Bio-Rad Bundle

Who Really Owns Bio-Rad?

Unraveling the Bio-Rad SWOT Analysis is just the beginning. Understanding the Bio-Rad ownership structure is key to grasping its trajectory in the life science and diagnostics arena. This deep dive into the Bio-Rad company will reveal the forces shaping its future, from its founding to its current standing as a global leader. Discover the key players and their influence on this innovative company.

From its humble beginnings in 1952, Bio-Rad Laboratories has grown into a significant player, and its ownership structure has evolved alongside its success. Knowing who the major Bio-Rad shareholders are provides a crucial lens for evaluating its strategic direction. This analysis will explore the Bio-Rad history, key investors, and the impact of Bio-Rad executives, offering a comprehensive view of the company's ownership dynamics and its implications for investors and stakeholders. We'll also touch upon questions like: Who is the current CEO of Bio-Rad? Who founded Bio-Rad? and Is Bio-Rad a publicly traded company?

Who Founded Bio-Rad?

The story of the company begins in 1952 with David and Alice Schwartz, the founders. They launched the enterprise with a modest investment of $720, marking the start of what would become a significant player in the life science research field. Their early focus on biochemicals and radiochemicals shaped the company's initial direction, leading to its concise name.

For over five decades, the company remained under the private ownership of the Schwartz family. This period was crucial for establishing its pioneering role in life science research. The founders' active involvement ensured continuity and a steadfast commitment to their original vision.

The company's history is closely tied to the Schwartz family. David and Alice Schwartz, graduates of the University of California, Berkeley, established the company. Their son, Norman Schwartz, joined in 1974 and currently holds the positions of CEO and President, continuing the family's influence on the company's direction. Understanding the evolution of the company's ownership provides insights into its strategic decisions and long-term goals.

Founded in 1952 by David and Alice Schwartz.

Started with $720 in personal savings.

Focused on biochemicals and radiochemicals.

Remained privately owned by the Schwartz family for over five decades.

David Schwartz served as Chairman, Alice Schwartz as a director, and Norman Schwartz as CEO and President.

The founding team's vision was to accelerate scientific discovery.

The company's journey from its inception to its current status reflects a strong commitment to its founding principles. The Schwartz family's sustained involvement has been a key factor in shaping the company's trajectory. To understand the competitive landscape, you can explore the Competitors Landscape of Bio-Rad. As of the latest reports, the company continues to be a significant player in the life science industry, with its ownership structure and leadership team playing crucial roles in its ongoing success. The long-term strategy and financial performance are influenced by the decisions made by the company's executives.

