Valid SA Bundle

Decoding Valid SA Company: How Does It Thrive?

In a world increasingly reliant on secure digital interactions, understanding the inner workings of Valid SA Company is more critical than ever. This South African Company, a key player in identification, data, and cybersecurity, offers essential solutions across various sectors. From civil identification to banking, Valid SA's influence is widespread, making its operational model a key area of interest.

For investors evaluating its potential, customers depending on its security, and industry observers tracking digital transformation, grasping Valid SA's business model is paramount. This analysis will delve into its revenue streams, competitive advantages, and strategic direction, providing a comprehensive understanding. Explore the Valid SA SWOT Analysis to gain further insights into its strengths, weaknesses, opportunities, and threats, offering a complete picture of this important South African Company.

What Are the Key Operations Driving Valid SA’s Success?

Valid S.A., a leading South African Company, focuses on delivering secure identification, data, mobility, IoT, and cybersecurity solutions. The company operates across diverse sectors, providing essential services to governments, financial institutions, and telecom companies. Their core offerings include civil identification, digital certification, banking solutions, telecom solutions, and track and trace systems, all designed to meet stringent security and operational efficiency standards.

The value proposition of Valid S.A. lies in its ability to enhance security, streamline digital processes, and improve operational efficiency for its clients. This is achieved through a combination of advanced technologies, large-scale production capabilities, and a global distribution network. The company's integrated approach to both physical and digital security, along with its adaptability to new technologies, positions it as a key player in the market.

The operational processes at Valid S.A. are highly specialized, involving secure manufacturing, personalization services, and robust data management. For digital certification and cybersecurity, the company utilizes advanced cryptographic technologies and secure infrastructure. In mobility and IoT, Valid S.A. develops secure connectivity solutions and device management platforms. Their supply chain incorporates specialized materials, and their distribution networks reach clients worldwide. The company's expertise in secure identification and its integrated approach to security are key differentiators. To learn more about the company's background, you can read a Brief History of Valid SA.

Valid S.A. offers a wide range of products and services, including civil identification documents like national ID cards and driver's licenses. They also provide digital certification services, banking solutions, telecom solutions, and track and trace systems. These offerings are designed to meet the diverse needs of their clients across various industries.

The operational processes involve secure manufacturing, data management, and the deployment of advanced technologies. This includes the use of cryptographic technologies for digital certification and the development of secure connectivity solutions for mobility and IoT. These processes are crucial for ensuring the security and efficiency of their products.

Valid S.A. serves a broad customer base, including governments, financial institutions, and telecommunications companies. They also cater to various other industries that require robust security and identification frameworks. This diverse customer base highlights the versatility and importance of their solutions in the market.

The company's value proposition centers on enhanced security, streamlined digital processes, and improved operational efficiency. This is achieved through a combination of advanced technologies, large-scale production capabilities, and a global distribution network. Their integrated approach to both physical and digital security sets them apart.

Valid S.A.'s long-standing experience in secure identification and its integrated approach to both physical and digital security are key differentiators. The company's ability to adapt to new technological paradigms, such as IoT and advanced cybersecurity threats, further strengthens its position in the market. Their focus on innovation and security makes them a reliable partner.

