant R&D investment, exceeding $1 billion over the past five years, has built a moat of proprietary technology.

Operational challenges include macroeconomic volatility impacting enterprise spending and potential competition from big tech companies. The company has responded by focusing on its enterprise clients, who are less sensitive to downturns, and leveraging its first-mover advantage in AI-driven industrial IoT.

The company's success is driven by its commitment to innovation and strategic partnerships. Its focus on AI and data analytics provides a strong foundation for future growth. For more insights into the company's target market, consider reading about the Target Market of Samsara.

The company's platform offers a range of features designed to enhance fleet management and industrial operations. These features include real-time GPS tracking, advanced data analytics, and comprehensive safety solutions. The company's commitment to innovation is evident in its continuous product development.

- Real-time GPS Tracking: Provides precise location data for vehicles and assets.

- AI-Driven Analytics: Offers predictive insights and automates tasks.

- Connected Workflows: Streamlines operations and improves efficiency.

- ELD Compliance: Ensures adherence to regulatory requirements.

Samsara Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Samsara Positioning Itself for Continued Success?

Samsara holds a strong position in the Industrial Internet of Things (IIoT) market, particularly in connected operations. Its focus on vehicle telematics, asset tracking, and operational safety has allowed it to gain a significant share in a large addressable market, estimated at $454.9 billion. The company's customer loyalty is high, with a net revenue retention rate of 120% for large customers and 115% for core customers in Q4 FY25. Its global reach includes North America and Europe, serving tens of thousands of organizations.

Despite its strong market position, Samsara faces several challenges. Macroeconomic volatility, competition from tech giants and telematics providers, cybersecurity threats, and evolving regulatory requirements are ongoing concerns. Additionally, currency headwinds can affect financial performance. However, Samsara is committed to sustained growth and profitability, with strategic initiatives focused on AI, enterprise expansion, and margin optimization.

Samsara is a leading player in the IIoT market, specializing in connected operations. The company benefits from strong customer loyalty, with impressive net revenue retention rates. Its global presence spans North America and Europe, serving a large customer base.

Samsara faces risks from macroeconomic volatility, competition, and cybersecurity threats. Currency headwinds can also impact financial results. The potential disruption from autonomous vehicles is a long-term consideration.

Samsara anticipates continued growth and profitability, with revenue projections of $350 million to $352 million for Q1 FY26. The company plans to host an Investor Day in June 2025 to highlight its product roadmap and long-term growth drivers. Samsara is focused on leveraging its AI-powered platform to deliver ROI to customers. For more insights, check out the Marketing Strategy of Samsara.

For the full fiscal year 2026, revenue is forecast to be between $1.523 billion and $1.533 billion, reflecting continued growth of 22-23% year-over-year. Samsara aims to sustain its ability to make money by continuing to leverage its AI-powered platform to deliver measurable ROI to customers through improved safety, efficiency, and sustainability.

Samsara is focused on several key initiatives to drive future growth and profitability. These include strategic investments in AI, expansion into new enterprise markets, and optimizing operational margins. By focusing on these areas, Samsara aims to maintain its competitive edge and deliver value to its customers.

- Continued investment in AI to enhance product capabilities.

- Expansion into new enterprise markets to broaden its customer base.

- Margin optimization to improve profitability and financial performance.

- Focus on delivering measurable ROI to customers.

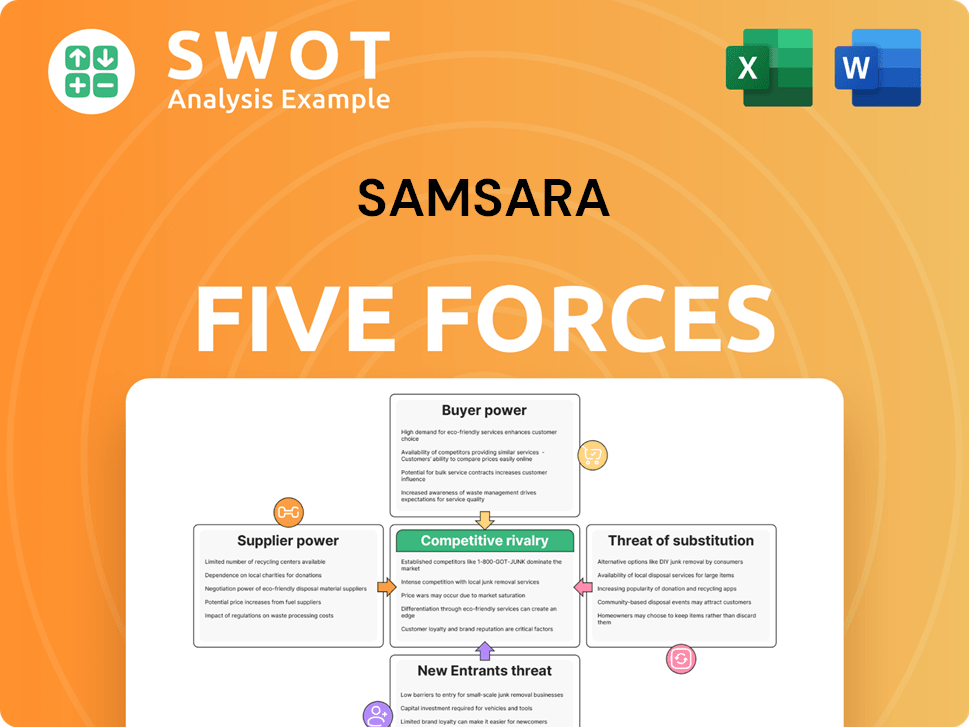

Samsara Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsara Company?

- What is Competitive Landscape of Samsara Company?

- What is Growth Strategy and Future Prospects of Samsara Company?

- What is Sales and Marketing Strategy of Samsara Company?

- What is Brief History of Samsara Company?

- Who Owns Samsara Company?

- What is Customer Demographics and Target Market of Samsara Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.