Tesco Bundle

How Does Tesco Thrive in the Retail Jungle?

Tesco, a retail behemoth with roots dating back to 1919, isn't just a grocery store; it's a complex ecosystem of supermarkets, online platforms, and financial services. Its enduring success in the UK and beyond begs the question: How does Tesco SWOT Analysis contribute to its sustained market leadership? Understanding the inner workings of Tesco is essential for anyone looking to navigate the ever-changing landscape of the retail industry.

This exploration into the Tesco business model will dissect its intricate operations, diverse revenue streams, and the strategic decisions that have shaped its trajectory. From its impressive market share in the UK to its global expansion efforts, we'll uncover the secrets behind Tesco's resilience and adaptability. Whether you're interested in Tesco's supply chain management, its financial performance, or its customer service reviews, this analysis provides a comprehensive overview of how this retail giant continues to evolve and compete.

What Are the Key Operations Driving Tesco’s Success?

The core operations of Tesco revolve around its extensive retail network, offering a wide array of products to diverse customer segments. This includes everything from groceries to clothing, all designed to meet the needs of individual shoppers and families alike. Its operational framework is built on sophisticated sourcing, efficient logistics, and multiple sales channels, ensuring a seamless shopping experience.

The value proposition of Tesco is centered on providing customers with convenience, variety, competitive pricing, and accessibility. This is achieved through a combination of physical stores and a robust online platform. Tesco's integrated approach, combining a vast physical presence with a strong digital offering, is supported by strong supplier relationships and a customer-centric service model.

Tesco's operational uniqueness lies in its ability to integrate a vast physical footprint with a robust digital offering, supported by strong supplier relationships and a customer-centric service model. This comprehensive framework translates into customer benefits such as convenience, variety, competitive pricing, and accessibility, differentiating Tesco in the crowded retail landscape.

Tesco sources products globally, leveraging its scale to secure competitive pricing and ensure product availability. The supply chain involves distribution centers and transportation networks for timely delivery to stores. Effective supply chain management is crucial for maintaining profitability and meeting customer demand.

Tesco operates various physical retail formats, including hypermarkets, supermarkets, and convenience stores, catering to different shopping missions. The online grocery platform provides home delivery and click-and-collect services. This multi-channel approach enhances customer convenience and accessibility.

Tesco emphasizes customer satisfaction through its service model and product offerings. The company focuses on understanding customer needs and preferences to tailor its services. This customer-centric approach is key to maintaining loyalty and attracting new shoppers.

Tesco's online platform is a significant part of its operations, providing convenience for customers. This includes online shopping with home delivery or click-and-collect. Digital integration allows Tesco to reach a broader customer base and adapt to evolving consumer behaviors.

Tesco's strategy focuses on delivering value through its integrated retail model. The company continues to invest in its supply chain and digital capabilities to enhance efficiency and customer experience. These investments are crucial for maintaining its market position.

- Tesco's market share in the UK grocery market was approximately 27% in early 2024.

- Online sales continue to grow, with digital channels playing a vital role in the company's overall revenue.

- Tesco's focus on private-label brands provides competitive pricing and higher profit margins.

- The company is committed to sustainability initiatives, reducing its environmental impact.

