N-able Bundle

Who Really Owns N-able?

Understanding a company's ownership structure is paramount for investors and strategists alike. N-able's journey, marked by its 2021 spin-off from SolarWinds, offers a compelling case study in strategic realignment. This transformation allowed N-able to focus on the managed service provider (MSP) market, driving innovation and growth. This exploration unveils the intricacies of N-able SWOT Analysis, from its origins to its present-day ownership landscape.

The evolution of N-able's ownership provides critical insights into its strategic direction and future prospects. From its roots as a part of SolarWinds to its independent status, understanding who owns N-able is crucial. Exploring the N-able ownership structure reveals the key players shaping the company's trajectory and the potential impact on its value. This analysis will also cover the N-able and SolarWinds relationship and the N-able company financials.

Who Founded N-able?

The story of N-able, a prominent player in the IT management solutions sector, began in Ottawa, Canada, in the year 2000. The company was founded by Mark Scott, who was supported by key members of the founding team, including Steven Revell and Gavin Garbutt. The initial focus of the company was on providing IT management and automation solutions tailored for managed service providers (MSPs).

Early developments shaped the trajectory of the company, including shifts in leadership and strategic acquisitions. These pivotal moments set the stage for N-able's growth and eventual integration into a larger corporate structure. Understanding the founders and early ownership provides a crucial foundation for comprehending the company's evolution.

The foundational steps taken by the initial leadership team were critical for the future of the company. These early decisions and the evolution of the leadership team set the stage for the company's later success. These early decisions and the evolution of the leadership team set the stage for the company's later success.

N-able was established in 2000 in Ottawa, Canada. Mark Scott was the founder, supported by Steven Revell and Gavin Garbutt. The company initially focused on IT management and automation solutions for MSPs.

In 2006, Mark Scott left N-able. Gavin Garbutt, initially an investor, took over as CEO. This marked a significant shift in the company's leadership.

HoundDog Technology, founded in Scotland by Doug Wilson in 2003, was later acquired. HoundDog was acquired by GFI Software in 2009, led by Walter Scott. At the time of acquisition, HoundDog served over 1,700 VARs and MSPs.

The early focus was on IT management and automation solutions. This focus was specifically tailored to the needs of managed service providers. This strategic direction helped shape the company's initial growth.

Mark Scott, Steven Revell, and Gavin Garbutt were key figures in the early days. Their contributions were vital to the company's initial direction and development. These individuals shaped the company's foundational strategies.

Specific details about the initial equity split and capital are not readily available. The early stages of the company were focused on establishing its core business model. The company's initial funding strategy is not publicly available.

The early ownership and leadership transitions of N-able set the stage for its future. The company's evolution included strategic acquisitions and changes in leadership. The early focus on IT management solutions for MSPs was a key factor in its growth. The acquisition of HoundDog Technology by GFI Software in 2009, which served over 1,700 VARs and MSPs, further solidified N-able's position in the market. Understanding the history of Marketing Strategy of N-able provides context to its current market position. The early decisions made by the founders and the subsequent leadership changes were crucial in shaping the company's path to becoming a significant player in the IT solutions industry. The early focus on IT management solutions for MSPs was a key factor in its growth.

The company was founded in 2000 in Ottawa, Canada, by Mark Scott.

- Gavin Garbutt became CEO in 2006.

- HoundDog Technology was acquired by GFI Software in 2009.

- The initial focus was on IT management for MSPs.

- Early leadership and acquisitions shaped the company's trajectory.

