TriMark USA Bundle

How Does TriMark USA Thrive in the Foodservice Industry?

TriMark USA stands as a powerhouse in the foodservice sector, but how does this TriMark USA SWOT Analysis reveal its inner workings? With a reported $2.5 billion in revenue in 2024, the TriMark company has established a significant footprint, equipping commercial kitchens and dining areas across the nation. Understanding the mechanics behind TriMark's operations is key to appreciating its influence.

This article explores the core functions of the TriMark business, from design and equipment provision to supply distribution. We'll examine how TriMark services support a wide array of clients and how its strategic approach has solidified its position as a leader. Whether you're curious about TriMark products, TriMark locations, or the company's overall strategy, this analysis provides valuable insights into its operations and market dynamics.

What Are the Key Operations Driving TriMark USA’s Success?

The TriMark USA company operates as a comprehensive provider for the foodservice industry. It offers a range of services and products, acting as a single-source solution for its clients. This approach allows TriMark to cater to a diverse customer base, including national restaurant chains and independent businesses.

The core of the TriMark business revolves around its ability to provide integrated solutions. This includes everything from initial kitchen design and installation to ongoing supply management. The company's operational processes encompass manufacturing, sourcing, logistics, and a direct sales model, ensuring efficient service delivery.

A significant aspect of TriMark's value proposition is its commitment to customer-centric strategies, which emphasizes tailored solutions and support. This approach helps drive repeat business and fosters customer loyalty. For a deeper dive into their strategic growth, consider reading about the Growth Strategy of TriMark USA.

TriMark USA's operations include design services, equipment supply, and ongoing maintenance. They manage a national distribution network, ensuring timely delivery of products. The company's direct sales model facilitates strong customer relationships and efficient service.

The value proposition centers around being a 'one-stop-shop' for foodservice operators. This integrated approach simplifies procurement and management for clients. TriMark's strong supplier relationships enhance its ability to offer competitive pricing and a wide range of products.

TriMark serves a broad range of customers, including national restaurant chains, independent restaurants, healthcare facilities, and entertainment venues. Their ability to tailor solutions makes them versatile. This diversification helps mitigate risks and ensures a steady customer base.

Key services include kitchen design, equipment supply, and ongoing support. They also offer supply management and maintenance services. This comprehensive approach ensures that clients receive end-to-end solutions for their foodservice needs.

TriMark USA operates a vast distribution network across the United States, ensuring efficient delivery of products. This network includes numerous distribution centers strategically located to serve customers quickly. Their logistics capabilities are essential for maintaining customer satisfaction and operational efficiency.

- Distribution centers are located in key areas to reduce delivery times.

- The company utilizes advanced logistics technologies for inventory management.

- Efficient supply chain management ensures product availability.

- TriMark's logistics network supports both large and small-scale projects.