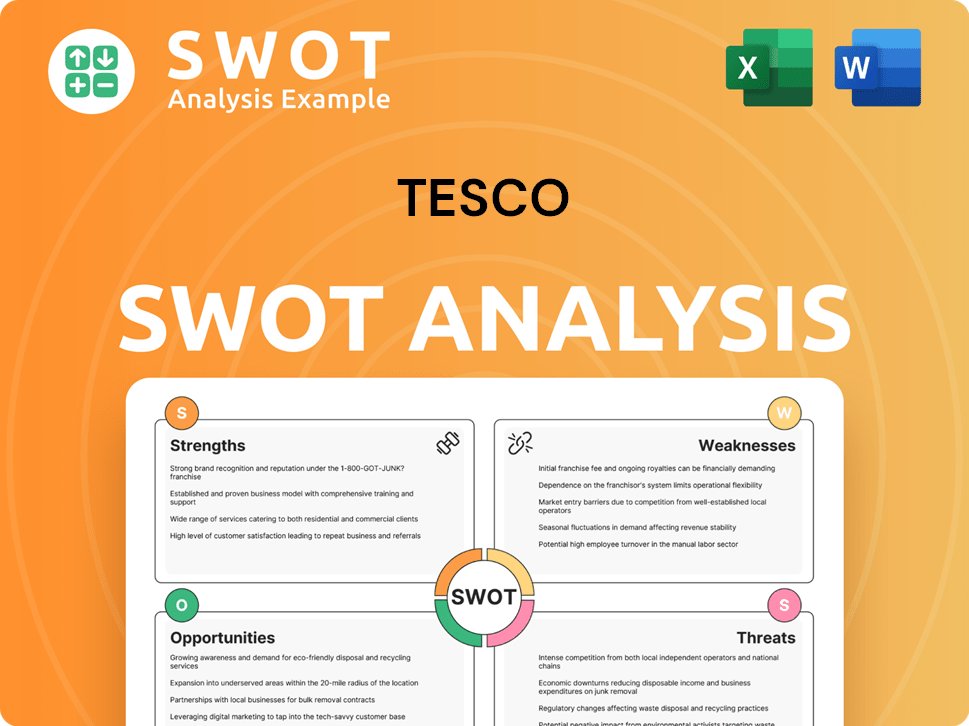

Tesco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tesco Make Money?

Understanding the revenue streams and monetization strategies of Tesco is crucial for grasping its overall business model. The company's financial success hinges on a multifaceted approach that extends beyond simple product sales. This involves a combination of direct sales, digital platforms, financial services, and loyalty programs, all contributing to its robust financial performance.

The core of

In the financial year ending February 2024,

Several key strategies and revenue streams contribute to

- Product Sales: The primary revenue source comes from selling groceries, clothing, and general merchandise across various retail formats.

-

Online Grocery Platforms:

monetizes its online grocery platforms through delivery fees and subscription models like 'Delivery Saver'. -

Financial Services:

Bank offers financial products such as credit cards, loans, and insurance, adding to the revenue streams. - Loyalty Programs: The Clubcard program drives customer retention and provides valuable data for targeted marketing, indirectly boosting sales.

- In-Store Advertising: Opportunities for suppliers to advertise in-store.

- Data Insights and Partnerships: Leveraging customer data for insights and partnerships.

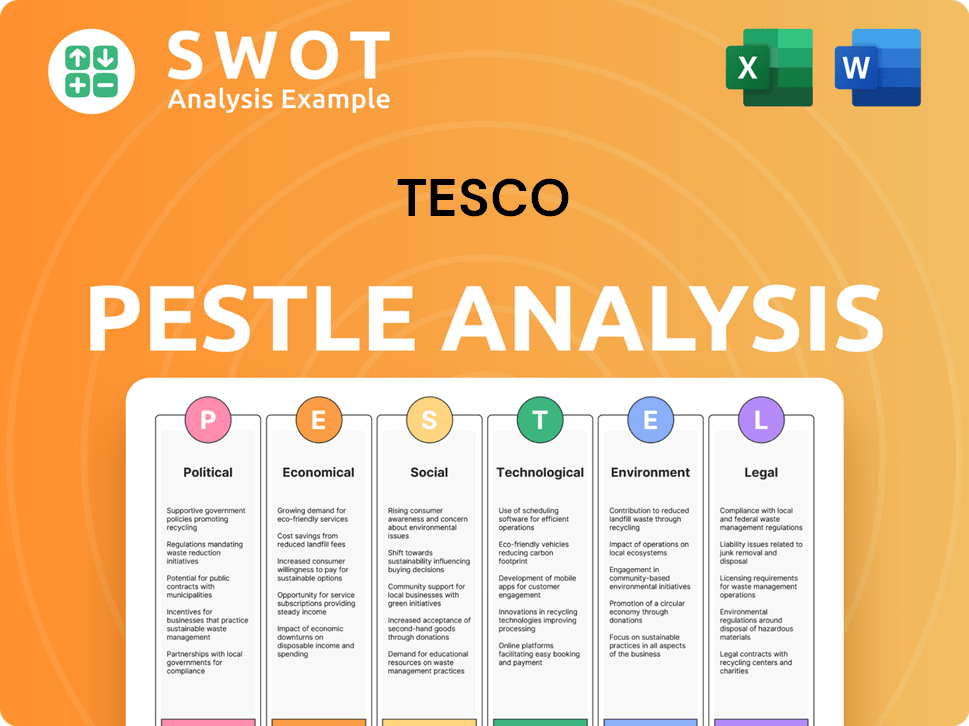

Tesco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tesco’s Business Model?

Understanding how the company operates involves examining its key milestones, strategic moves, and competitive advantages. The company has a long history, marked by significant developments and strategic decisions. These elements have shaped its current position in the retail market. The company's ability to adapt and innovate has been crucial to its ongoing success.

