TotalEnergies Bundle

How Does the TotalEnergies Company Thrive in the Energy Transition?

TotalEnergies, a French energy giant, stands as a pivotal player in the global energy sector. With a robust 2024 performance, including an adjusted net income of $18.3 billion, the TotalEnergies SWOT Analysis reveals a company navigating the complexities of the energy transition. This integrated energy business model, encompassing oil and gas, renewable energy, and electricity, is crucial to understanding its operations.

This examination dives deep into the inner workings of the TotalEnergies company, exploring its global operations and strategic shifts. Understanding its diverse revenue streams and commitment to sustainable energy is key. By analyzing TotalEnergies' approach to the energy transition and its financial performance, we can better grasp its adaptability and future prospects in the evolving energy landscape, including its efforts to reduce carbon emissions.

What Are the Key Operations Driving TotalEnergies’s Success?

The TotalEnergies company operates as an integrated multi-energy business, encompassing the entire energy value chain, from production to distribution. This French energy giant focuses on oil and gas exploration and production, refining and petrochemicals, and the marketing of energy products. The TotalEnergies business has also significantly expanded into renewables and electricity, offering green gases and low-carbon energy solutions to a broad customer base across approximately 130 countries.

The core operations are meticulously managed across various segments. Upstream activities involve complex oil and gas exploration and production, with an emphasis on low-cost and low-emission assets. Downstream, the company transforms crude oil into various petroleum products and chemicals. In the growing renewables and electricity segment, TotalEnergies develops and operates solar, wind, and hydropower projects, along with battery storage solutions. Logistics, sales channels, and customer service are integral to delivering these products to the market, ensuring efficient distribution and customer satisfaction.

The integrated multi-energy strategy distinguishes TotalEnergies operations, enabling it to leverage synergies across business lines and adapt to market changes. This integration of upstream and downstream activities allows for more effective margin capture and technological innovation. It also extends to its new electricity and renewable energy businesses, benefiting from the company's global brand, technical expertise, and established partnerships. For instance, the company anticipates growing power production to more than 50 TWh in 2025, equivalent to 10% of its hydrocarbon production, demonstrating its commitment to a diversified and sustainable energy mix. For more insights into the company's historical performance and strategic direction, consider reading about the [TotalEnergies' evolution and future strategies](0).

The TotalEnergies company operates through several key business segments. These include Exploration and Production (E&P) of oil and gas, Refining and Chemicals, and Marketing & Services. The company is also heavily involved in Renewables and Electricity, which is a growing segment.

The value proposition of TotalEnergies lies in its integrated model. This allows the company to offer a diverse range of energy solutions. The company aims to provide reliable and sustainable energy to its customers.

Operational processes are carefully managed across each segment. Upstream operations focus on efficient oil and gas production. Downstream operations involve refining and petrochemicals. Renewables and electricity operations focus on project development and energy generation.

The integrated strategy allows TotalEnergies to capture margins effectively. It also fosters innovation and technological advancements. This approach enables the company to better navigate market fluctuations and capitalize on emerging opportunities.

In 2023, TotalEnergies increased its renewable electricity generation capacity. The company is actively involved in projects across the globe. These projects include solar farms, wind turbines, and hydropower plants.

- The company's focus on sustainable energy is growing.

- TotalEnergies is investing in technologies to reduce carbon emissions.

- The company is expanding its presence in the energy sector.

- TotalEnergies is committed to the energy transition.

TotalEnergies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TotalEnergies Make Money?

The TotalEnergies company generates revenue through a diversified approach, leveraging its extensive energy portfolio. This includes the exploration, production, and sale of crude oil, natural gas, and refined petroleum products. The company's financial performance is significantly impacted by global energy market dynamics.

In addition to traditional oil and gas operations, TotalEnergies business is increasingly focused on renewable energy and petrochemicals. Electricity sales from renewable projects and the sale of petrochemical products are becoming more critical revenue streams. The company's strategy aims to balance its existing fossil fuel operations with investments in sustainable energy sources.

For the twelve months ending March 31, 2025, TotalEnergies reported revenue of $191.626 billion, reflecting a 9.86% year-over-year decline. This highlights the volatility inherent in the energy sector and the impact of changing market conditions.

The primary revenue streams include the exploration, production, and sale of crude oil and natural gas. Refined petroleum products also contribute significantly. These activities are central to the TotalEnergies company's financial performance.

Petrochemical and chemical product sales are another key source of revenue. Electricity sales from renewable energy projects are growing in importance. This diversification supports the company's long-term strategy.

