Bank of Nova Scotia Bundle

What Drives Scotiabank's Success? Unveiling Its Core Principles!

Understanding the Bank of Nova Scotia mission, Bank of Nova Scotia vision, and Bank of Nova Scotia core values is key to grasping its strategic direction. These statements are more than just words; they are the foundation upon which Scotiabank builds its global presence and serves its diverse clientele. They guide every decision, from product development to community engagement.

As a leading financial institution with approximately $1.4 trillion in assets, Scotiabank's commitment to its Scotiabank mission statement and Scotiabank strategic goals is paramount. Discover how Scotiabank's Scotiabank company values shape its operations and drive its commitment to customers, employees, and shareholders. For a deeper dive into Scotiabank's strategic approach, consider exploring our Bank of Nova Scotia SWOT Analysis.

Key Takeaways

- Scotiabank's mission, vision, and values are central to its strategy and identity.

- Customer-centric mission, forward-looking vision, and core values drive success.

- Strategic priorities, like North America focus and digital transformation, align with core principles.

- Consistent reinforcement of these principles builds trust and ensures responsible growth.

- Adherence to mission, vision, and values is crucial for navigating future challenges.

Mission: What is Bank of Nova Scotia Mission Statement?

Scotiabank's mission is "for every future," we help our clients, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets.

Let's delve into the mission of the Bank of Nova Scotia, exploring its core tenets and how it shapes the institution's operations and strategic goals.

The Bank of Nova Scotia mission places the customer at the heart of its operations. It explicitly aims to empower clients, their families, and communities. This customer-centric approach is a cornerstone of Scotiabank's identity, driving its strategic decisions and service offerings. This focus is evident in its broad range of financial products and services.

Scotiabank provides a wide array of services, including personal and commercial banking, wealth management, private banking, corporate and investment banking, and capital markets. This comprehensive approach ensures that the bank can meet diverse financial needs. This broad spectrum of services reflects the bank's commitment to being a full-service financial institution.

As Canada's most international bank, Scotiabank has a significant presence across the Americas. This wide geographic scope allows the bank to serve a diverse customer base and capitalize on international market opportunities. This global presence is a key differentiator, enabling it to offer services in multiple markets.

The unique value proposition of Scotiabank lies in providing a "broad range of advice, products, and services." This emphasizes a holistic approach to financial well-being, going beyond simple transactions to offer guidance and solutions. This advisory role is crucial in helping clients achieve their financial goals. The bank's strategic plan is heavily influenced by this value proposition.

Scotiabank's mission is reflected in its actions, such as the ScotiaRISE initiative, a $500 million community investment program. This program supports economic resilience, directly aligning with the mission of helping communities succeed. Such initiatives demonstrate the bank's commitment to its core values and its role in community development. The bank's commitment to community is a key aspect of its corporate social responsibility.

In 2024, Scotiabank served over 10 million customers across the Americas, demonstrating its wide reach and customer-focused strategy. This expansive customer base underscores the importance of the bank's mission in providing financial solutions. This data highlights the bank's impact on a large scale. If you want to learn more about the competitive landscape, consider exploring the Competitors Landscape of Bank of Nova Scotia.

The Bank of Nova Scotia mission statement is more than just words; it is a guiding principle that shapes the bank's operations, strategic goals, and commitment to its customers and communities. Understanding this mission is crucial for anyone seeking to understand Scotiabank's strategic direction and its role in the financial landscape. The Scotiabank mission statement is a key element of its overall strategy.