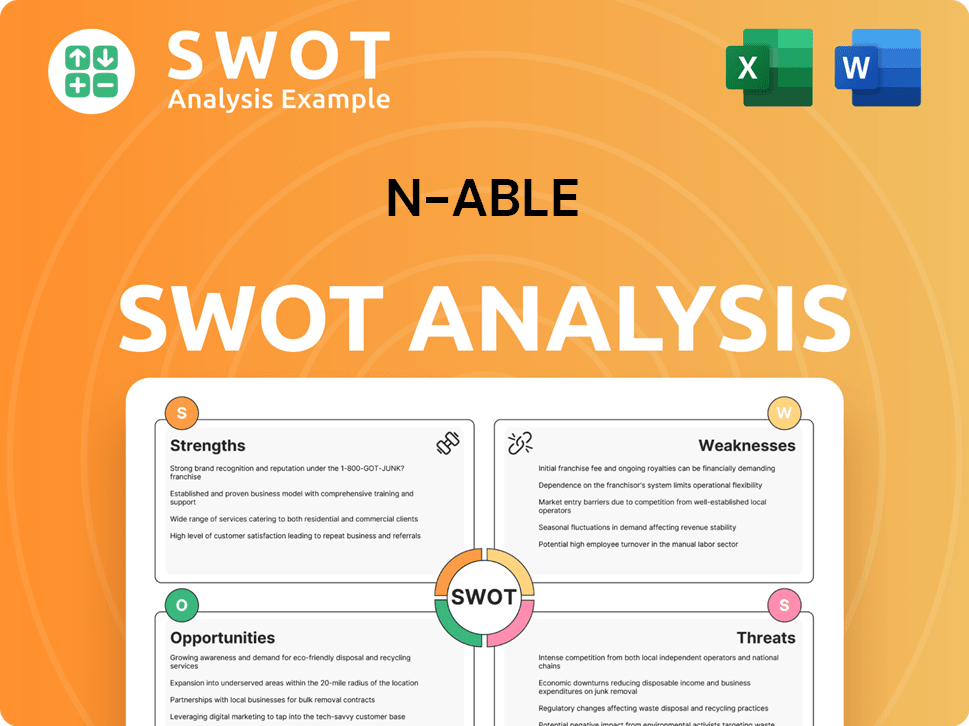

N-able SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has N-able’s Ownership Changed Over Time?

The journey of N-able's ownership has been marked by significant shifts. Initially, in 2013, SolarWinds acquired N-able Technologies, integrating its remote monitoring and management solutions into SolarWinds' MSP offerings. This N-able acquisition broadened its service offerings and technological capabilities. Later, in 2021, a pivotal change occurred when N-able separated from SolarWinds, becoming an independent, publicly traded entity on the NYSE under the ticker symbol NABL. This spin-off allowed N-able to concentrate solely on the MSP market, reshaping its N-able ownership structure.

As of early 2025, the N-able company's ownership is primarily institutional. This structure indicates the strong influence of large financial entities on the company's governance and strategic direction. The transition from being part of a larger entity to an independent public company has significantly altered the landscape of its stakeholders, impacting its operational focus and market strategy. Understanding the evolution of N-able ownership provides insight into its strategic direction and market position.

| Shareholder | Shares Owned (approx.) | Percentage of Ownership (approx.) |

|---|---|---|

| Silver Lake Group, L.L.C. | 61.47 million | 32.52% |

| Thoma Bravo, Llc | 50.09 million | 26.49% |

| BlackRock, Inc. | Data not available | Data not available |

| Vanguard Group Inc | Data not available | Data not available |

| Canada Pension Plan Investment Board | Data not available | Data not available |

Institutional investors hold a substantial portion of N-able's shares, with ownership ranging from approximately 88.94% to 95.84% as of May and June 2025. Key institutional shareholders include Silver Lake Group, L.L.C., and Thoma Bravo, Llc, who collectively hold a significant percentage of the company's shares. Insider ownership, including executives and board members, accounts for roughly 0.79% to 1.47%, while retail investors hold a negligible percentage. This ownership distribution highlights the influence of institutional investors on the company's strategic decisions. To understand the specific market segments that N-able targets, you can explore the Target Market of N-able.

N-able's ownership has evolved significantly, from being acquired by SolarWinds to becoming an independent public company.

- Institutional investors are the primary shareholders, influencing the company's strategic direction.

- Silver Lake Group, L.L.C. and Thoma Bravo, Llc are among the major institutional shareholders.

- The spin-off from SolarWinds marked a significant shift in N-able's focus and market approach.

- Understanding the N-able ownership structure provides insights into its governance and strategic decisions.

