Tesco Bundle

How Well Does Tesco Know Its Customers?

In the fast-paced world of retail, understanding your customer is the key to staying ahead. For Tesco, a global leader in the grocery industry, knowing its customer demographics and target market is not just important—it's essential for survival and growth. Founded over a century ago, Tesco has consistently adapted to changing consumer needs. This deep understanding has fueled its expansion and market dominance.

Tesco's success story is a testament to the power of customer-centric strategies. From its humble beginnings to its current status, Tesco has meticulously analyzed its Tesco SWOT Analysis to refine its approach. The company's ability to identify and cater to various segments, including understanding Tesco customer age range and Tesco customer income levels, has been crucial to maintaining its competitive edge. Through detailed analysis of Tesco customer buying behavior and preferences, Tesco continues to tailor its offerings to meet the evolving needs of its diverse customer base, solidifying its position as a market leader.

Who Are Tesco’s Main Customers?

Understanding the customer demographics and Tesco target market is crucial for analyzing its business strategy. Tesco, a major player in the retail sector, focuses on a broad Tesco customer profile, aiming to serve a diverse range of consumers. This approach is reflected in its varied store formats and product offerings, designed to meet different needs and preferences.

The company's ability to segment its market effectively is a key factor in its success. By analyzing the Tesco shoppers and their behaviors, Tesco can tailor its products and services, ensuring customer satisfaction and loyalty. This market segmentation strategy allows Tesco to adapt to changing consumer trends and maintain a competitive edge.

The company's extensive use of data from its Clubcard program, which had 23 million members in the UK in 2024, enables it to personalize marketing efforts. This data-driven approach helps Tesco understand the Tesco consumers better, leading to more effective targeting and improved customer engagement. Furthermore, the company's commitment to expanding its service offerings, such as its online marketplace launched in June 2024, demonstrates its ongoing efforts to cater to evolving consumer needs.

Tesco operates various store formats, including Extra, Superstore, Metro, Express, and One Stop. These formats cater to different customer needs, from large family shops to quick convenience purchases. The strategic location of these stores ensures accessibility for a wide range of consumers.

The Clubcard loyalty program is a cornerstone of Tesco's customer strategy. In 2024, the program had 23 million members in the UK, representing over 80% of UK households. The Clubcard app had 12.7 million users in the UK, 2.6 million in Central Europe, and 1 million in the Republic of Ireland in 2024.

Tesco segments its product offerings to meet various customer needs. The 'Tesco Finest' range targets premium shoppers, while 'Everyday Value' caters to budget-conscious consumers. This approach allows Tesco to capture a broader market share by appealing to different Tesco customer income levels and preferences.

Tesco has enhanced its e-commerce capabilities, with UK online sales up 10.2% in 2024/25, and is committed to increasing healthy product sales to 65% by 2025. These initiatives reflect Tesco's adaptation to changing consumer behaviors, including the growing demand for online shopping and healthier food options. To learn more about Tesco's strategic direction, consider reading about the Growth Strategy of Tesco.

Tesco's primary customer base includes families, individuals seeking convenience, and those looking for value. The company's diverse store formats and product ranges cater to various Tesco customer lifestyle characteristics and needs. The Clubcard program provides valuable insights into Tesco customer buying behavior, allowing Tesco to refine its marketing and product development strategies.

- Families seeking affordable groceries and household items.

- Individuals prioritizing convenience and quick shopping experiences.

- Customers looking for premium products through the 'Tesco Finest' range.

- Budget-conscious shoppers seeking value through the 'Everyday Value' line.

