Valid SA Bundle

Who Really Owns Valid S.A.?

Understanding a company's ownership is paramount for investors and stakeholders alike. It unveils the power dynamics, strategic priorities, and potential risks that shape a company's future. This deep dive into Valid S.A. explores its ownership structure, a key factor in its evolution and current market position.

Valid S.A., a Brazilian powerhouse, has a fascinating ownership story, evolving significantly since its inception in 1957. From its roots in high-security printing to its current status as a global leader in identification and security solutions, the Valid SA SWOT Analysis can help you understand the current market. This analysis will help you understand who controls the company and how it impacts its strategic direction. Uncover the details of Valid SA ownership, including Valid SA shareholders and directors, to make informed decisions.

Who Founded Valid SA?

The story of Valid S.A. begins in Brazil in 1957, as a subsidiary of the British security printing firm, Thomas De La Rue. The specifics of the initial founders and their equity distribution aren't publicly available. However, its origin as a subsidiary suggests that Thomas De La Rue held the primary ownership stake during its early years. This structure set the stage for the company's initial operations and strategic direction.

In 1994, American Banknote Corporation acquired Thomas de La Rue, leading to the company's renaming to American Banknote, and later, ABNote in 1999. This acquisition was a pivotal moment, transferring control from the original English parent company to American Banknote Corporation. This change marked a significant shift in the company's ownership and strategic focus.

During this period, the details of early agreements and their impact on ownership are not extensively documented in public records. As a subsidiary, it's reasonable to infer that strategic decisions and financial control largely rested with the parent company, American Banknote Corporation. Any internal ownership matters within the subsidiary would have been managed under the purview of American Banknote Corporation. The founding vision was aligned with the parent company's objectives in the security printing sector.

Valid S.A. started as a subsidiary, indicating Thomas De La Rue held initial control.

American Banknote Corporation's acquisition in 1994 shifted ownership.

Strategic decisions and financial control were largely with the parent company.

Internal ownership matters were likely managed by American Banknote Corporation.

The initial vision was aligned with the parent company's goals in security printing.

The company's ownership structure has evolved significantly since its inception.

Understanding the early ownership of Valid S.A. is crucial for grasping its historical development and strategic direction. The shift from Thomas De La Rue to American Banknote Corporation highlights the dynamic nature of corporate ownership. For those interested in a deeper dive, exploring the Competitors Landscape of Valid SA can provide additional context on the company's position within the industry and its competitors.

- Valid S.A. started as a subsidiary of Thomas De La Rue.

- American Banknote Corporation acquired the company in 1994.

- Early strategic decisions were largely influenced by the parent company.

- The ownership structure has evolved over time.