- Expertise in secure technology development

- Large-scale production capabilities

- Global logistics and distribution networks

- Adaptability to new technologies

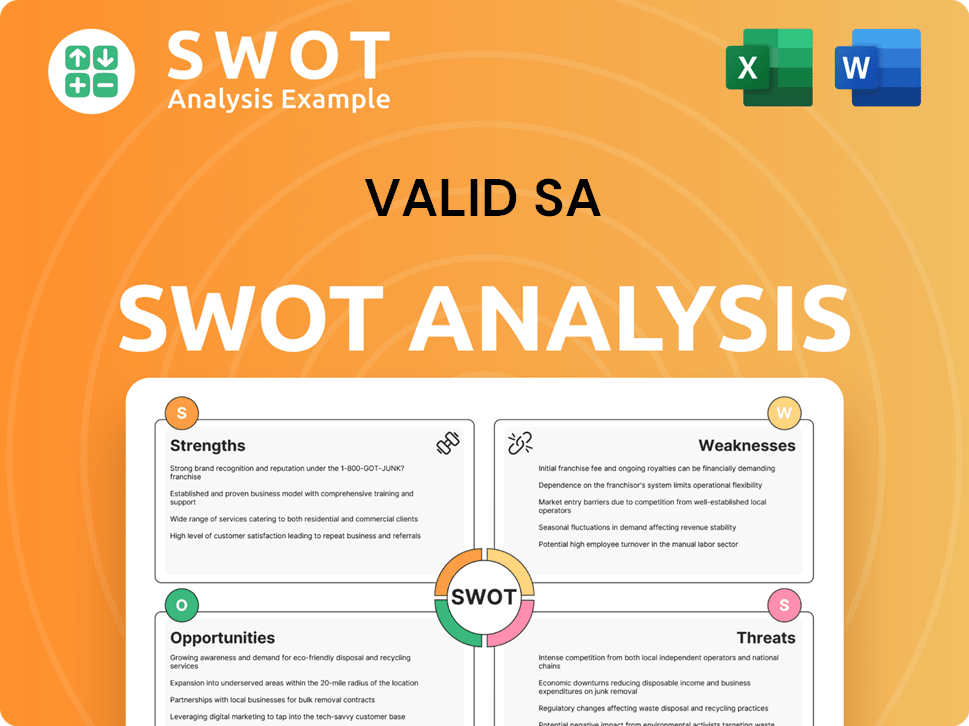

Valid SA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Valid SA Make Money?

The primary revenue streams for Valid S.A. involve the sale of its specialized products and services. These offerings span various segments, with significant contributions from product sales, particularly in civil identification and banking solutions. Additionally, the company generates revenue through subscriptions and licensing fees for its digital certification, cybersecurity, and potentially IoT platforms.

Valid S.A.'s monetization strategies often include a blend of upfront product sales, recurring service fees, and project-based revenue. For instance, contracts for national ID cards involve substantial product sales, while ongoing services like digital certificate validation generate recurring income. The company may also use tiered pricing models for digital services, offering different levels of security or functionality based on client needs.

Over time, Valid S.A. has likely seen a shift towards more revenue from digital services and recurring subscriptions. This reflects the broader digital transformation trend across the industries it serves. The evolution in revenue mix complements its traditional hardware-centric offerings, adapting to market demands.

Valid S.A. employs several strategies to generate revenue and monetize its offerings. Understanding these strategies is crucial for anyone interested in Marketing Strategy of Valid SA or considering business in South Africa.

- Product Sales: A significant portion of revenue comes from selling physical products like cards and related secure components, especially in civil identification and banking solutions. This is a key aspect of understanding the requirements for SA company registration.

- Subscriptions and Licensing: Recurring income is generated through subscriptions and licensing fees for digital certification, cybersecurity, and potentially IoT platforms. This model provides a stable revenue stream and is essential for SA company compliance regulations.

- Transaction Fees: The company may earn fees from processing secure transactions, particularly in its banking and payment solutions. This is another facet of how a South African Company operates.

- Project-Based Revenue: Large-scale projects, such as national ID card deployments, generate significant upfront revenue. This is often tied to the SA company registration process.

- Tiered Pricing: Digital services may be offered with tiered pricing models, providing different levels of security or functionality based on client needs. This flexibility is a key benefit of a Valid SA Company.