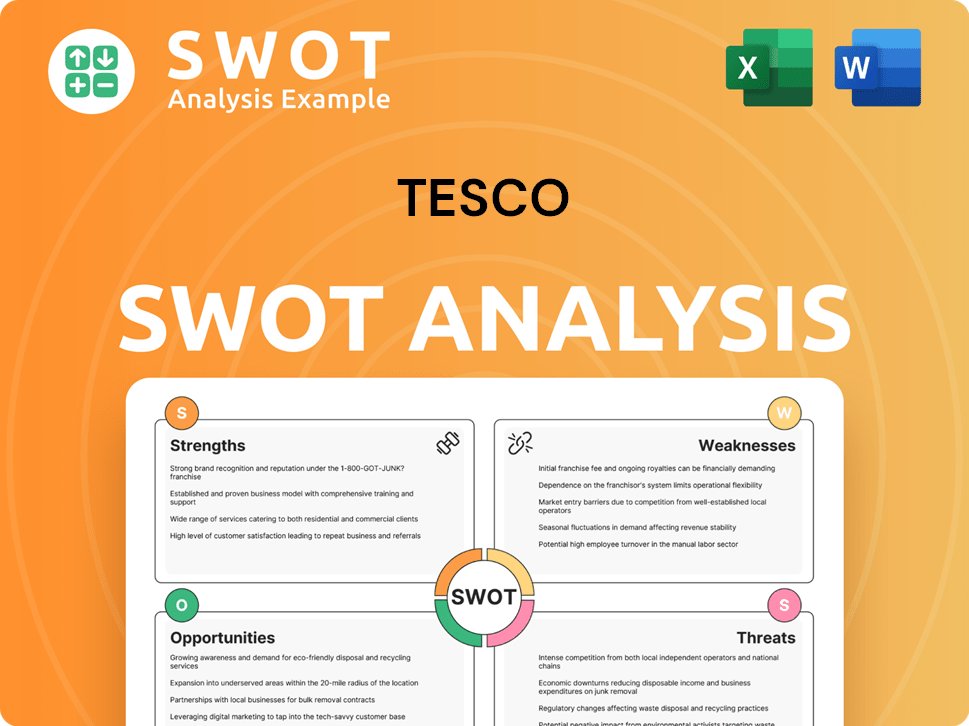

Tesco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Tesco’s Customers Want?

Understanding the needs and preferences of its customers is crucial for the success of any business, and this is particularly true for a large retailer like the company. The customer base is diverse, with varying needs and expectations. The company's ability to meet these needs directly impacts customer loyalty, sales, and overall market position.

The company's strategy is centered around providing "magnetic value," which includes competitive pricing, quality products, and convenient services. This approach is designed to attract and retain a broad customer base by focusing on the key drivers of customer satisfaction: value for money, quality, convenience, and sustainability.

The company's customer base, or Tesco shoppers, is driven by several key factors. Value for money is a primary concern for many customers, with initiatives like the Aldi Price Match and Clubcard Prices directly addressing this need. Quality is also a significant factor, with the company offering a diverse range of products, including its own-brand options, to cater to different preferences and budgets. Convenience and sustainability are also increasingly important, with the company adapting its services and product offerings to meet these evolving demands.

The company's commitment to value is evident through initiatives like Aldi Price Match and Clubcard Prices. Clubcard members saved up to £392 annually in 2024-2025. This focus directly addresses the 85% of customers in 2025 who prioritize value for money.

The company offers a diverse product range, including own-brand products, to stimulate customer interest. The introduction of over 1,600 new or improved products in 2024/25, including 400 new Finest lines, which saw overall sales growth of 15%.

The company is responding to the growing demand for healthier options. 86% of customers in a recent survey expressed a desire to eat more healthily. The company aims to increase the sale of healthy products to 65% of sales by 2025.

The company adapts its store formats and digital services to meet convenience needs. The expansion of its rapid delivery service, Whoosh, to over 1,500 stores and a 10.2% rise in UK online sales in 2024/25 underscore this commitment.

The company focuses on sustainability through initiatives like the 'Better Baskets' campaign, which helps customers make healthier and more sustainable choices. The company also aims to grow its plant-based 'Wicked Kitchen' range by 300% between 2020 and 2025.

The company tailors its marketing and product features through personalized discounts via Clubcard and location-specific product ranges based on store demographics.

The company employs several strategies to understand and meet customer needs. These include:

- Market Research and Feedback: Gathering customer feedback and market trends to inform product development and service improvements, such as the 'Better Baskets' campaign.

- Product Innovation: Introducing new products and improving existing ones to meet changing customer preferences, including healthier options and own-brand products.

- Convenience Services: Expanding services like Whoosh to provide convenient shopping experiences.