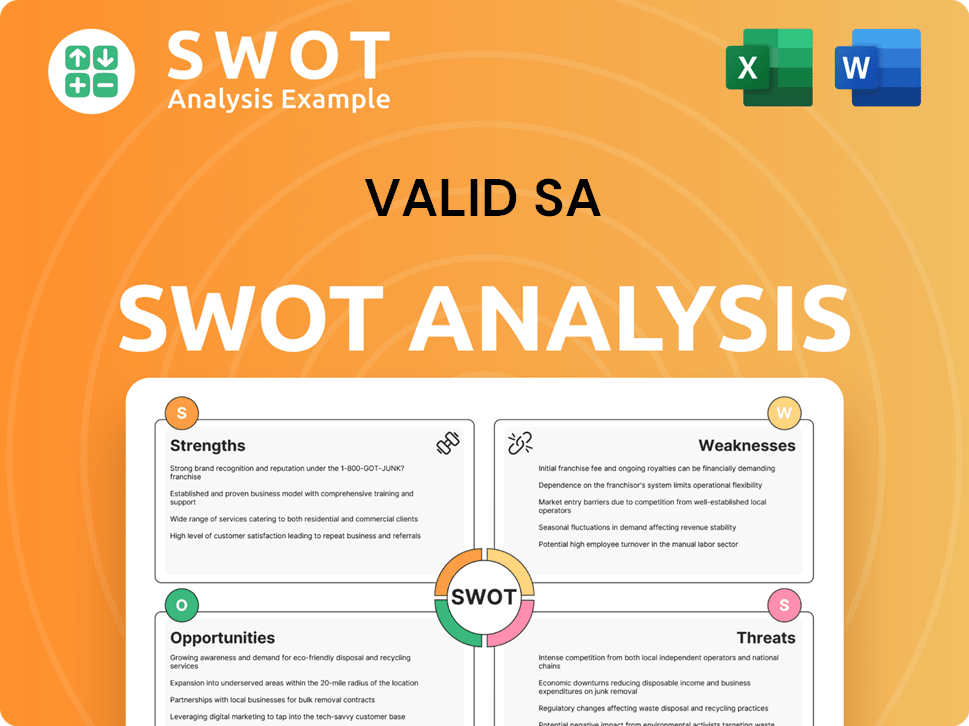

Valid SA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Valid SA’s Ownership Changed Over Time?

The journey of Valid S.A. from its origins to its current ownership structure is marked by key milestones. Initially, the company operated under a different structure, but a pivotal shift occurred with its initial public offering (IPO) in 2006. This transition signaled a move toward broader market participation. The company's name changed in October 2010, marking a significant evolution in its identity and ownership dynamics. This transformation from a subsidiary to a publicly traded entity has been a defining aspect of its corporate history.

The evolution of Valid S.A.'s ownership reflects its strategic growth and adaptation to market dynamics. The change from a subsidiary to a publicly traded company, coupled with shifts in major shareholdings, highlights a focus on broader market participation and access to capital. The influence of institutional investors, such as Alaska Asset Management and BTG Pactual, indicates a commitment to long-term value creation and potentially a more disciplined approach to governance.

| Event | Date | Impact |

|---|---|---|

| IPO | 2006 | Transitioned to a publicly traded company. |

| Name Change | October 2010 | American Banknote Corporation ceased to be the main shareholder; changed name to Valid. |

| Shareholder Composition | February 13, 2025 | Predominantly institutional investors. |

As of February 13, 2025, the ownership of Valid S.A. is primarily held by institutional investors. With a total of 81,836,375 common shares, the largest shareholder is Alaska Asset Management, holding a significant stake of 34.49%. Other major shareholders include BTG Pactual Family Office with 11.28%, 4UM Gestão de Recursos with 3.75%, and Organon Capital with 3.56%. Valid S.A. itself holds 3.76% of its own shares. The remaining 43.16% is distributed among various other shareholders. Understanding the current Valid SA ownership structure is key. For those looking to understand the company's structure, searching for Who owns Valid SA or researching Valid SA shareholders can provide valuable insights.

The ownership of Valid S.A. has evolved significantly, with a shift from a subsidiary to a publicly traded company. The major shareholders are primarily institutional investors, including Alaska Asset Management and BTG Pactual Family Office.

- Alaska Asset Management is the largest shareholder, holding 34.49% of the shares.

- The company’s strategic direction and governance are influenced by these major shareholders.

- The current ownership structure reflects a focus on long-term value creation.

- For more details, you can check out this article about Valid SA: 0.

