Salesforce Bundle

Who Really Owns Salesforce?

Uncover the intricate web of ownership behind the cloud-computing giant, Salesforce. Understanding the Salesforce SWOT Analysis is just the beginning; knowing who controls the company reveals its true potential. From its pioneering days to its current status as a market leader, the story of Salesforce is inextricably linked to its ownership structure.

Delving into "Who owns Salesforce?" unveils more than just shareholder names; it illuminates the strategic vision and financial interests shaping the company's future. As a publicly traded entity, understanding the Salesforce ownership structure, including the influence of key investors and the role of the Salesforce CEO, is paramount. This analysis will explore the dynamics of Salesforce stock, its market capitalization, and the evolution of its shareholder base, providing a comprehensive view of this tech titan.

Who Founded Salesforce?

The journey of Salesforce began in March 1999, thanks to the vision of four founders: Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez. Marc Benioff, with his experience from Oracle, spearheaded the company's direction, focusing on cloud-based software. Parker Harris played a crucial role in developing the initial technology, while Moellenhoff and Dominguez contributed to the platform's early development.

Details regarding the initial equity split among the founders remain private, typical for a company in its early stages. However, it's understood that the founders held the primary ownership stakes. This initial ownership structure was critical in shaping the company's culture and strategic direction from the start.

Early financial backing came from venture capital firms and individual investors. Halsey Minor, a co-founder of CNET, provided initial seed funding. The company secured its first round of venture capital in June 1999, raising $2 million. These early investments were vital for developing the product and establishing operations. Early agreements likely included standard vesting schedules for founder shares and potentially buy-sell clauses to manage ownership transitions.

The early ownership structure of Salesforce was primarily held by its founders, with Marc Benioff taking the lead as the primary visionary. Early investors provided the necessary capital to launch the company. The focus on a cloud-based, subscription-model CRM was evident in the distribution of control, with Benioff guiding the strategic direction.

- The company's early success was fueled by its innovative cloud-based CRM model.

- Marc Benioff's leadership was instrumental in shaping the company's vision.

- Early venture capital funding played a crucial role in the company's growth.

- The founders' initial ownership stakes set the stage for future developments.

Salesforce SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Salesforce’s Ownership Changed Over Time?

The ownership structure of Salesforce, the cloud-based software giant, has evolved significantly since its inception. A pivotal moment was the initial public offering (IPO) on June 23, 2004. This event marked a transition from private to public ownership, with the company listing on the New York Stock Exchange under the ticker symbol 'CRM.' The IPO raised approximately $1.1 billion and fundamentally shifted the ownership landscape, opening the door for a broader base of investors.

Following the IPO, the ownership of Salesforce has largely transitioned from its founders and early private investors to a diverse group of public shareholders. This shift has been driven by market dynamics, secondary offerings, and the natural progression of a publicly traded company. Institutional investors have become the dominant force, influencing corporate governance and strategic decisions.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | June 23, 2004 | Transitioned from private to public ownership; increased shareholder base. |

| Subsequent Stock Offerings | Various Dates | Diluted ownership of founders and early investors; increased public float. |

| Acquisitions | Ongoing | Could lead to changes in ownership structure depending on the terms of the deal. |

As of early 2025, the major stakeholders in Salesforce include a wide array of institutional investors. These firms, such as Vanguard Group Inc., BlackRock Inc., and State Street Corp., collectively hold a substantial percentage of the company's outstanding shares. While specific percentages fluctuate, these top institutional investors often control upwards of 40-50% or more of the company's stock. The influence of these institutional investors is significant, as they often advocate for shareholder-friendly policies and consistent financial performance. Marc Benioff, the co-founder and current Salesforce CEO, remains a significant individual shareholder, although his percentage has decreased over time due to share issuances. The shift towards institutional ownership has generally pushed Salesforce to maintain strong corporate governance and transparency.

Understanding the dynamics of Salesforce ownership is crucial for investors and stakeholders. The company's shift from private to public ownership has transformed its shareholder base.

- Institutional investors, including Vanguard and BlackRock, are major shareholders.

- Marc Benioff, the Salesforce CEO, remains a key individual stakeholder.

- The evolution of Salesforce's ownership structure reflects its growth and market position.

- Learn more about the company's business model by checking out the Revenue Streams & Business Model of Salesforce.

Salesforce PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Salesforce’s Board?

The Board of Directors at Salesforce significantly influences the company's governance and strategic direction. As of early 2025, the board includes Marc Benioff, who serves as Chair and CEO. The board also consists of independent directors with expertise in technology, finance, and business leadership. While direct representation of significant institutional investors isn't the norm, independent oversight is a key feature.

The board's decisions are subject to scrutiny from institutional investors and proxy advisory firms. The composition of the board, with a strong presence of independent directors, aims to ensure robust oversight and accountability to the broader shareholder base. This structure helps mitigate the risk of outsized control by any single individual or entity. Understanding the Growth Strategy of Salesforce is crucial for investors.

| Board Member | Title | Notes |

|---|---|---|

| Marc Benioff | Chair and CEO | Founder and key decision-maker. |

| Independent Directors | Various | Provide oversight and diverse expertise. |

| Institutional Investor Representatives | Various | May be present, but independent oversight is more common. |

Salesforce operates with a one-share-one-vote structure, ensuring equitable voting power among shareholders. This structure promotes a more balanced distribution of voting power, without special voting rights or 'golden shares' that would grant disproportionate control. This structure helps to ensure that all shareholders have a fair say in the company's decisions.