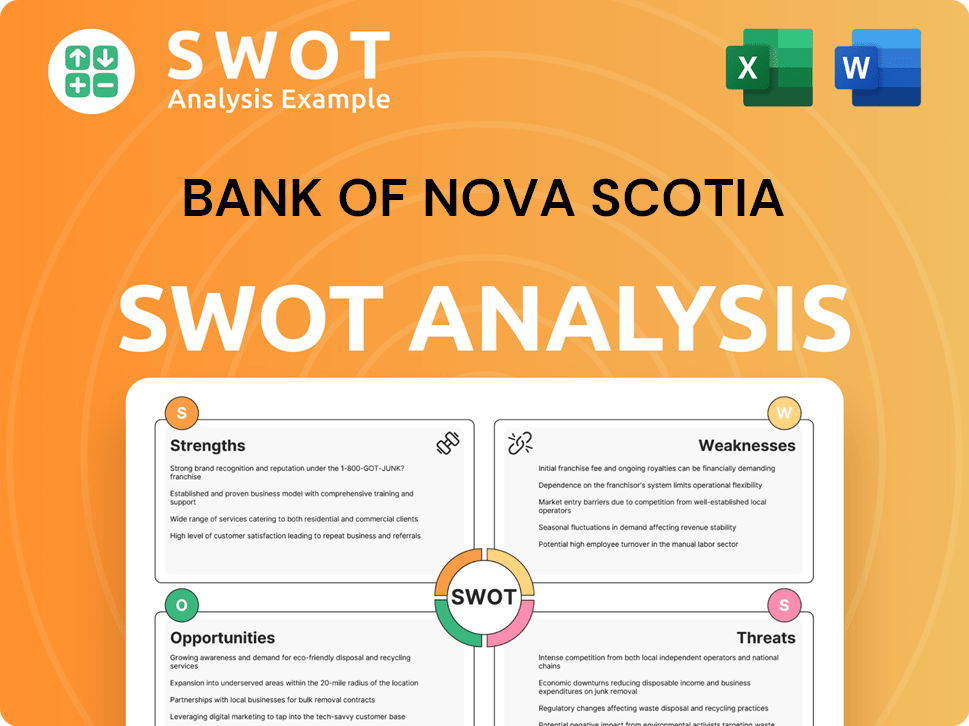

Bank of Nova Scotia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Bank of Nova Scotia Vision Statement?

Scotiabank's vision is 'to be our clients' most trusted financial partner and deliver sustainable, profitable growth.'

Let's delve into the essence of the Bank of Nova Scotia vision, exploring its implications and strategic alignment. This vision statement, coupled with its purpose 'for every future,' paints a clear picture of Scotiabank's aspirations within the financial landscape. Understanding this vision is crucial for anyone seeking to understand the Bank of Nova Scotia mission and its long-term strategic direction.

The vision is decidedly future-focused, emphasizing the desire to become the 'most trusted financial partner'. This signifies a commitment to building enduring relationships and adapting to future challenges. This forward-thinking approach is key to understanding Scotiabank's vision for the future of banking.

The vision's dual focus on client trust and sustainable, profitable growth highlights Scotiabank's strategic priorities. It suggests a balanced approach, prioritizing both customer relationships and shareholder value. This balance is essential for the long-term success of the bank, as explored in the Bank of Nova Scotia's strategic plan.

The ambition to be the 'most trusted financial partner' implicitly aims for market leadership. This entails not only providing superior financial products and services but also fostering a culture of integrity and transparency. This is a cornerstone of Scotiabank's commitment to customers.

While the vision doesn't explicitly mention industry disruption, the pursuit of trust and sustainable growth necessitates adaptability and innovation. Scotiabank must continuously evolve to meet changing client needs and technological advancements. This is a critical element in understanding how does Scotiabank define its mission.

The emphasis on 'sustainable, profitable growth' underscores Scotiabank's commitment to financial stability and shareholder value. This focus is reflected in its financial performance, with a reported net income of $8.4 billion in fiscal year 2024. This demonstrates Bank of Nova Scotia's commitment to customers.

Scotiabank's vision is supported by its strategic focus on key markets, including North America and Latin America. Recent investments, such as the 14.9% equity stake in KeyCorp in 2024, demonstrate concrete steps towards achieving its vision. For more details on the company's growth strategy, see the Growth Strategy of Bank of Nova Scotia.

In conclusion, the Bank of Nova Scotia vision is ambitious and well-defined, setting a clear direction for the company's future. The emphasis on client trust and sustainable growth, combined with its strategic priorities, positions Scotiabank for continued success in a dynamic financial environment. Understanding this vision is key to appreciating the Scotiabank mission statement and its overall strategic direction. The vision also aligns with the Scotiabank company values, guiding the bank's actions and decisions. Furthermore, the vision provides a framework for understanding Bank of Nova Scotia's core values, which are crucial for employees and stakeholders alike. The vision also encompasses Bank of Nova Scotia's purpose statement, which is 'for every future'.

