Texas Instruments Bundle

Who Really Controls Texas Instruments?

Understanding the Texas Instruments SWOT Analysis is key to unlocking the company's potential. Knowing the TI ownership structure is paramount for investors and industry watchers. This directly impacts the company's strategic direction and its responsiveness to market changes. Uncover the influence behind one of the world's leading semiconductor manufacturers.

From its humble beginnings to its current status, the evolution of Texas Instruments company has been shaped by its ownership. This exploration into Texas Instruments owner reveals how decisions regarding acquisitions, innovation, and market positioning are influenced. Knowing who controls Texas Instruments provides valuable insights for anyone interested in the Texas Instruments stock and its future.

Who Founded Texas Instruments?

The story of Texas Instruments (TI) began in 1930 as Geophysical Service Inc. (GSI). The founders, J. Clarence Karcher and Eugene McDermott, initiated the company with a focus on seismic exploration for the oil industry. Their early vision set the stage for the technological advancements that would come to define the company.

Early financial backing came from Everette Lee DeGolyer and Patrick E. Haggerty. While precise equity distributions at the outset aren't publicly available, the founders' expertise and initial capital were crucial. The shift to electronics and semiconductor manufacturing in 1951, marked by the name change to Texas Instruments, was a pivotal moment.

The evolution of TI ownership reflects its transition from a geophysical services provider to a leader in the electronics sector. The company's early years saw a focus on technological innovation and expansion into new markets. This laid the groundwork for its future as a publicly traded entity.

J. Clarence Karcher and Eugene McDermott founded Geophysical Service Inc. (GSI) in 1930. Karcher was a physicist and geophysicist, while McDermott was also a geophysicist. Their expertise in seismic exploration was key to the company's initial focus.

Everette Lee DeGolyer and Patrick E. Haggerty provided early financial support. Their backing was essential for establishing and growing the nascent enterprise. The exact equity splits at the beginning are not available in public records.

In 1951, GSI became Texas Instruments, reflecting a shift towards electronics and semiconductors. This transition marked a significant change in the company's direction. The ownership structure began to evolve during this period.

The initial focus was on seismic exploration for the oil industry. This early specialization provided a foundation for future diversification. The company's early endeavors laid the groundwork for future expansion.

There were no widely publicized early ownership disputes or buyouts. The founding team's vision for technological innovation guided the early distribution of control. This early stability was key for the company's growth.

The early distribution of control paved the way for its future growth as a publicly traded entity. The company's evolution reflects its ability to adapt and innovate. The founders' foresight was critical to TI's success.

Understanding the early days of Texas Instruments, including its founders and initial financial backing, provides a critical context for its later development. The company's transition from GSI to Texas Instruments and its shift towards electronics were pivotal. The early focus on technological innovation and expansion, guided by the founding team, set the stage for its eventual success. For more insights, you can read about the Growth Strategy of Texas Instruments.

The founders of Texas Instruments were J. Clarence Karcher and Eugene McDermott. Early financial backing came from Everette Lee DeGolyer and Patrick E. Haggerty. The company's initial focus was on seismic exploration, transitioning to electronics later.

- The company's name changed from Geophysical Service Inc. (GSI) to Texas Instruments in 1951.

- There were no significant early ownership disputes.

- The founders' vision drove technological innovation and expansion.

- Early ownership dynamics were crucial for the company's growth.

Texas Instruments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Texas Instruments’s Ownership Changed Over Time?

The evolution of Texas Instruments (TI) ownership reflects its journey from a privately held entity to a publicly traded corporation. A pivotal moment occurred in 1953 when Texas Instruments became a publicly listed company on the New York Stock Exchange (NYSE). This initial public offering (IPO) opened the door for a broader investor base and marked the beginning of a shift in the company's ownership structure.

Over time, the ownership of Texas Instruments has transitioned significantly towards institutional investors. This shift has been driven by factors such as the increasing importance of institutional investment in the stock market and the company's growth and stability. Today, institutional investors, mutual funds, and index funds hold the majority of TI ownership, reflecting a widely dispersed ownership structure.

| Shareholder | Share Percentage (as of March 30, 2024) | Notes |

|---|---|---|

| Vanguard Group Inc. | 8.92% | A significant institutional investor. |

| BlackRock Inc. | 8.27% | Another major institutional holder. |

| State Street Corp. | 4.39% | Holds a substantial stake in the company. |

The current Texas Instruments owner structure is characterized by a diverse group of institutional investors. This distribution typically promotes a focus on long-term value creation and shareholder returns. The influence of any single founder or family has diminished, leading to a more diversified shareholder base. For more information, you can read about the Competitors Landscape of Texas Instruments.

The ownership of Texas Instruments has evolved from private to public, with institutional investors now holding a significant portion of the shares. This shift has led to a more diversified shareholder base and a focus on long-term value creation.

- The IPO in 1953 was a critical event in the company's ownership history.

- Major institutional investors include Vanguard, BlackRock, and State Street.

- The ownership structure is typical of a large-cap public company.

- This structure promotes long-term value and shareholder returns.

Texas Instruments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Texas Instruments’s Board?

