SharkNinja Bundle

Who Really Owns SharkNinja?

Understanding a company's ownership is crucial for investors and strategists alike. SharkNinja, a household name with products like the SharkNinja SWOT Analysis, offers a compelling case study in evolving ownership structures. This analysis will explore the journey of SharkNinja, from its origins to its current status as a publicly traded entity.

Delving into the SharkNinja ownership reveals a fascinating narrative of growth and transformation. From its inception by Mark Rosenzweig to its spin-off, the SharkNinja company has seen significant shifts. Examining the SharkNinja parent company and key stakeholders provides valuable insights into its strategic direction and future prospects, especially now that it is a public company. Uncovering Who owns SharkNinja today can help investors make informed decisions.

Who Founded SharkNinja?

The story of SharkNinja begins with Mark Rosenzweig, who founded the company in 1994. His vision was to create a brand focused on innovative small appliances, aiming to build both a strong company and customer loyalty. This entrepreneurial spirit was the driving force behind what would become a major player in the home appliance market. Understanding the Revenue Streams & Business Model of SharkNinja is key to understanding its trajectory.

Rosenzweig's background, including his education at the University of Pennsylvania's Wharton School, provided a solid foundation for his business ventures. His experience within his family's sewing business, Jolson Corp., gave him insights into the industry. This led him to launch Euro-Pro Operating LLC, which later evolved into SharkNinja. The company's early focus was on developing steam cleaners and upright vacuums.

The company's early success was fueled by the development of the Shark steam mops and the 'no loss of suction' vacuum technology. By the end of fiscal year 2009, Euro-Pro's gross sales had exceeded $400 million, a testament to the effectiveness of its product development and market strategy. The introduction of the Ninja brand in 2009 further diversified the company's product offerings into kitchen appliances, expanding its market reach.

Mark Rosenzweig founded the company in 1994.

Initially, the company concentrated on steam cleaners and upright vacuums.

The Shark steam mops and 'no loss of suction' vacuum technology were developed in 2007.

The Ninja brand was launched in 2009, broadening the product range to include kitchen appliances.

By the end of fiscal year 2009, Euro-Pro's gross sales exceeded $400 million.

Mark Rosenzweig, as the founder, held a significant ownership stake.

The early structure of SharkNinja ownership was primarily centered around its founder, Mark Rosenzweig. The company's roots in a family-run operation highlight a focus on creating affordable and efficient household appliances. The initial success, particularly with the Shark brand, laid the groundwork for future expansion. Here are some key points:

- Mark Rosenzweig's vision and leadership were crucial in shaping the company's early growth.

- The development of innovative products like the Shark steam mops significantly boosted sales.

- The introduction of the Ninja brand expanded the company's product portfolio and market reach.

- While specific early equity details aren't public, Rosenzweig's stake was substantial.