- Personalized Marketing: Using Clubcard data to offer personalized discounts and tailoring product ranges based on store demographics.

For a deeper dive into the company's marketing approach, consider exploring the Marketing Strategy of Tesco.

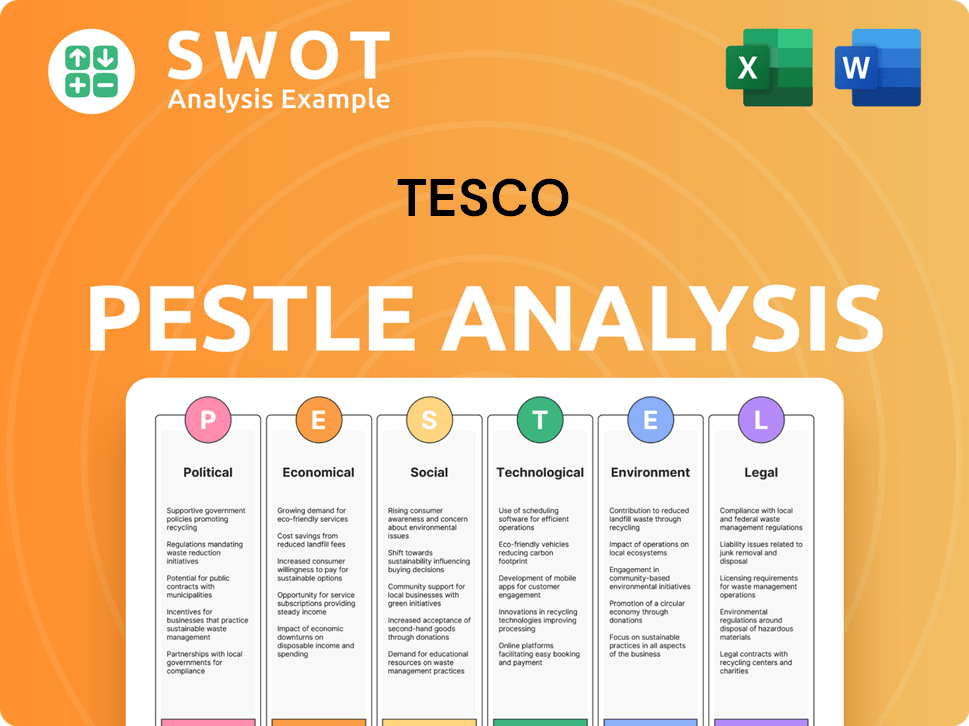

Tesco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Tesco operate?

The geographical market presence of the company is primarily concentrated in the United Kingdom, the Republic of Ireland, and Central Europe. The UK serves as its most significant market, where it holds a substantial share of the grocery sector. This strategic focus allows for localized offerings and marketing strategies to cater to diverse consumer needs.

In the UK, the company's market share reached 28.5% in 2025, solidifying its position as the leading supermarket. The company's expansion plans include opening 150 new Express stores in the UK by 2027. This expansion strategy aims to enhance convenience and accessibility for its Tesco shoppers.

In the Republic of Ireland, the company's market share grew to 23.9% in 2024/25. Central Europe also experienced positive sales growth, with like-for-like sales up 2.2% in 2024/25. These figures highlight the company's robust performance and strategic market positioning across key regions.

The company's strong presence in the UK market is evident, holding a 28.5% market share in 2025, making it the leading supermarket. This dominance reflects successful strategies in understanding its Tesco customer profile and adapting to local consumer preferences. The company's market share in the UK increased by 67 basis points year-on-year to 28.3% in 2024/25, representing its highest level since 2016.

The company plans to open 150 new Express stores in the UK by 2027, expanding its convenience store estate to over 2,200 stores. This expansion is expected to create 2,000 jobs, demonstrating a commitment to growth and accessibility. This strategic move aims to cater to the evolving needs of the Tesco target market.

Central Europe contributed positively to sales growth, with like-for-like sales up 2.2% in 2024/25. This growth was driven by improved category mix and volume growth. Customer satisfaction scores improved in 2024/25 as customers responded well to product innovation and targeted value investments, with an average of approximately 650 products added to its Low Price Guarantee per market.

