Quest Diagnostics Bundle

Who Really Controls Quest Diagnostics?

Unraveling the Quest Diagnostics SWOT Analysis is just the beginning; understanding its ownership structure is key to grasping its strategic maneuvers. From its roots as a spin-off from Corning to its current status, the evolution of Quest Diagnostics ownership tells a compelling story. Knowing who owns Quest Diagnostics offers crucial insights into its future direction and market position.

The journey of Quest Diagnostics, from its inception to its present-day prominence, is a testament to how ownership shapes a company's destiny. Exploring the Quest Diagnostics SWOT Analysis, along with its ownership, reveals how strategic decisions have propelled it to become a leader in the healthcare diagnostics sector. This exploration will provide a comprehensive overview of Quest Diagnostics ownership, from its initial public offering to the influence of major shareholders and the impact on Quest Diagnostics stock.

Who Founded Quest Diagnostics?

The story of Quest Diagnostics' ownership begins not with founders in the traditional sense, but with a corporate spin-off. It emerged from Corning Clinical Laboratories, a division of Corning Glass Works, in 1997. This unique origin shaped its initial ownership structure, differing significantly from typical startup scenarios.

Following the spin-off, Quest Diagnostics became a publicly traded company. This transition meant that the initial ownership was distributed among Corning's shareholders. These shareholders received shares of the newly independent company, establishing a broad base of investors from the outset.

The early ownership of Quest Diagnostics was thus defined by its public status. There were no specific angel investors or venture capitalists involved in the initial stages. The focus was on establishing a dedicated management team and board of directors to lead the diagnostic services business.

Quest Diagnostics went public in 1997 after being spun off from Corning. The IPO allowed the company to operate independently and raise capital.

Shares were initially distributed to Corning's shareholders. This created a diverse ownership base from the start.

Early agreements focused on the spin-off terms, including asset transfer and share distribution. These were crucial for establishing the new company.

The establishment of a dedicated management team and board of directors was a key step. This team focused solely on the laboratory business.

The spin-off allowed Quest Diagnostics to operate independently. This independence was vital for pursuing its own strategic objectives.

Being a publicly traded company meant that Quest Diagnostics was subject to public scrutiny. This also provided access to capital markets.

Understanding the initial ownership structure of Quest Diagnostics provides context for its subsequent development. Unlike startups with individual founders, Quest Diagnostics ownership began with a corporate spin-off. This unique beginning shaped its trajectory as a publicly traded entity. For those interested in a deeper dive, a look at the Competitors Landscape of Quest Diagnostics can provide additional insights.

- Who owns Quest Diagnostics? Initially, shareholders of Corning. Today, it is owned by a diverse group of institutional and individual investors, as it is a public company.

- Is Quest Diagnostics a public company? Yes, it is listed on the New York Stock Exchange (NYSE) under the ticker DGX.

- When did Quest Diagnostics go public? In 1997, following its spin-off from Corning.

- Who founded Quest Diagnostics? Quest Diagnostics emerged from Corning Clinical Laboratories, so it did not have traditional founders.

Quest Diagnostics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Quest Diagnostics’s Ownership Changed Over Time?

The ownership structure of Quest Diagnostics has transformed significantly since its initial public offering (IPO) in 1997. The company's evolution has been marked by a shift towards institutional investors. Understanding Quest Diagnostics' target market is also crucial when considering its ownership dynamics, as it influences investor confidence and strategic decisions.

As of early 2025, institutional investors hold a significant portion of Quest Diagnostics' shares. This is typical for large, publicly traded companies. The major shareholders include prominent asset management firms, mutual funds, and index funds. These entities collectively hold billions of dollars worth of Quest Diagnostics stock, impacting the company through their voting power and engagement in corporate governance. The ownership structure reflects the company's growth and its position in the healthcare sector.

| Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Brought in public investors, establishing the initial ownership structure. | 1997 |

| Institutional Investment Growth | Increased the influence of institutional investors like Vanguard and BlackRock. | Ongoing |

| Changes in Shareholder Holdings | Reflect shifts in market sentiment and investment strategies, impacting stock price. | Throughout the years |

