TriMark USA Bundle

Who Really Owns TriMark USA?

Understanding the ownership structure of a company is crucial for investors and business strategists alike. TriMark USA, a leading distributor in the foodservice industry, has a fascinating ownership history that has significantly shaped its growth and market position. From its humble beginnings to its current status, the evolution of TriMark USA SWOT Analysis reveals key strategic shifts.

This exploration dives deep into the TriMark ownership journey, examining its founders, key investors, and the impact of these changes on the company's operations. We'll uncover the answers to questions like "Who is the CEO of TriMark USA?" and "Where is TriMark USA based?" while also examining the company's financial performance and its competitive landscape. Discover how TriMark USA's ownership has influenced its relationships with TriMark distributors and suppliers, and its overall strategic direction.

Who Founded TriMark USA?

The story of TriMark USA begins with Harry Halpern, who established a small family business in 1947. This initial venture, focused on selling brewing supplies, was the genesis of what would evolve into a major player in the foodservice equipment and supplies sector. While specific details on the initial ownership structure aren't publicly available, the company started as a family-owned, regional dealership.

The company's journey from a regional entity to a national presence was significantly shaped by private equity involvement. The transition marked a shift towards external ownership and a period of rapid expansion. The company's evolution demonstrates how strategic financial partnerships can drive significant growth and transformation within the foodservice industry.

The early years of the

Harry Halpern founded the business in 1947 in North Smithfield, Rhode Island, starting as a seller of brewing supplies. This laid the foundation for the future

Initially, the company operated as a family-owned, regional dealership. Details on the exact equity splits during its inception are not publicly available.

In 1998, Bradford Equities invested, marking the beginning of external ownership. This investment fueled a period of aggressive growth and expansion.

During Bradford Equities' ownership, sales increased significantly. Several dealerships were acquired to expand the company's national presence.

Harry Halpern retired towards the end of Bradford's ownership. Jerry Hyman, who was not a family member, was appointed CEO in 2005.

The company's evolution involved strategic moves that transformed it into a major player in the foodservice industry. The company's headquarters relocated to South Attleboro, Massachusetts, in August 2000, and the name

- 1947: Harry Halpern founds the company.

- 1998: Bradford Equities invests, marking the beginning of private equity ownership.

- 2000: Headquarters relocated to South Attleboro, Massachusetts.

-

2001: The name

is formally introduced. - 2005: Jerry Hyman becomes CEO.

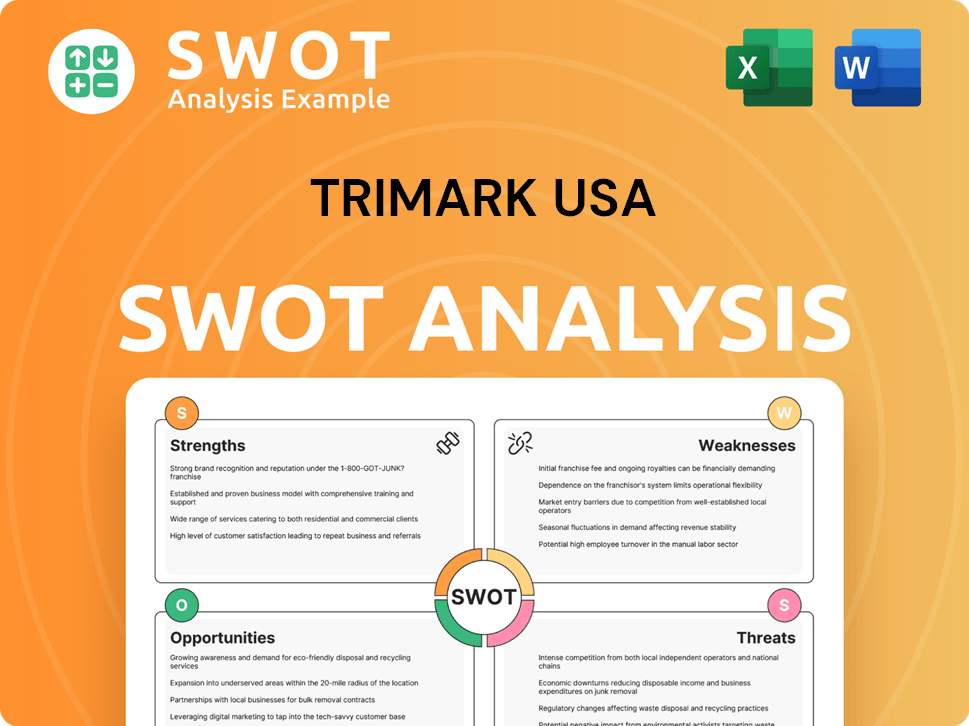

TriMark USA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TriMark USA’s Ownership Changed Over Time?