The company extended its partnership with The Entertainer, a toy specialist, to supply over 850 superstores in the UK and Ireland from 2024. This expansion to over 2,000 Express stores from April 2025, indicates a strategic focus on expanding non-food offerings in convenience formats. This is part of the company's Tesco's customer segmentation strategy.

The company's strategic market focus is evident through its strong presence in the UK, Republic of Ireland, and Central Europe. This focus allows for tailored offerings and marketing strategies. For more details on the company's operations, you can read this article on Tesco's market analysis.

- The UK remains its strongest market, with a 28.5% grocery market share in 2025.

- Expansion plans include opening 150 new Express stores in the UK by 2027.

- Central Europe saw like-for-like sales increase by 2.2% in 2024/25.

- Partnerships and localized offerings are key to success in diverse markets.

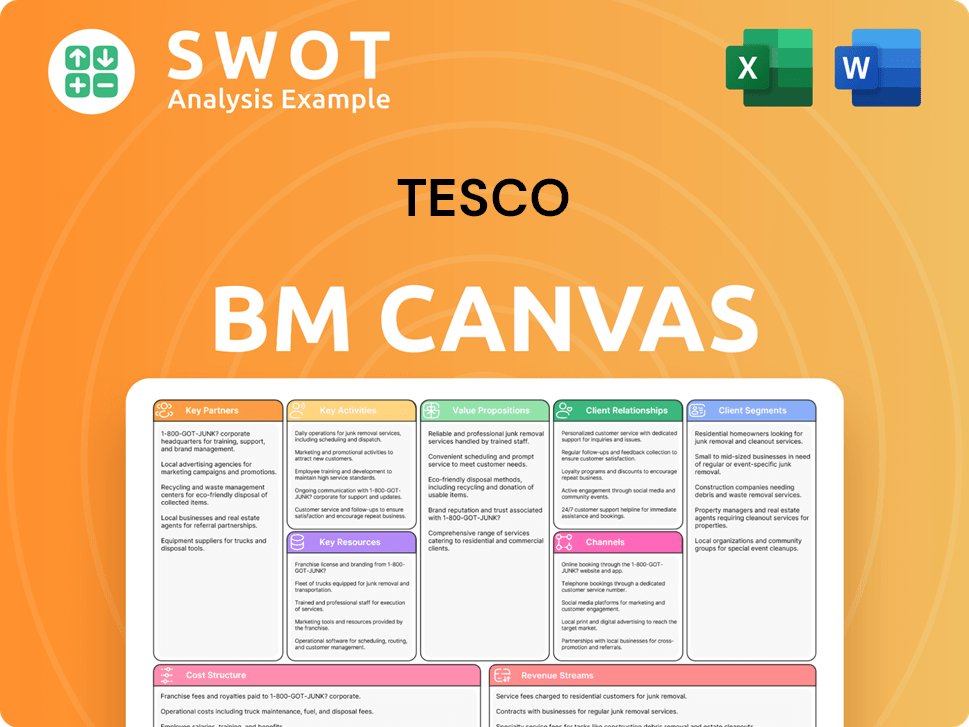

Tesco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Tesco Win & Keep Customers?

Customer acquisition and retention strategies are crucial for any business, and the company leverages a multi-faceted approach. These strategies integrate digital and traditional marketing channels with robust loyalty programs to attract and retain customers effectively. A key component of this strategy is the Clubcard loyalty program, which significantly contributes to revenue and customer loyalty.

The company's approach involves a combination of targeted advertising, customer segmentation, and promotional campaigns. The goal is to attract a diverse customer base by focusing on quality, affordability, and convenience. The company also utilizes customer data extensively through its Clubcard and the Tesco Media & Insight Platform, which enables highly targeted advertising campaigns.

By understanding the needs and preferences of its Owners & Shareholders of Tesco, the company aims to foster long-term relationships and drive sustainable growth. The company's CRM system supports an omnichannel communication strategy, managing customer data and interactions across various channels to ensure a customer-focused culture. Digital expansion, including the rapid delivery service Whoosh and the launch of an online marketplace, further enhances customer satisfaction and expands the online customer base.

