Alten Bundle

Who Really Owns Alten?

Uncover the hidden forces driving Alten's success. Understanding Alten SWOT Analysis and its ownership structure is key to grasping its strategic moves and future potential. This deep dive into the Alten Group reveals the key players shaping its trajectory in the competitive tech landscape.

From its founding by three engineers to its current status as a global powerhouse, the Alten company's ownership has evolved significantly. This analysis explores the Alten ownership structure, examining the influence of Alten shareholders and major investors on the company's direction and performance. We'll explore the Alten stock dynamics and how they reflect the company's financial health and market position, providing a comprehensive view of who controls this industry leader.

Who Founded Alten?

The story of the Alten company begins in 1988, founded by three engineers: Simon Azoulay, Laurent Schwarz, and Thierry Woog. This marked the genesis of a company focused on providing high-level engineering services. Simon Azoulay, a graduate of Supélec, currently leads the Alten Group as Chairman and Chief Executive Officer.

While the specific initial ownership distribution among the founders isn't publicly detailed, their vision was clear. They aimed to offer advanced engineering services, continuously expanding their offerings with new skills and services. A key aspect of their strategy was maintaining close geographical proximity to their clients.

Alten's early focus was on building its presence in France. This foundational period set the stage for future expansion and growth. The company's initial public offering (IPO) in 1999 was a pivotal moment, opening the door to public shareholders and providing the financial resources needed for further development.

Simon Azoulay, one of the founders, continues to lead the company as Chairman and CEO. This continuity highlights the enduring influence of the founders.

The 1999 IPO was crucial, transforming the Alten ownership structure. It introduced public shareholders and provided capital for growth.

Emily Azoulay, who has been with the company since its inception, held key roles early on. This suggests a strong connection between the founding families and the company's operations.

The company's initial strategy included maintaining close proximity to clients. This approach likely facilitated strong client relationships and understanding of local markets.

Alten's early focus was on expanding its service offerings. This strategy has been key to its long-term success, allowing it to meet evolving client needs.

The founders' vision was centered on providing high-level engineering services. This vision has guided the company's growth and development.

The Alten Group's journey began with a clear vision from its founders. The initial focus on high-level engineering services, combined with a strategy of close client proximity, set the stage for the company's early success. The IPO in 1999 was a significant milestone, changing the Alten ownership structure and providing the financial backing for expansion. The involvement of the founding families, such as Emily Azoulay, further demonstrates the commitment to the company's growth. For more insights into how the company has grown, you can read more about the Marketing Strategy of Alten.

Understanding the Alten ownership structure is crucial for investors and stakeholders. The company's history reveals a strategic focus on engineering services and expansion.

- Founded in 1988 by Simon Azoulay, Laurent Schwarz, and Thierry Woog.

- IPO in 1999 marked a shift in Alten ownership by introducing public shareholders.

- Simon Azoulay continues to lead as Chairman and CEO.

- Early focus on expanding services and maintaining client proximity.

- Family involvement, such as Emily Azoulay's roles, highlights the founders' impact.