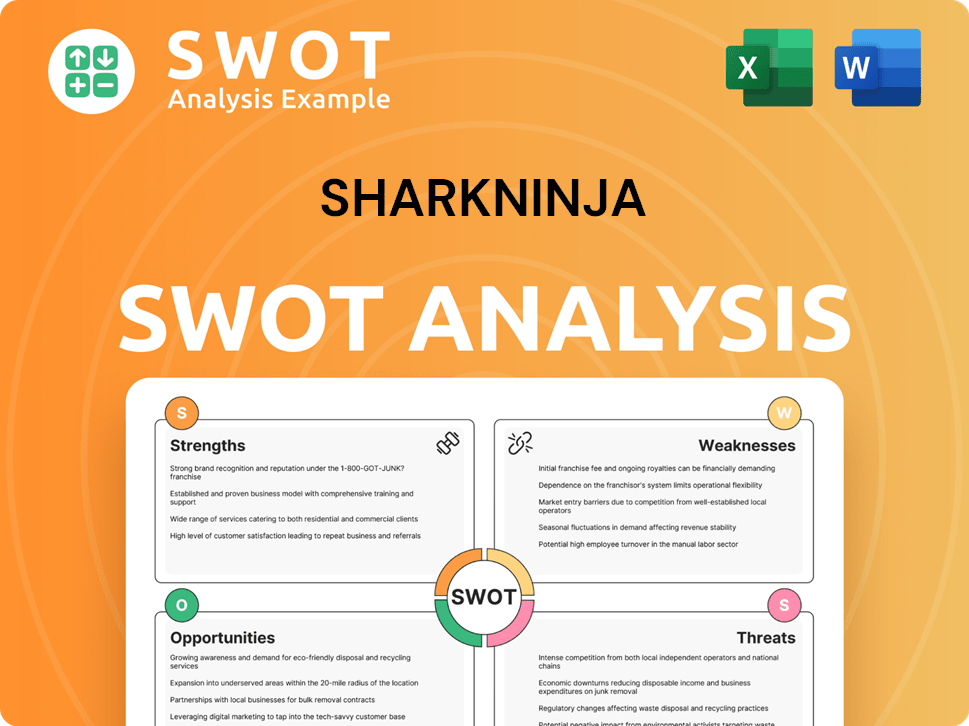

SharkNinja SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has SharkNinja’s Ownership Changed Over Time?

The journey of SharkNinja from a privately held entity to a publicly traded company marks a significant evolution in its ownership structure. Originally operating as Euro-Pro Operating LLC, the company experienced a shift in 2015 when it was acquired by a private equity firm. This acquisition brought new leadership and resources that fueled the company's expansion. In 2017, CDH Private Equity acquired a stake, structuring SharkNinja as a subsidiary of JS Global, an investment holding company.

A pivotal moment occurred on July 31, 2023, when SharkNinja separated from JS Global and became an independent public company. Its ordinary shares began trading on the New York Stock Exchange (NYSE) under the ticker 'SN'. This transition to a public entity broadened its ownership base to include institutional investors, mutual funds, and individual shareholders. The transformation has influenced the company's strategic direction, emphasizing innovation, market share growth, and international expansion.

| Ownership Phase | Key Event | Impact |

|---|---|---|

| Private Ownership (Pre-2015) | Operated as Euro-Pro Operating LLC | Focused on initial market presence and brand building. |

| Private Equity Acquisition (2015) | Acquired by a private equity firm | Provided resources for expansion and strategic shifts. |

| Subsidiary of JS Global (2017) | CDH Private Equity acquired a stake | Restructured under an investment holding company. |

| Public Offering (July 31, 2023) | Separation from JS Global; IPO on NYSE | Expanded ownership to include institutional and individual investors. |

As of May 2025, SharkNinja Inc. has 707 institutional owners and shareholders who have filed 13D/G or 13F forms with the SEC. Major institutional investors include FMR LLC, which increased its portfolio by 59.8% in Q4 2024, with an estimated value of $599,759,603. HIGHTOWER ADVISORS, LLC added 42.9% during the same period, totaling an estimated $209,824,040. Other significant institutional holders include Baillie Gifford & Co, BlackRock, Inc., and AllianceBernstein L.P.

SharkNinja's ownership structure has evolved significantly, from private ownership to a publicly traded company.

- Initially, the company operated privately.

- Private equity firms and investment holding companies played a role.

- The IPO in July 2023 marked a major shift to public ownership.

- Institutional investors now hold a significant portion of the shares.

