N-able Bundle

Who are N-able's Key Customers?

In today's fast-paced tech world, understanding your customer is the key to success. For N-able, a leading provider of cloud-based solutions, pinpointing its N-able SWOT Analysis customer demographics and target market is essential. This analysis delves into who N-able's ideal customer is and how the company caters to their specific needs.

This exploration will dissect N-able's customer demographics, including their geographic reach and the evolving demands of their target market. We'll examine how N-able identifies and engages with its ideal customer profile, providing insights for anyone interested in audience analysis and effective market segmentation. This deep dive into N-able's customer base breakdown offers valuable information for both industry professionals and those looking to understand the managed services landscape.

Who Are N-able’s Main Customers?

Understanding the Revenue Streams & Business Model of N-able involves a close look at its primary customer segments. The company operates primarily in the B2B sector, focusing on managed service providers (MSPs). These MSPs are the direct customers, and they, in turn, serve small and medium-sized businesses (SMBs) and mid-market businesses. This structure allows for targeted product development and marketing strategies.

The target market for N-able isn't defined by typical demographics like age or income. Instead, it's characterized by the size and industry of the businesses the MSPs serve. This approach helps N-able tailor its offerings to meet the specific needs of these IT service providers. The focus on MSPs is crucial for N-able's business model, allowing it to provide comprehensive solutions that MSPs can then offer to their clients.

In 2025, a significant portion of N-able's network security customers are companies with 20-49 employees, representing 193 companies. Following this, there are 105 companies with 100-249 employees and 80 companies with 0-9 employees. This data illustrates the company's focus on SMBs and mid-market businesses, which are key components of N-able's customer base.

N-able's primary focus is on managed service providers (MSPs), who then serve SMBs and mid-market businesses. This B2B approach allows for targeted product development and marketing efforts. The customer demographics are primarily defined by the size and industry of the end-user businesses.

Cybersecurity is a major growth driver for MSPs. Approximately 90% of those surveyed expect growth in cybersecurity managed services sales in 2025, up from 80% the previous year. N-able has responded by enhancing its cybersecurity offerings, including the acquisition of Adlumin in late 2024.

N-able's strategy is heavily influenced by the increasing demand for cybersecurity. This is reflected in its acquisitions and product development. The company aims to capture a larger share of the rapidly expanding cybersecurity market, which is growing at about 14% annually.

- The primary target market consists of MSPs.

- MSPs are increasingly focused on cybersecurity services.

- N-able is expanding its cybersecurity capabilities.

- The company is adapting to the evolving needs of its customer base.