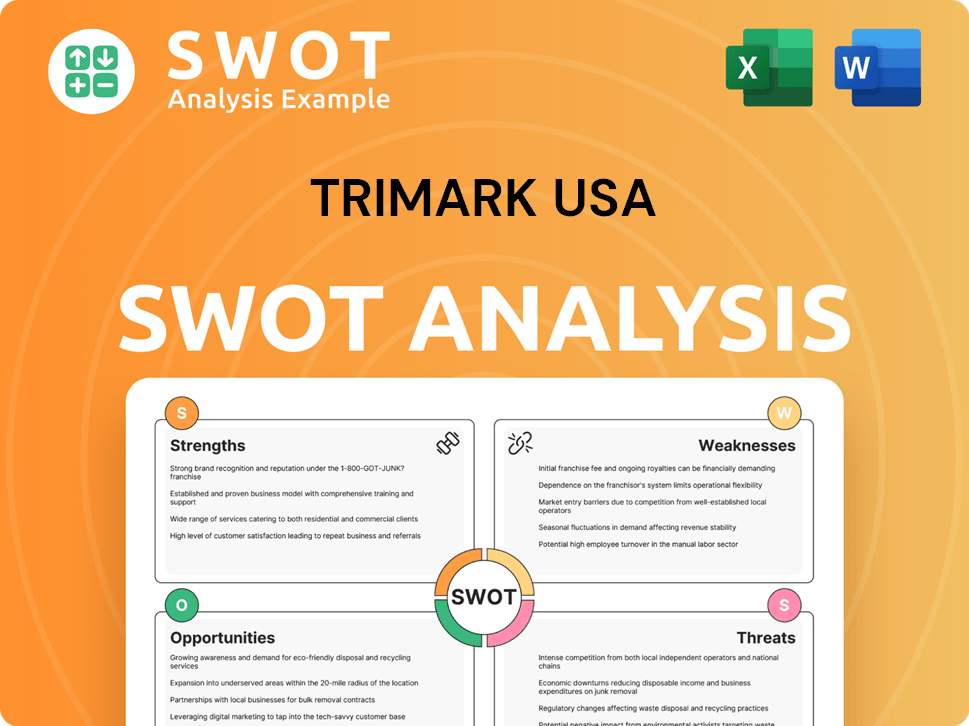

TriMark USA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TriMark USA Make Money?

The TriMark USA company generates revenue primarily through the sale of its products and services. The TriMark business model focuses on providing comprehensive solutions to the foodservice industry. As of 2024, the company's estimated annual revenue reached approximately $2.5 billion.

The TriMark company strategically balances its product offerings to mitigate competition. This approach allows TriMark USA to maintain a strong market position. The company's sales strategy includes a direct sales model, emphasizing customer relationships and tailored services.

The TriMark USA revenue streams and monetization strategies are multifaceted. The company's sales mix historically included heavy equipment, smallwares, and other categories. The direct sales model, accounting for around 60% of revenue in 2024, is crucial for customer relationship management. Design and project management services also contribute significantly to revenue and competitive advantage.

The core of TriMark USA's revenue comes from selling a wide array of TriMark products. These include heavy equipment, smallwares, tabletop items, and paper/disposables. The sales strategy is designed to meet the diverse needs of the foodservice industry.

A significant portion of TriMark services revenue is generated through design and project management. These services provide a competitive edge. The design services market reached $15.3 billion in 2024.

The direct sales model is a key monetization strategy for TriMark USA. This model involves a dedicated sales team. This approach fosters strong customer relationships and offers tailored solutions.

TriMark likely employs value-based pricing. This strategy aligns costs with the comprehensive solutions offered. This can lead to higher profit margins and increased customer satisfaction.

The company targets a mix of approximately 70% equipment and projects and 30% supplies. This strategy helps to mitigate competition from online-only competitors. This balance is crucial for sustained growth.

The company's strategy focuses on providing complete solutions. This approach is designed to meet the diverse needs of the foodservice industry. This complete approach sets TriMark apart.

The primary revenue drivers for TriMark USA are product sales and services. The company's direct sales model and project management services are crucial. Understanding the Marketing Strategy of TriMark USA helps to understand its revenue generation.

- Product Sales: Heavy equipment, smallwares, and other supplies.

- Service Revenue: Design and project management services.

- Direct Sales: Dedicated sales team building customer relationships.

- Pricing: Value-based pricing aligned with comprehensive solutions.

