DaVita Bundle

Who Really Owns DaVita Inc.?

Delving into the ownership of DaVita SWOT Analysis, a major player in the kidney dialysis market, is key to understanding its strategic moves and future prospects. From near-bankruptcy to a healthcare company giant, DaVita's journey is a testament to the impact of ownership on a company's trajectory. This exploration unveils the key players and their influence.

DaVita Inc.'s ownership structure, including its major DaVita investors like Berkshire Hathaway, profoundly shapes its decisions and its role in the evolving healthcare landscape. Understanding who owns DaVita is crucial for investors, analysts, and anyone interested in the company's financial performance and strategic direction. This analysis will examine the evolution of DaVita's ownership, its current shareholders, and the implications for its future, including its DaVita stock price and overall DaVita company profile.

Who Founded DaVita?

The story of DaVita Inc. begins in 1979 as Medical Ambulatory Care, Inc., a subsidiary of National Medical Enterprises, Inc., now known as Tenet Healthcare. This early structure laid the foundation for what would become a major player in the kidney dialysis and healthcare company industry.

A pivotal moment arrived in August 1994. DLJ Merchant Banking Partners acquired a significant stake, purchasing 70% of the company in a leveraged buyout. This transaction, valued at $75.5 million, saw DLJ itself invest $10.5 million, leading to a name change to Total Renal Care Holdings, Inc.

The company's journey continued with an initial public offering (IPO) in October 1995, raising $107 million. By December 1996, DLJ had achieved a remarkable 386% return on its initial investment. Subsequent acquisitions, such as the $1.3 billion purchase of Renal Treatment Centers in February 1998, further shaped the company's early ownership landscape.

Initially Medical Ambulatory Care, Inc., a subsidiary of National Medical Enterprises, Inc.

DLJ Merchant Banking Partners acquired 70% of the company.

The company was renamed Total Renal Care Holdings, Inc.

Total Renal Care Holdings, Inc. became a public company through an IPO in 1995.

DLJ achieved a 386% return by December 1996.

Renal Treatment Centers was acquired for $1.3 billion in stock in 1998.

The early years of DaVita Inc. saw significant shifts in ownership and strategic moves that shaped its trajectory in the kidney dialysis market. The acquisition of Renal Treatment Centers, while substantial, presented integration challenges, leading to leadership changes and a decline in stock price. The company's evolution reflects the dynamic nature of the healthcare industry and the impact of investment decisions on the company's growth. Understanding the DaVita ownership structure and its early history is crucial for anyone interested in the healthcare company, including potential DaVita investors. To understand the target market of DaVita, consider reading Target Market of DaVita.

The early ownership of DaVita, formerly Medical Ambulatory Care, Inc., was marked by a leveraged buyout and an IPO.

- DLJ Merchant Banking Partners acquired a 70% stake in 1994.

- The company went public in 1995.

- Acquisitions, such as Renal Treatment Centers, played a role in shaping the company.

- The initial public offering raised $107 million.

- DLJ saw a 386% return on its investment by 1996.

DaVita SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has DaVita’s Ownership Changed Over Time?

The evolution of DaVita's ownership has been marked by significant milestones since its initial public offering (IPO) in October 1995. Initially known as Total Renal Care Holdings, Inc., the company rebranded as DaVita Inc. in October 2000. As a publicly traded entity, DaVita (NYSE: DVA) has seen considerable shifts in its major shareholding, with institutional investors consistently holding a dominant position. This journey reflects the healthcare company's growth and adaptation within the competitive kidney dialysis market.

A crucial development in DaVita's ownership structure is the 2024 repurchase agreement with Berkshire Hathaway. This agreement sets a cap on Berkshire's ownership at 45%. The arrangement requires DaVita to repurchase shares quarterly to ensure Berkshire's holdings remain below this threshold. This strategic cap, combined with voting restrictions above 40%, aims to preserve DaVita's operational independence while allowing Berkshire to benefit from the company's growth.

| Metric | Details | As of |

|---|---|---|

| Institutional Ownership | Approximately 91.33% | March 2025 |

| Institutional Ownership | Approximately 92.95% | May 2025 |

| Berkshire Hathaway Ownership | 41.2% | 2024 |

| Berkshire Hathaway Shares | 35,142,479 shares | Latest Data from Nasdaq |

| Share Price | $137.90 per share | June 6, 2025 |

| Market Capitalization | Approximately $10.43 billion | Latest Available Data |

As of December 31, 2024, institutional investors held a substantial stake in DaVita, totaling 77,934,665 shares. By May 2025, institutional ownership had increased to 92.95%. Major institutional shareholders include Vanguard Group Inc., BlackRock, Inc., and State Street Corp. The Growth Strategy of DaVita highlights how these ownership dynamics influence the company's strategic direction and financial performance. The company's market capitalization was approximately $10.43 billion as of the latest available data, reflecting its position in the healthcare sector.