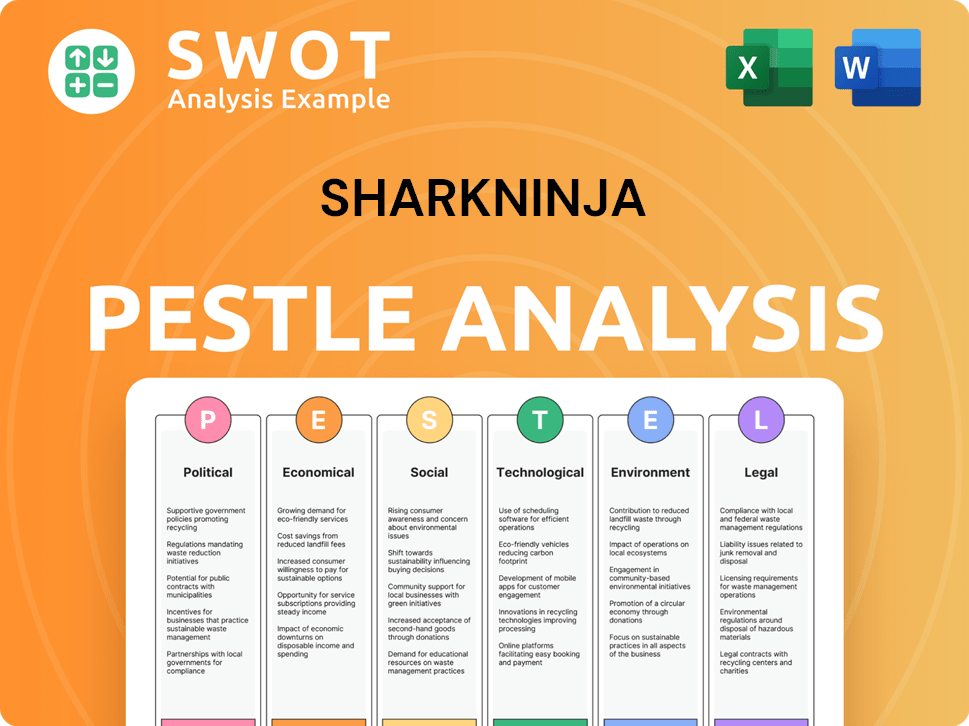

SharkNinja PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on SharkNinja’s Board?

Information on the current board of directors for the company, including details about major shareholders, founders, or independent members, isn't readily available in the provided search results. Publicly traded companies like this one (NYSE: SN) typically have governance standards that include a diverse board structure. Specifics would be detailed in their SEC filings.

The company's voting structure, such as whether it uses a one-share-one-vote system or if there are any special voting rights, isn't explicitly stated. However, publicly traded companies generally adhere to a one-share-one-vote principle. Recent SEC filings from 2025 indicate ongoing reporting of beneficial ownership by specific investors, showing active engagement from major stakeholders. For more insights, you can check out the Marketing Strategy of SharkNinja.

| Board Member | Role | Notes |

|---|---|---|

| Not Available | Not Available | Information on specific board members is not available in the provided search results. |

| Not Available | Not Available | Details about which members represent major shareholders, founders, or independent seats are not available. |

| Not Available | Not Available | Specifics on the board's composition can usually be found in the company's SEC filings. |

Understanding the ownership structure of a company like this one, and who owns the company, is crucial for investors. While precise details about the board and voting rights may vary, staying informed through SEC filings and financial news is essential. This helps in assessing the company's governance and the influence of major stakeholders. The company's stock information is also a key factor.

Understanding the ownership structure of the company involves knowing the board of directors and voting power.

- Publicly traded companies generally follow a one-share-one-vote principle.

- SEC filings provide details on board composition and major shareholders.

- Staying updated on financial news and SEC filings is important for investors.

- The company's stock information is a key factor.