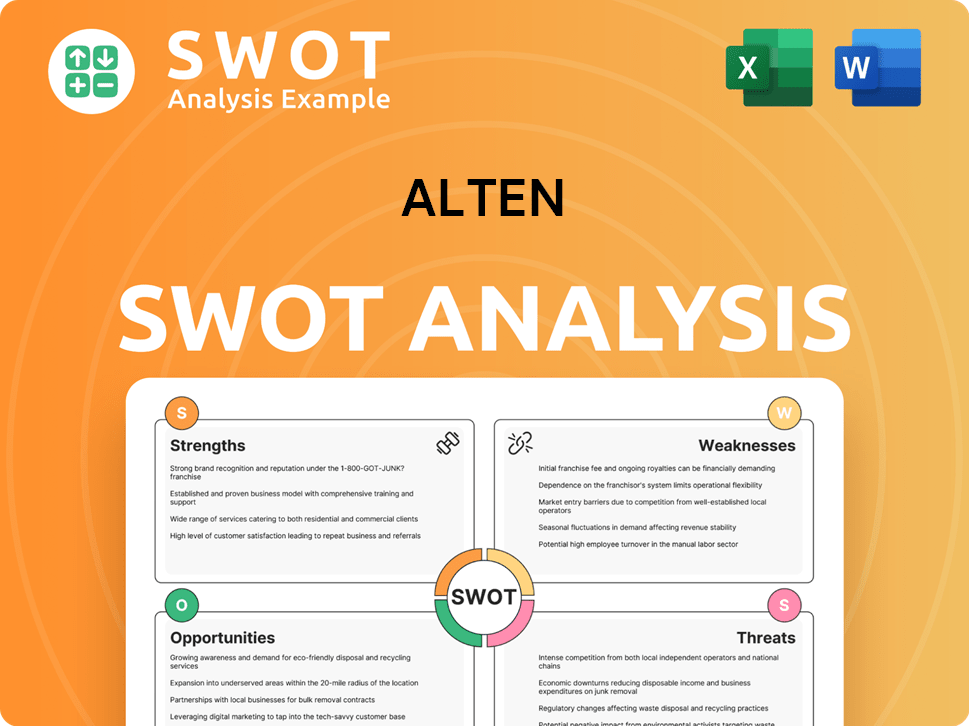

Alten SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Alten’s Ownership Changed Over Time?

The evolution of the Alten's ownership structure is a story of growth and strategic adaptation, starting with its initial public offering (IPO) in 1999 on the Paris Stock Exchange. As a publicly traded entity, its shares are listed on Euronext Paris (ISIN FR0000071946) and are included in key indices like the SBF 120, IT CAC 50, and MIDCAP 100. This public listing has opened avenues for capital raising and has shaped the company's ownership landscape over time.

The company's expansion strategy, which includes acquisitions, has also played a significant role in shaping its ownership. In 2023, Alten completed five acquisitions, totaling €94 million and adding 1,885 consultants. The acquisition of Atos Worldgrid in December 2024, for an enterprise value of €270 million, further demonstrates this strategic approach and its impact on the overall structure. These moves reflect Alten's commitment to growth and its ability to integrate new entities, potentially influencing the distribution of shares among existing and new stakeholders. To understand more about the company's operations, you can read about the Revenue Streams & Business Model of Alten.

| Key Dates | Event | Impact on Ownership |

|---|---|---|

| 1999 | IPO on Paris Stock Exchange | Public listing, initial public shareholders |

| 2023 | Five Acquisitions | Potential share issuance, diversification of ownership |

| December 2024 | Acquisition of Atos Worldgrid | Further expansion, potential changes in shareholder base |

Major stakeholders in Alten include a diverse group of institutional investors, mutual funds, and individual insiders. As of December 31, 2024, institutional ownership data indicates that 119 institutional owners and shareholders have filed 13D/G or 13F forms with the SEC, holding a total of 7,561,056 shares. As of June 12, 2025, Alten has a market capitalization of approximately €2.65 billion with 34.8 million shares outstanding. The company's strong financial position, with a net cash position of €275.5 million and a gearing of -12.5% at the end of 2024, provides it with the financial flexibility to pursue further growth opportunities, potentially influencing its ownership structure through future investments or acquisitions.

Alten's ownership structure is dynamic, shaped by its public listing, strategic acquisitions, and the involvement of institutional investors.

- Publicly traded on Euronext Paris.

- Significant institutional ownership.

- Active in strategic acquisitions.

- Strong financial health supports growth.

