Health Catalyst Bundle

Who Really Controls Health Catalyst?

Understanding the ownership structure of a company is paramount for investors and strategists alike. Health Catalyst, a key player in the HealthTech sector, has evolved significantly since its 2008 founding. This deep dive into Health Catalyst SWOT Analysis will unveil the key players shaping its future.

From its inception in Salt Lake City to its current status as a public company, Health Catalyst's ownership has undergone a fascinating transformation. This analysis will explore the influence of Health Catalyst investors, executives, and major shareholders on the company's direction and performance. We'll examine the impact of its IPO and the roles of institutional investors, providing critical insights into the company's governance and strategic outlook, including its market capitalization and stock price history.

Who Founded Health Catalyst?

Health Catalyst, a prominent player in the healthcare data analytics field, was established in 2008. The company's foundation rests on the vision of its founders, Tom Burton and Steven Barlow. Their combined expertise in healthcare, particularly their experience at Intermountain Healthcare, laid the groundwork for the company's data-driven approach.

The initial concept for Health Catalyst was developed with Dr. David Burton, Tom's father. The goal was to create a data platform that could be used beyond Intermountain Healthcare. This vision drove the early development of the company. While specific details on the initial equity distribution among the founders are not publicly available, the focus was on building a robust data platform.

Early funding rounds involved angel investors and venture capital firms. Norwest Venture Partners invested in 2012, and Sequoia Capital and Kaiser Permanente Ventures also became early investors. These early investments were crucial in shaping the trajectory and growth of the Health Catalyst company.

Dan Burton, Tom Burton's brother, took on the role of CEO, bringing business acumen and the trust of the founding team. Before its IPO, the company secured approximately $392 million in funding across 10 rounds. Early investors included Norwest Venture Partners, Sequoia Capital, and Kaiser Permanente Ventures.

- Founders: Tom Burton and Steven Barlow.

- Early Investors: Norwest Venture Partners, Sequoia Capital, Kaiser Permanente Ventures.

- CEO: Dan Burton.

- Total Funding Before IPO: $392 million.

Health Catalyst SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Health Catalyst’s Ownership Changed Over Time?

The journey of Health Catalyst as a publicly-traded entity began with its initial public offering (IPO) in 2019, marking a pivotal shift from private to public ownership. The company's market capitalization, a key indicator of its value, was approximately $264 million as of late 2024 and early 2025. This transition to the public market significantly altered the company's ownership structure, introducing a broader range of shareholders and increasing the visibility of the Health Catalyst company in the financial world. You can learn more about the company's origins in this Brief History of Health Catalyst.

The structure of Health Catalyst ownership is primarily institutional, which has a significant impact on the company's strategic direction and stock performance. The IPO in 2019 was a key event that opened the door for institutional investors to acquire substantial stakes in the company. This shift towards institutional ownership has been a defining characteristic of the company's shareholder base since its public debut. The concentration of shares among institutional investors can lead to increased volatility in the stock price, as their trading decisions can significantly influence market dynamics.

| Ownership Category | Percentage of Shares (April 2025) | Key Stakeholders |

|---|---|---|

| Institutional Investors | Approximately 76% | BlackRock, Inc. (8.0%), First Light Asset Management, LLC (7.5%), The Vanguard Group, Inc. (6.3%), Impax Asset Management Group plc, PXSCX - Pax Small Cap Fund Investor Class, Nepsis, Inc., Wellington Management Group Llp, Primecap Management Co/ca/, Dimensional Fund Advisors Lp |

| Individual Investors | Approximately 21% | General public |

| Insiders | Approximately 1.4% | Including CEO Daniel Burton |

The influence of institutional investors on Health Catalyst stock is considerable, given their substantial ownership stake. Their investment decisions can have a noticeable impact on the Health Catalyst share price and the company's strategic direction. Understanding the dynamics of Health Catalyst investors, including the major shareholders and the Health Catalyst executives, is crucial for anyone interested in the company's financial performance and future prospects. The slight decrease in insider holdings, while institutional holdings remain steady, is a detail that investors often watch closely.

Health Catalyst is predominantly owned by institutional investors, with a significant portion held by a few major firms.

- Institutional investors hold approximately 76% of the company's stock as of April 2025.

- Individual investors hold around 21% of the shares.

- Insiders, including the CEO, own about 1.4% of the total shares.

- The concentration of institutional ownership can influence the Health Catalyst stock price history and company strategy.

Health Catalyst PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Health Catalyst’s Board?

As of May 2025, the board of directors for Health Catalyst consists of seven members. The board operates under a staggered system, with directors serving three-year terms. This structure ensures that a portion of the board is up for election each year. Dr. Jill Hoggard Green joined the Board of Directors on December 1, 2024. Anita Pramoda concluded her nearly decade-long tenure on March 1, 2025.

The current board composition reflects the company's leadership structure and strategic direction. Understanding the board's composition is crucial for Health Catalyst investors and anyone interested in the Health Catalyst company's governance. The board's decisions significantly impact the company's performance and strategic initiatives.

| Board Member | Role | Start Date (if applicable) |

|---|---|---|

| (Information not available as of May 2025) | (Information not available as of May 2025) | (Information not available as of May 2025) |

| (Information not available as of May 2025) | (Information not available as of May 2025) | (Information not available as of May 2025) |

| (Information not available as of May 2025) | (Information not available as of May 2025) | (Information not available as of May 2025) |

Health Catalyst operates under a one-share-one-vote system. This means each share of common stock carries one vote on all matters put to a stockholder vote, including director elections. Stockholders do not have cumulative voting rights. The board has the power to issue preferred stock with different rights, preferences, and privileges, including voting rights, without further action by stockholders, although no such preferred stock was outstanding as of September 30, 2024. For more insights into the company's strategic growth, consider reading about the Growth Strategy of Health Catalyst.