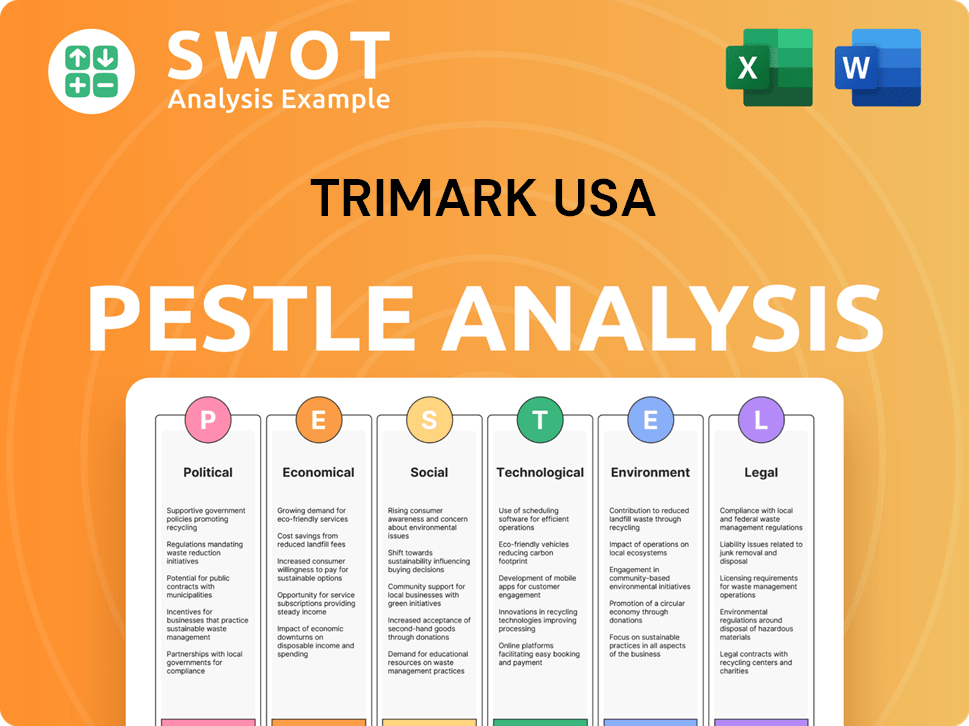

TriMark USA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TriMark USA’s Business Model?

Understanding the operational dynamics of the TriMark USA company involves examining its key milestones, strategic maneuvers, and competitive strengths. The company's growth strategy has historically been a blend of acquisitions and organic expansion. A significant financial move was the early 2024 equity investment of $350 million from Ares Management, Oaktree Capital Management, and Bayside Capital. This capital injection was aimed at reducing debt and fueling expansion plans.

In 2024, TriMark USA acquired Singer Equipment Company, further illustrating its strategy of integrating acquisitions to leverage economies of scale and operational efficiencies. This acquisition, along with others, has helped shape the TriMark business model. The company's ability to adapt and integrate new entities is crucial for its long-term success in the competitive foodservice industry.

The company faces challenges, including increased competition and economic pressures. Direct-to-consumer sales from manufacturers, which grew by 15% for some in 2024, pose a threat. Economic headwinds, such as slower U.S. restaurant sales growth in 2024 and potential inflation, also impact demand. Supply chain disruptions and rising costs, with many companies facing a 10-15% rise in supply chain costs in 2024, present further challenges. Additionally, TriMark faces risks related to its debt obligations, with an asset-based lending (ABL) facility maturing in July 2025.

The $350 million equity investment in early 2024 from Ares Management, Oaktree Capital Management, and Bayside Capital. This capital infusion was intended to substantially deleverage the balance sheet and fuel expansion plans.

Acquisition of Singer Equipment Company in 2024, highlighting the company's strategy of integrating acquisitions to leverage economies of scale and operational efficiencies. This move is part of a broader strategy to strengthen its market position.

Extensive national footprint, allowing for broad reach and local market expertise. This wide reach helps TriMark serve a diverse customer base across various TriMark locations.

Intensified competition from manufacturers selling directly to consumers, which grew by 15% for some manufacturers in 2024. Economic headwinds, such as slowed U.S. restaurant sales growth in 2024 and potential inflation, have also impacted demand.

TriMark's competitive advantages include its extensive national footprint, allowing for broad reach and local market expertise. Its established relationships with a diverse customer base and significant purchasing power further strengthen its position.

