Synthomer Bundle

Unveiling Synthomer: How Does This Chemical Giant Operate?

In a world driven by innovation, Synthomer, a leading specialty chemicals company, plays a crucial role in shaping everyday products. From enhancing the durability of your home's paint to improving the performance of medical adhesives, Synthomer's Synthomer SWOT Analysis is key to understanding its strategic position. Its influence spans across critical sectors, making it a pivotal player in the global chemicals market.

This exploration into the Synthomer company will uncover the intricate workings behind its success, providing insights into its Synthomer operations and strategic focus. We'll examine how Synthomer manufactures its diverse range of Synthomer products, its global presence, and its impact on the chemical industry. Whether you're considering Synthomer stock or simply curious about the industry, this article offers a comprehensive overview.

What Are the Key Operations Driving Synthomer’s Success?

The Synthomer company creates value by producing and delivering a wide range of polymers. These polymers are essential for many industries. They are used in products like paints, construction materials, adhesives, and healthcare items.

Synthomer's core operations involve research and development, sourcing raw materials, manufacturing, quality control, and global distribution. The company focuses on innovation and sustainability. Its manufacturing facilities are located worldwide to ensure efficient production and delivery.

The company's strength lies in its ability to provide customized solutions and technical support. This collaborative approach, combined with its global presence and extensive product range, offers significant benefits to customers. These include better product performance, improved sustainability, and reliable supply, setting Synthomer apart in the specialty chemicals market.

Synthomer products include latices, dispersions, and specialty polymers. These are used in coatings, construction, adhesives, textiles, paper, and healthcare. The company serves manufacturers of paints, sealants, flooring, nonwovens, and medical gloves.

Synthomer operations are highly integrated, from R&D to global logistics. The company has R&D centers focused on new polymer technologies. Manufacturing facilities are strategically located across continents. The supply chain uses long-term relationships with suppliers.

Synthomer focuses on customized solutions and technical support. This collaborative approach helps co-develop products with customers. The global manufacturing footprint and extensive product portfolio lead to customer benefits. These include improved product performance and reliable supply.

The company provides improved product performance and enhanced sustainability. It ensures a reliable supply. This approach differentiates Synthomer in the specialty chemicals market. Learn more about the Marketing Strategy of Synthomer.

Synthomer's success is built on its strong focus on customized solutions and technical support. Its global manufacturing footprint and extensive product portfolio are also key. This helps the company meet diverse customer needs.

- Customized solutions and technical support.

- Global manufacturing presence.

- Extensive product portfolio.

- Focus on sustainability and innovation.

Synthomer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Synthomer Make Money?

The Synthomer company generates revenue primarily through the sale of its specialty polymer products. These products are essential for various industries, contributing to the company's financial performance. Understanding the revenue streams and monetization strategies of Synthomer is key to assessing its business model and market position.

The company's revenue is diversified across several key end-markets, including coatings, construction, adhesives, textiles, paper, and healthcare. This diversification helps to mitigate risks associated with fluctuations in any single sector. For instance, in its 2023 full-year results, Synthomer reported a group revenue of £2.0 billion.

The monetization strategies of Synthomer are largely driven by its value-added product offerings and technical expertise. The company often engages in direct sales to large industrial customers, providing customized polymer solutions that address specific performance requirements. Pricing strategies are typically based on the value proposition of its specialized products, often reflecting the superior performance, sustainability benefits, or unique functionalities they provide.

The main revenue stream for Synthomer comes from selling its specialized polymer products to various industries. The company focuses on providing high-value solutions and technical expertise to its customers. The company's global presence and strategic acquisitions also play a significant role in its revenue generation.

- Product Sales: The primary source of revenue is the sale of specialty polymer products.

- Direct Sales: Engaging directly with industrial customers to provide customized solutions.

- Value-Based Pricing: Pricing products based on their superior performance and benefits.

- R&D Contribution: Extensive research and development enable the creation of higher-value products.

- Global Presence: Regional diversification of revenue, catering to specific market demands.

Synthomer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Synthomer’s Business Model?

The evolution of the Synthomer company, marked by strategic acquisitions and a focus on innovation, has been pivotal in shaping its operational and financial trajectory. A key move was the 2020 acquisition of the Performance Adhesives and Functional Polymers business from Eastman Chemical Company. This expanded its footprint and diversified its product portfolio, particularly in high-growth segments. The company's consistent investment in research and development has led to new products and technologies, aligning with industry demands, especially in sustainable solutions.

Operational challenges, including volatile raw material costs and supply chain disruptions, have been addressed through optimized manufacturing processes and cost control measures. In its 2023 full-year results, the company highlighted actions taken to improve operational efficiency and manage costs in a challenging macro environment. Synthomer's competitive advantages are rooted in its strong brand reputation, technological leadership in advanced polymer formulations, economies of scale from its global manufacturing footprint, and deep customer relationships.

The company's strategic initiatives, such as portfolio optimization and a focus on specialty markets, demonstrate its commitment to adapting to competitive threats and maintaining its market position. The company continues to adapt to new trends, such as the increasing demand for sustainable and bio-based materials, and technological shifts by investing in R&D and strategically aligning its product development with these emerging opportunities. To learn more about the company's growth strategy, consider reading Growth Strategy of Synthomer.

The acquisition of the Performance Adhesives and Functional Polymers business from Eastman Chemical Company in 2020 was a significant milestone. This expanded the company's presence in the adhesives and specialty polymers markets. Consistent investment in R&D has led to new products and technologies.

The company has focused on portfolio optimization and expanding into specialty markets. It has implemented cost control measures and strengthened supply chain resilience. Investing in R&D aligns product development with emerging opportunities.

