IndusInd Bank Bundle

Who are IndusInd Bank's Customers, and Why Does it Matter?

In the ever-changing financial world, understanding the customer base is crucial for any bank's success. IndusInd Bank, a key player in India's private sector, has a fascinating customer profile that's evolved since its inception in 1994. Despite recent financial challenges, the bank continues to serve a diverse group, making it essential to analyze its customer demographics and target market.

This analysis delves into the core of IndusInd Bank SWOT Analysis, exploring its customer segmentation, from age groups and income levels to geographic locations and spending habits. Understanding the bank's target audience analysis, including their financial needs and service expectations, is key to evaluating its strategic positioning. We will also examine IndusInd Bank's customer acquisition and retention strategies to gain insights into its market approach and ideal customer profile, comparing it to its competitors' customer bases.

Who Are IndusInd Bank’s Main Customers?

Understanding the customer demographics of IndusInd Bank is crucial for its strategic direction. The bank serves a diverse customer base, segmented into retail and wholesale banking, each with specific needs and financial profiles. This segmentation allows IndusInd Bank to tailor its products and services effectively, enhancing customer satisfaction and driving growth. As of March 31, 2025, the bank serves approximately 41 million customers, reflecting its broad reach and market penetration.

The target market of IndusInd Bank is multifaceted, encompassing both individual consumers and businesses. The bank's customer profile includes a wide range of individuals seeking various financial products and services, from microfinance to investment options. Simultaneously, it caters to corporate clients, providing comprehensive banking solutions to meet their diverse financial needs. This dual approach allows IndusInd Bank to capture a significant share of the market.

IndusInd Bank's customer segmentation strategy is dynamic, adapting to market changes and customer preferences. The bank continually refines its approach to better serve its customers, focusing on segments with high growth potential, such as affluent and NRI clients. This proactive stance ensures that IndusInd Bank remains competitive and responsive to the evolving financial landscape. For a deeper insight into the bank's growth strategy, consider reading about the Growth Strategy of IndusInd Bank.

Retail banking at IndusInd Bank focuses on individual customers. Products include microfinance, personal loans, and debit/credit cards. Vehicle finance is a key area, representing approximately 28% of the loan book in Q4 FY2025. The bank also targets affluent and NRI clients.

Wholesale banking provides services to corporate clients. These services include working capital loans and trade finance. The retail-to-wholesale loan mix was 54:46 as of December 2024. Corporate banking experienced a year-on-year decline of 4.9% in Q4 FY2025.

Microfinance is a significant segment for IndusInd Bank. Microfinance loans accounted for 9% of total advances as of December 31, 2024. Gross NPAs in this segment increased to 7.05% as of December 31, 2024, from 4.53% as of March 31, 2024.

IndusInd Bank is investing in digital banking to reach a wider audience. This includes tech-savvy consumers. The bank leverages technology to improve customer service and expand its market reach.

IndusInd Bank's customer base is segmented into retail and wholesale banking, with a focus on vehicle finance and microfinance within retail. The bank is also expanding its affluent and NRI client base, adapting its strategies to reduce reliance on bulk deposits.

- Retail Banking: Individuals with needs for personal loans and cards.

- Wholesale Banking: Corporate clients requiring working capital and trade finance.

- Microfinance: Serving rural customers through BFIL.

- Digital Banking: Targeting tech-savvy consumers.

IndusInd Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do IndusInd Bank’s Customers Want?

Understanding customer needs and preferences is central to the strategy of IndusInd Bank, driving its approach to customer relationships and product development. The bank aims to offer tailored solutions to its diverse customer base, focusing on enhancing customer satisfaction and loyalty. This customer-centric approach is evident in its product offerings and service delivery across various segments.

The bank's focus on customer demographics and preferences is reflected in its digital banking initiatives and its approach to microfinance and corporate clients. By understanding the specific needs of each segment, IndusInd Bank strives to create lasting relationships and drive customer engagement. Market research and customer feedback are critical in tailoring marketing efforts and product features.

The bank continuously adapts its services to meet evolving customer expectations. This responsiveness is crucial in a dynamic market. The bank's strategy is to provide relevant financial solutions that resonate with the target audience.

IndusInd Bank prioritizes digital solutions for its retail customers, especially the younger, tech-savvy demographic. The 'INDIE' platform has expanded to over 15 million retail customers, integrating core banking services. This focus on digital solutions reflects a clear understanding of customer preferences for convenience and enhanced security.

Features like numberless debit cards, virtual single-use cards, and dynamic ATM PINs cater to the preference for enhanced security and convenience. The bank's digital initiatives align with the increasing adoption of digital payment methods in India. This is a key element of the bank's strategy to meet the needs of its target market.