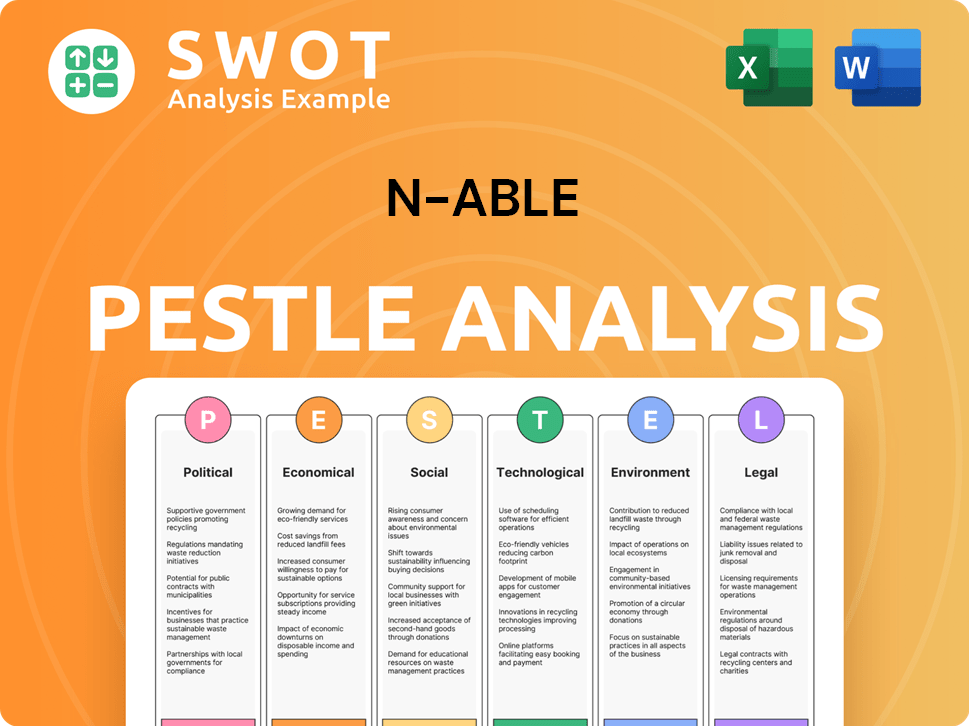

N-able PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on N-able’s Board?

The current leadership at N-able, Inc. includes key figures such as John Pagliuca as Chief Executive Officer, Tim O'Brien as Chief Financial Officer, and Jeff Nulsen as Chief Technology Officer. The Board of Directors, while not fully detailed in the available information, is responsible for guiding the company's strategic direction and overseeing its operations. Understanding the composition of the board is crucial for investors and stakeholders to assess the company's governance and decision-making processes.

The company's governance structure is designed to ensure transparency and accountability. Regular filings with the SEC, including ownership reports (13D, 13G), provide detailed information on significant holdings. This transparency helps investors stay informed about the ownership structure and potential influences on the company's direction. The company's commitment to regulatory compliance and shareholder transparency is essential for maintaining investor confidence and ensuring responsible corporate governance.

| Leadership Position | Name | Title |

|---|---|---|

| Chief Executive Officer | John Pagliuca | CEO |

| Chief Financial Officer | Tim O'Brien | CFO |

| Chief Technology Officer | Jeff Nulsen | CTO |

N-able operates with a one-share-one-vote structure, which is standard for publicly traded companies listed on the NYSE. This structure ensures that voting power is directly proportional to share ownership. Major shareholders like Silver Lake Group, L.L.C. and Thoma Bravo, Llc hold significant stakes, granting them considerable voting power. The company's structure and regulatory oversight by the SEC are designed to protect investor interests. To learn more about the business, check out the Revenue Streams & Business Model of N-able.

Understanding who owns N-able is essential for investors. The company's ownership structure is transparent, with major shareholders holding significant voting power. The leadership team includes key figures like the CEO, CFO, and CTO.

- N-able operates with a one-share-one-vote structure.

- Major shareholders include Silver Lake Group, L.L.C. and Thoma Bravo, Llc.

- The company is publicly traded on the NYSE.

- Regular SEC filings provide transparency.