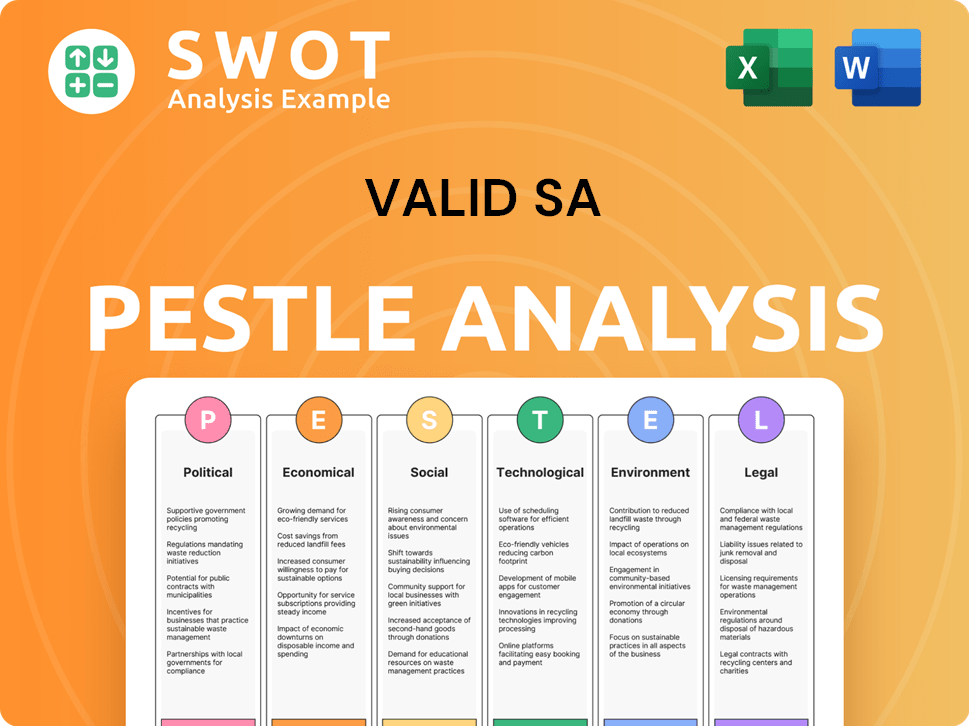

Valid SA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Valid SA’s Business Model?

The journey of Valid S.A., a prominent South African Company, has been marked by several key milestones that have significantly influenced its operational and financial outcomes. These achievements include pivotal product launches in digital identification, strategic expansions into new geographical markets, and the formation of strategic partnerships aimed at bolstering its technology stack and market reach. For instance, successful deployments of large-scale national identification programs or substantial contracts with major financial institutions represent critical operational successes. Understanding the Growth Strategy of Valid SA provides further insights into its strategic initiatives.

The strategic moves of Valid S.A. have been characterized by a proactive approach to navigating challenges and seizing opportunities. The company has consistently invested in research and development to maintain its technological edge, undertaken strategic acquisitions to broaden its capabilities and market share, and diversified its service offerings to minimize reliance on single product lines. These actions are designed to ensure adaptability and resilience in a dynamic market environment.

Valid S.A.'s competitive edge is multifaceted, stemming from its established brand reputation and technological leadership. Its strong brand, particularly in sectors demanding high security and reliability, such as government and finance, is a significant asset. Furthermore, its expertise in secure identification, cryptography, and smart card technologies provides a substantial barrier to entry for competitors. Economies of scale in manufacturing and personalization of secure documents also contribute to its cost-effectiveness.

Major product launches in digital identification have been pivotal. Expansion into new geographical markets has been a strategic move. Strategic partnerships have enhanced technology and market reach.

Continuous investment in R&D to maintain technological leadership. Strategic acquisitions to expand capabilities and market share. Diversification of service offerings to reduce reliance on single product lines.

Long-standing brand strength and reputation in secure sectors. Technological leadership in secure identification and cryptography. Economies of scale in manufacturing and personalization.

Evolving regulatory landscapes in data privacy and digital security. Global supply chain disruptions impacting hardware production. Intense competition from established players and startups.

To address the proliferation of IoT devices and increasing cyber threats, Valid S.A. is investing in innovation. This includes expanding cloud-based security offerings and integrating AI into solutions to anticipate and counter emerging threats. The company is also likely focusing on compliance with evolving regulations, such as those related to data protection, which is crucial for maintaining its market position.

- Investment in cloud-based security offerings.

- Integration of AI to counter emerging threats.

- Focus on compliance with data protection regulations.

- Continuous R&D to stay ahead of technological advancements.