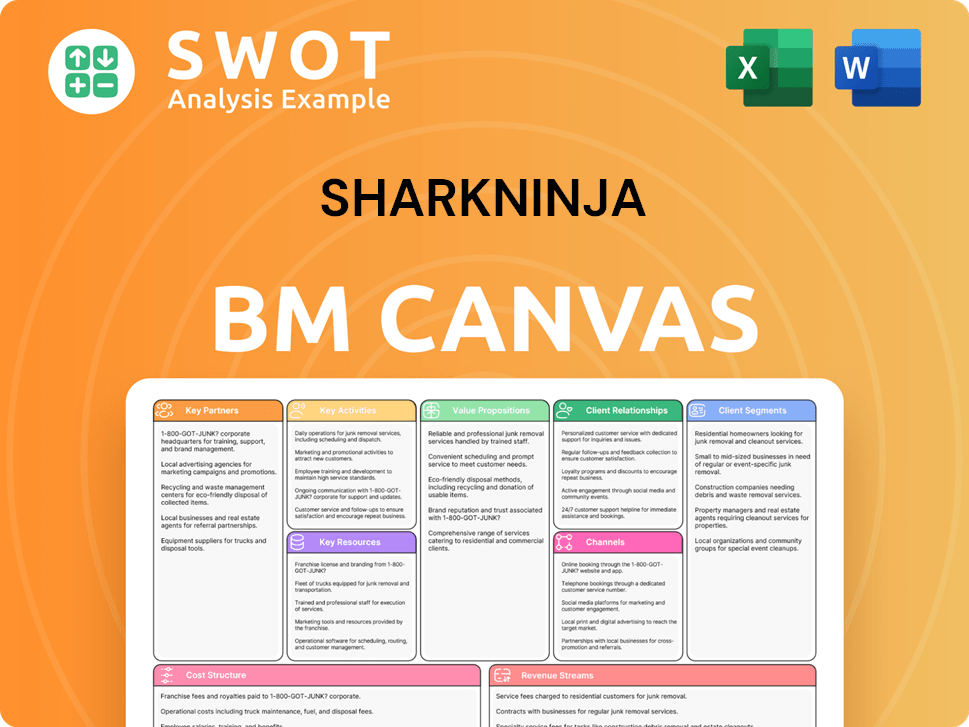

SharkNinja Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped SharkNinja’s Ownership Landscape?

In the past few years, the ownership of the company, often searched as 'Who owns SharkNinja?', has undergone significant changes. The most notable was the spin-off from JS Global and its subsequent listing on the New York Stock Exchange (NYSE) in July 2023. This move transformed the company from a subsidiary of an investment holding company into an independent public entity. This transition is a key aspect of understanding the current 'SharkNinja ownership' structure.

Financially, the company has demonstrated robust performance since becoming public. For the entire fiscal year of 2024, net sales increased by 30.0% compared to 2023. Adjusted EBITDA also saw a substantial rise, increasing by 32.2% to reach $951.1 million in 2024. In the first quarter of 2025, the company continued its strong performance, with net sales increasing by nearly 15% year-over-year globally, reaching $1,222.6 million, and adjusted EBITDA reaching $200.4 million. The company is forecasting net sales to increase 10.0% to 12.0% for the full fiscal year 2025. This financial success is crucial to understanding the company's trajectory and investor confidence.

| Metric | Fiscal Year 2024 | Q1 2025 |

|---|---|---|

| Net Sales | Increased 30.0% | $1,222.6 million (nearly 15% increase YoY) |

| Adjusted EBITDA | $951.1 million (32.2% increase) | $200.4 million |

| R&D Expenses | N/A | $87.6 million (25.9% increase) |

Ownership trends reveal an increase in institutional ownership, a common pattern for newly public companies. As of May 2025, institutions holding shares of the company have increased their positions. For example, FMR LLC and HIGHTOWER ADVISORS, LLC significantly increased their holdings in Q4 2024. The company continues to invest in research and development, with expenses increasing by 25.9% to $87.6 million in Q1 2025, reflecting a commitment to innovation that can attract and retain investor interest. For more insights into the company's strategic growth, consider the Growth Strategy of SharkNinja.

Spin-off from JS Global and IPO in July 2023 transformed the company into an independent public entity.

Strong financial results, with significant increases in net sales and adjusted EBITDA in 2024 and Q1 2025.

Increasing institutional ownership and continued investment in research and development.

The company forecasts continued growth, with net sales expected to increase by 10.0% to 12.0% for the full fiscal year 2025.

SharkNinja Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SharkNinja Company?

- What is Competitive Landscape of SharkNinja Company?

- What is Growth Strategy and Future Prospects of SharkNinja Company?

- How Does SharkNinja Company Work?

- What is Sales and Marketing Strategy of SharkNinja Company?

- What is Brief History of SharkNinja Company?

- What is Customer Demographics and Target Market of SharkNinja Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.