The Clubcard program is a cornerstone of the company's retention strategy. In 2024, it had 23 million members across 80% of UK households. This program provides personalized discounts, exclusive access to products, and rewards. It significantly contributes to customer loyalty and revenue generation.

The company employs targeted advertising across various channels. These channels include television, radio, print, social media, and email marketing. Customer segmentation and brand positioning are key elements of this strategy. The focus is on quality, affordability, and convenience to attract a broad customer base.

The company leverages customer data extensively through its Clubcard and the Tesco Media & Insight Platform. This platform uses data from over 23 million Clubcard households. This enables highly targeted advertising campaigns across its website, app, and in-store digital screens. These campaigns provide valuable customer insights.

Digital expansion includes the rapid delivery service Whoosh, available in over 1,500 stores. The launch of an online marketplace with over 400,000 third-party products also contributes. These initiatives enhance customer satisfaction and expand the online customer base. This expansion is a key part of the company's strategy.

The company's strategies include specific initiatives to attract and retain customers. These initiatives are designed to boost customer loyalty and improve the overall customer experience. The focus is on providing value and convenience to customers.

- Clubcard Challenges: In 2024, 4.9 million customers received 'Clubcard Challenges' tailored to their shopping habits.

- Aldi Price Match and Low Everyday Prices: These initiatives attract value-conscious customers.

- CRM System: The CRM system supports an omnichannel communication strategy.

- Whoosh: Rapid delivery service available in over 1,500 stores.

- Online Marketplace: Features over 400,000 third-party products.

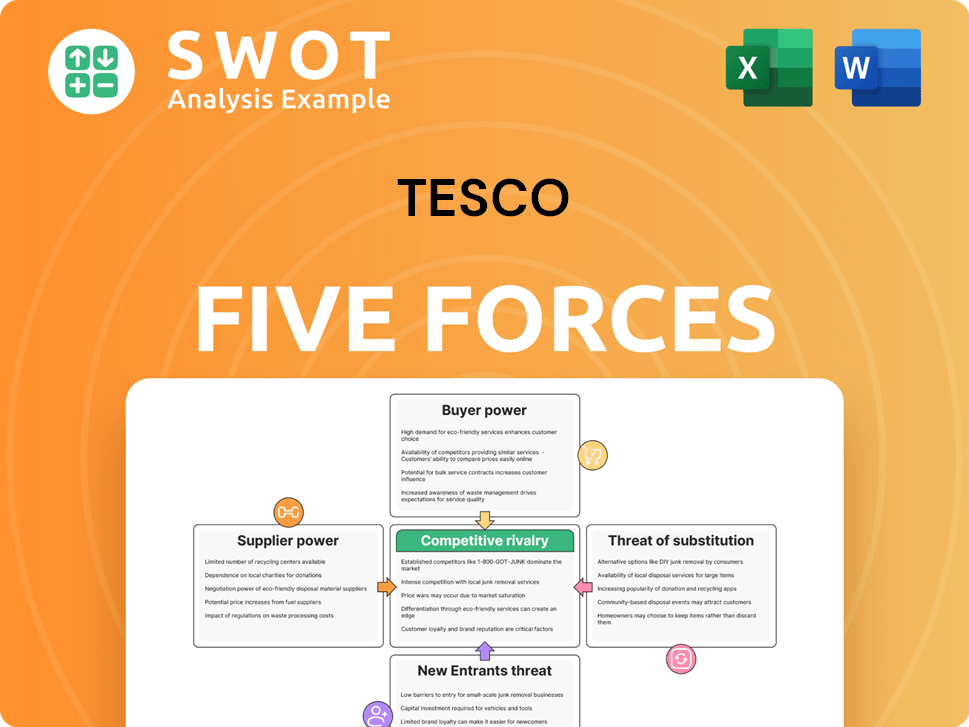

Tesco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tesco Company?

- What is Competitive Landscape of Tesco Company?

- What is Growth Strategy and Future Prospects of Tesco Company?

- How Does Tesco Company Work?

- What is Sales and Marketing Strategy of Tesco Company?

- What is Brief History of Tesco Company?

- Who Owns Tesco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.