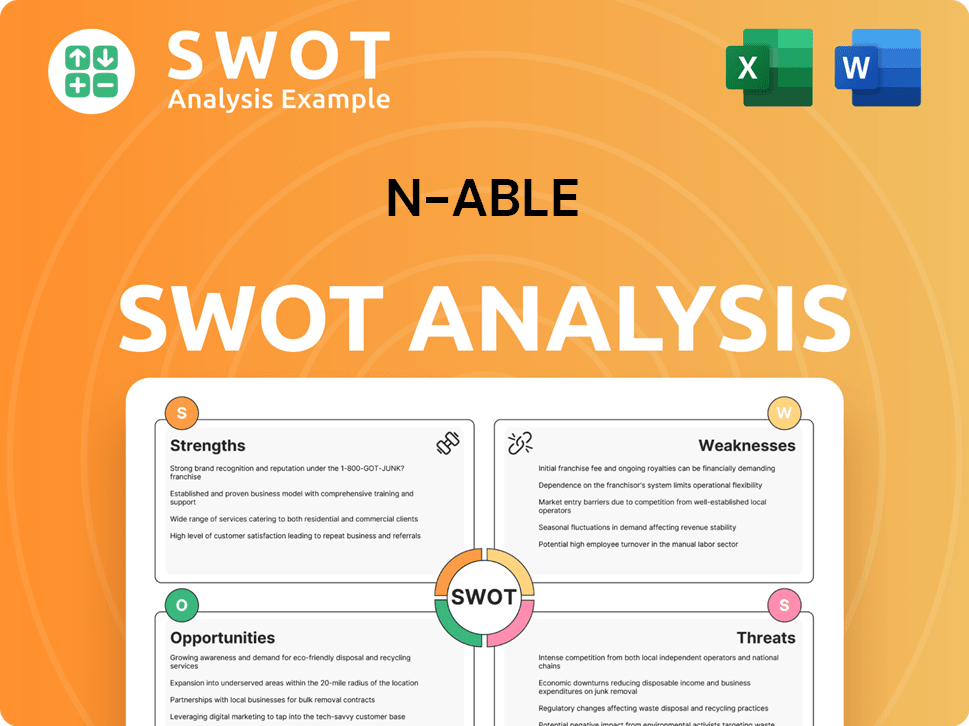

N-able SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do N-able’s Customers Want?

Understanding the customer needs and preferences is crucial for any business. For Owners & Shareholders of N-able, this involves a deep dive into the characteristics and requirements of its primary customer base: Managed Service Providers (MSPs).

The focus on customer demographics and the target market allows for tailored solutions and effective marketing strategies. This approach ensures that the company can meet the specific demands of its clients, driving customer satisfaction and loyalty. Analyzing the ideal customer profile helps in refining product offerings and sales approaches.

By addressing these key areas, the company can maintain a competitive edge and foster long-term relationships with its clients. The company's success heavily relies on its ability to understand and cater to the evolving needs of MSPs in the IT landscape.

MSPs consistently seek ways to enhance their operational efficiency. This includes automating IT services and streamlining workflows to reduce manual tasks and improve service delivery times. Efficiency directly impacts profitability and the ability to scale operations.

Security remains a paramount concern for MSPs. They are increasingly expected to act as security consultants for their clients. This shift requires advanced cybersecurity solutions and a deep understanding of emerging threats.

MSPs need to provide a wide range of IT services to meet the diverse needs of their end-customers. This includes remote monitoring and management, data protection, and cloud solutions. The ability to offer a full suite of services is crucial for competitiveness.

Pricing is a significant factor in the purchasing decisions of MSPs. They seek cost-effective solutions that allow them to offer competitive pricing to their own clients. Value for money is a key consideration.

MSPs highly value reliable customer support from their vendors. Quick and effective support helps them resolve issues promptly and maintain their service levels. Strong vendor relationships are built on dependable support.

MSPs often prioritize establishing long-term relationships with their vendors. This fosters trust and allows for better integration of solutions. Stability and consistency are key drivers in these relationships.

The company focuses on addressing the key pain points and emerging trends in the MSP market. This involves providing solutions that help MSPs acquire new customers, develop cloud strategies, and automate IT services. The company's approach is data-driven, with product development and marketing strategies informed by market research and customer feedback.

- Customer Acquisition: MSPs struggle with acquiring new customers. The company's solutions help MSPs enhance their sales and marketing efforts.

- Cloud Strategy: Developing and executing effective cloud strategies is a major challenge. The company offers tools and services to support MSPs in their cloud initiatives.

- Automation: Automating IT services is crucial for efficiency. The company provides automation capabilities to streamline operations and reduce costs.

- Security Trends: In 2024, security concerns continue to dominate the MSP landscape. Cybersecurity solutions and expertise are in high demand. The company is investing in advanced security features.

- AI Adoption: AI adoption is rapidly increasing among MSPs. Most are using AI to streamline workflows and boost sales and ticketing processes.