A strong brand reputation and technological leadership in advanced polymer formulations are key advantages. Economies of scale from its global manufacturing footprint enable competitive pricing. Deep customer relationships and a collaborative approach foster strong loyalty.

In 2023, Synthomer focused on improving operational efficiency and managing costs. The company continues to adapt to the increasing demand for sustainable and bio-based materials. Strategic initiatives aim to maintain market position amid competitive threats.

In 2023, Synthomer reported challenges in a difficult macro environment, focusing on cost management and operational efficiency. The company's strategic moves, including portfolio optimization and a focus on specialty markets, are designed to maintain its market position.

- The company's strong brand reputation provides a significant edge.

- Technological leadership in advanced polymer formulations and sustainable solutions.

- Economies of scale from its global manufacturing footprint.

- Deep customer relationships and collaborative product development.

Synthomer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Synthomer Positioning Itself for Continued Success?

The Synthomer company holds a strong position within the specialty chemicals sector, particularly in emulsion polymers. The company's global footprint, with manufacturing and sales operations spanning Europe, North America, and Asia, allows it to serve a diverse international customer base. Synthomer's reputation for quality and innovation supports significant customer loyalty. This article aims to analyze the Synthomer business, its industry position, the associated risks, and the future outlook.

Several factors could impact Synthomer's operations, including fluctuations in raw material prices, which directly affect production costs and profitability. Regulatory changes, especially those related to environmental and health standards, might necessitate costly adjustments to manufacturing processes. Competition and technological disruptions could erode market share, necessitating further R&D investments. Global economic downturns and geopolitical instability can impact demand across end-markets.

Synthomer is a key player in the specialty chemicals industry. Its global presence and diverse product range help it serve various sectors. The company's focus on innovation and sustainability strengthens its market position.

Synthomer faces risks such as raw material price volatility. Regulatory changes and competition also pose challenges. Economic downturns and geopolitical issues can impact demand.

Synthomer focuses on portfolio optimization and innovation. Strategic moves, like the 2024 sale of its interest in the Viscose partnership, highlight its commitment to these goals. The company plans to capitalize on growing demand for advanced materials.

Synthomer's strategic initiatives include portfolio optimization and sustainable solutions. The company invests in R&D and operational efficiency. These efforts aim to deliver long-term value to shareholders.

Synthomer's future outlook involves leveraging technological expertise and global presence to meet the increasing demand for advanced materials. The company is focused on innovation, operational excellence, and strategic portfolio management, aiming to deliver long-term value to its shareholders and customers. For a broader understanding of the competitive landscape, consider exploring the Competitors Landscape of Synthomer.

Synthomer is focused on strategic initiatives to optimize its portfolio and drive innovation. The company aims to strengthen its position in higher-growth markets, as seen with the sale of its interest in the Viscose partnership in early 2024. Leadership is emphasizing continued investment in research and development to bring new, high-performance, and environmentally friendly polymer solutions to market.

- Focus on high-growth, specialized markets.

- Investment in research and development for advanced materials.

- Portfolio optimization through strategic divestitures.

- Emphasis on sustainable solutions.

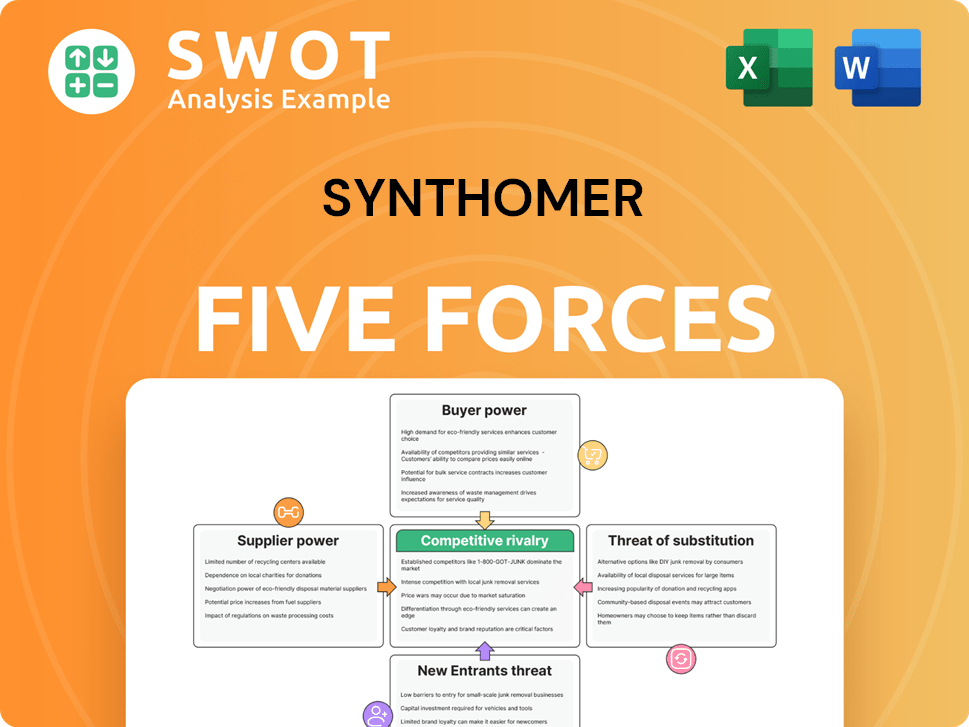

Synthomer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synthomer Company?

- What is Competitive Landscape of Synthomer Company?

- What is Growth Strategy and Future Prospects of Synthomer Company?

- What is Sales and Marketing Strategy of Synthomer Company?

- What is Brief History of Synthomer Company?

- Who Owns Synthomer Company?

- What is Customer Demographics and Target Market of Synthomer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.