A crucial strategic move was the expansion into online grocery retailing. This became increasingly important, especially during the surge in e-commerce during the pandemic. The company has also divested from non-core assets to focus on its primary retail operations. Navigating supply chain disruptions and adapting to inflationary pressures have been key operational challenges. The company responded by investing in supply chain resilience and focusing on value propositions for customers. To better understand the competitive environment, take a look at the Competitors Landscape of Tesco.

The company's competitive advantages are multifaceted. Its brand strength, built over a century, fosters customer loyalty. Economies of scale, stemming from its vast purchasing power and extensive store network, allow for competitive pricing and efficient operations. The Clubcard loyalty program provides a powerful ecosystem effect, gathering valuable customer data. The company continues to adapt to new trends, such as the growing demand for sustainable products and plant-based options, and invests in technology to enhance its online platforms and in-store experiences.

The company has a rich history, with initial growth in the UK. Expansion into international markets marked a significant phase. Adapting to changing consumer behaviors and technological advancements has been ongoing.

Aggressive expansion into online grocery, especially during the pandemic. Divestment from non-core assets to concentrate on core retail operations. Investment in supply chain resilience and value propositions to counter inflation.

Strong brand reputation and customer loyalty built over decades. Economies of scale due to its vast network and purchasing power. The Clubcard loyalty program provides valuable customer data and personalized offers.

Continued investment in online platforms and in-store technology. Focus on sustainability initiatives and plant-based options. Adapting to changing consumer preferences and market dynamics.

In the fiscal year 2024, the company reported a group revenue of £68.1 billion. The company has a significant market share in the UK grocery market, estimated at around 27% as of early 2024. Online sales remain a significant part of the business, with continued growth in the online grocery segment.

- The company's operating profit for the fiscal year 2024 was £2.76 billion, reflecting its operational efficiency.

- The Clubcard program has over 20 million active members, driving customer engagement and data collection.

- The company's supply chain includes over 1,500 stores and distribution centers.

- The company has been actively reducing its carbon footprint, with sustainability initiatives across its operations.

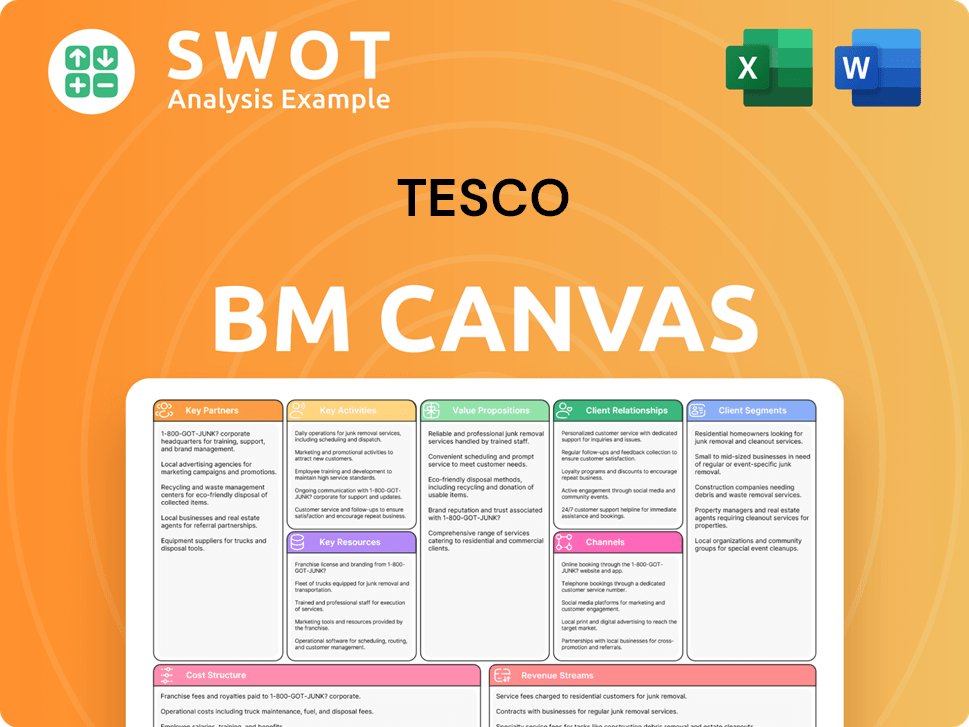

Tesco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tesco Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of Tesco is crucial for anyone looking into the company's performance. The company has a strong foothold in the UK grocery market, maintaining a significant market share despite competition. Its customer loyalty program and extensive store network support its dominant position. Globally, while focused on the UK and Ireland, it also has a presence in Central Europe.