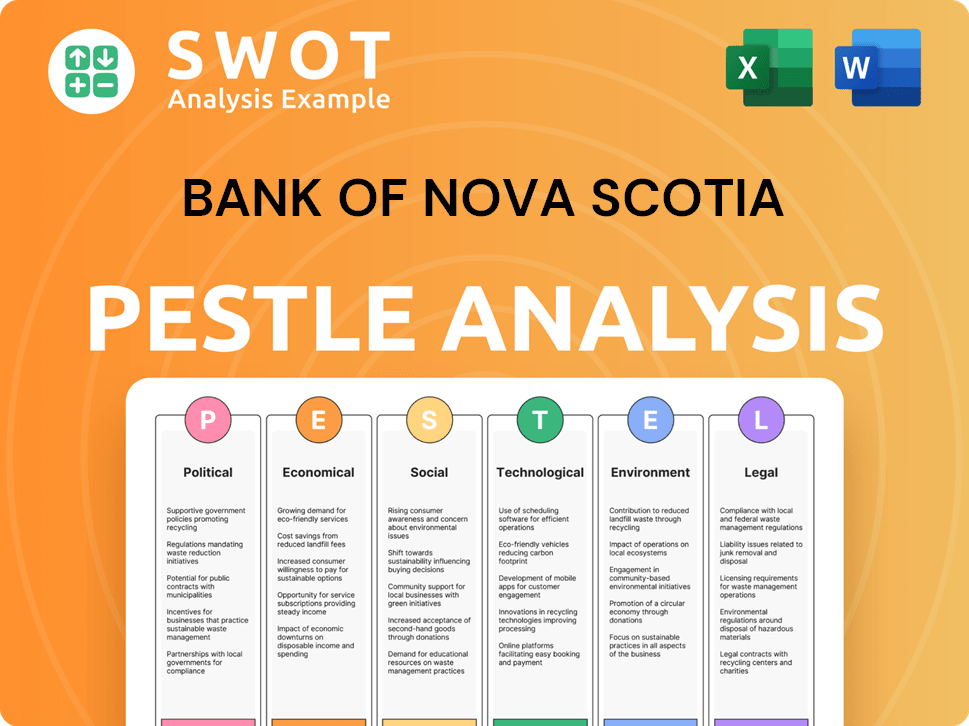

Bank of Nova Scotia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Bank of Nova Scotia Core Values Statement?

Understanding the core values of Bank of Nova Scotia (Scotiabank) provides crucial insights into its operational philosophy and commitment to stakeholders. These values, deeply embedded within the "ScotiaBond" framework, shape the bank's culture and guide its strategic initiatives.

Client Centricity is a cornerstone of Scotiabank's approach, focusing on delivering exceptional value and tailored financial solutions. This value is evident in its product development, such as specific offerings to help customers achieve financial goals, and in its commitment to providing high-quality experiences across all channels. Scotiabank's dedication to its customers is a key aspect of its Target Market of Bank of Nova Scotia.

Integrity is paramount, ensuring Scotiabank makes ethical decisions for clients, employees, and the bank itself. This commitment is reflected in its transparent reporting, including the 2024 Climate Report and 2024 Sustainability Report. Scotiabank's focus on integrity reinforces trust and accountability in all its operations.

Teamwork is essential for delivering comprehensive financial services, with collaboration across departments to provide the best solutions. The integrated approach in wealth management, where specialists bring local and global expertise, exemplifies this value. This collaborative spirit fosters a supportive environment for employees.

Passion drives innovation and continuous improvement at Scotiabank, bringing energy and enthusiasm to all its endeavors. This is evident in the development of new digital banking platforms and cybersecurity infrastructure, with Scotiabank allocating $2.4 billion in 2024 for these enhancements. Passionate employees are key to achieving the bank's strategic goals.

These core values of Bank of Nova Scotia, including its mission, vision, and core values, collectively define its corporate identity and guide its strategic plan. They create a culture that prioritizes client trust, ethical conduct, collaboration, innovation, and responsibility, setting Scotiabank apart in the competitive financial landscape. Next, we will explore how these values, along with the Bank of Nova Scotia mission and vision, influence the company's strategic decisions.

How Mission & Vision Influence Bank of Nova Scotia Business?

Scotiabank's mission and vision statements are fundamental to its strategic decision-making, acting as a guiding 'North Star' for all its business endeavors. These statements shape the bank's actions, from capital allocation to sustainability initiatives, ensuring alignment with its long-term goals.

Scotiabank's new enterprise strategy, launched in December 2023, is built upon four strategic pillars that directly reflect its mission and vision. These pillars – 'Grow and scale in priority markets; Earn primary client relationships; Make it easy to do business with us; and Win as one team' – are designed to help clients achieve success and position Scotiabank as their most trusted financial partner.

- The "Grow and scale in priority markets" pillar focuses on expanding in key regions.

- "Earn primary client relationships" emphasizes building strong customer connections.

- "Make it easy to do business with us" aims to simplify client interactions.

- "Win as one team" promotes internal collaboration and unity.

A key example of mission-driven strategy is Scotiabank's focus on the "North America corridor" – Canada, the United States, and Mexico. This strategic allocation of capital, with the majority of new investment going to these franchises, aims to leverage its unique position as the only bank operating at scale across this corridor, benefiting wealth management and commercial clients, and multinational corporations. This strategic approach directly supports the Bank of Nova Scotia mission of meeting diverse financial needs and its vision of being a trusted partner.

