Solo Brands Bundle

Can Solo Brands Navigate the Changing Outdoor Market?

Solo Brands, a prominent player in the outdoor lifestyle market, captivates consumers with its innovative products, from fire pits to coolers. This direct-to-consumer (DTC) powerhouse, encompassing brands like Solo Stove and Chubbies, has built a strong reputation for fostering outdoor experiences. However, recent financial challenges have raised questions about its future.

To truly understand the trajectory of Solo Brands SWOT Analysis, we must dissect its operational model. The company's financial performance, including its Solo Brands revenue streams and strategic shifts, paints a complex picture. This analysis will explore the Solo Brands business model, providing critical insights into its current standing and future prospects, especially concerning the performance of Solo Stove.

What Are the Key Operations Driving Solo Brands’s Success?

Solo Brands creates value by developing and acquiring outdoor lifestyle brands. Its core focus is on building authentic experiences and fostering community engagement around its products. The company's diverse product range includes fire pits, camp stoves, and accessories under the Solo Stove and TerraFlame brands, along with premium casual apparel and activewear from Chubbies, inflatable and hard paddle boards from ISLE, and origami folding kayaks from Oru Kayak. These products cater to various customer segments seeking high-quality and innovative solutions for their outdoor and lifestyle needs.

The company operates primarily through a digitally-native, direct-to-consumer (DTC) strategy. This approach, which accounted for 70.2% of its sales in 2024, involves in-house management of its global supply chain, fulfillment, research and development, sales and marketing, and customer service. This integrated model aims to provide an authentic end-to-end customer experience, expedite delivery, and achieve cost efficiencies. Solo Brands also utilizes wholesale partnerships with key retailers and operates retail stores, including twelve Chubbies locations and one ISLE surf pro-shop, with plans for further expansion.

A key aspect of Solo Brands' operations is its 'plug and play' digital DTC platform. This platform supports the acquisition and integration of new outdoor brands that align with its values. This infrastructure, initially developed by Solo Stove since its founding in 2011, facilitates efficient product development based on real-time customer feedback gathered through its DTC and wholesale channels. This strong customer connection is designed to drive favorable returns on marketing spend and position the company for future growth, creating a 'flywheel effect' of expansion, scalability, and free cash flow generation. Furthermore, the company is implementing cost reduction initiatives, including tariff-related manufacturing diversification and contingency plans, to enhance efficiency. To understand more about how the company approaches its digital presence, you can read about the Marketing Strategy of Solo Brands.

The Solo Brands business model centers on a direct-to-consumer (DTC) approach, complemented by wholesale partnerships. This strategy allows for direct customer engagement and feedback, which informs product development and marketing efforts. The company's focus on acquiring and integrating brands with strong community ties enhances its market presence.

Solo Brands offers a diverse range of outdoor and lifestyle products. These include fire pits, camp stoves, apparel, paddle boards, and kayaks. This varied product portfolio caters to a broad customer base seeking high-quality and innovative solutions for outdoor activities and casual living.

The direct-to-consumer (DTC) strategy is a cornerstone of Solo Brands' operations. This approach allows the company to control the entire customer experience, from product development to delivery and customer service. The DTC model accounted for 70.2% of sales in 2024.

While Solo Stove is a prominent brand, Solo Brands' portfolio extends beyond fire pits and camp stoves. The company has expanded to include apparel, paddle boards, and kayaks. This diversification allows Solo Brands to capture a larger share of the outdoor and lifestyle market.

Solo Brands' operations are characterized by a vertically integrated DTC model and a focus on brand acquisition. This approach allows for greater control over the customer experience and the ability to efficiently integrate new brands. The company's emphasis on community building and authentic experiences enhances its brand value.

- Direct-to-consumer (DTC) sales accounted for 70.2% of total sales in 2024.

- The company manages its global supply chain, fulfillment, and customer service in-house.

- The 'plug and play' digital platform facilitates the acquisition and integration of new brands.

- Cost reduction initiatives include tariff-related manufacturing diversification.

Solo Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Solo Brands Make Money?

The revenue streams and monetization strategies of Solo Brands are primarily centered around the sale of its outdoor lifestyle products. The company leverages a direct-to-consumer (DTC) approach, complemented by wholesale partnerships and physical retail locations. This multi-channel strategy allows Solo Brands to reach a broad customer base and optimize its sales channels.