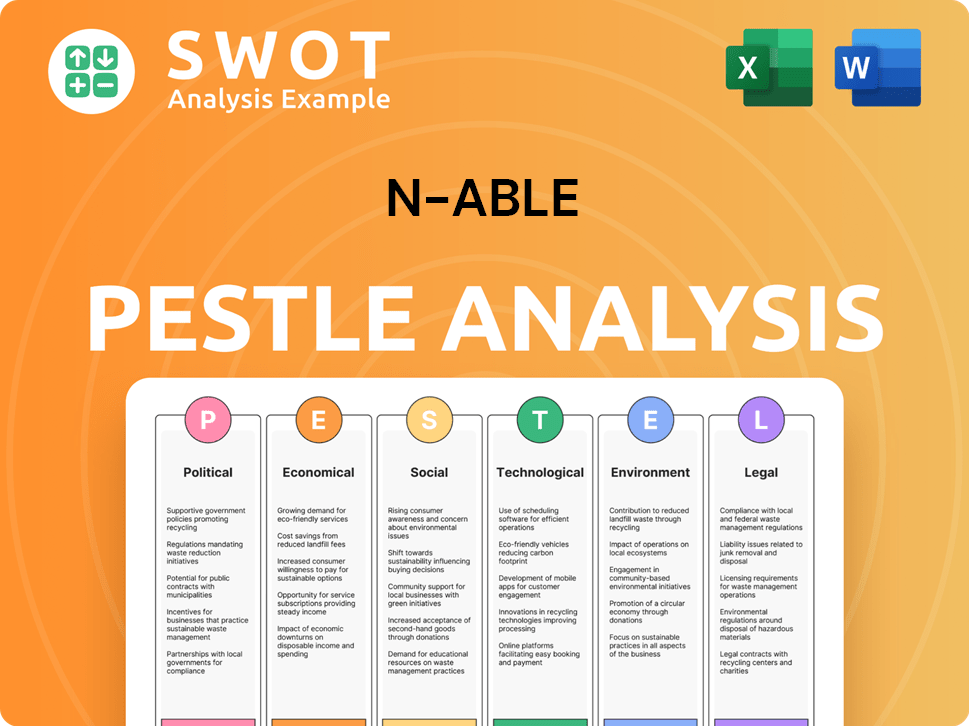

N-able PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does N-able operate?

The geographical market presence of N-able, a global software company, is extensive. While specific market share data by country or city isn't readily available, the company's operations span across multiple regions. This widespread presence is crucial for understanding the diverse needs of its customer demographics and effectively targeting its market.

N-able's reach is further highlighted by its focus on the Managed Service Provider (MSP) landscape, as indicated by the MSP Horizons Report, a collaborative effort with Canalys. This suggests a significant international footprint, with a commitment to serving MSPs globally. This international focus is key to understanding the N-able customer base breakdown.

The company's approach likely involves localization strategies to cater to regional differences in customer preferences, buying power, and regulatory requirements. For example, North American customers may prefer local data centers and 24/7 support, while European clients prioritize GDPR compliance. A comprehensive Marketing Strategy of N-able would likely address these geographical considerations.

Geographic location is a common factor in B2B customer segmentation. Companies like N-able often tailor their offerings to meet regional needs, such as data residency preferences and language support.

N-able's global operations are supported by a strong financial performance. In 2024, total revenue reached $466.1 million, and projections for 2025 estimate revenue between $486.5 million and $492.5 million, indicating a broad and active customer base across various geographies.