The future for Tesco involves navigating various challenges and opportunities. The company faces risks from intense competition, regulatory changes, and evolving consumer preferences. However, strategic initiatives focusing on online capabilities, store format optimization, and sustainability offer pathways for continued growth and market dominance.

Tesco maintains a leading market share in the UK grocery sector, competing with Sainsbury's, Asda, and Morrisons. Its customer loyalty program, Clubcard, contributes significantly to customer retention. The company's operations extend beyond the UK, with a presence in Central Europe.

Key risks include competition from discounters like Aldi and Lidl, and regulatory changes. Technological disruption and changing consumer preferences, such as the demand for convenience and online shopping, also pose challenges. These factors require constant adaptation in the Tesco business model.

The company focuses on enhancing online capabilities and optimizing store formats to meet customer needs. Tesco strategy includes a continued emphasis on value, convenience, and sustainability. These initiatives aim to attract and retain customers effectively.

Looking ahead, Tesco plans to leverage its brand strength and omnichannel strategy. The company aims to innovate in product offerings and customer experience. Its goal is to remain a dominant force in the retail landscape, adapting to market changes.

Recent reports indicate that Tesco has maintained a strong market share in the UK. In 2024, Tesco reported a significant increase in online sales, reflecting the growing importance of e-commerce. The company is actively investing in its supply chain to improve efficiency.

- Tesco's market share in the UK grocery market remains above 27% as of early 2024, demonstrating its continued dominance.

- Online sales growth has been a key driver, with digital channels contributing significantly to overall revenue in 2024.

- Investments in automation and logistics are aimed at improving Tesco supply chain management and reducing operational costs.

- The company is also focusing on sustainability, with initiatives aimed at reducing carbon emissions and promoting responsible sourcing.

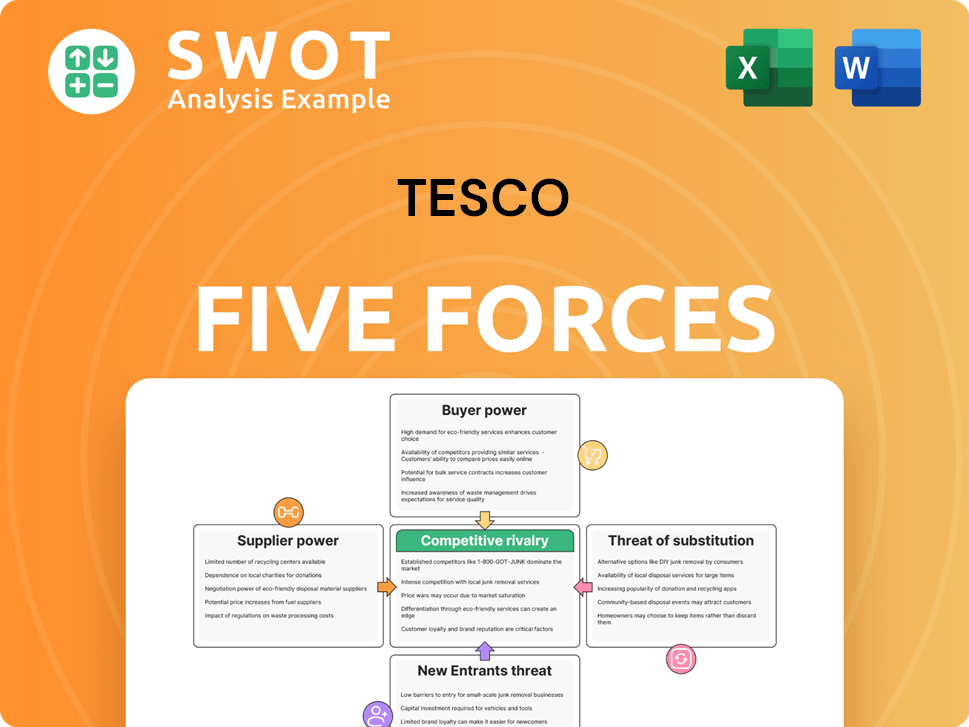

Tesco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tesco Company?

- What is Competitive Landscape of Tesco Company?

- What is Growth Strategy and Future Prospects of Tesco Company?

- What is Sales and Marketing Strategy of Tesco Company?

- What is Brief History of Tesco Company?

- Who Owns Tesco Company?

- What is Customer Demographics and Target Market of Tesco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.