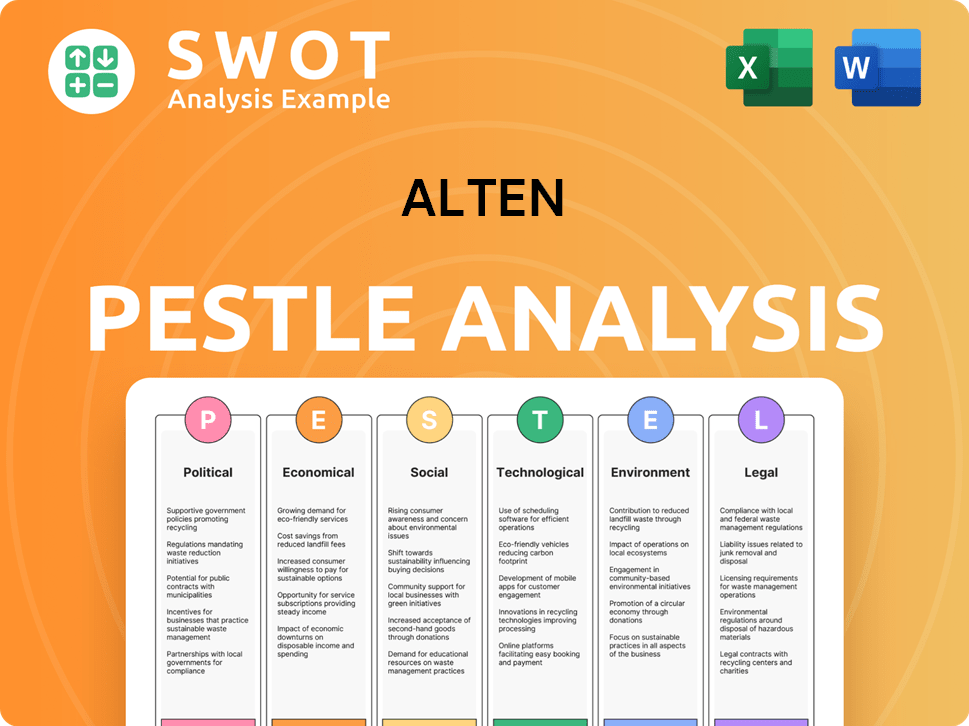

Alten PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Alten’s Board?

The board of directors significantly influences the strategic direction of the company, ensuring that decisions align with corporate interests and address social and environmental concerns. As of December 31, 2023, the board included a strong representation of women, holding 50% of the seats, excluding the employee representative. This demonstrates a commitment to diversity, aiming to incorporate a wide range of skills and experiences within the leadership structure.

The current board members include Simon Azoulay (Chairman and Chief Executive Officer), Emily Azoulay (Director), Jean-Philippe Collin (Independent Director), Marc Eisenberg (Independent Director), Maryvonne Labeille (Independent Director), Aliette Mardyks (Independent Director), Pierre-Louis Ryser (Director representing employees), and Jane Seroussi (Director). Philippe Tribaudeau serves as the Independent Lead Director. Simon Azoulay has been with the company for over 26 years, holding a key leadership position.

| Board Member | Position | Committee Memberships |

|---|---|---|

| Simon Azoulay | Chairman and CEO | N/A |

| Emily Azoulay | Director | Remuneration and Nomination Committee |

| Jean-Philippe Collin | Independent Director | Audit, Remuneration and Nomination, and CSR Committees |

| Marc Eisenberg | Independent Director | N/A |

| Maryvonne Labeille | Independent Director | Chairwoman of the Remuneration and Nomination Committee and CSR Committee |

| Aliette Mardyks | Independent Director | Chairwoman of the Audit Committee |

| Pierre-Louis Ryser | Director (Employee Representative) | N/A |

| Jane Seroussi | Director | N/A |

| Philippe Tribaudeau | Independent Lead Director | N/A |

The company actively engages with its shareholders to understand their expectations, particularly regarding resolutions at General Meetings. They regularly review their shareholding structure, with the last review completed on January 31, 2024. The board also establishes a remuneration policy for corporate officers, which is designed to align with the company's interests and support its sustainability goals. Understanding the Alten ownership structure and the influence of the board is crucial for anyone interested in the Alten Group and Alten shareholders.