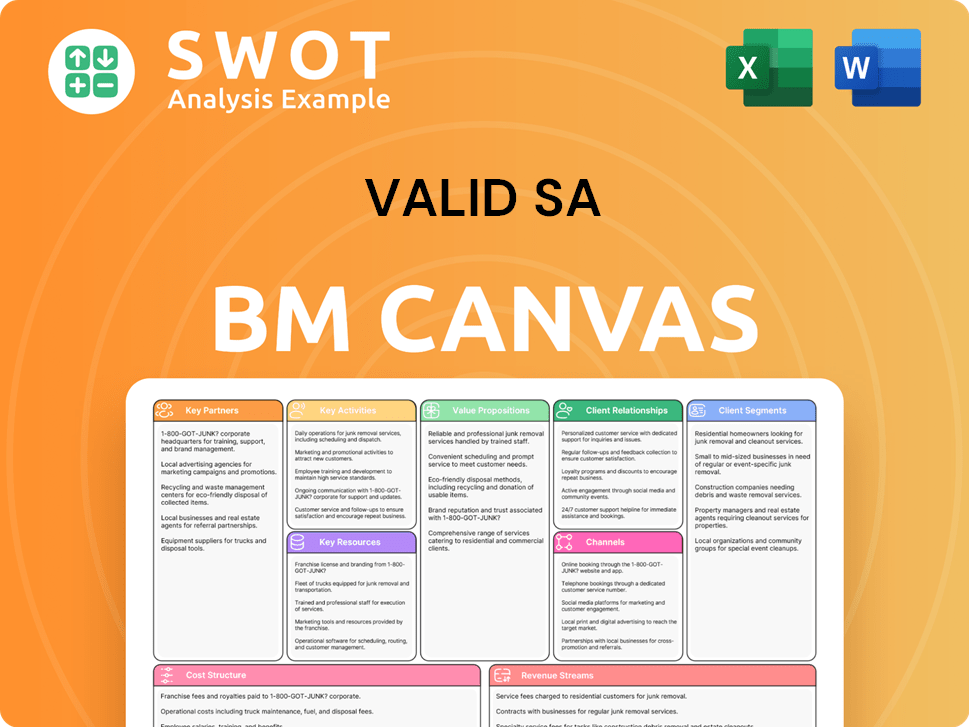

Valid SA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Valid SA Positioning Itself for Continued Success?

The SA Company holds a prominent position within the identification, data, mobility, IoT, and cybersecurity sectors. Its established presence with governments and large enterprises underscores its market strength. While specific market share data for 2024-2025 is subject to ongoing analysis, its long-standing contracts and specialized offerings suggest a firm foothold in its niche markets, particularly in civil identification and secure banking solutions. Customer loyalty is likely high due to the critical and embedded nature of its services, which often involve complex integrations and high security requirements. The company's global reach, serving clients across various continents, further solidifies its market standing.

However, the Valid SA Company faces several key risks and headwinds. Regulatory changes, particularly concerning data privacy (e.g., GDPR-like regulations globally) and digital identity standards, could necessitate significant operational adjustments and investments. The emergence of new competitors, especially agile tech startups focusing on niche cybersecurity or decentralized identity solutions, poses a constant threat. Technological disruption, such as advancements in biometric authentication or quantum computing, could impact the relevance of existing solutions if the company fails to innovate rapidly. Changing consumer preferences towards purely digital interactions could also diminish demand for physical identification products over time.

The company's strong presence in civil identification and secure banking solutions indicates a robust market position. Its global reach and long-standing contracts contribute to its market standing. The critical nature of its services often leads to high customer loyalty.

Regulatory changes, especially in data privacy, pose a significant risk. Competition from agile tech startups and technological disruptions, such as advancements in biometric authentication, also present challenges. Changing consumer preferences towards digital interactions could impact demand.

The company is likely investing in R&D for digital identity solutions and expanding into new IoT and cybersecurity verticals. Strategic partnerships or acquisitions could enhance its capabilities. The focus is on capitalizing on global demand for secure digital transformation.

Focus on recurring revenue streams from digital services is a key strategy. Diversifying the client base while maintaining relationships with government and financial institutions is essential. The company aims to leverage its core expertise for the evolving needs of a connected world.

The company's strategic initiatives include continued investment in research and development for next-generation digital identity solutions. Expansion into new high-growth IoT and cybersecurity verticals is also a priority, along with potential strategic partnerships or acquisitions. These efforts are aimed at enhancing technological capabilities and market penetration.

- The global cybersecurity market is projected to reach $345.7 billion in 2024, growing to $466.7 billion by 2029.

- The digital identity market is expected to grow, driven by increasing demand for secure online transactions and authentication.

- The company plans to sustain and expand revenue by capitalizing on the global demand for secure digital transformation.

- Focus on recurring revenue streams from digital services and client base diversification are key strategies.

For a deeper understanding of the potential customer base, refer to the article about Target Market of Valid SA.

Valid SA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valid SA Company?

- What is Competitive Landscape of Valid SA Company?

- What is Growth Strategy and Future Prospects of Valid SA Company?

- What is Sales and Marketing Strategy of Valid SA Company?

- What is Brief History of Valid SA Company?

- Who Owns Valid SA Company?

- What is Customer Demographics and Target Market of Valid SA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.