Solo Brands' business model is heavily reliant on its e-commerce platform, which accounted for a significant portion of its revenue. The company also focuses on expanding its reach through strategic retail partnerships. These strategies are designed to enhance customer engagement and drive revenue growth.

In the fiscal year 2024, Solo Brands reported total net sales of $454.6 million. The DTC channel represented a substantial part of this, contributing to 70.2% of total sales. The company's financial performance reflects the impact of its strategic initiatives and market dynamics.

The Solo Stove segment experienced a decline in net sales in 2024, influenced by a lack of new product launches and strategic shifts in promotional activities. However, the Chubbies segment showed an increase in net sales, driven by growth in both retail partnerships and direct-to-consumer demand. The company's performance is significantly impacted by the success of its different product lines and sales channels.

- For the first quarter of 2025, Solo Brands' net sales were $77.3 million, a 9.5% decline year-over-year.

- The Solo Stove segment's net sales declined by 49.2% to $26.1 million in Q1 2025.

- In contrast, the Chubbies segment's net sales increased by 43.9% to $42.7 million in Q1 2025.

- The company's net sales are primarily concentrated in the United States, with a growing international presence in Europe, Canada, and Australia.

Solo Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Solo Brands’s Business Model?

The evolution of Solo Brands is marked by significant milestones, strategic shifts, and a focus on cultivating a robust direct-to-consumer (DTC) business model. A key moment was the introduction of Solo Stove's innovative fire pits in 2016, which not only established a new product category but also fostered a strong customer community. This success fueled expansion and acquisitions, leading to the formation of Solo Brands, Inc. and the diversification of its brand portfolio.

In recent years, Solo Brands has navigated operational and market challenges. In 2024, the company faced a decline in net sales, experiencing an 8.1% decrease to $454.6 million. This downturn, coupled with strategic changes like reduced promotional discounting, resulted in a net loss of $113.4 million. In response, Solo Brands implemented cost-saving measures and leadership transitions to adapt to the changing market dynamics.

Solo Brands' strategic moves include streamlining operations and adapting to market conditions. The company's focus on product innovation, with five new products planned for the Solo Stove segment in 2024, and efforts to refine marketing and pricing strategies, reflect its commitment to long-term growth. The company's ability to acquire and integrate outdoor brands, as well as its direct-to-consumer approach, contributes to its competitive edge.

The launch of Solo Stove's fire pits in 2016 was a pivotal moment, creating a new product category. The acquisition of Oru Kayak, ISLE Paddle Boards, and Chubbies in 2021 expanded the brand portfolio. The company's DTC model and community-building efforts have been central to its growth.

In 2024, Solo Brands terminated underperforming marketing agreements and reorganized units to reduce costs. Leadership changes, including the appointment of an Interim President and CEO, reflect strategic adjustments. The company is focusing on product innovation and refining marketing strategies.

Solo Brands benefits from a strong DTC model and loyal customer communities. The company's leadership in premium market segments and efficient DTC operations provide a competitive advantage. Recognition as No. 2 in the Consumer Goods category on Fast Company's 2024 list of the World's Most Innovative Companies highlights its commitment to innovation.

In 2024, Solo Brands reported a net sales decrease of 8.1% to $454.6 million. The company experienced a net loss of $113.4 million. These results prompted strategic adjustments and a focus on improving financial performance.

Solo Brands' success is rooted in its innovative products and direct connection with its customers. The company's ability to adapt to market changes and its focus on innovation are critical for future growth. Understanding the Competitors Landscape of Solo Brands can provide additional insights into the company's position.

- Solo Stove's fire pits established a new product category.

- The company's DTC model fosters strong customer relationships.

- Strategic adjustments are underway to address financial challenges.

- Innovation and brand diversification are key competitive strengths.

Solo Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Solo Brands Positioning Itself for Continued Success?

The company, operating under the name, holds a significant position in the outdoor lifestyle market. It manages a portfolio of brands, including Solo Stove, Chubbies, ISLE, Oru Kayak, and TerraFlame. Despite strong brand recognition and loyal customer bases, the company's market share and financial performance have faced challenges.