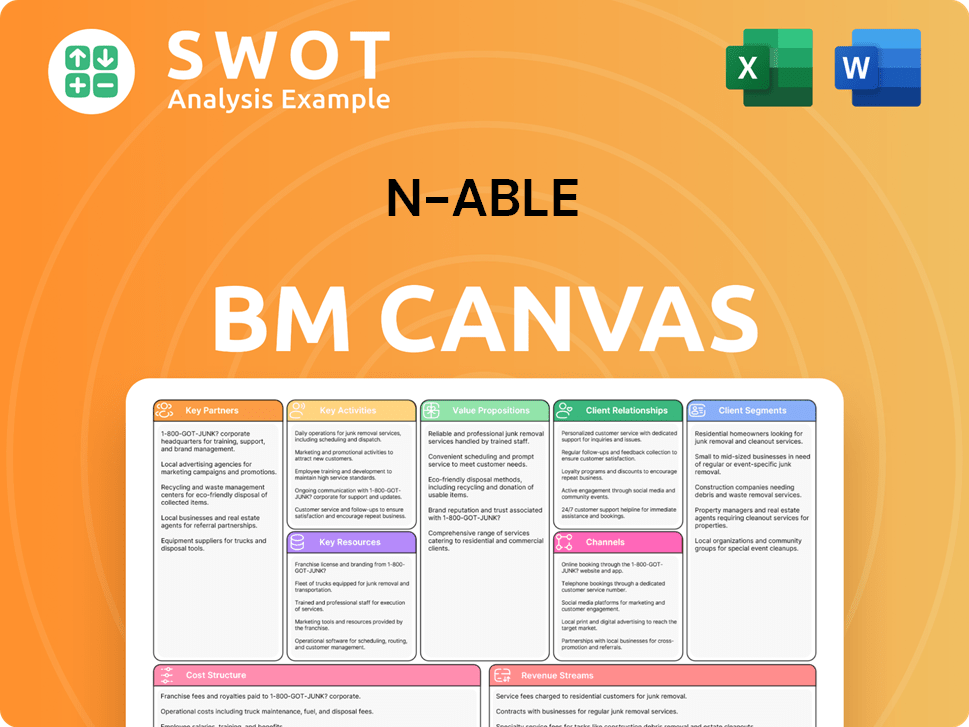

N-able Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does N-able Win & Keep Customers?

Understanding customer acquisition and retention is crucial for any company, and for the company, this involves a strategic approach. Their focus is primarily on managed service provider (MSP) partners, and they employ various tactics to attract and retain these customers. A key element of their strategy is analyzing customer lifetime value (CLV) and customer acquisition cost (CAC) to ensure sustainable growth.

The company's acquisition strategies involve optimizing marketing spending by tracking leads and closed sales based on the contact method used. They also host 'head nerd boot camps,' which are open to all MSP business owners, not just their partners. This initiative underscores their focus on education and engagement to attract potential new customers. Their approach to retention is equally comprehensive, with a strong emphasis on account management and customer support.

Customer data and CRM systems are central to their targeting campaigns. CRM platforms enable customer segmentation based on purchasing behavior, preferences, and interactions, which allows for tailored marketing strategies and personalized communications. Proactive customer support and loyalty programs are also key retention strategies. Additionally, a shift towards long-term contracts, with 40% of sales related to annual and multi-year agreements by Q2 2024, is a retention strategy aimed at reducing revenue fluctuations and customer churn.

The company uses various methods to acquire new customers, emphasizing the importance of understanding Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC). This helps in targeting efforts effectively. Their acquisition strategies involve tracking leads and closed sales by contact method to refine marketing spend.

The company hosts 'head nerd boot camps' open to all MSP business owners. These educational events are designed to attract potential customers by providing valuable information and fostering engagement. This strategy showcases their commitment to providing value beyond their direct partners.

The focus on retention includes enhancing account management and customer support to increase customer loyalty and reduce churn. Customer satisfaction surveys and regular strategic business reviews are also part of this effort. The company aims to improve this through cross-sell opportunities within its existing customer base.

A strategic shift towards long-term contracts is a significant retention strategy. By Q2 2024, 40% of sales were related to annual and multi-year agreements. This approach minimizes revenue fluctuations and customer churn, thereby increasing the predictability of future revenues.

The company's customer acquisition strategy is multifaceted, focusing on attracting and retaining managed service provider (MSP) partners. They analyze customer lifetime value (CLV) and customer acquisition cost (CAC) to refine their targeting efforts. The company's approach includes tracking leads and closed sales by contact method to optimize marketing spending. This data-driven approach is essential for understanding the Growth Strategy of N-able and its customer base.