In the first quarter of 2025, adjusted net income was $4.2 billion. Cash flow from operations reached $7.0 billion. The Integrated LNG business posted $1.3 billion in adjusted net operating income in Q1 2025.

The company focuses on a profitable integrated power model. TotalEnergies is involved in international trading of crude oil and petroleum products. Value-added services like energy storage are also provided.

Declines in European refining margins pose a challenge. Diversified revenue streams help mitigate these impacts. TotalEnergies is committed to shareholder returns.

A confirmed first interim dividend of €0.85 per share for fiscal year 2025. This represents a 7.6% increase compared to 2024. This commitment underscores the company's financial stability.

The energy company's monetization strategies include a focus on an integrated power model designed to become a future cash engine, international trading of crude oil and petroleum products, and value-added services. While challenges exist, such as fluctuating refining margins, the diversification of revenue streams helps to mitigate these impacts. For more detailed insights into the company's history and evolution, you can explore the Brief History of TotalEnergies.

The company's financial health is reflected in its revenue streams and strategic investments. Key figures from recent reports highlight its performance.

- Annual revenue in 2024 was $195.61 billion, a 10.66% decrease from 2023.

- Adjusted net income for Q1 2025 was $4.2 billion, demonstrating continued profitability.

- Cash flow from operations in Q1 2025 was $7.0 billion, indicating strong cash generation.

- European refining margins averaged $29.4 per ton in Q1 2025, a 59% decrease from Q1 2024.

- The first interim dividend for fiscal year 2025 is set at €0.85 per share, a 7.6% increase.

TotalEnergies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TotalEnergies’s Business Model?

The TotalEnergies company has achieved significant milestones, particularly in its shift towards a multi-energy strategy. In 2024, the French energy giant continued to expand its integrated power model through strategic acquisitions. These included Quadra Energy and VSB in Germany, along with gas-fired power plants in the United States and the United Kingdom, enhancing its flexible generation capacity. This expansion is part of its broader strategy to diversify its energy portfolio and adapt to the evolving energy landscape. The company's commitment to the energy transition is evident in its substantial investments in low-carbon energy.

In 2024, TotalEnergies invested nearly $5 billion in low-carbon energy, primarily in electricity and renewables, positioning itself as a leading investor in the energy transition among major oil companies. This investment underscores its commitment to sustainability and reducing its carbon footprint. Additionally, the company achieved five major project start-ups in 2024, including Mero-2 and Mero-3 in Brazil, Anchor in the United States, Fenix in Argentina, and Tyra in Denmark. These projects are expected to support a projected production growth of over 3% in 2025, demonstrating the company's continued focus on expanding its production capabilities.

Despite facing operational and market challenges, such as weak margins in its downstream segment, TotalEnergies has maintained strong financial health. The European Refining Margin Marker averaged $29.4 per ton in Q1 2025, a 59% drop from Q1 2024. However, the company's gearing remained below 10% at year-end 2024, reflecting its financial resilience. These strategic moves and financial discipline are crucial for navigating the complexities of the energy sector and ensuring long-term sustainability. For more insight into how the company positions itself, consider exploring the Target Market of TotalEnergies.

TotalEnergies' competitive advantages include its strong position in LNG and deepwater portfolios, and a credible integrated power strategy. The company has a diverse and high-quality asset portfolio, and consistently ranks as the most profitable major, achieving a 14.8% return on average capital employed (ROACE) in 2024 for the third consecutive year. This profitability is supported by a low upstream production cost, reported below $5/boe in 2024, which enhances its resilience even in low-price environments.

- LNG and Deepwater Expertise: Strong position in LNG and deepwater projects provides a significant advantage in the oil and gas sector.

- Integrated Power Strategy: A credible integrated power strategy supports the company's diversification into renewable energy sources.

- Financial Performance: Consistently high ROACE demonstrates efficient capital management and profitability.

- Low Production Costs: Low upstream production costs enhance resilience, even in low-price environments.

TotalEnergies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TotalEnergies Positioning Itself for Continued Success?

As a leading integrated energy company, TotalEnergies holds a prominent position in the global energy market. Its diversified strategy, encompassing oil, gas, renewables, and electricity, positions it well within the ongoing energy transition. The company's strong operational performance and strategic investments underscore its commitment to sustainable growth and shareholder value.

However, TotalEnergies faces risks such as volatile oil and gas prices and changing regulatory environments. Despite these challenges, the company's strategic initiatives and investments in low-carbon energies demonstrate its adaptability and long-term vision. TotalEnergies’ ability to balance hydrocarbon production with renewable energy development will be crucial for its future success.