The current Texas Instruments (TI) board of directors is key to the company's governance, representing its shareholders. As of early 2025, the board includes independent directors and executive management, such as the CEO. While specific board members representing major shareholders aren't explicitly detailed, the presence of independent directors ensures diverse perspectives and oversight. For example, Rich Templeton serves as Chairman of the Board, and Haviv Ilan is the President and Chief Executive Officer and a member of the Board. The board's composition and structure reflect a commitment to broad shareholder representation and transparent governance.

The Texas Instruments company operates with a standard one-share-one-vote principle, common among U.S. publicly traded companies. There are no indications of dual-class shares or special voting rights that would give outsized control to specific entities. This structure ensures voting power aligns directly with share ownership. The board remains accountable to shareholders through regular elections and corporate governance practices. To understand more about the company's origins, you can explore the Brief History of Texas Instruments.

| Board Member | Title | Role |

|---|---|---|

| Rich Templeton | Chairman of the Board | Oversees board activities |

| Haviv Ilan | President and Chief Executive Officer | Leads the company |

| Independent Directors | Various | Provide oversight and diverse perspectives |

Texas Instruments owner structure ensures that voting power is proportional to share ownership. This structure is typical for publicly traded companies, ensuring fairness. The board is accountable to shareholders through regular elections and corporate governance practices.

- One-share-one-vote principle.

- No special voting rights.

- Board accountable to shareholders.

- Transparent governance practices.

Texas Instruments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Texas Instruments’s Ownership Landscape?

Over the past few years (2022-2025), the Texas Instruments (TI) ownership structure has remained relatively stable. The company has focused on returning capital to shareholders through dividends and share repurchases, which is a common strategy for publicly traded companies. This approach helps to manage the ownership profile without any major shifts. For instance, in 2024, the company continued its practice of returning value to its shareholders.

Texas Instruments has not reported any significant changes in ownership due to mergers, acquisitions, or founder departures during this period. While leadership transitions, such as the appointment of Haviv Ilan as President and CEO in 2023, represent strategic moves, they did not directly impact the ownership structure. The trend in the technology sector shows increasing institutional ownership, which Texas Instruments also reflects. The company's ownership is now largely held by institutional investors. There have been no public announcements about potential privatization or major future ownership changes, suggesting the continuation of its current publicly traded status.

Texas Instruments continues to be primarily owned by institutional investors. Share buybacks are a key strategy to manage the ownership profile. Leadership changes, like the CEO transition in 2023, have not altered the ownership structure. The company remains a publicly traded entity with no announced plans for privatization.

Consistent share repurchase programs are a key financial strategy. Dividends and share repurchases are used to return capital to shareholders. No significant secondary offerings or major acquisitions have occurred. These strategies help maintain the current ownership structure.

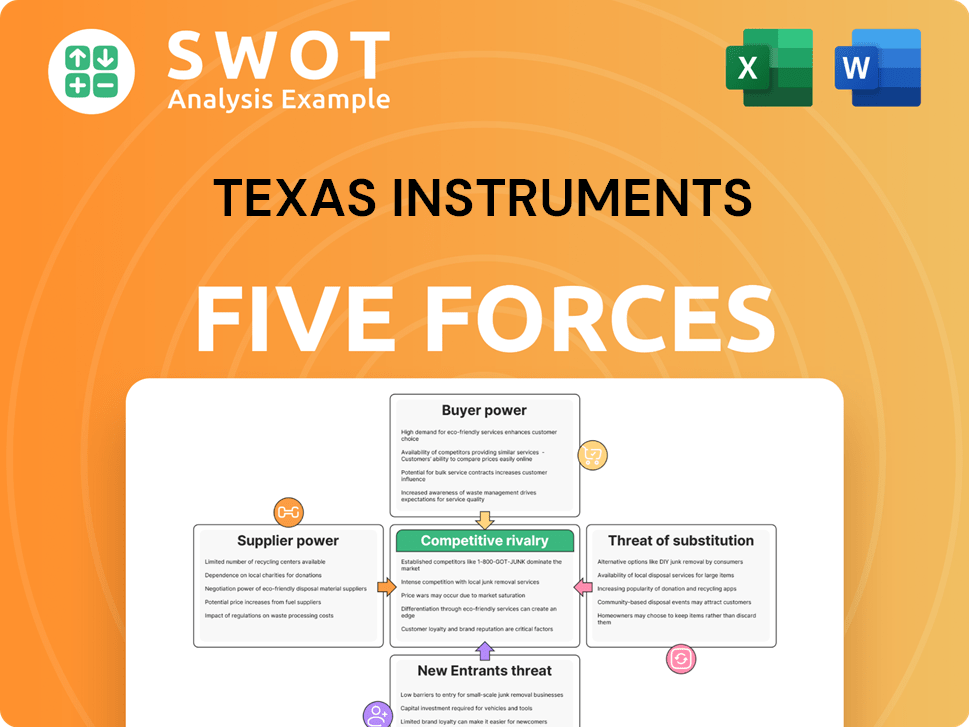

Texas Instruments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Texas Instruments Company?

- What is Competitive Landscape of Texas Instruments Company?

- What is Growth Strategy and Future Prospects of Texas Instruments Company?

- How Does Texas Instruments Company Work?

- What is Sales and Marketing Strategy of Texas Instruments Company?

- What is Brief History of Texas Instruments Company?

- What is Customer Demographics and Target Market of Texas Instruments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.