The Board of Directors plays a pivotal role in shaping the strategic direction of the company, ensuring alignment with corporate interests and addressing social and environmental challenges. The board composition reflects a commitment to diversity, with a significant representation of women. The company actively engages with its shareholders and regularly reviews its shareholding structure.

- The board includes a diverse group of experienced professionals.

- Simon Azoulay, the Chairman and CEO, has been with the company for over 26 years.

- The company follows the recommendations of the Middlenext Corporate Governance Code.

- The company focuses on shareholder engagement and transparency.

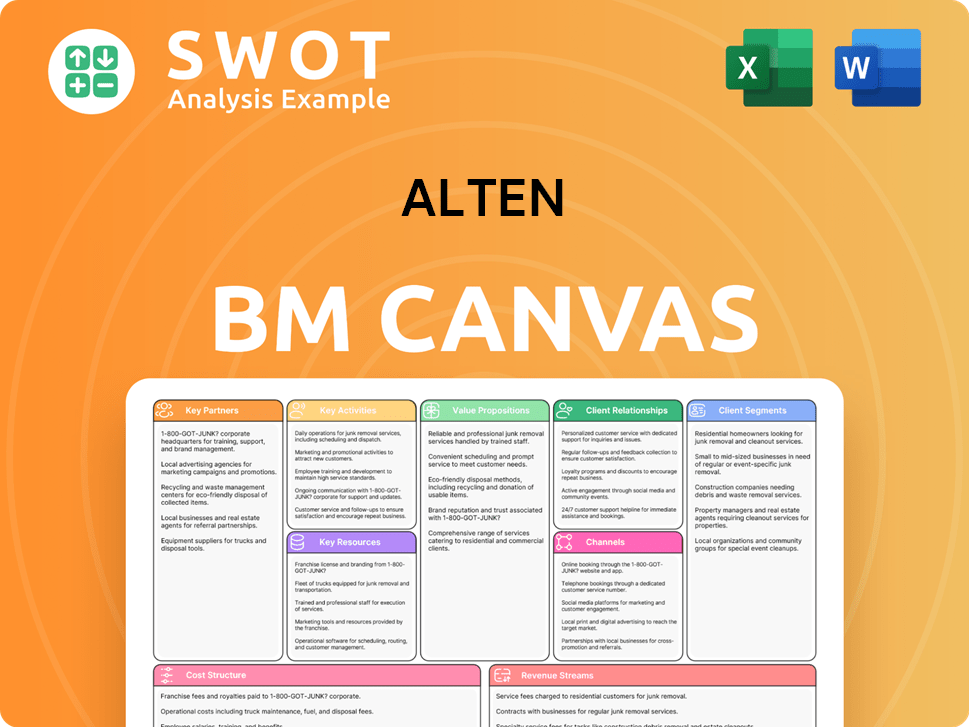

Alten Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Alten’s Ownership Landscape?

Over the past few years, the Growth Strategy of Alten has focused on strategic acquisitions to bolster its market position. A key development in December 2024 was the acquisition of Worldgrid from Atos, valued at €270 million. This move was aimed at strengthening its presence in the Energy and Utilities sector, specifically in nuclear energy. The acquisition is projected to contribute approximately €170 million in revenue and add 1,100 employees in 2024.

Financially, the Alten Group reported a revenue of €4,143.3 million for the full year 2024, marking a 1.8% year-over-year increase. However, there was a slight like-for-like decline of 0.2%. Operating profit for 2024 decreased to €277.0 million (6.7% of revenue), influenced by goodwill impairments and restructuring expenses, especially in the UK and Germany. Despite these challenges, the company's free cash flow significantly increased by 81.4% to €333.2 million, and its net cash position reached €275.5 million by the end of 2024, showing its capacity for self-funded growth. For the first quarter of 2025, Alten reported a slight revenue decline of 0.5% to €1,062 million, primarily due to one fewer working day. The company anticipates a 6% decline for the first half of 2025 due to an uncertain macroeconomic environment.