The board of directors includes Marc Benioff, the Salesforce CEO, and independent directors. Salesforce operates under a one-share-one-vote structure, ensuring equitable voting power. The board's decisions are regularly reviewed by institutional investors.

- Marc Benioff leads the company.

- Independent directors provide oversight.

- Shareholders have equal voting rights.

- Institutional investors monitor board decisions.

Salesforce Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Salesforce’s Ownership Landscape?

Over the past few years (roughly 2022-2025), the ownership of Salesforce has seen several key developments. A major trend has been share buybacks, with the company authorizing a $10 billion share repurchase program in August 2022, followed by another $10 billion in February 2023. These buybacks indicate a commitment to returning capital to shareholders. Such actions can increase the proportional ownership of the remaining shareholders. The company's market capitalization stood at approximately $300 billion as of early 2024, reflecting its significant presence in the enterprise software sector.

While there haven't been major secondary offerings, Salesforce has engaged in mergers and acquisitions, such as the significant acquisition of Slack in 2021. This acquisition, valued at around $27.7 billion, involved a stock component, potentially impacting existing shareholder ownership, although the main effect is on the company's strategic direction and financial performance. Marc Benioff continues to serve as Chairman and CEO of Salesforce, maintaining a consistent leadership presence. The increasing concentration of ownership among large institutional investors is a notable trend, with a growing emphasis on Environmental, Social, and Governance (ESG) factors in their investment decisions.

| Metric | Value | Year |

|---|---|---|

| Market Capitalization (approx.) | $300 billion | 2024 |

| Slack Acquisition Value (approx.) | $27.7 billion | 2021 |

| Share Repurchase Authorization (August) | $10 billion | 2022 |

| Share Repurchase Authorization (February) | $10 billion | 2023 |

The overall trend in the enterprise software sector, including for Salesforce, is an increasing concentration of ownership among large institutional investors. These firms, driven by passive investing strategies (e.g., index funds) and active management, continue to accumulate significant stakes. This trend generally leads to a greater focus on Environmental, Social, and Governance (ESG) factors, as institutional investors increasingly incorporate these considerations into their investment decisions and engage with companies on related issues. For more insights, you can explore the Competitors Landscape of Salesforce.

Salesforce has been repurchasing shares, signaling confidence in its value. Institutional investors are increasing their stakes, influencing company strategy. Marc Benioff remains CEO, ensuring leadership continuity.

Large institutional investors are the primary shareholders. These investors often drive ESG considerations. Founder ownership has decreased over time due to company growth.

Acquisitions like Slack can dilute existing shareholder ownership. The primary impact is on strategic direction. Acquisitions are a key part of Salesforce's growth strategy.

Focus on sustainable growth and shareholder value. No plans for privatization have been announced. Continued public listing status is expected.

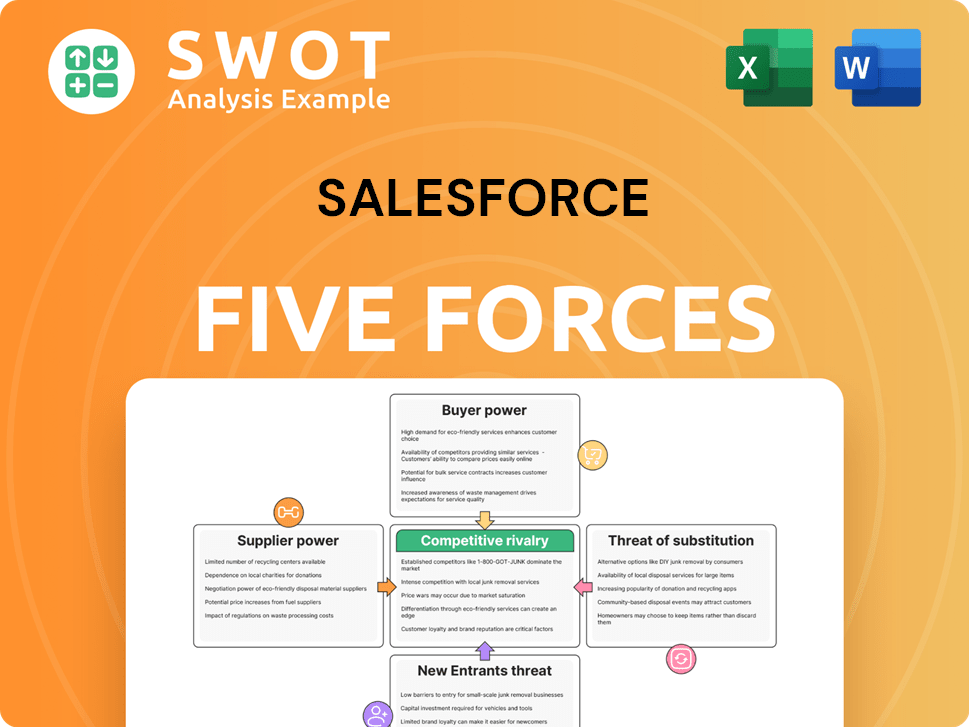

Salesforce Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Salesforce Company?

- What is Competitive Landscape of Salesforce Company?

- What is Growth Strategy and Future Prospects of Salesforce Company?

- How Does Salesforce Company Work?

- What is Sales and Marketing Strategy of Salesforce Company?

- What is Brief History of Salesforce Company?

- What is Customer Demographics and Target Market of Salesforce Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.