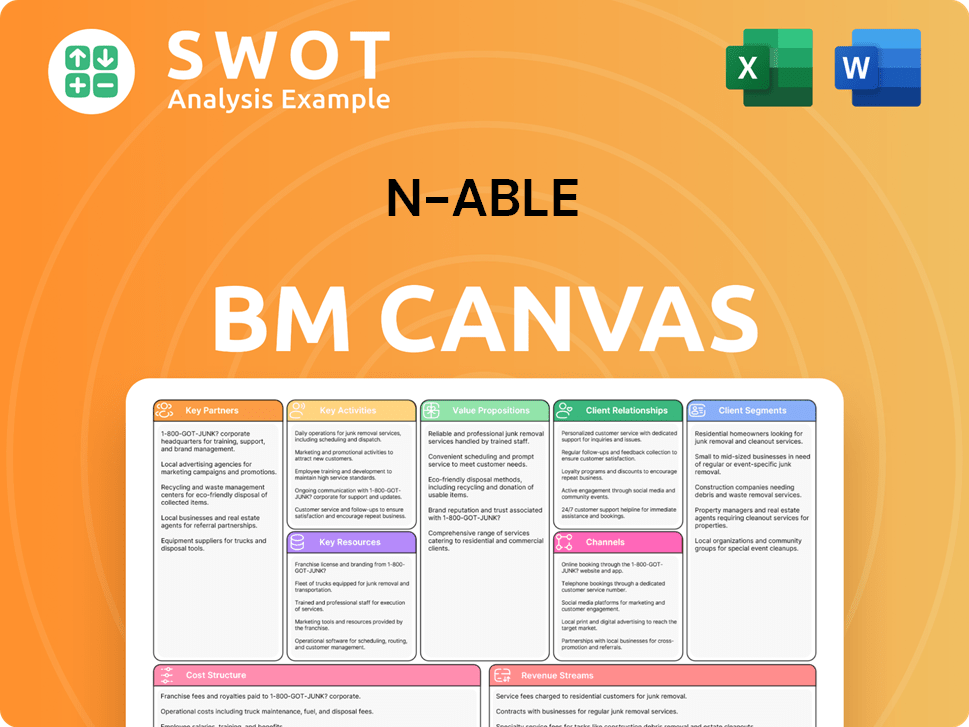

N-able Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped N-able’s Ownership Landscape?

Over the past few years, the ownership structure of the company has seen significant changes. The most pivotal event was the spin-off from SolarWinds in July 2021, establishing it as an independent, publicly traded entity. This strategic move allowed the company to focus on the MSP market, driving investments in technologies and services tailored for its partners. The company's journey from being part of a larger entity to an independent public company has reshaped its strategic direction and ownership dynamics.

In November 2024, the company acquired Adlumin, a cloud-native XDR and MDR platform provider. This acquisition, valued at approximately $100 million, is expected to boost cybersecurity capabilities. Furthermore, in March 2025, a share repurchase program was announced, authorizing the repurchase of up to $75 million of its common stock. These actions reflect the confidence in the company's future and a commitment to enhancing shareholder value. The company’s acquisitions, including SpinPanel in July 2022 and Passportal in July 2021, have further shaped its service offerings and market position.

| Metric | Details | As of |

|---|---|---|

| Institutional Ownership | 440 institutional owners | June 2025 |

| Total Shares Held by Institutions | 196.66 million shares | June 2025 |

| Peak Institutional Ownership | Up to 95.66% | April 2025 |

Industry trends highlight increasing institutional ownership in the company, with a significant percentage of shares held by institutional investors. Despite exceeding earnings expectations in Q4 2024, the stock price experienced a decline, reflecting investor concerns. The management projects over $500 million in Annual Recurring Revenue (ARR) for 2025, along with maintaining strong profit margins. These projections are crucial for assessing the company's future performance and its impact on the company’s value.

The company is a publicly traded entity, following its spin-off from SolarWinds. Institutional investors hold a significant portion of shares. The company's ownership structure reflects a mix of institutional and potentially individual investors.

The company has expanded its capabilities through strategic acquisitions. Adlumin, SpinPanel, and Passportal are notable acquisitions. These acquisitions have enhanced its service offerings and market position.

The company's financial performance is a key factor influencing investor sentiment. Management projects over $500 million in ARR for 2025. Share repurchase programs indicate confidence in the company's financial health.

The spin-off from SolarWinds was a major turning point. The separation allowed the company to focus solely on the MSP market. This strategic shift has influenced its acquisitions and future strategies.

N-able Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of N-able Company?

- What is Competitive Landscape of N-able Company?

- What is Growth Strategy and Future Prospects of N-able Company?

- How Does N-able Company Work?

- What is Sales and Marketing Strategy of N-able Company?

- What is Brief History of N-able Company?

- What is Customer Demographics and Target Market of N-able Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.