- Established relationships with a diverse customer base and significant purchasing power.

- Ability to differentiate its TriMark services, such as design and installation, helps maintain margins amidst rivalry.

- Experienced leadership, with a new CEO and Chairman appointed in October 2024, expected to drive strategic initiatives and operational improvements.

- Risks include debt obligations, with an asset-based lending (ABL) facility maturing in July 2025.

For more insights into the competitive landscape, consider reading about the Competitors Landscape of TriMark USA. Understanding these aspects provides a comprehensive view of how TriMark operates and competes within the foodservice industry.

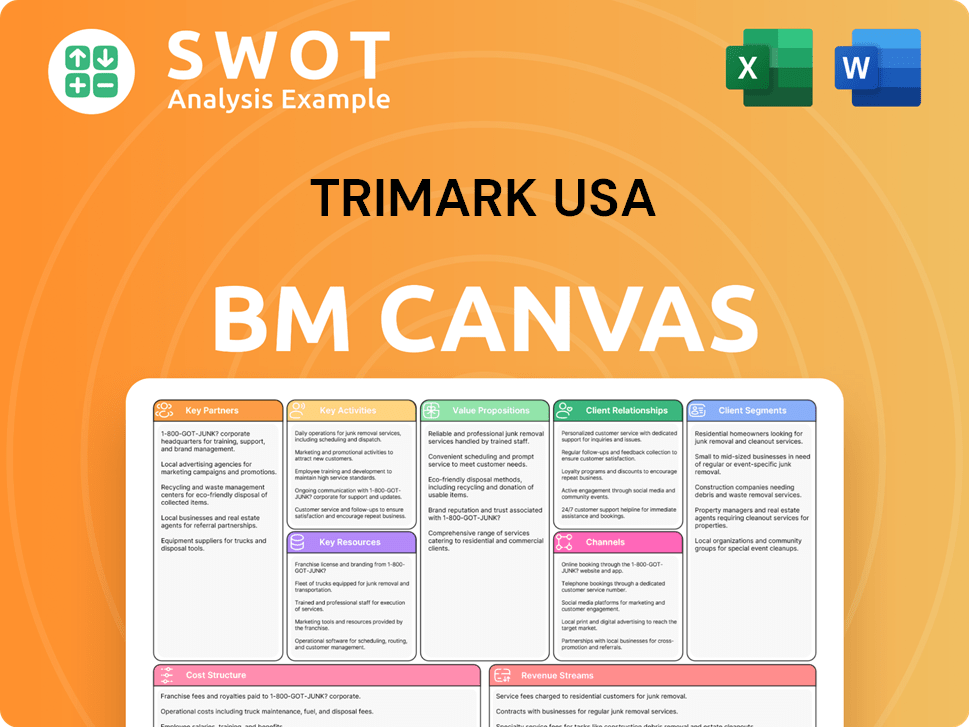

TriMark USA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TriMark USA Positioning Itself for Continued Success?

Understanding the operational landscape of TriMark USA involves assessing its industry position, the risks it faces, and its future outlook. As a significant player in the U.S. Restaurant & Hotel Equipment Wholesaling sector, TriMark USA holds a notable market share. This analysis provides insights into the company's strategic positioning and potential challenges.

TriMark USA's position in the market is influenced by various factors, including competition, economic conditions, and supply chain dynamics. The future outlook for TriMark USA hinges on its ability to navigate these challenges while capitalizing on growth opportunities. This exploration will provide a comprehensive view of the company's current standing and future prospects.

In 2024, TriMark USA held an estimated 4.7% of the U.S. Restaurant & Hotel Equipment Wholesaling industry's revenue. It is recognized as an 'All Star' due to its strong market share, profit, and revenue growth, outperforming its peers. The company's market position is crucial for understanding its influence and potential within the foodservice industry.