The ownership of TriMark USA has changed hands several times, mainly through private equity firms. The company's journey began with Bradford Equities, followed by Audax Group, which acquired TriMark in late 2006. Under Audax's ownership, TriMark expanded significantly, completing six acquisitions and increasing sales to nearly $1 billion over seven years. This expansion cemented its position as a leading foodservice equipment and supplies dealer.

In August 2014, Warburg Pincus took over from Audax Group. Warburg Pincus continued the growth strategy, adding three more acquisitions and boosting annual sales to $1.8 billion within three years. Key acquisitions during this period included Hockenbergs Food Service Equipment & Supply, R.W. Smith & Co., and Adams-Burch. The most recent ownership change occurred in August 2017 when Centerbridge Partners LP acquired TriMark USA from Warburg Pincus. Centerbridge Partners supported TriMark's 'buy-and-build' strategy through acquisitions.

| Ownership Phase | Owner | Key Events |

|---|---|---|

| Late 2006 - August 2014 | Audax Group | Completed six add-on acquisitions; Sales grew to nearly $1 billion. |

| August 2014 - August 2017 | Warburg Pincus | Completed three more acquisitions; Sales reached $1.8 billion. |

| August 2017 - January 2024 | Centerbridge Partners LP | Continued 'buy-and-build' strategy; Supported acquisitions. |

| January 2024 - Present | Ares Management, Oaktree Capital Management, Bayside Capital | $350 million cash equity investment; Substantial deleveraging of balance sheet. |

As of November 2024, TriMark USA is a private company backed by private equity. Major stakeholders include Centerbridge Partners, Ares Management, Oaktree Capital Management, and Bayside Capital. In December 2023, TriMark announced a transaction with lenders, led by Ares Management, Oaktree Capital Management, and Bayside Capital, involving a $350 million cash equity investment. This led to these lenders taking a controlling ownership stake in January 2024, converting much of their debt into equity. This significantly reduced the ownership stake of previous private equity sponsors, Centerbridge Partners and Blackstone, from a controlling near 90% position to a small minority stake. This restructuring aimed to deleverage the balance sheet and support future growth for TriMark USA.

TriMark USA's ownership has evolved through various private equity firms, each driving growth through acquisitions.

- Audax Group, Warburg Pincus, and Centerbridge Partners have all played key roles.

- Recent restructuring involved a $350 million cash equity investment from lenders.

- Ares Management, Oaktree Capital Management, and Bayside Capital now hold a controlling stake.

- The company's history is marked by strategic acquisitions and financial restructuring.

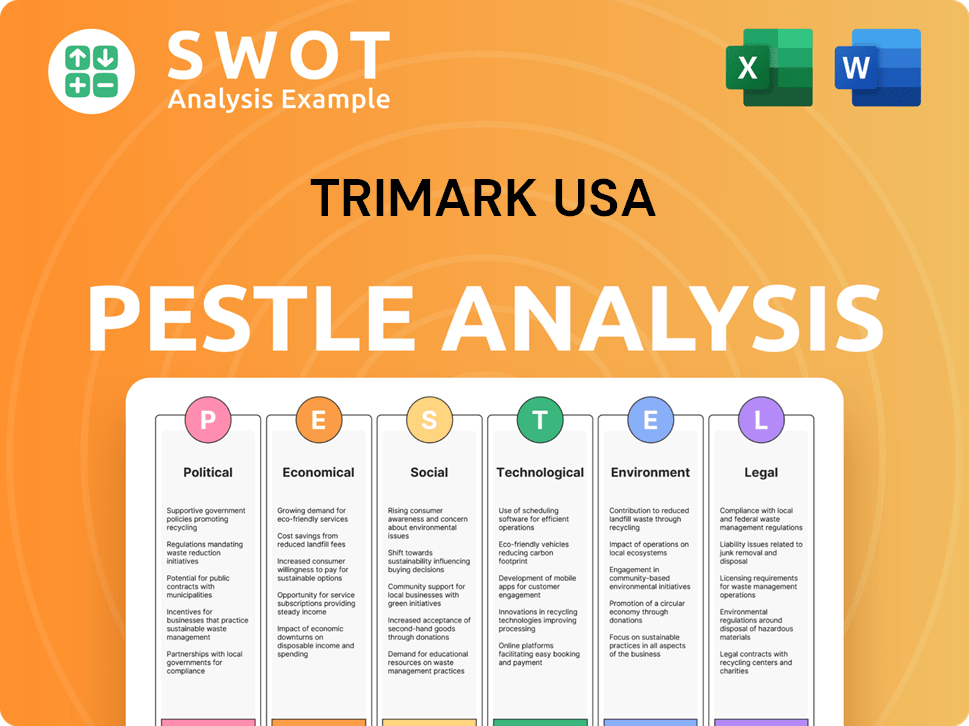

TriMark USA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TriMark USA’s Board?