Key institutional holders, such as Vanguard Group, BlackRock Inc., and State Street Corp., often hold significant stakes in Quest Diagnostics stock. These firms' holdings reflect their broad market index and passively managed fund strategies. The cumulative voting power of these large institutional investors plays a critical role in company strategy and governance. Changes in their holdings, often reported through SEC filings, can signal shifts in market sentiment or investment strategies. For instance, a notable increase or decrease in a major fund's stake can signal a change in their outlook on the diagnostic industry or Quest Diagnostics specifically. As of December 2024, the market capitalization of Quest Diagnostics was approximately $18 billion.

Institutional investors dominate Quest Diagnostics' ownership, influencing the company's strategic direction. The major shareholders include Vanguard Group, BlackRock Inc., and State Street Corp.

- Institutional ownership accounts for a substantial majority of shares.

- Changes in holdings reflect market sentiment and investment strategies.

- No single founder or family maintains a controlling interest.

- The company is publicly traded under the ticker symbol DGX.

Quest Diagnostics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Quest Diagnostics’s Board?

The current board of directors of Quest Diagnostics plays a crucial role in the company's governance. As of early 2025, the board is composed of a mix of independent directors and individuals with significant executive experience. These directors typically bring expertise from diverse fields, including healthcare, finance, and technology. This structure reflects a commitment to strong corporate governance practices, ensuring a balance of perspectives and skills to guide the company's strategic direction. The board's composition is regularly reviewed to ensure it aligns with the company's evolving needs and strategic priorities.

The board's influence extends to major decisions, including director elections and other corporate matters. While the company does not have founders in the traditional sense due to its spin-off origin, major institutional shareholders exert considerable influence through their voting power. The company generally operates under a one-share-one-vote structure, providing each common share with one vote. There are no publicly reported dual-class shares or special voting rights that would grant outsized control to specific individuals or entities. Recent governance efforts have focused on enhancing diversity and expertise on the board.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Stephen H. Rusckowski | Chairman of the Board | Former CEO of Quest Diagnostics |

| Mark J. Guinan | Lead Independent Director | Experience in Healthcare and Finance |

| Other Directors | Various | Diverse backgrounds in healthcare, finance, and technology |

Institutional investors frequently engage with management on environmental, social, and governance (ESG) issues, executive compensation, and strategic direction. Their collective voting power and engagement significantly influence decision-making within the company. This active engagement helps ensure that the company remains responsive to shareholder interests and maintains a focus on long-term value creation. For example, in 2024, institutional investors voted on executive compensation packages and board member elections, reflecting their influence on corporate governance. You can learn more about the company's history and structure by reading about Quest Diagnostics history.

The board of directors at Quest Diagnostics is pivotal in the company's strategic direction and governance. The company operates under a one-share-one-vote structure, ensuring equitable voting rights for shareholders.

- The board includes independent directors with diverse expertise.

- Major institutional shareholders influence decisions through voting.

- Governance focuses on ESG issues and executive compensation.

- The board's composition is regularly reviewed for relevance.

Quest Diagnostics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Quest Diagnostics’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of Quest Diagnostics has largely maintained its structure, with a strong presence of institutional investors. These investors often influence the company's strategic decisions and direction. The company has engaged in share buyback programs, which can positively affect the stock's value by reducing the number of outstanding shares. This strategy, along with other financial maneuvers, is a common practice among publicly traded companies to enhance shareholder value.

While there haven't been significant changes in the overall ownership structure, there have been adjustments at the executive level and within the board of directors. These changes can bring in new perspectives and potentially influence the company's strategic initiatives. The diagnostic industry has seen some consolidation, with Quest Diagnostics making strategic acquisitions to expand its testing capabilities and market reach. These acquisitions can slightly alter ownership dynamics as shares might be issued for such transactions. Analyst reports consistently highlight the company's focus on operational efficiency and growth in specialized testing areas, which are attractive to institutional investors.

