BlackBerry Bundle

Who Really Owns BlackBerry?

Curious about the forces steering the future of a cybersecurity giant? Understanding BlackBerry SWOT Analysis is key to grasping its strategic direction. The transformation from a mobile phone titan to a software and services leader has fundamentally reshaped its ownership landscape. Discover the key players and influences shaping BlackBerry's journey.

Delving into "Who owns BlackBerry" unveils more than just shareholders; it reveals the power dynamics driving innovation in the cybersecurity and IoT sectors. From its roots as Research In Motion to its current status, BlackBerry's ownership has evolved significantly. This evolution reflects strategic shifts and market adaptations, impacting its trajectory. Exploring the BlackBerry ownership structure, including its parent company and current owner, provides crucial insights into its future.

Who Founded BlackBerry?

The company, initially known as Research In Motion (RIM), was established in 1984. The founders were Mike Lazaridis and Douglas Fregin. Their early vision focused on wireless data transmission, which eventually led to the development of the BlackBerry pager and smartphone.

Lazaridis, an engineering student at the University of Waterloo, and Fregin, his childhood friend, started the company. While specific initial equity details are not publicly available, Lazaridis's role as co-CEO alongside Jim Balsillie for many years indicates their significant control during the early years. Early backing likely came from angel investors or private capital.

The company's early direction was deeply influenced by the founding team. Early agreements, such as vesting schedules, would have been in place to solidify founder commitment. There are no widely publicized accounts of significant initial ownership disputes that dramatically reshaped the company's control in its early stages.

Founded in 1984 as Research In Motion (RIM).

The founders were Mike Lazaridis and Douglas Fregin.

Mike Lazaridis served as co-CEO for many years.

Jim Balsillie joined later, forming a strong leadership team.

Focused on wireless data transmission.

Led to the development of the BlackBerry pager and smartphone.

Specific initial equity splits are not publicly detailed.

Early backers likely included angel investors or private capital.

Vesting schedules and buy-sell clauses were likely in place.

Aimed to solidify founder commitment.

No widely publicized ownership disputes in early stages.

Lazaridis and Balsillie provided a unified front.

The shared leadership of Lazaridis and Balsillie, especially after Balsillie joined in 1992, was crucial in driving the company's growth. Understanding the Revenue Streams & Business Model of BlackBerry helps to understand the company's evolution. As of late 2024, the company's market capitalization fluctuates, but it is a publicly traded company. The current business focus includes cybersecurity and software solutions. The company's headquarters are located in Waterloo, Ontario, Canada. The current owner is BlackBerry Limited. The company has several subsidiaries, and the stock symbol is BB.

BlackBerry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BlackBerry’s Ownership Changed Over Time?

The evolution of BlackBerry's ownership is a story of transformation, especially since its initial public offering (IPO) in 1997. This IPO marked a significant shift, moving the company from private to public ownership, opening the door for a wider range of investors. The company's market value has seen considerable fluctuations, especially during its smartphone era and subsequent transition. Understanding Competitors Landscape of BlackBerry is essential to grasp the company's strategic shifts and how they've influenced its ownership structure.

BlackBerry's ownership structure today is primarily characterized by institutional investors, mutual funds, and individual shareholders. As of the latest available data from Q1 2024, major institutional investors hold substantial portions of the company's shares. For instance, Fairfax Financial Holdings Limited has historically been a key investor. Other significant stakeholders often include large asset management firms and mutual funds focused on technology and cybersecurity. These holdings are dynamic, influenced by market conditions, investment strategies, and BlackBerry's stock performance. The question of 'Who owns BlackBerry' is thus answered by a diverse group of financial entities.

| Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Transition from private to public ownership, enabling broader investment. | September 1997 (Toronto Stock Exchange), 1999 (NASDAQ) |

| Strategic Pivot under CEO John Chen | Shift in investor focus towards enterprise software, cybersecurity, and IoT. | 2013 |

| Focus on QNX and Cybersecurity | Attracted long-term institutional investors interested in embedded systems and security solutions. | Ongoing |

The shift from a hardware-focused company to a software and services provider has reshaped investor confidence and ownership trends. Under CEO John Chen, the strategic pivot aimed to stabilize the company and attract investors interested in enterprise software, cybersecurity, and the Internet of Things (IoT). This has led to a shift in the profile of major stakeholders, with an emphasis on long-term institutional investors who see potential in BlackBerry's current business model. The company's focus on its QNX operating system for embedded systems and its cybersecurity solutions has attracted specific types of investors. The company's strategic direction continues to influence who the BlackBerry parent company is and the interests of its shareholders.