The voting structure at Health Catalyst is straightforward, with each share holding equal voting power. This system impacts how Health Catalyst investors can influence company decisions.

- One-share-one-vote structure.

- No cumulative voting rights.

- Board can issue preferred stock with varying rights.

- Daniel Burton, Jason Alger, and Benjamin Landry designated as proxy holders for the 2025 Annual Meeting.

Health Catalyst Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Health Catalyst’s Ownership Landscape?

In the past few years, Health Catalyst has undergone significant changes affecting its ownership and strategic direction. The company has been actively involved in mergers and acquisitions, completing 12 acquisitions at an average cost of $72.5 million. A notable acquisition was Upfront Healthcare in January 2025, costing $86 million. These moves, primarily in healthcare IT, aim to bolster its offerings in areas like care coordination and patient communication. For those following Health Catalyst ownership, these developments are key.

From an ownership perspective, institutional investors continue to hold a dominant position, with approximately 76.54% ownership as of January 2025. While institutional ownership remains high, there's been a slight decrease in shares held by long-only funds recently. Insider ownership has also seen a minor decrease, from 8.26% to 8.25% in May 2025. Furthermore, share dilution has occurred, with total shares outstanding increasing by 17.9% in the past year. Understanding the dynamics of Health Catalyst company ownership is crucial for investors.

Financially, Health Catalyst reported total revenue of $307 million and an Adjusted EBITDA of $26 million for the full year 2024. In the first quarter of 2025, revenue reached $79.4 million, and Adjusted EBITDA was $6.3 million, exceeding guidance. The company anticipates continued top-line growth reacceleration for the full year 2025, with the technology segment expected to outperform the overall business. Additionally, Health Catalyst plans to add 40 net new platform clients in 2025. For more information on how the company approaches its market, check out the Marketing Strategy of Health Catalyst.

Institutional ownership of Health Catalyst remains high, at roughly 76.54% as of January 2025. This indicates strong confidence from major investment firms and funds. However, there has been a slight decrease in institutional shares held by long-only funds.

Insider ownership, representing the stake held by executives and insiders, has seen a slight decrease. As of May 2025, insider ownership was at 8.25%, slightly down from 8.26%. This data point is important for Health Catalyst investors.

Health Catalyst has been actively acquiring companies to expand its offerings. Over the past few years, 12 acquisitions have been made, with the Upfront Healthcare acquisition in January 2025 for $86 million being a significant example. This signals growth and strategic expansion.

Health Catalyst reported $307 million in revenue for 2024, with Q1 2025 revenue at $79.4 million. The company anticipates continued top-line growth. The company is also expecting to add 40 new platform clients in 2025. These figures are key for understanding Health Catalyst financial performance.

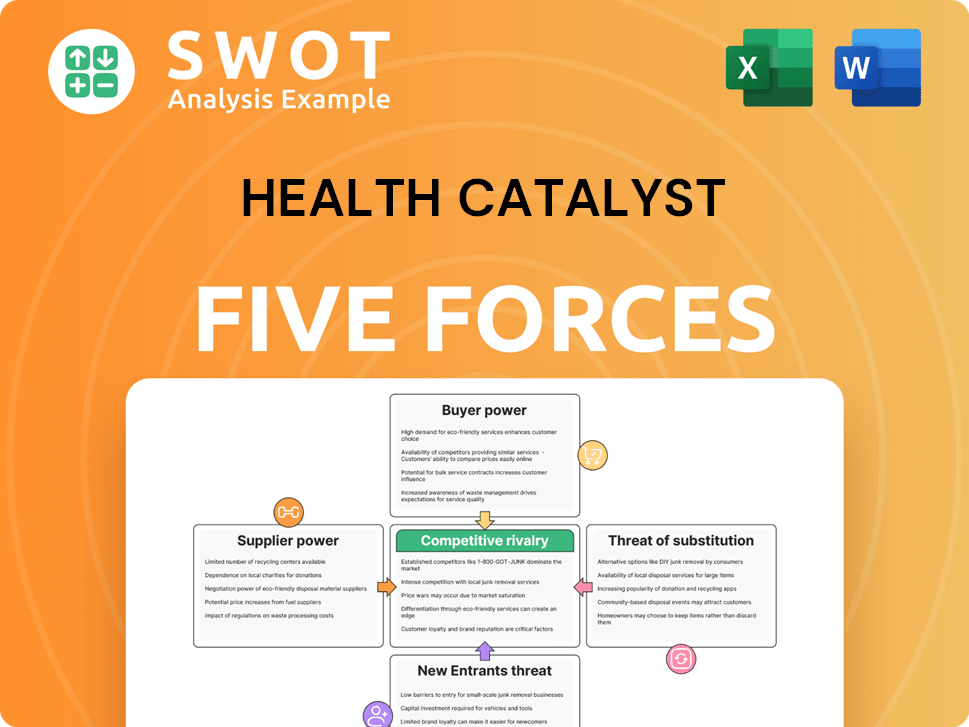

Health Catalyst Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Health Catalyst Company?

- What is Competitive Landscape of Health Catalyst Company?

- What is Growth Strategy and Future Prospects of Health Catalyst Company?

- How Does Health Catalyst Company Work?

- What is Sales and Marketing Strategy of Health Catalyst Company?

- What is Brief History of Health Catalyst Company?

- What is Customer Demographics and Target Market of Health Catalyst Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.