The growth in monthly active users on digital platforms and reduced customer acquisition costs for digitally sold products highlight the success of these initiatives. The rise of UPI transactions in India, with over 131 billion transactions processed in FY 2023-24, underscores a strong preference for digital payment methods. This data emphasizes the shift towards digital banking.

In the microfinance segment, customers are driven by the need for accessible credit, often in rural and semi-urban areas. The bank's focus on vehicle finance suggests a customer base with specific needs for mobility and business-related asset acquisition. This highlights the importance of understanding the specific financial needs of different customer segments.

For corporate and business clients, the bank offers services like working capital loans and trade finance, indicating a need for robust financial support for business operations. This comprehensive suite of services is designed to meet the diverse needs of corporate clients. The bank's offerings are tailored to support business growth.

The bank's consistent efforts in market research and customer feedback are crucial in tailoring its marketing, product features, and customer experiences to specific segments. This approach aims to build long-lasting relationships and drive customer engagement. This customer-centric approach is key to the bank's success.

IndusInd Bank serves a diverse customer base with varying needs. Understanding these needs is crucial for providing tailored financial solutions and maintaining customer satisfaction. The bank’s approach to customer segmentation allows it to offer relevant products and services.

- Retail Customers: Primarily focused on digital solutions, convenience, and security. The bank caters to the tech-savvy demographic with digital banking platforms and features.

- Microfinance Customers: Require accessible credit, particularly in rural and semi-urban areas. Vehicle finance is a key offering, reflecting the need for mobility and business asset acquisition.

- Corporate and Business Clients: Need robust financial support, including working capital loans and trade finance. The bank provides a comprehensive suite of services to support business operations.

- Customer Preferences: Customers increasingly prefer digital banking, convenient transactions, and personalized financial solutions. The bank's focus on these areas reflects its understanding of evolving customer expectations.

- Customer Service Expectations: Customers expect efficient, reliable, and personalized service. The bank aims to meet these expectations through its digital platforms and customer support initiatives.

To gain a deeper understanding of the competitive environment, you can explore the Competitors Landscape of IndusInd Bank. This analysis provides valuable insights into the strategies and customer bases of its competitors.

IndusInd Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does IndusInd Bank operate?

IndusInd Bank has established a robust pan-India presence, focusing on both retail and wholesale banking. The bank's extensive network includes a substantial number of branches and ATMs, ensuring broad accessibility across the country. This widespread presence is a key aspect of its strategy to reach a diverse customer base.

As of March 31, 2025, IndusInd Bank's distribution network comprised 3,081 branches/banking outlets and 3,027 onsite and offsite ATMs. This network extends to approximately 162,000 villages across India, demonstrating a significant reach into both urban and rural areas. This extensive network supports its ability to serve a wide range of customers.

The bank's geographical distribution strategy includes a balanced presence across different regions and urban classifications. This approach allows the bank to cater to various customer demographics and economic activities. The strategic placement of branches and ATMs is crucial for capturing different segments of the market.

The branch distribution across India reveals a strategic focus on multiple areas. As of May 21, 2025, 28% of branches were located in Metro areas, 25% in Urban areas, 23% in Semi-Urban areas, and 24% in Rural areas. This distribution reflects a balanced approach to serve diverse customer segments.

Regionally, the bank's presence is distributed as follows: 20% in Eastern India, 23% in Northern India, 13% in Central India, 18% in Western India, and 26% in Southern India. This regional spread supports the bank's ability to cater to diverse customer demographics and economic activities across different regions.

IndusInd Bank maintains a global presence with representative offices in London, Dubai, and Abu Dhabi. This global presence supports the needs of the growing Indian diaspora and facilitates international business transactions. This international reach complements its domestic operations.

The bank recognizes the potential in Tier II and Tier III cities, indicating future expansion strategies. Its strategic presence in rural and semi-urban areas, partly through its subsidiary Bharat Financial Inclusion Ltd (BFIL), allows it to cater to the specific financial needs of these regions, including microfinance. This expansion strategy is key to reaching a broader target market.

IndusInd Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does IndusInd Bank Win & Keep Customers?

IndusInd Bank employs a multi-pronged strategy for acquiring and retaining customers, focusing on digital transformation, customer-centricity, and a diverse product portfolio. The bank's approach is designed to attract new customers while fostering long-term relationships and loyalty. This includes leveraging digital channels and personalized services to meet the evolving needs of its diverse customer base.