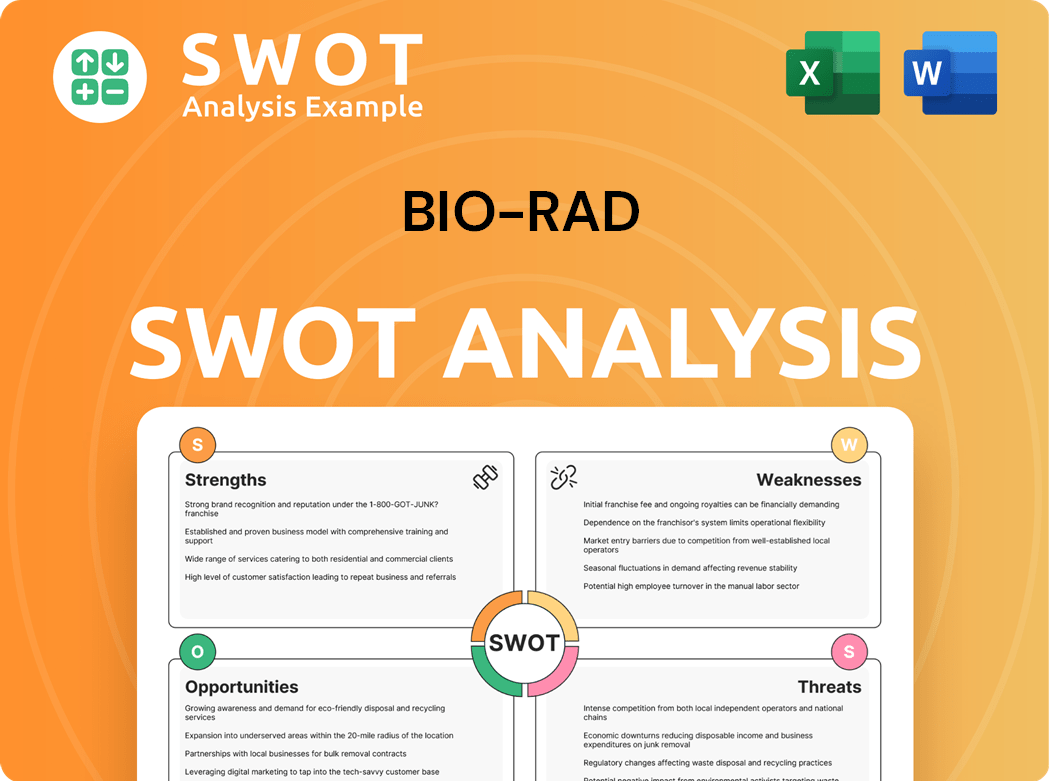

Bio-Rad SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Bio-Rad’s Ownership Changed Over Time?

The evolution of Bio-Rad Laboratories' ownership reflects a significant transition. Initially a privately held, family-owned business, the company went public in 2004. This initial public offering (IPO) marked a pivotal moment, allowing Bio-Rad to access capital markets and fuel its global expansion. This shift from private to public ownership was a crucial step in the company's growth trajectory, impacting its capital structure and strategic direction.

The move to become a publicly traded entity was a strategic decision that enabled Bio-Rad to broaden its investor base and support its ambitious growth plans. This transition provided the financial flexibility needed to invest in research and development, expand its product portfolio, and increase its market presence. The IPO facilitated the company's ability to compete more effectively in the global life science and clinical diagnostics markets.

| Key Event | Date | Impact |

|---|---|---|

| Going Public | 2004 | Transitioned from private to public ownership, enabling access to capital markets. |

| Share Repurchases | 2023-2024 | Reduced outstanding shares, indicating confidence in the company's financial health. |

| Institutional Investment | Ongoing | Significant institutional ownership, reflecting investor confidence and market stability. |

As of June 6, 2025, the Bio-Rad ownership structure is characterized by a mix of institutional and individual shareholders. Institutional investors collectively hold approximately 70.4% of the company's shares. Key institutional holders include BlackRock, Inc., and The Vanguard Group, Inc. However, the founding family, particularly Alice N. Schwartz, maintains a substantial ownership stake, holding 20.57 million shares, which represents 75.60% of the company. Further insights into the company's strategic direction can be found in an analysis of the Growth Strategy of Bio-Rad.

Bio-Rad's ownership structure is a blend of institutional and family control, with a significant portion held by the founding family. The company has been actively managing its capital through share repurchases, demonstrating financial discipline. Understanding the ownership structure is crucial for investors and stakeholders.

- Institutional investors hold a significant portion of shares.

- The founding family retains a substantial ownership stake.

- Share repurchase programs indicate financial health.

- The company's stock is listed on the NYSE.