BlackBerry's ownership has evolved significantly since its IPO, with a shift towards institutional investors. The company's strategic pivot to software and services has influenced investor interest and ownership trends. Understanding the current ownership structure is crucial for anyone asking 'Who owns BlackBerry' and for those interested in how to invest in BlackBerry stock.

- Institutional investors hold a significant portion of BlackBerry shares.

- The company's focus on cybersecurity and IoT attracts specific investor types.

- BlackBerry's ownership structure reflects its strategic direction.

BlackBerry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BlackBerry’s Board?

The current Board of Directors of the company plays a critical role in its governance and strategic direction, representing the interests of its diverse ownership base. As of recent disclosures, the board includes a blend of independent directors and individuals with connections to the company's past or present. While specific board members representing major shareholders aren't always explicitly stated, the presence of long-term investors in advisory roles can influence decision-making. For example, individuals associated with Fairfax Financial Holdings Limited have historically held significant influence due to their substantial investment.

The board's composition and decisions are vital for overseeing the company's performance, approving major investments, and ensuring accountability to shareholders. The company's focus on its transformation into a software and services provider has largely been supported by its board, reflecting a unified approach to its strategic direction. Understanding Marketing Strategy of BlackBerry is also crucial for grasping the company's current trajectory and how the board supports its initiatives.

| Board Member | Role | Affiliation |

|---|---|---|

| John Chen | Executive Chairman and CEO | BlackBerry Limited |

| Richard J. Lynch | Lead Independent Director | Independent |

| Michael Stumm | Director | Independent |

The voting structure for shares generally follows a one-share-one-vote principle for common shares, typical for publicly traded companies. There are no widely reported instances of dual-class shares or special voting rights that would grant outsized control to specific entities beyond their proportional ownership. This structure ensures that voting power is distributed based on equity holdings. As of May 2024, the company's market capitalization is approximately $2.5 billion, reflecting the market's valuation of the company's equity.

The Board of Directors oversees the company's strategic direction and financial performance. The voting structure is based on a one-share-one-vote principle. The board's decisions are crucial for overseeing the company's performance.

- Board members include both independent directors and those with ties to the company.

- Major shareholders, such as Fairfax Financial Holdings Limited, have historically held significant influence.

- The board supports the company's transformation into a software and services provider.

- The company's focus on its transformation into a software and services provider has largely been supported by its board, reflecting a unified approach to its strategic direction.

BlackBerry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BlackBerry’s Ownership Landscape?

Over the past few years, the BlackBerry ownership landscape has been shaped by the company's strategic shifts. Instead of major share buybacks or significant secondary offerings, the focus has been on operational improvements and expansion within its software and services divisions. The company's strategy has centered on strategic acquisitions to strengthen its cybersecurity and IoT portfolios, rather than large-scale corporate takeovers that would drastically alter its ownership.

A key trend in BlackBerry's ownership is the continuing influence of institutional investors. While early founders have stepped back from executive roles and board positions, their direct ownership influence has lessened. The company's strategic direction, led by CEO John Chen, has attracted new strategic investors and maintained the interest of existing institutional holders who believe in its long-term vision, especially in the enterprise software and automotive sectors. For more insights, you can explore a Brief History of BlackBerry.

| Metric | Data | Notes |

|---|---|---|

| Total Revenue (Q4 FY2024) | $132 million | For the quarter ended February 29, 2024 |

| IoT Revenue (Q4 FY2024) | $66 million | Reflects growth in the Internet of Things segment |

| Cybersecurity Revenue (Q4 FY2024) | $63 million | Indicates continued focus on cybersecurity offerings |

Industry trends, such as the rise of institutional ownership in tech companies and the influence of activist investors, indirectly affect BlackBerry. While the company hasn't been a recent target of major activist campaigns, its performance is consistently scrutinized by its institutional shareholder base. The company’s focus remains on leveraging its intellectual property, expanding cybersecurity offerings, and growing its QNX embedded software business, influencing investor confidence and ownership trends. Financial performance, including revenue growth and profitability in key segments, remains a primary driver for attracting and retaining investors.