As a privately held entity, the specifics of the TriMark USA board of directors and its voting structure are not publicly available. However, recent leadership changes offer some insight into the current governance. In October 2024, Terry O'Brien assumed the role of CEO, succeeding Tom Wienclaw. Jim Clough was appointed Chairman of the Board. Clough's experience includes over 35 years in retail and foodservice, and he currently serves as chairman of the board at GS Foods and a board member at Aspire Bakeries. O'Brien's background includes CEO and board director roles at Chef Holdings and CTI Foods.

Jerry Hyman, former CEO, transitioned to Vice Chairman of the Board in 2022 and continues to support the company. The board likely reflects the interests of major private equity stakeholders, particularly after the January 2024 debt-for-equity restructuring. Lenders, including Ares Management, Oaktree Capital Management, and Bayside Capital, now hold a controlling ownership stake. This shift suggests significant influence over strategic decisions and governance by these new controlling lenders. Information regarding TriMark ownership and its parent company is not publicly available.

| Board Member | Title | Notes |

|---|---|---|

| Terry O'Brien | CEO | Succeeded Tom Wienclaw in October 2024 |

| Jim Clough | Chairman of the Board | Chairman of the board at GS Foods |

| Jerry Hyman | Vice Chairman of the Board | Former CEO, transitioned in 2022 |

The significant ownership stake held by the lending consortium implies considerable influence over TriMark company's strategic direction. While the exact voting structures, such as dual-class shares, are not disclosed for private companies, the controlling ownership by lenders indicates their substantial impact on decision-making. For more information, you can check the Competitors Landscape of TriMark USA.

The board is currently led by CEO Terry O'Brien and Chairman Jim Clough. The shift in ownership to a lending consortium, including Ares Management and Oaktree Capital Management, suggests a significant influence on the company's strategic decisions. TriMark USA's financial information is not publicly available due to its private status.

- Terry O'Brien is the current CEO.

- Jim Clough serves as Chairman of the Board.

- Lenders now hold a controlling ownership stake.

- Jerry Hyman is the Vice Chairman of the Board.

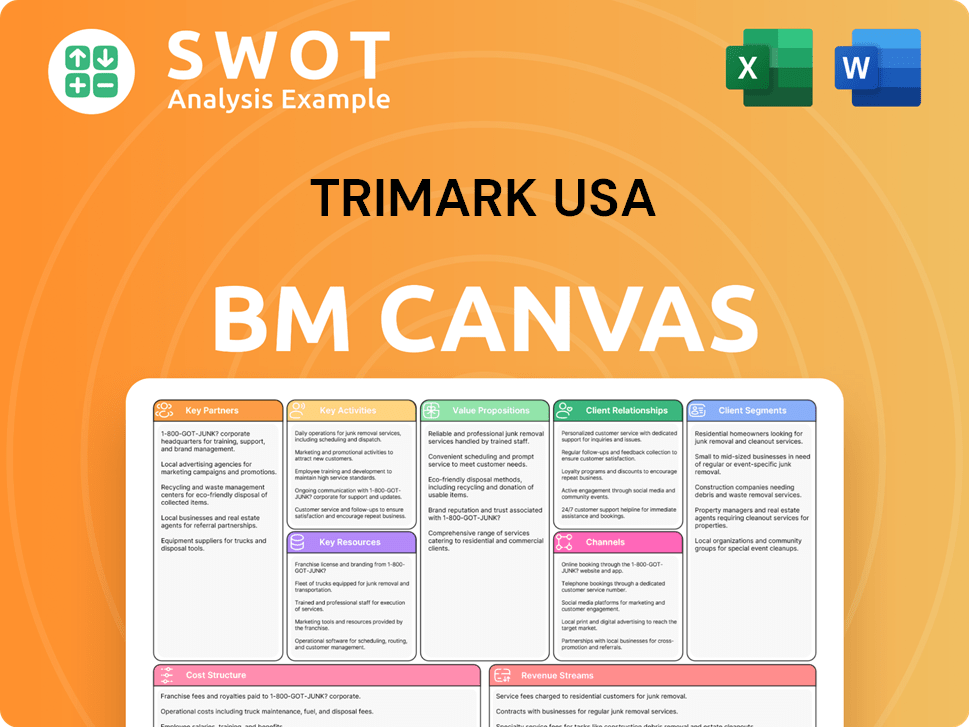

TriMark USA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TriMark USA’s Ownership Landscape?