In 2024, faced a net loss of $$113.4 million and an accumulated deficit of $$228.8 million, raising substantial doubt about its ability to continue as a going concern. Its stock price also experienced a significant decline, leading to a delisting notice from the NYSE in February 2025.

The company operates within the outdoor lifestyle market, managing several brands. While the company has built strong brand recognition, its market share and financial performance have encountered headwinds. The company's financial health has raised concerns about its ability to sustain operations.

Key risks include a challenging financial condition and liquidity concerns. The company faces operational risks related to strategic plans and restructuring. Economic uncertainties, changing consumer spending, and market competition also pose risks. The company's reliance on cash flow and debt refinancing are significant concerns.

The company is focused on stabilizing and transforming its business through strategic initiatives. It aims to address its debt structure and implement cost-reduction strategies. Management is working on improving marketing, pricing, and product innovation. The company plans to improve liquidity and operational performance.

The company is addressing its debt structure and implementing cost-reduction initiatives, including tariff-related manufacturing diversification. Management is working on improving marketing effectiveness, building pricing strategies, and fostering product innovation. It aims to improve liquidity and operational performance.

The company faces financial and operational risks that require strategic responses. The company is focused on improving its financial flexibility by addressing its debt structure and implementing cost-reduction measures. Management is prioritizing marketing, pricing strategies, and product innovation to enhance performance.

- Addressing existing debt structure to enhance financial flexibility.

- Implementing cost reduction initiatives, including tariff-related manufacturing diversification.

- Improving marketing effectiveness and building pricing strategies.

- Fostering a culture of product innovation, with new products planned for the Solo Stove segment.

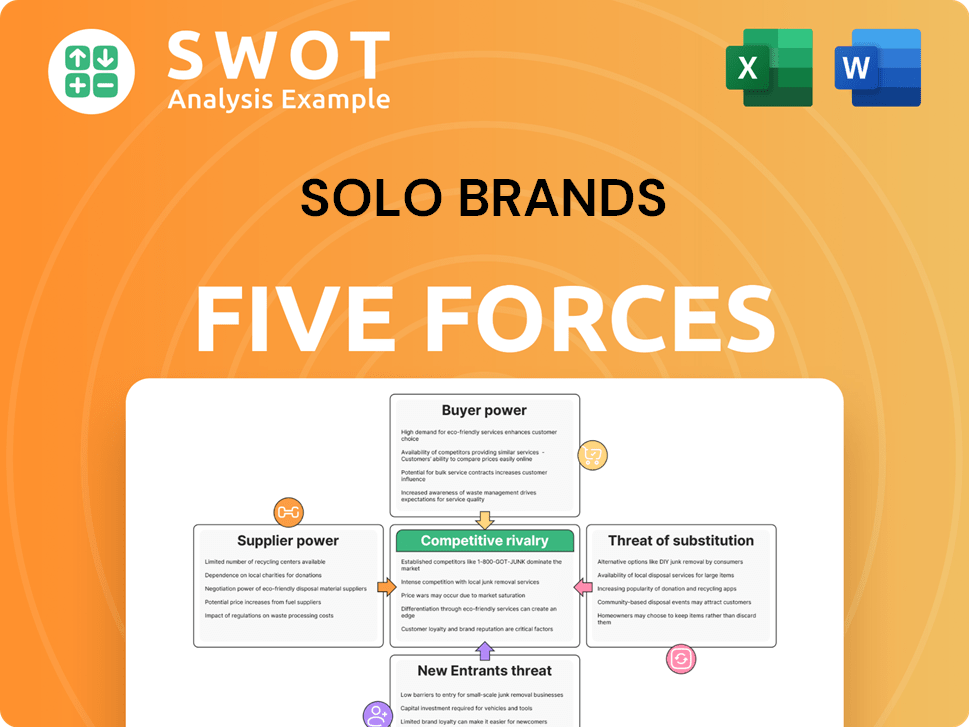

Solo Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Solo Brands Company?

- What is Competitive Landscape of Solo Brands Company?

- What is Growth Strategy and Future Prospects of Solo Brands Company?

- What is Sales and Marketing Strategy of Solo Brands Company?

- What is Brief History of Solo Brands Company?

- Who Owns Solo Brands Company?

- What is Customer Demographics and Target Market of Solo Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.