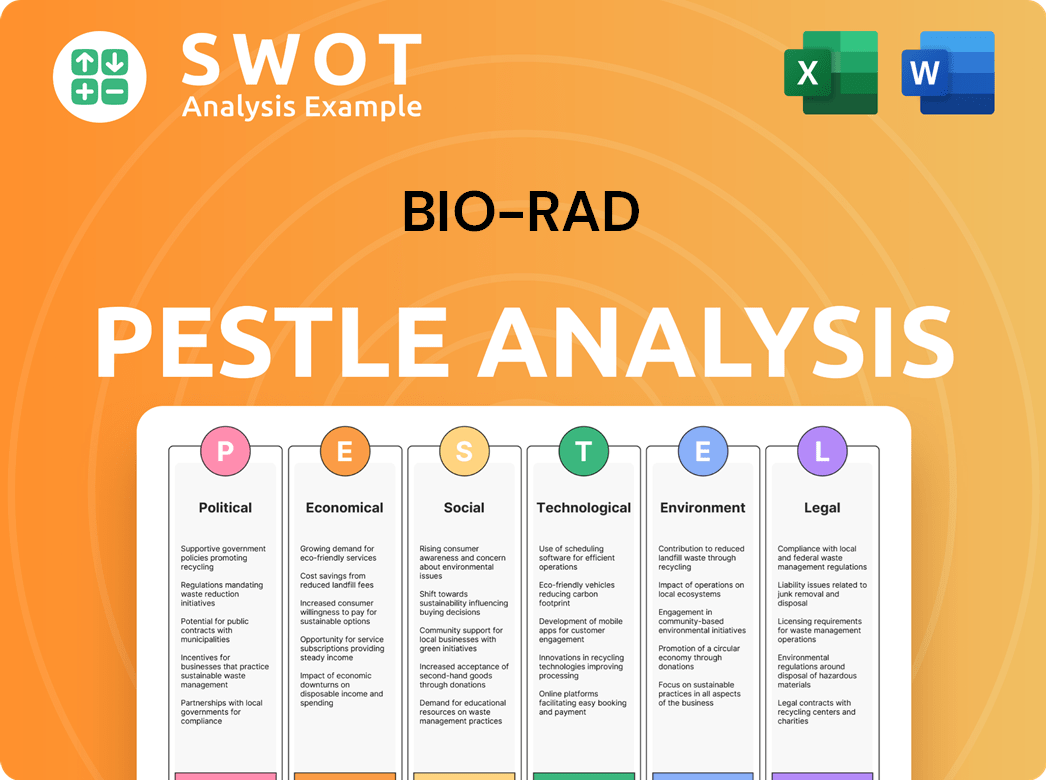

Bio-Rad PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Bio-Rad’s Board?

The current Board of Directors for the Bio-Rad Laboratories includes six members, elected annually. The structure ensures a balance of perspectives in the company's governance. The board's composition is a crucial aspect of understanding the Bio-Rad company and its operational strategies.

The Bio-Rad ownership structure is defined by a dual-class share system. This system significantly impacts voting power among Bio-Rad shareholders. Class A Common Stock (NYSE: BIO) holders elect two directors, while Class B Common Stock (NYSE: BIO.B) holders elect the other four. Each Class A share has one-tenth of a vote, whereas each Class B share has one vote, except in director elections where both classes have one vote per share when voting separately.

| Director Nominees for 2025 | ||

|---|---|---|

| Norman Schwartz | Chairman of the Board, President, and CEO | |

| Allison Schwartz | Vice President, Global Supply Chain Clinical Diagnostics Group Operations | Nominee for 2025 Annual Meeting |

| Jeffrey L. Edwards | Nominee for 2025 Annual Meeting | |

| Gregory K. Hinckley | Nominee for 2025 Annual Meeting | |

| Melinda Litherland | Nominee for 2025 Annual Meeting | |

| Arnold A. Pinkston | Nominee for 2025 Annual Meeting |

The Schwartz family holds substantial influence through their Class B share ownership and board representation. Norman Schwartz, the Chairman, President, and CEO, plays a central role. Allison Schwartz, appointed Vice President in November 2024, is also nominated as a director for the 2025 annual meeting. Alice N. Schwartz, a co-founder, holds the position of Director Emeritus. Understanding the Bio-Rad executives and their roles is key to analyzing the company's direction. For insights into the company's marketing strategies, you can explore the Marketing Strategy of Bio-Rad.

The board consists of six members, elected annually, ensuring a balance of perspectives.

- Dual-class shares impact voting power, with Class B shares holding more influence.

- The Schwartz family's ownership and board representation are significant.

- The 2025 director nominees include key figures like Norman and Allison Schwartz.

- Alice N. Schwartz, as Director Emeritus, provides continuity and historical perspective.