CRM platforms enable customer segmentation based on purchasing behavior, preferences, and interactions. This allows the company to tailor marketing strategies and personalize communications. They use the data to create more targeted and effective campaigns.

Personalized communication, loyalty programs, and proactive customer support are vital retention strategies. These efforts aim to build stronger relationships with customers and increase their loyalty. Happy customers are more likely to remain loyal.

The company's net retention rate (NRR) was 101% in Q1 2025, indicating some customer revenue growth and low customer churn. This is a slight decrease from 103% in 2024. The company aims to improve this through cross-sell opportunities within its existing customer base.

Regular strategic business reviews are conducted to ensure customer satisfaction and identify areas for improvement. These reviews help to strengthen relationships and provide opportunities to address any issues proactively. This is a key part of their retention strategy.

The company focuses on cross-sell opportunities within its existing customer base to increase revenue and customer lifetime value. This strategy leverages existing relationships to offer additional products or services. This increases customer loyalty and revenue.

The company is shifting towards long-term contracts, with a significant portion of sales related to annual and multi-year agreements. This strategy aims to minimize revenue fluctuations and reduce customer churn. Long-term contracts provide more predictable revenue streams.

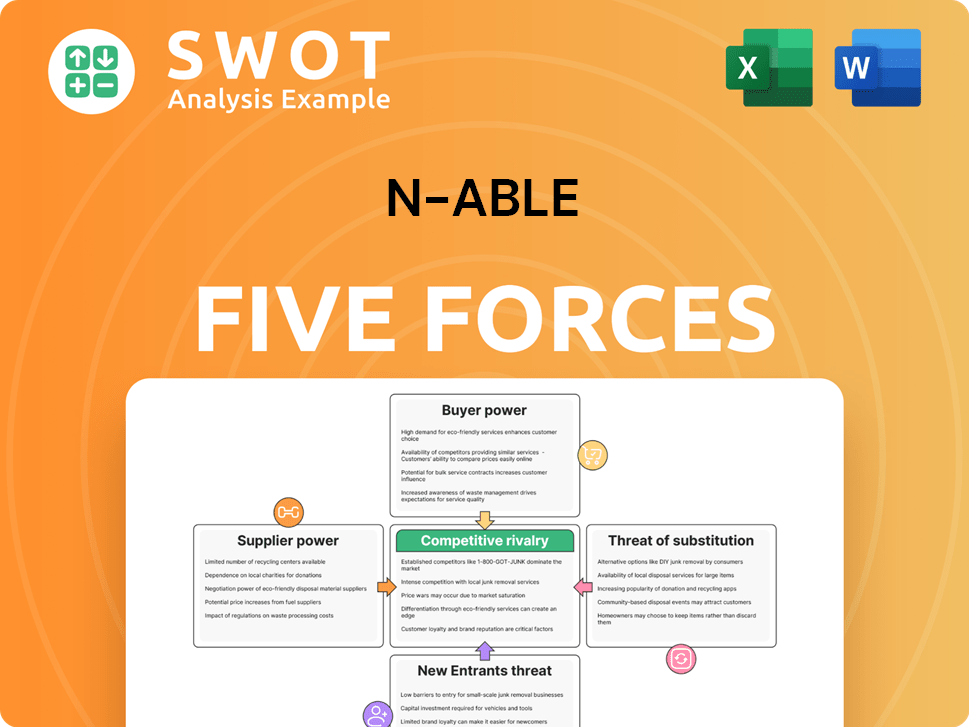

N-able Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of N-able Company?

- What is Competitive Landscape of N-able Company?

- What is Growth Strategy and Future Prospects of N-able Company?

- How Does N-able Company Work?

- What is Sales and Marketing Strategy of N-able Company?

- What is Brief History of N-able Company?

- Who Owns N-able Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.