Over the past few years, significant changes have reshaped the ownership structure of TriMark USA. In January 2024, a major restructuring occurred, with lenders like Ares Management, Oaktree Capital Management, and Bayside Capital investing $350 million in cash equity. This move saw these lenders take control, converting much of their debt into equity. This shift considerably reduced the ownership stakes of former private equity sponsors, Centerbridge Partners and Blackstone.

This restructuring aimed to reduce TriMark's debt significantly. The company's outstanding debt was targeted to decrease from over $1 billion to between $300 million and $400 million. Despite this effort, TriMark faced challenges in the first quarter of 2024, with sales decreasing by 7.9% to $518.6 million. The company's revenue in 2023 was reported at $2.37 billion, and $2.5 billion in 2024, making it the country's second-largest foodservice equipment and supplies dealer.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue | $2.37 billion | $2.5 billion |

| Sales Decline (Q1 2024) | N/A | 7.9% |

| Debt Reduction (Target) | Over $1 billion | $300 - $400 million |

The foodservice equipment and supplies market is seeing a trend toward institutional ownership and private equity involvement. TriMark USA's growth strategy has been built on acquisitions, buying regional dealerships to expand its national footprint. Recent leadership changes in October 2024, with Terry O'Brien becoming CEO and Jim Clough taking on the Chairman role, are designed to drive strategic initiatives. The company continues to focus on leveraging its distribution network and services to meet foodservice challenges and expand its reach.

The 2024 restructuring saw lenders gain control through a cash equity investment. This shifted ownership from previous private equity sponsors. The goal was to reduce TriMark's substantial debt load.

Sales decreased in Q1 2024, despite a substantial revenue in 2023 and 2024. The company experienced negative free cash flow during the period. The company is the second largest foodservice equipment and supplies dealer.

New leadership in October 2024 aims to drive strategic initiatives. The company focuses on national distribution and comprehensive services. Expansion and efficiency remain key priorities.

The foodservice equipment market shows increasing institutional ownership. TriMark has a history of acquisitions for growth. The trends influence the company's strategic direction.

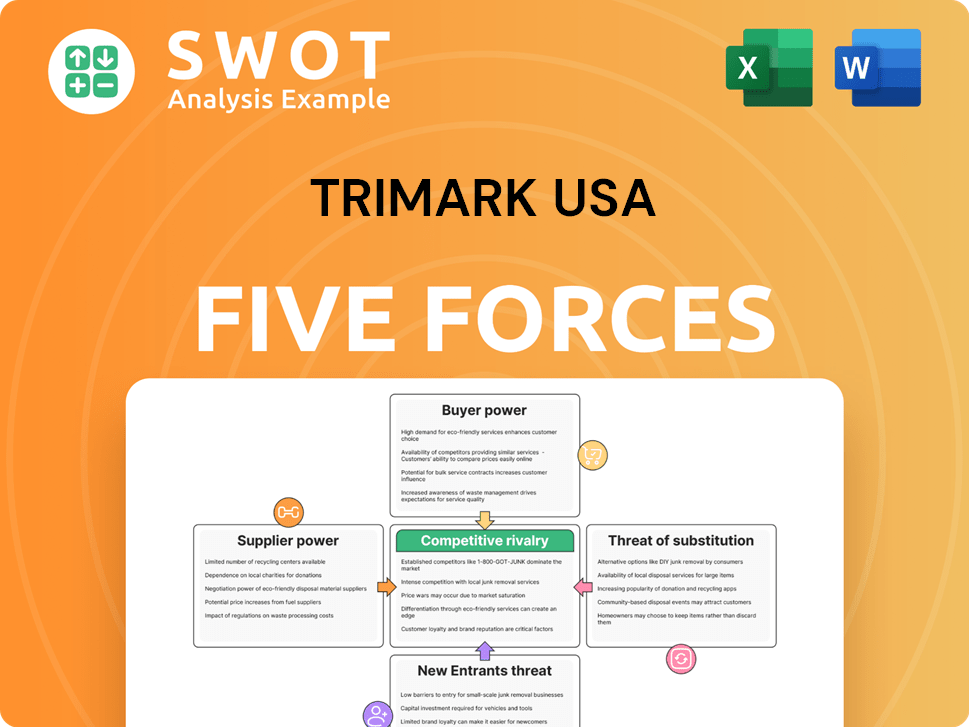

TriMark USA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TriMark USA Company?

- What is Competitive Landscape of TriMark USA Company?

- What is Growth Strategy and Future Prospects of TriMark USA Company?

- How Does TriMark USA Company Work?

- What is Sales and Marketing Strategy of TriMark USA Company?

- What is Brief History of TriMark USA Company?

- What is Customer Demographics and Target Market of TriMark USA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.