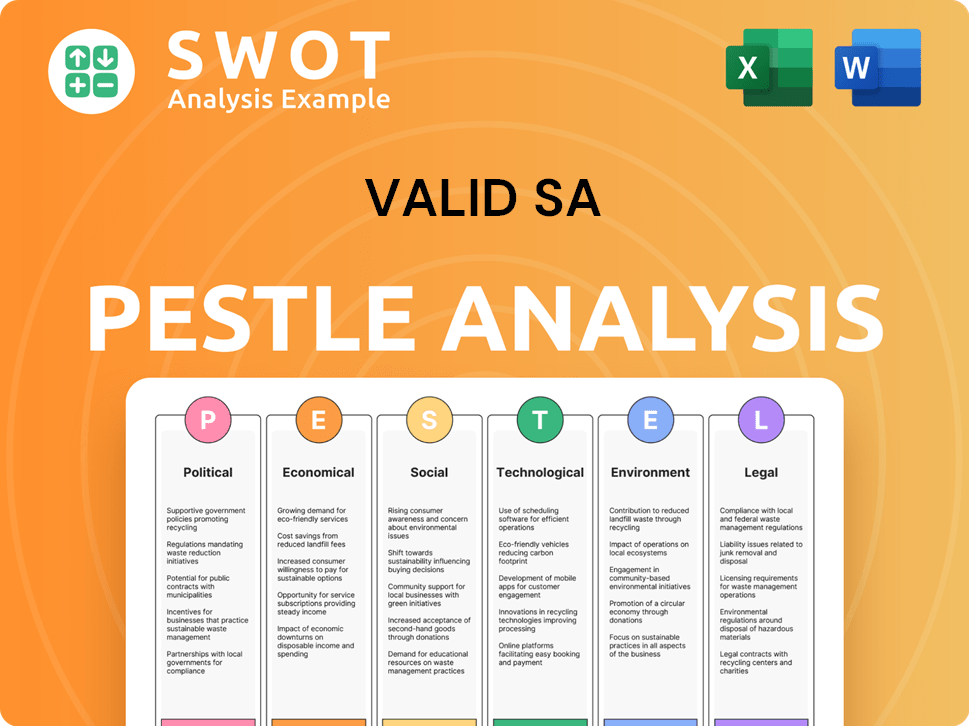

Valid SA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Valid SA’s Board?

The Board of Directors of Valid S.A. oversees the company's strategy and governance. As of April 17, 2024, the Chairman of the Board is Mr. Sidney Levy, and the CEO, Mr. Ilson Roque Bressan, is also a board member. The Supervisory Board included Mr. William Cordeiro, Mr. Vanderlei Dominguez da Rosa, and Mr. Regis Lemos de Abreu. Understanding the structure of Valid SA ownership and the roles of its key figures is essential for anyone looking into Valid SA company information.

In a Brazilian 'Sociedade Anônima' (S.A.), the board is elected by shareholders. Resolutions typically pass by a simple majority, unless the bylaws state otherwise. The annual global remuneration for administrators for the 2024 financial year was approved at up to BRL 21,167,174.45. Of this, BRL 2,628,852.36 was allocated to Board members, and BRL 18,538,322.09 to the Executive Board members. Knowing who owns Valid SA and the governance structure provides insight into the company's decision-making processes. For more details, you can explore the Growth Strategy of Valid SA.

| Board Member | Title | Date Joined (as of April 17, 2024) |

|---|---|---|

| Sidney Levy | Chairman | N/A |

| Ilson Roque Bressan | CEO & Board Member | April 17, 2024 |

| William Cordeiro | Supervisory Board Member | April 17, 2024 |

| Vanderlei Dominguez da Rosa | Supervisory Board Member | April 17, 2024 |

| Regis Lemos de Abreu | Supervisory Board Member | April 17, 2024 |

At the Ordinary General Meeting on April 17, 2024, shareholders representing 63.98% of the voting share capital were present. This highlights the importance of shareholder participation in the governance of Valid SA. The presence of institutional investors suggests their potential influence through board representation or active engagement. Understanding the roles of Valid SA directors and Valid SA shareholders is key to assessing the company's direction.

The Board of Directors plays a vital role in Valid S.A.'s governance, elected by shareholders. Resolutions are typically passed by a simple majority, unless stated otherwise in the bylaws.

- The Chairman of the Board is Mr. Sidney Levy.

- The CEO, Mr. Ilson Roque Bressan, joined the board as of April 17, 2024.

- Annual remuneration for administrators was approved at up to BRL 21,167,174.45 for 2024.

- Shareholders representing 63.98% of voting share capital attended the Ordinary General Meeting on April 17, 2024.