Industry trends indicate a rise in institutional ownership, and the Alten ownership structure reflects this. As of December 31, 2024, there were 119 institutional owners holding significant shares. The company also demonstrates a commitment to diversity and gender equality, having signed the United Nations Women's Empowerment Principles. The 2024 Universal Registration Document, filed on April 25, 2025, provides comprehensive financial and governance information for investors. This information is crucial for understanding who owns Alten and the broader Alten company structure.

Revenue: €4,143.3 million, Operating Profit: €277.0 million, Free Cash Flow: €333.2 million, Net Cash Position: €275.5 million.

119 institutional owners held significant shares as of December 31, 2024. The company is committed to gender equality.

Worldgrid acquisition from Atos for €270 million in December 2024. Expected to contribute €170 million in revenue and 1,100 employees in 2024.

Q1 2025 revenue slightly down. Company forecasts a 6% decline for the first half of 2025 due to the macroeconomic environment.

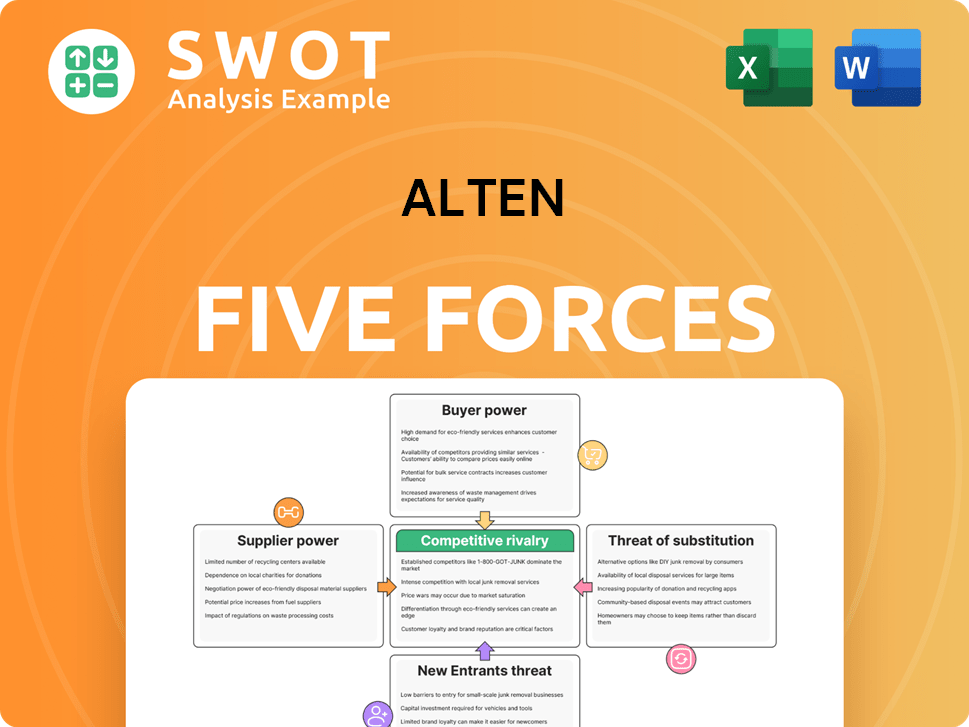

Alten Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Alten Company?

- What is Competitive Landscape of Alten Company?

- What is Growth Strategy and Future Prospects of Alten Company?

- How Does Alten Company Work?

- What is Sales and Marketing Strategy of Alten Company?

- What is Brief History of Alten Company?

- What is Customer Demographics and Target Market of Alten Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.