Scotiabank's commitment to providing $350 billion in climate-related finance by 2030 is a clear demonstration of its values in action. The bank provided $40 billion in 2024 alone, and a total of $172 billion since November 1, 2018. This initiative aligns with the 'for every future' purpose, reflecting the vision of sustainable growth and demonstrating influence on market expansion into green finance. The issuance of CAD $1.25 billion in five-year Sustainability Notes in September 2024, the largest sustainability issuance by any financial institution in Canada, further exemplifies this commitment.

The Bank's strategic decision to invest in its higher-return Canadian market, aiming to increase deposit shares and cross-selling of wealth products, is guided by the pursuit of profitable growth and earning primary client relationships. This directly supports the vision of sustainable growth and being a trusted financial partner. These actions are part of the larger Marketing Strategy of Bank of Nova Scotia, which is designed to enhance its market position.

Scotiabank's financial performance reflects the success of its mission-driven strategy. The bank achieved a Common Equity Tier 1 (CET1) ratio of 13.2% in Q2 2025, exceeding its medium-term target of 12%+. This strong capital position supports its strategic growth initiatives. In 2024, Euromoney magazine recognized Scotiabank as the World's Best Bank for Corporate Responsibility, and it secured the top S&P Global ESG Score amongst banks in North America. These accolades highlight how Scotiabank's core values are implemented.

Scott Thomson, President and CEO of Scotiabank, underscores the importance of the bank's mission and vision. He emphasized the new vision: "To be our clients' most trusted financial partner." This "North Star" guides the bank's business and culture, ensuring a client-first and responsible approach across the organization, shaping both long-term planning and day-to-day operations.

The mission and vision statements are not just lofty goals; they influence daily operations. By instilling a client-first and responsible approach, Scotiabank ensures that its core values are reflected in every interaction and decision. This commitment to its mission and vision drives Scotiabank's strategic plan and its pursuit of sustainable growth.

Scotiabank's unwavering commitment to its mission and vision is evident in its strategic decisions, financial performance, and recognition from industry leaders. This dedication to its core values ensures that the bank remains focused on its clients' success and its vision for the future of banking. Ready to delve deeper into how Scotiabank is refining its mission and vision to meet future challenges? Let's explore the next chapter: Core Improvements to Company's Mission and Vision.

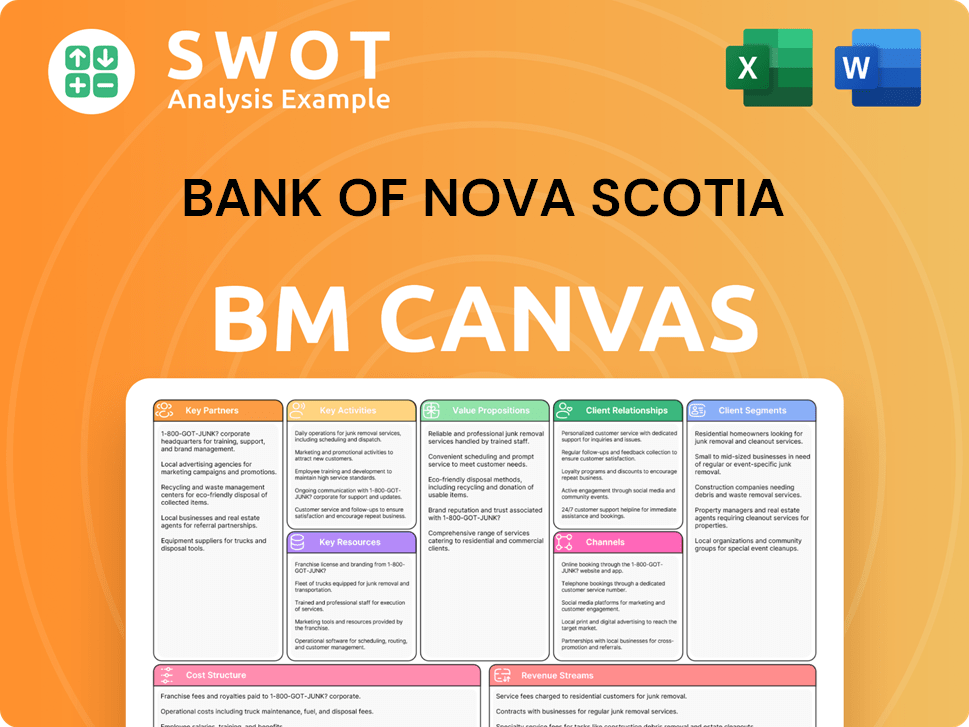

Bank of Nova Scotia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While the current statements provide a solid foundation, there are opportunities to enhance Scotiabank's mission and vision to better reflect the evolving financial landscape. These improvements focus on integrating digital transformation, expanding the scope of sustainability efforts, and emphasizing proactive client solutions to ensure the bank remains competitive and relevant.

