Charles Schwab Bundle

Who Are Charles Schwab's Customers Today?

The financial services landscape is constantly reshaped by technological advancements and shifting client expectations, making it crucial for companies like Charles Schwab to understand their customer base. The move towards commission-free trading, for instance, fundamentally altered how brokerages like Schwab attract and retain clients. Founded with the mission of democratizing investing, Charles Schwab has undergone a significant evolution, adapting to the changing needs of its customers.

This analysis will explore the Charles Schwab SWOT Analysis, providing a comprehensive look at the company's customer demographics and target market. Understanding the Schwab customer profile, including their age range of Charles Schwab customers, average income of Charles Schwab investors, and geographic location of Schwab clients, is key to grasping the company's strategic direction. We'll delve into Schwab's ideal customer profile, examining how Charles Schwab attracts customers and its customer acquisition strategies for Schwab within the competitive financial services industry, focusing on the investor profile of its Schwab clients.

Who Are Charles Schwab’s Main Customers?

Understanding the customer demographics and target market is crucial for success in the financial services industry. For the company, this involves a deep dive into who their clients are, what they need, and how to best serve them. This analysis helps in tailoring services, marketing efforts, and overall strategies to meet the specific needs of each customer segment.

The company's customer base is primarily divided into two main segments: Investor Services and Advisor Services. Each segment has distinct characteristics, needs, and behaviors, which influence the company's approach to customer acquisition, retention, and service delivery. This segmentation allows for a more focused and effective approach to meeting the diverse needs of its clientele.

The company's ability to attract and retain customers across these segments is a key factor in its overall performance. The company continuously adapts its strategies to meet the evolving needs of its customers, ensuring it remains competitive in the dynamic financial services market. This includes leveraging technology, providing personalized services, and expanding its offerings to cater to a broad range of investors and advisors.

This segment focuses on individual investors, ranging from novice traders to high-net-worth individuals. The customer demographics include a wide range of ages, though historically, a significant portion has been older, more established investors. However, the company has increasingly targeted younger, digitally native investors, especially with commission-free trading and accessible investment platforms. Income levels vary significantly, from those just starting their investment journey to affluent individuals needing sophisticated wealth management solutions.

Education and occupation are diverse, reflecting the broad appeal of the company's accessible platforms and comprehensive services. The company's goal is to provide a platform that is user-friendly for new investors and offers advanced tools for experienced traders. The company aims to attract and retain a diverse customer base by offering educational resources, a wide range of investment products, and competitive pricing.

This segment focuses on independent registered investment advisors (RIAs) and other institutional clients. This segment is a crucial growth area for the company, as these advisors manage significant assets on behalf of their own clients. The characteristics of this group revolve around their professional needs: robust technology platforms, comprehensive back-office support, and access to a wide array of investment products. The company's acquisition of TD Ameritrade further solidified its position as a leading custodian for independent advisors, significantly expanding its reach within this B2B segment.

This shift was prompted by the growing trend of investors seeking advice from independent fiduciaries, making the advisor segment a key driver of revenue and asset growth. The company provides advisors with the tools and resources they need to manage their clients' assets efficiently. This includes technology platforms, trading capabilities, and a wide range of investment products. The company's focus on the advisor segment reflects its commitment to supporting the independent financial advisor community and providing them with the resources they need to succeed.

The company's customer base is segmented into Investor Services (B2C) and Advisor Services (B2B), each with distinct demographics and needs. The Investor Services segment targets individual investors of various ages, income levels, and experience. The Advisor Services segment caters to independent RIAs and institutional clients, providing them with technology, support, and investment products. Understanding these segments is crucial for the company to tailor its services, marketing, and strategies effectively. For further insights, consider exploring the Competitors Landscape of Charles Schwab to understand the competitive environment.

- The company's focus on both individual investors and financial advisors allows it to capture a broad market share.

- The company's investment in technology and customer service is key to attracting and retaining customers.

- By understanding the customer demographics and target market, the company can better tailor its services and marketing efforts.

- The company's ability to adapt to changing market trends and customer needs is essential for long-term success.

Charles Schwab SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Charles Schwab’s Customers Want?

Understanding the needs and preferences of its diverse customer base is crucial for the success of the company. The company caters to both individual investors and independent financial advisors, each with distinct requirements and expectations. By offering a comprehensive suite of services and continuously adapting to market trends, the company aims to maintain its competitive edge and foster lasting client relationships.