| Metric | Details | Data (Approximate) |

|---|---|---|

| Market Capitalization | Reflects the total value of the company's outstanding shares. | Around $17.5 billion (as of early 2024) |

| Institutional Ownership | Percentage of shares held by institutional investors. | Typically above 80% |

| Share Buyback Programs | Company's activity in repurchasing its own shares. | Ongoing, with varying amounts annually |

| Revenue | The total income generated by a company during a period. | Around $9.6 billion (2023) |

The ownership of Quest Diagnostics, as with many large-cap public companies, is dominated by institutional investors, who collectively hold a significant portion of the outstanding shares. This concentration of ownership gives these investors considerable influence over the company's strategic direction and corporate governance. For a deeper dive into how the company operates, you can explore the Marketing Strategy of Quest Diagnostics.

Major shareholders include large institutional investors such as mutual funds, pension funds, and investment management firms. These entities collectively hold a significant percentage of the outstanding shares, influencing the company's strategic decisions.

Changes in leadership, including the CEO and board members, can impact the company's strategic direction. These changes often bring new perspectives and potentially influence the company's operational strategies and financial performance.

The stock performance of Quest Diagnostics is closely watched by investors. The company's financial results, market conditions, and industry trends all influence its stock price. Investors often monitor key financial metrics to assess the company's value and growth potential.

Quest Diagnostics has been involved in strategic acquisitions to expand its testing capabilities and market reach. These acquisitions can alter the company's ownership dynamics as shares may be issued for such transactions, and they play a significant role in its growth strategy.

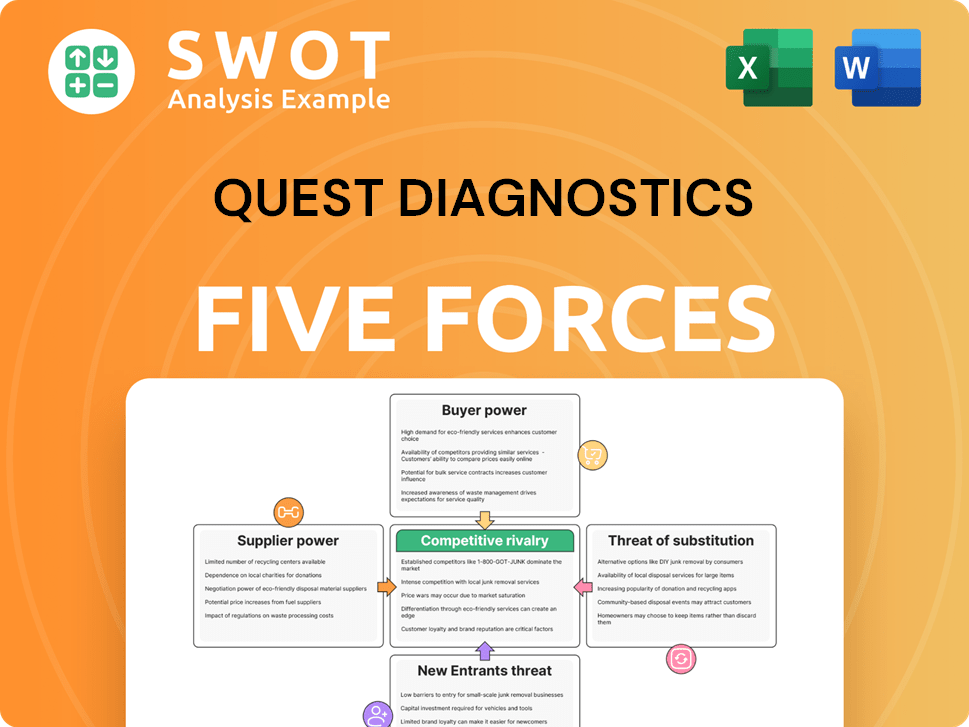

Quest Diagnostics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Quest Diagnostics Company?

- What is Competitive Landscape of Quest Diagnostics Company?

- What is Growth Strategy and Future Prospects of Quest Diagnostics Company?

- How Does Quest Diagnostics Company Work?

- What is Sales and Marketing Strategy of Quest Diagnostics Company?

- What is Brief History of Quest Diagnostics Company?

- What is Customer Demographics and Target Market of Quest Diagnostics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.