To stay ahead, Scotiabank should explicitly integrate digital transformation into its vision statement. This would reflect the bank's substantial investments in digital banking platforms and cybersecurity, including the $2.4 billion allocated in 2024 for these enhancements. Refining the vision to highlight digital empowerment would better align with market conditions where digital channels are central to the customer experience, ensuring Scotiabank's vision for the future of banking remains competitive.

The current mission and vision statements could be strengthened by explicitly linking Scotiabank’s role in addressing global challenges beyond climate-related finance. This would differentiate the bank by emphasizing its commitment to fostering economic inclusion and acknowledging the broader social impact it aims to achieve. Highlighting initiatives focused on community and social responsibility would further showcase Scotiabank's commitment to its Mission, Vision & Core Values of Bank of Nova Scotia.

Considering the evolving nature of consumer behaviors, particularly the younger demographic's preference for personalized and seamless digital experiences, the mission could be refined to emphasize proactive and predictive financial solutions. This involves anticipating and meeting future client needs through advanced analytics and AI, which would further solidify their forward-looking approach and support Scotiabank's strategic goals.

To ensure Scotiabank's core values resonate with employees, particularly in a hybrid work environment, the bank could enhance its communication and integration of these values. This might include more frequent internal discussions, training programs, and examples of Scotiabank's values in action examples to foster a culture of ethical guidelines and commitment to community. This will also help in measuring its values.

How Does Bank of Nova Scotia Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible actions and outcomes. This chapter examines how Bank of Nova Scotia (Scotiabank) puts its guiding principles into practice, ensuring alignment across its operations and stakeholder engagement.

Scotiabank's commitment to its mission and vision is evident in its strategic initiatives, particularly its focus on the "North America corridor," encompassing Canada, the United States, and Mexico. This strategic direction is where the bank is deploying the majority of its incremental capital, demonstrating a commitment to growth in key markets. This approach supports the Bank of Nova Scotia vision of being a trusted financial partner and its Scotiabank mission statement of helping clients succeed.

- Strategic Focus: Prioritizing the North America corridor (Canada, US, Mexico) for capital deployment.

- KeyCorp Investment: A 14.9% equity stake in KeyCorp in 2024 allows Scotiabank to learn about US retail banking.

- Expanded Services: Supporting the mission by increasing access to financial services for clients.

Leadership plays a critical role in reinforcing the Bank of Nova Scotia mission, vision, and core values. CEO Scott Thomson's emphasis on the new vision as a "North Star" underscores the importance of these principles throughout the organization. This commitment from the top ensures that the mission and vision are embedded in Scotiabank's strategic priorities, guiding its actions and decisions.

Scotiabank communicates its mission, vision, and values to all stakeholders through various channels, including annual reports, sustainability reports, and investor presentations. These communications consistently reiterate the bank's guiding principles, ensuring transparency and accountability. This approach helps to build trust and reinforces the bank's commitment to its stakeholders, including customers, employees, and investors. For more information about the company, check out this article about Owners & Shareholders of Bank of Nova Scotia.

Scotiabank demonstrates the alignment between its stated values and actual business practices through concrete examples. This commitment is evident in its actions related to sustainability, community involvement, and social responsibility. These initiatives reflect the bank's dedication to creating a positive impact and contributing to a sustainable future.

Formal programs, such as the introduction of 'ScotiaBond', are used to ensure alignment between the Scotiabank company values and daily operations. This framework influences performance and development goals, ensuring that actions align with the bank's overarching principles. Furthermore, Scotiabank’s commitment to diversity and inclusion, demonstrated by meeting its goal of increasing the representation of people with disabilities by 20% by the end of 2025, shows its commitment to its values.

Bank of Nova Scotia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank of Nova Scotia Company?

- What is Competitive Landscape of Bank of Nova Scotia Company?

- What is Growth Strategy and Future Prospects of Bank of Nova Scotia Company?

- How Does Bank of Nova Scotia Company Work?

- What is Sales and Marketing Strategy of Bank of Nova Scotia Company?

- Who Owns Bank of Nova Scotia Company?

- What is Customer Demographics and Target Market of Bank of Nova Scotia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.