TriMark faces several risks, including intensified competition, particularly from direct sales by manufacturers, which may affect its market share. Economic downturns, inflation, and shifts in consumer spending can decrease demand. Supply chain disruptions and labor shortages, projected into 2024/2025, pose additional challenges.

TriMark USA aims to expand its coast-to-coast equipment, design, and smallware solutions. Growth opportunities exist in markets like national chains, healthcare, and education. Investment in technological advancements, such as AI-driven inventory management, could enhance efficiency. The robotics in foodservice market is projected to reach $2.8 billion by 2025.

TriMark's liquidity is considered weak, with significant refinancing risk related to its ABL facility maturing in July 2025. The company reported negative free cash flow in the first quarter of 2024, following a deficit in the fourth quarter of 2023. This information is crucial for evaluating the financial health of the TriMark USA business.

The foodservice equipment market is projected to grow with a CAGR of 5.2% from 2024 to 2032. The healthcare foodservice market is expected to reach $25.6 billion by 2025, presenting a significant growth opportunity for TriMark USA. Strategic initiatives include leveraging its recent equity injection to expand its market presence.

- Competition from direct sales by manufacturers poses a threat.

- Economic downturns and inflation can decrease demand.

- Supply chain disruptions and labor shortages are significant risks.

- Technological advancements, like AI and robotics, offer opportunities.

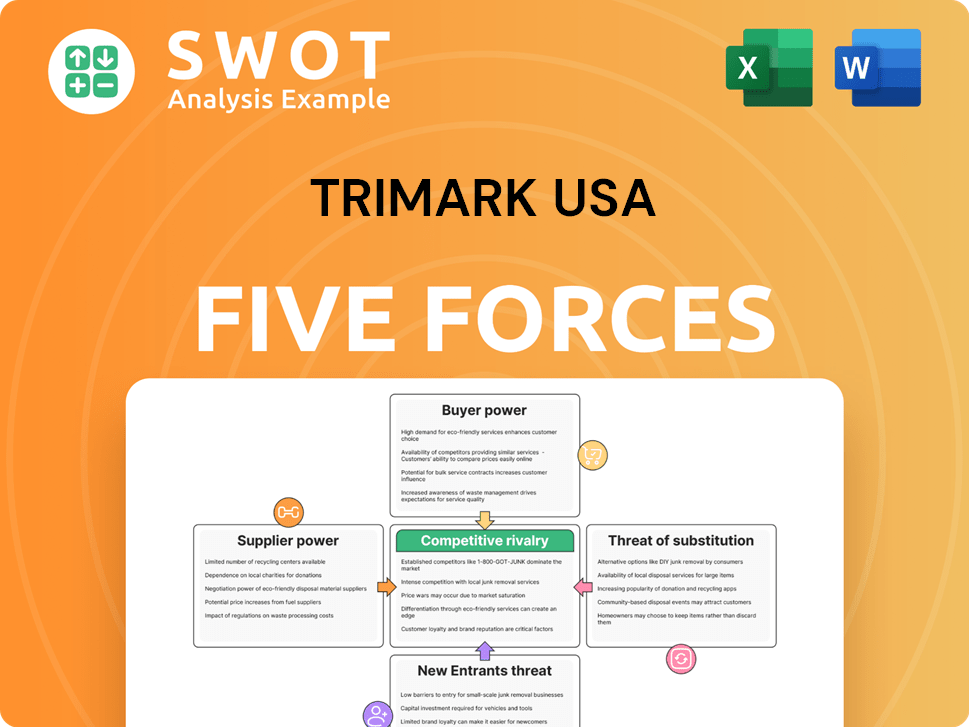

TriMark USA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TriMark USA Company?

- What is Competitive Landscape of TriMark USA Company?

- What is Growth Strategy and Future Prospects of TriMark USA Company?

- What is Sales and Marketing Strategy of TriMark USA Company?

- What is Brief History of TriMark USA Company?

- Who Owns TriMark USA Company?

- What is Customer Demographics and Target Market of TriMark USA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.