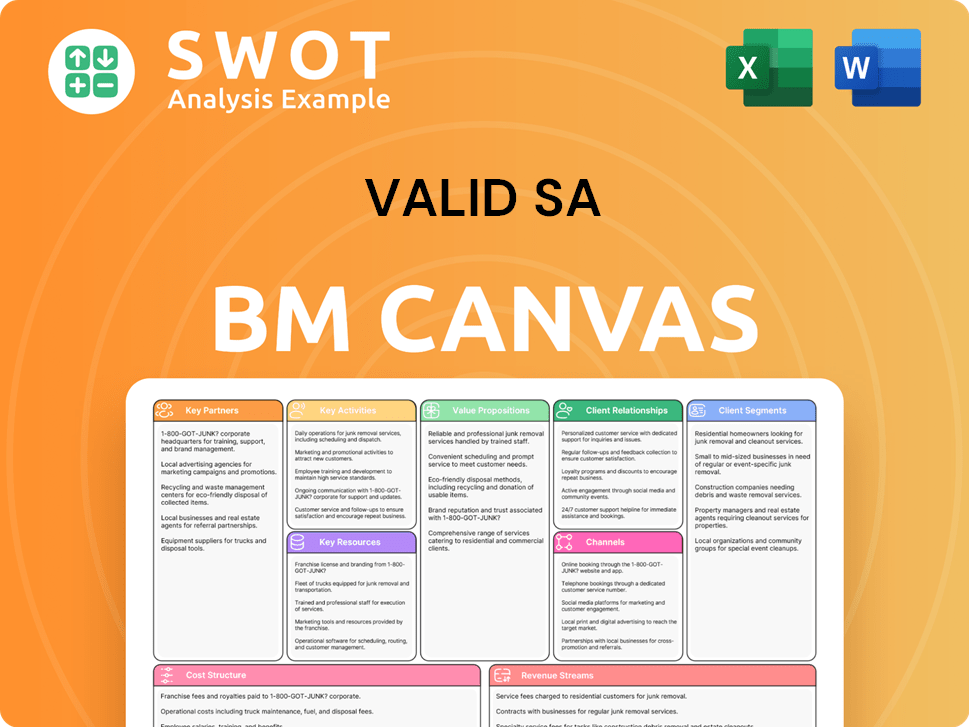

Valid SA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Valid SA’s Ownership Landscape?

Over the past few years, Valid SA's approach to portfolio and capital management has been dynamic. The company has focused on a blend of digital and physical solutions, along with multichannel platforms. Financially, Valid Soluções S.A. reported sales of BRL 2,171.34 million for the full year ended December 31, 2024, with a net income of BRL 380.91 million. As of March 31, 2025, Valid's trailing 12-month revenue was $390 million. These figures demonstrate the company's growth and strategic focus on key market areas.

In terms of ownership, institutional investors hold a significant portion of Valid SA company shares. As of April 2025, institutional investors held 52.5% of the company's shares, with hedge funds holding 36.9% and the general public 10.5%. This high level of institutional ownership often leads to increased scrutiny and a focus on robust corporate governance. The company's share buyback programs, such as the equity buyback for 2,000,000 shares authorized on May 21, 2024, also reflect a strategy to return value to shareholders and potentially influence the share price. These trends highlight the company's commitment to shareholder value and strategic financial management.

Valid SA has shown an active approach to its capital structure, including share buybacks and acquisitions. The acquisition of Flexdoc Tecnologia da Informação Ltda. for BRL 40 million further indicates strategic growth initiatives. There have been no public announcements about future privatization or public listings beyond its current public status, maintaining its position in the market.

Valid SA's ownership is primarily held by institutional investors, with a significant portion also controlled by hedge funds. The general public holds a smaller percentage of the shares. This structure suggests a stable ownership base with a focus on long-term value creation. Institutional ownership often leads to increased scrutiny and demand for strong corporate governance.

The company reported sales of BRL 2,171.34 million for the full year ended December 31, 2024, with a net income of BRL 380.91 million. Valid's trailing 12-month revenue as of March 31, 2025, was $390 million. These financial metrics underscore the company's robust performance. The growth in net income reflects successful strategic initiatives and efficient operations.

Valid Soluções S.A. completed the acquisition of Flexdoc Tecnologia da Informação Ltda. for BRL 40 million. This acquisition highlights Valid SA's strategic moves to expand its market presence. The company's focus on integrating digital and physical solutions positions it well for future growth. These acquisitions are part of a broader growth strategy.

On May 21, 2024, Valid SA authorized an equity buyback for 2,000,000 shares, representing 2.57% of its issued share capital. This strategic move aims to return value to shareholders and potentially influence the share price. Share buybacks are a common method to boost shareholder value. This indicates confidence in the company's future.

Valid SA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valid SA Company?

- What is Competitive Landscape of Valid SA Company?

- What is Growth Strategy and Future Prospects of Valid SA Company?

- How Does Valid SA Company Work?

- What is Sales and Marketing Strategy of Valid SA Company?

- What is Brief History of Valid SA Company?

- What is Customer Demographics and Target Market of Valid SA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.