DaVita's ownership structure is primarily characterized by significant institutional investment, with Berkshire Hathaway as a major stakeholder.

- Institutional investors held a considerable majority of shares.

- Berkshire Hathaway's ownership is capped at 45% through a repurchase agreement.

- The company's market capitalization is approximately $10.43 billion.

- The stock price was $137.90 per share as of June 6, 2025.

DaVita PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on DaVita’s Board?

The current board of directors at DaVita Inc. is responsible for overseeing the company's governance and strategic direction. The board includes a mix of independent directors and those with leadership roles within the company. Javier J. Rodriguez, the CEO since June 2019, is also a director. Pamela M. Arway serves as the Independent Chair of the Board. Other independent directors include Barbara J. Desoer, Jason M. Hollar, Gregory J. Moore, and Dennis W. Pullin, who joined the board in April 2024.

Dennis W. Pullin, for instance, is part of the Compliance and Quality Committee and the Nominating and Governance Committee. The board's composition and the roles of its members are crucial for ensuring effective oversight of the healthcare company. This structure helps to maintain a balance between internal leadership and external oversight, which is important for DaVita's operations and strategic decisions. The board's decisions directly impact DaVita's ability to provide quality kidney dialysis services to its patients.

| Board Member | Role | Additional Information |

|---|---|---|

| Javier J. Rodriguez | Chief Executive Officer & Director | Joined as CEO in June 2019. |

| Pamela M. Arway | Independent Chair of the Board | Oversees the board's activities. |

| Dennis W. Pullin | Independent Director | Appointed in April 2024; serves on committees. |

The voting structure for director elections at DaVita generally follows a one-share-one-vote principle for common stock. In uncontested elections, directors are elected by a majority of votes cast by shareholders. In contested elections, directors are elected by a plurality of shares. While Berkshire Hathaway holds a significant stake in DaVita, the 2024 repurchase agreement includes voting restrictions. These restrictions prevent Berkshire Hathaway from exercising outsized control beyond a certain threshold (above 40%), aiming to preserve DaVita's operational independence. Understanding the DaVita ownership structure is key for DaVita investors.

DaVita has faced legal challenges and controversies that have touched upon its governance. In October 2014, the company settled claims of illegal kickbacks for $350 million. In June 2015, a settlement of $450 million was reached regarding allegations of improper drug disposal. These events highlight the ongoing scrutiny and challenges that can impact a company's governance and decision-making. Learn more about the Marketing Strategy of DaVita.

- Legal settlements have impacted DaVita's financial performance.

- DaVita's governance structure aims to balance internal and external oversight.

- The board's decisions directly affect the company's operations.

- The voting structure is designed to maintain operational independence.