Institutional investors play a significant role in BlackBerry's ownership structure. Their continued interest and scrutiny are key factors influencing the company's strategic decisions and market performance. They are focused on long-term value creation.

BlackBerry has focused on strategic acquisitions to strengthen its cybersecurity and IoT portfolios. These acquisitions are designed to enhance the company's technological capabilities and market position. They are a part of the company's growth strategy.

The company's financial results, particularly revenue growth in key segments like IoT and Cybersecurity, are crucial. These results directly impact investor confidence and ownership trends. Solid performance is key for attracting and retaining investors.

BlackBerry's future hinges on its ability to capitalize on its intellectual property and expand its software offerings. The company's strategic focus on cybersecurity and IoT is designed to drive long-term value. This focus is essential for future growth.

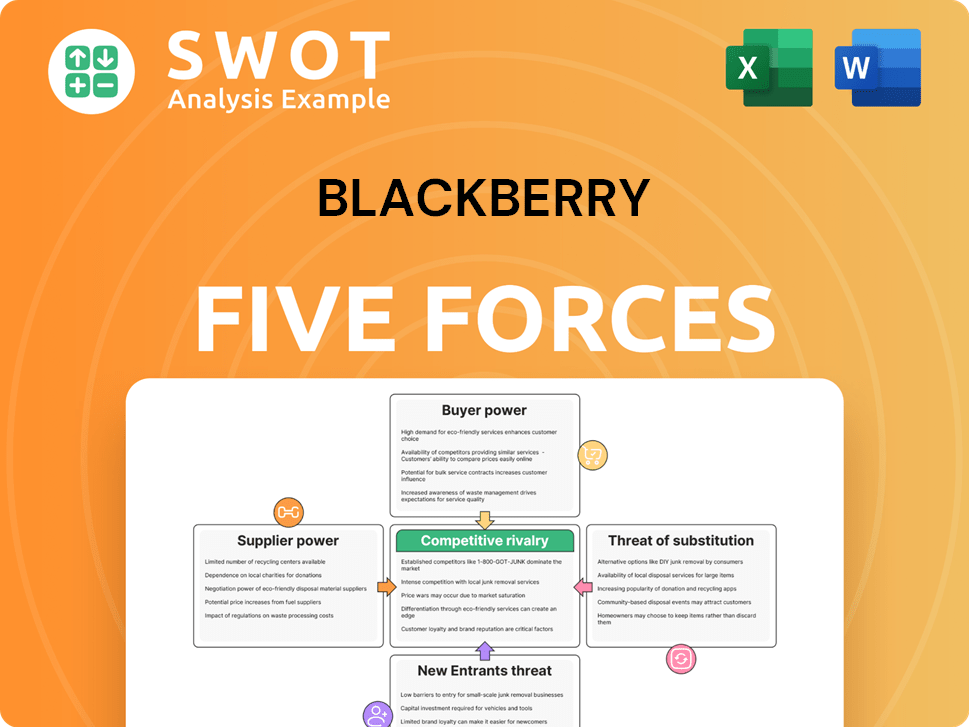

BlackBerry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BlackBerry Company?

- What is Competitive Landscape of BlackBerry Company?

- What is Growth Strategy and Future Prospects of BlackBerry Company?

- How Does BlackBerry Company Work?

- What is Sales and Marketing Strategy of BlackBerry Company?

- What is Brief History of BlackBerry Company?

- What is Customer Demographics and Target Market of BlackBerry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.