TotalEnergies is a major player in the energy sector, recognized for its integrated approach. The company's focus on both traditional and renewable energy sources provides a competitive edge. Its global operations and diverse portfolio contribute to its resilience and growth potential. Competitors Landscape of TotalEnergies can provide more insights into the competitive environment.

TotalEnergies faces risks including fluctuating oil and gas prices and refining margin declines. Regulatory changes and stricter emissions rules in Europe also pose challenges. Concerns about net debt levels are another factor to consider. These factors can impact the company's financial performance.

TotalEnergies plans significant investments in low-carbon energies, with around $5 billion annually allocated for this purpose. The company aims to increase power production and expand its renewable capacity. TotalEnergies has set ambitious climate goals for 2025, including reducing methane emissions and the lifecycle carbon intensity of its energy products.

Hydrocarbon production in Q1 2025 increased nearly 4% year-over-year. The average Brent crude price in Q1 2025 was $72.2 per barrel, an 11% decrease. European Refining Margin Marker averaged $29.4 per ton in Q1 2025, a 59% drop from Q1 2024. TotalEnergies plans to invest between $16-$18 billion annually during 2025-2030.

TotalEnergies is committed to a balanced approach, combining profitable growth in hydrocarbons with accelerated development in electricity and renewables. The company aims to increase power production to over 50 TWh in 2025. By 2030, the company targets a gross capacity of 10 TWh equivalent biomethane per year.

- Investing between $16-$18 billion per year during 2025-2030.

- Allocating around $5 billion annually to low-carbon energies.

- Focusing on a 60% reduction in methane emissions compared to 2020 levels by 2025.

- Reducing the lifecycle carbon intensity of its energy products by 17% compared to 2015 levels by 2025.

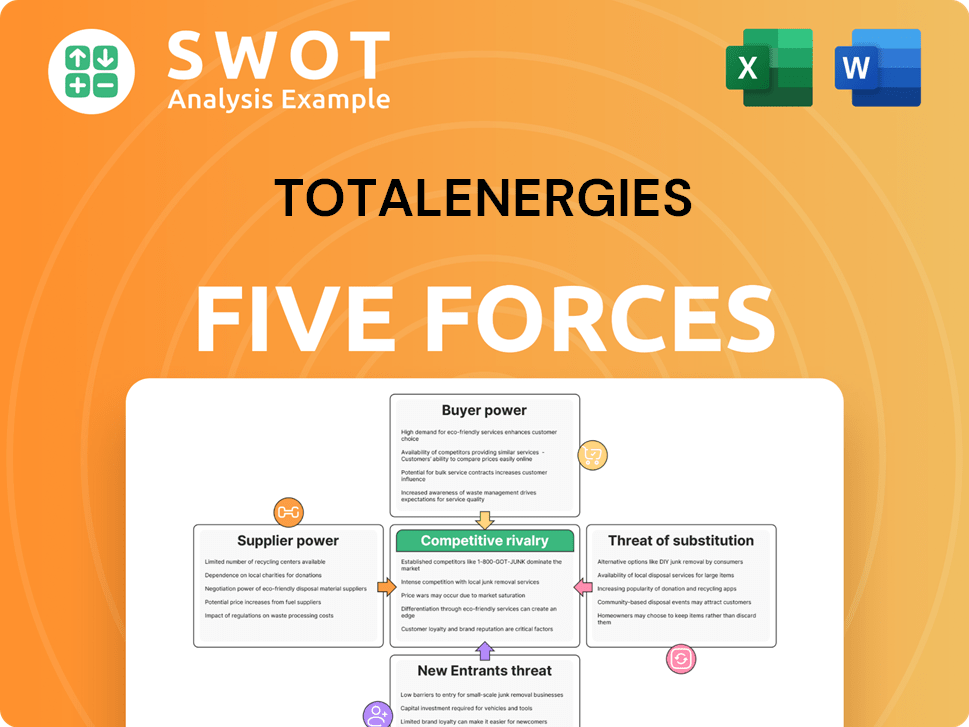

TotalEnergies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TotalEnergies Company?

- What is Competitive Landscape of TotalEnergies Company?

- What is Growth Strategy and Future Prospects of TotalEnergies Company?

- What is Sales and Marketing Strategy of TotalEnergies Company?

- What is Brief History of TotalEnergies Company?

- Who Owns TotalEnergies Company?

- What is Customer Demographics and Target Market of TotalEnergies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.