The bank’s customer acquisition strategy heavily relies on digital channels. This digital push has led to a reduction in customer acquisition costs for digitally sold products. By expanding its digital banking platform and utilizing digital marketing, the bank aims to reach a wider audience and streamline the onboarding process.

For customer retention, IndusInd Bank emphasizes enhancing customer engagement and building strong relationships. This is achieved through CRM strategies designed to boost customer satisfaction and loyalty. The bank's efforts include tailoring products and services to meet specific needs, using customer feedback to drive improvements, and providing a seamless user experience. The bank also aims to scale up its affluent and NRI businesses and build its merchant acquiring business.

The bank aims to expand its 'INDIE' digital banking platform to over 15 million retail customers by June 2025. This platform provides a hyper-personalized and secure banking experience. Features include numberless debit cards and virtual single-use cards.

CRM strategies are central to retaining customers. These strategies leverage technology and data analytics. They personalize the banking experience and tailor products to meet specific needs, boosting customer satisfaction and loyalty.

The bank offers a diversified product portfolio. This caters to various segments like corporate, retail, treasury, and foreign exchange. This comprehensive approach supports both customer acquisition and retention efforts.

The bank focuses on scaling up its affluent and NRI businesses. It also aims to build its merchant acquiring business. These strategies are vital for growth and customer base expansion.

IndusInd Bank's customer acquisition and retention strategies are crucial for its growth. The bank’s digital initiatives and customer-centric approach are key. Despite facing challenges like increased provisioning and a net loss in Q4 FY2025, the bank remains committed to its digital strategy. The bank’s focus on granular retail deposits supports a robust liability franchise. For more insights, explore the Marketing Strategy of IndusInd Bank.

- Digital Transformation: The expansion of the 'INDIE' platform.

- Customer-Centricity: Personalized banking experiences and tailored services.

- Product Diversification: Catering to various customer segments.

- Strategic Growth: Focus on affluent, NRI, and merchant acquiring businesses.

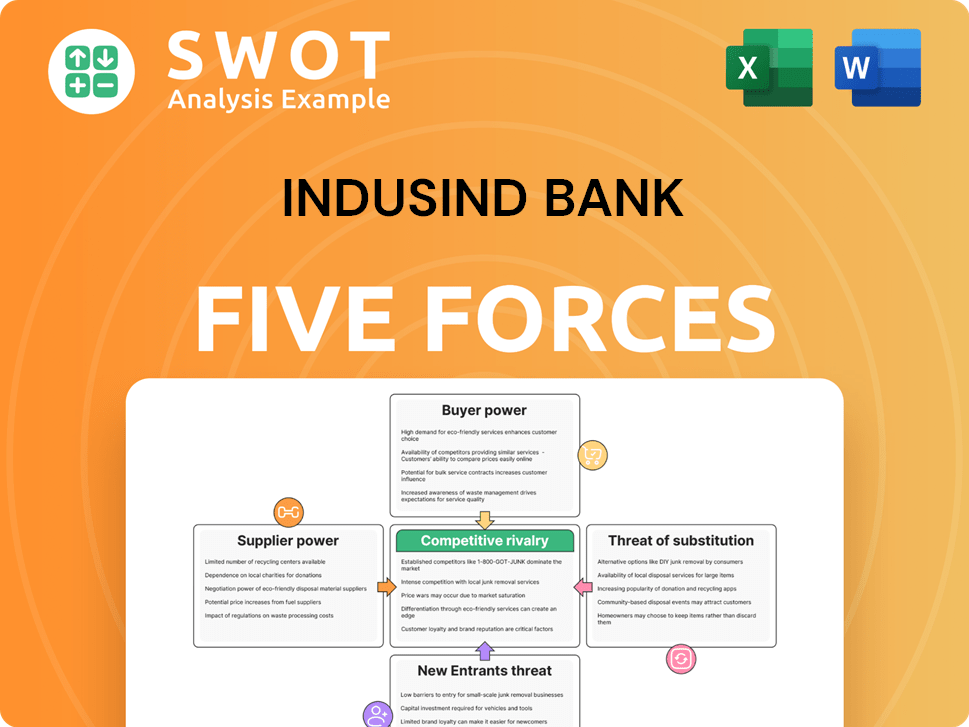

IndusInd Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of IndusInd Bank Company?

- What is Competitive Landscape of IndusInd Bank Company?

- What is Growth Strategy and Future Prospects of IndusInd Bank Company?

- How Does IndusInd Bank Company Work?

- What is Sales and Marketing Strategy of IndusInd Bank Company?

- What is Brief History of IndusInd Bank Company?

- Who Owns IndusInd Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.