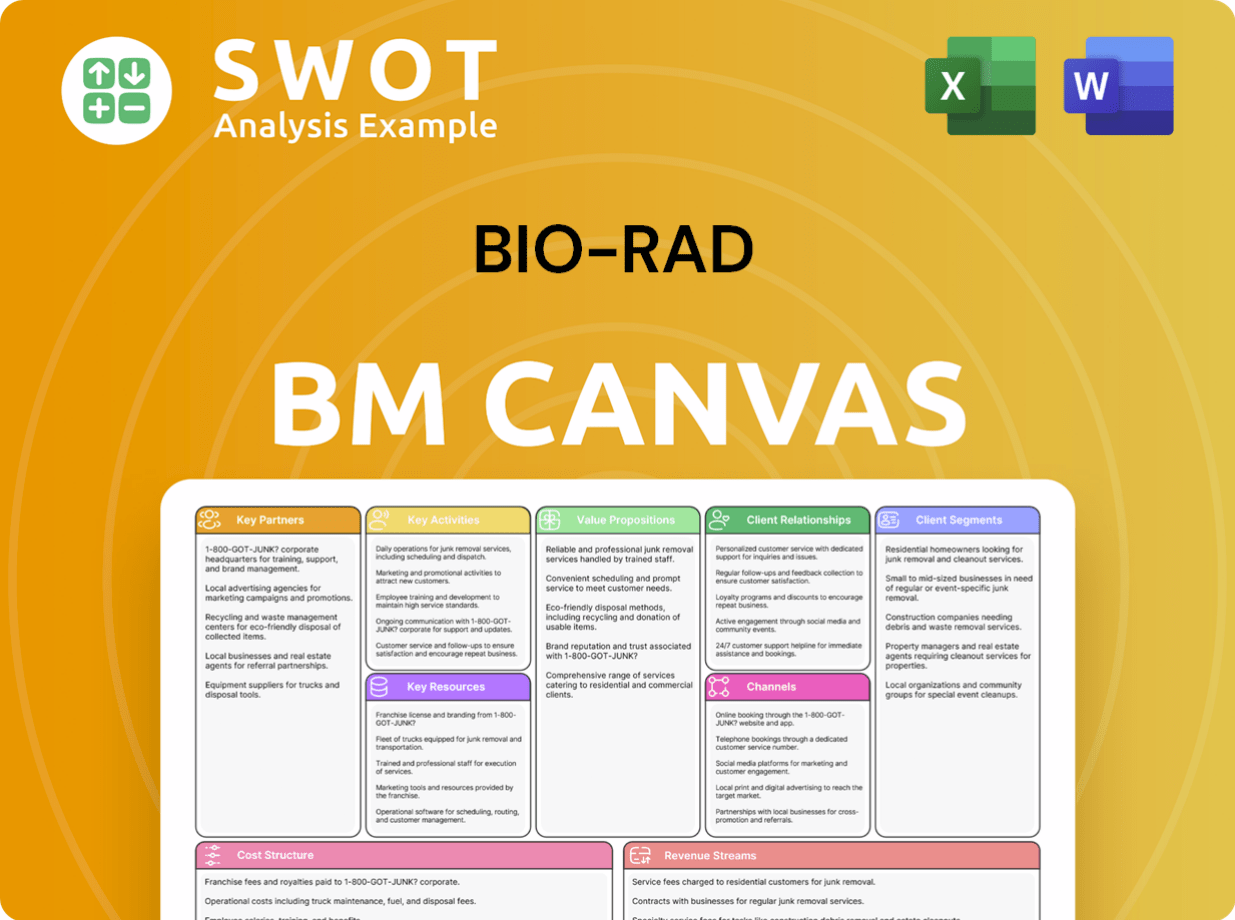

Bio-Rad Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Bio-Rad’s Ownership Landscape?

Over the past few years, several developments have influenced the ownership profile and strategic direction of the Bio-Rad company. The company has consistently demonstrated confidence in its long-term value through share buyback programs. For instance, in Q1 2025, approximately $101 million was spent on repurchasing shares, totaling 399,295 shares. In 2024, the company repurchased 691,000 shares for about $22 million.

Leadership transitions and strategic acquisitions have also played a role in shaping the company. James J. Barry was promoted to Executive Vice President and President of the Life Science Group in May 2024. Jon DiVincenzo joined as President and Chief Operating Officer in September 2024, replacing Andy Last. Furthermore, the company has been focused on enhancing its portfolio, as seen in its binding offer to acquire Stilla Technologies, a digital PCR specialist, which is expected to strengthen its position in precision diagnostics.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Total Net Sales (in millions) | $610.8 | $585.4 |

| Non-GAAP Operating Margin | 9.7% | 10.8% |

| Share Repurchases (in millions) | N/A | $101 |

Financially, the company reported a 3.9% decrease in full-year 2024 net sales, totaling $2.567 billion compared to $2.67 billion in 2023. In Q1 2025, total net sales decreased by 4.2% compared to Q1 2024. Despite these top-line declines, the company improved its non-GAAP operating margin to 10.8% in Q1 2025, up from 9.7% in the same quarter last year, due to cost discipline. For 2025, the company anticipates a non-GAAP, currency-neutral revenue growth of approximately 1.5% to 3.5% and an estimated non-GAAP operating margin of approximately 13.0% to 13.5%.

The company's ownership structure is influenced by its share buyback programs and the holdings of institutional investors.

Key personnel changes, such as promotions and new hires, impact the company's strategic direction and operational management.

Financial results, including sales figures and operating margins, reflect the company's ability to navigate market challenges.

Strategic acquisitions, like the potential acquisition of Stilla Technologies, demonstrate efforts to strengthen market position.

Bio-Rad Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bio-Rad Company?

- What is Competitive Landscape of Bio-Rad Company?

- What is Growth Strategy and Future Prospects of Bio-Rad Company?

- How Does Bio-Rad Company Work?

- What is Sales and Marketing Strategy of Bio-Rad Company?

- What is Brief History of Bio-Rad Company?

- What is Customer Demographics and Target Market of Bio-Rad Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.