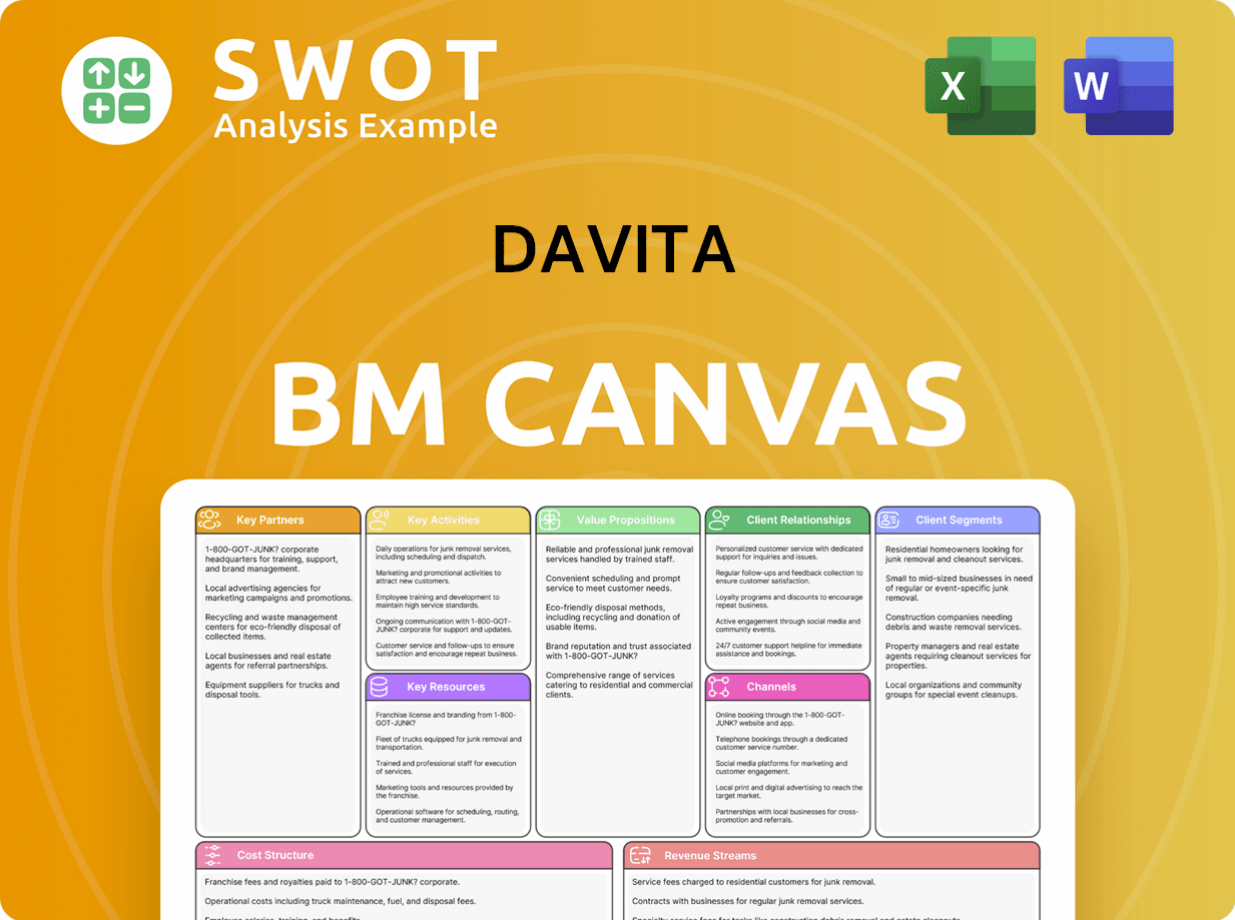

DaVita Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped DaVita’s Ownership Landscape?

Over the past few years, the ownership structure of DaVita Inc. has been marked by significant share repurchases. In 2024, the company spent $1.386 billion on share buybacks. This trend continued into 2025, with $550 million spent in Q1 and an additional $259 million repurchased between March and May 2025. These actions reflect a strategy of returning value to shareholders, which could also signal that the stock is undervalued.

As of February 13, 2025, DaVita had $1,811,069 available under its share repurchase authorization. The company's full-year 2025 guidance projects $1.0–$1.25 billion in free cash flow, which highlights management's confidence in its ability to generate cash for these repurchases. Institutional investors held approximately 92.95% of DaVita shares as of May 2025. Berkshire Hathaway remains a major shareholder, but a 2024 agreement caps their beneficial ownership at 45%.

| Metric | Value | Date |

|---|---|---|

| Share Repurchases (2024) | $1.386 billion | 2024 |

| Share Repurchases (Q1 2025) | $550 million | Q1 2025 |

| Share Repurchases (March-May 2025) | $259 million | March 31 - May 12, 2025 |

| Institutional Ownership | 92.95% | May 2025 |

| Share Repurchase Authorization | $1,811,069 | February 13, 2025 |

Leadership changes also occurred, with David Maughan becoming Chief Operating Officer and Jessica Hergenreter becoming Chief People Officer in September 2024. The consistent share buybacks and high institutional ownership, coupled with the Brief History of DaVita, indicate a focus on shareholder value and confidence in the healthcare company's market position, despite challenges such as fluctuating patient volumes.

DaVita's ownership is primarily driven by institutional investors. Berkshire Hathaway has a significant stake, capped at 45% through a repurchase agreement. The company's share repurchase programs also play a key role in shaping the ownership profile.

DaVita's financial performance is highlighted by its free cash flow projections for 2025, estimated between $1.0 and $1.25 billion. This strong cash flow supports the company's share repurchase strategy, demonstrating confidence in its financial health.

Recent developments include significant share repurchases and leadership changes. These strategic moves reflect DaVita's commitment to enhancing shareholder value and adapting to market dynamics. These actions are vital for the kidney dialysis company.

DaVita investors are largely institutional, with a substantial portion of shares held by these entities. This ownership structure suggests a high level of confidence in DaVita's long-term prospects and its ability to navigate the healthcare market.

DaVita Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DaVita Company?

- What is Competitive Landscape of DaVita Company?

- What is Growth Strategy and Future Prospects of DaVita Company?

- How Does DaVita Company Work?

- What is Sales and Marketing Strategy of DaVita Company?

- What is Brief History of DaVita Company?

- What is Customer Demographics and Target Market of DaVita Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.