For individual investors, the company focuses on providing accessible, user-friendly platforms and educational resources. This includes commission-free trading, robust digital tools, and a commitment to excellent customer service. For independent financial advisors, the company offers a range of custodial services, advanced trading capabilities, and back-office support to help them manage and grow their businesses efficiently.

The company's approach is data-driven, incorporating customer feedback and market analysis to refine its offerings and marketing strategies. This includes expanding advisory services and investment options to meet the evolving needs of its clients, such as personalized financial planning and ESG investing. The company's ability to adapt and innovate ensures it remains a leader in the financial services industry, attracting and retaining a broad spectrum of clients.

Individual investors prioritize ease of access to investment products, competitive pricing, and reliable customer service. They often seek self-directed investing options with intuitive online platforms and mobile apps. The psychological drivers include a desire for financial independence and growth.

Independent financial advisors require robust custodial services, advanced trading capabilities, and comprehensive reporting tools. They need efficient back-office support to scale their businesses. Technological integration, pricing, and the breadth of investment products are key decision-making criteria.

The company continuously enhances its digital platforms through app updates and online tool improvements. This reflects a commitment to meeting the digital preferences of its client base. These enhancements are crucial for attracting and retaining customers in today's market.

Customer feedback and market trends influence the company's product development. This includes the increasing demand for personalized financial planning and ESG investing options. The company responds by expanding its advisory services and investment offerings.

The company tailors its marketing and product features to different customer segments. For advisors, it emphasizes technological prowess and resources. For individual investors, it highlights user-friendly interfaces and educational content.

The company employs various strategies to acquire and retain customers. These include offering competitive pricing, providing excellent customer service, and continuously improving its digital platforms. The company focuses on building long-term client relationships.

The company's success hinges on understanding and meeting the diverse needs of its customers. This involves a multi-faceted approach, including technological innovation, competitive pricing, and a commitment to customer service. The company's ability to adapt to changing market dynamics and customer preferences ensures its continued growth and market leadership.

- Commission-Free Trading: Offering commission-free trading on stocks, ETFs, and options is a significant draw for individual investors.

- Digital Platform Enhancements: Continuous updates to online platforms and mobile apps to improve user experience and functionality.

- Educational Resources: Providing a wealth of educational materials, including articles, videos, and webinars, to help customers make informed investment decisions.

- Custodial Services: Robust custodial services for independent financial advisors, ensuring secure and efficient management of client assets.

- Advanced Trading Capabilities: Offering sophisticated trading tools and analytics for advisors to manage client portfolios effectively.

- Comprehensive Reporting Tools: Providing detailed reporting tools to help advisors track performance and manage client accounts.

- Back-Office Support: Efficient back-office support to streamline operations and reduce administrative burdens for advisors.

- Personalized Financial Planning: Expanding advisory services to offer personalized financial planning and wealth management solutions.

- ESG Investing Options: Providing access to ESG (Environmental, Social, and Governance) investment options to meet the growing demand for sustainable investing.

Charles Schwab PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Charles Schwab operate?

The primary geographical market presence of Charles Schwab is concentrated within the United States, where it holds a dominant position in the financial services industry. The company's extensive network of branches across various states and major metropolitan areas highlights its strong physical footprint, complementing its robust online presence. This widespread accessibility is a key factor in reaching a broad spectrum of investors.

While specific market share data by city or region is proprietary, Schwab's brand recognition is exceptionally strong nationwide. This is particularly evident in major financial hubs and areas with a high concentration of affluent individuals, reflecting a strategic focus on markets with significant investment potential. The company's strategic acquisitions, such as the integration of TD Ameritrade in 2020, have further solidified its presence across all U.S. regions, expanding its client base and assets under management.

Although its core operations are U.S.-centric, Charles Schwab also serves clients internationally, though on a more limited scale. Non-U.S. persons can open accounts, but the primary focus remains domestic. This U.S.-centric approach allows for targeted marketing and localized branch support, addressing differences in customer demographics and preferences across various regions. Understanding the Growth Strategy of Charles Schwab provides further insights into the company's expansion and market penetration strategies.

Charles Schwab's customer demographics are largely within the United States, with a significant presence in major financial centers. The company's branch network and online platform cater to a diverse range of investors across the country. Schwab's strategic acquisitions, such as TD Ameritrade, have expanded its reach and client base throughout the U.S.

While primarily focused on the U.S. market, Charles Schwab does offer services to international clients. This international presence is more limited compared to its domestic operations. The company's focus remains on serving the needs of U.S.-based investors, with international services as a secondary priority.

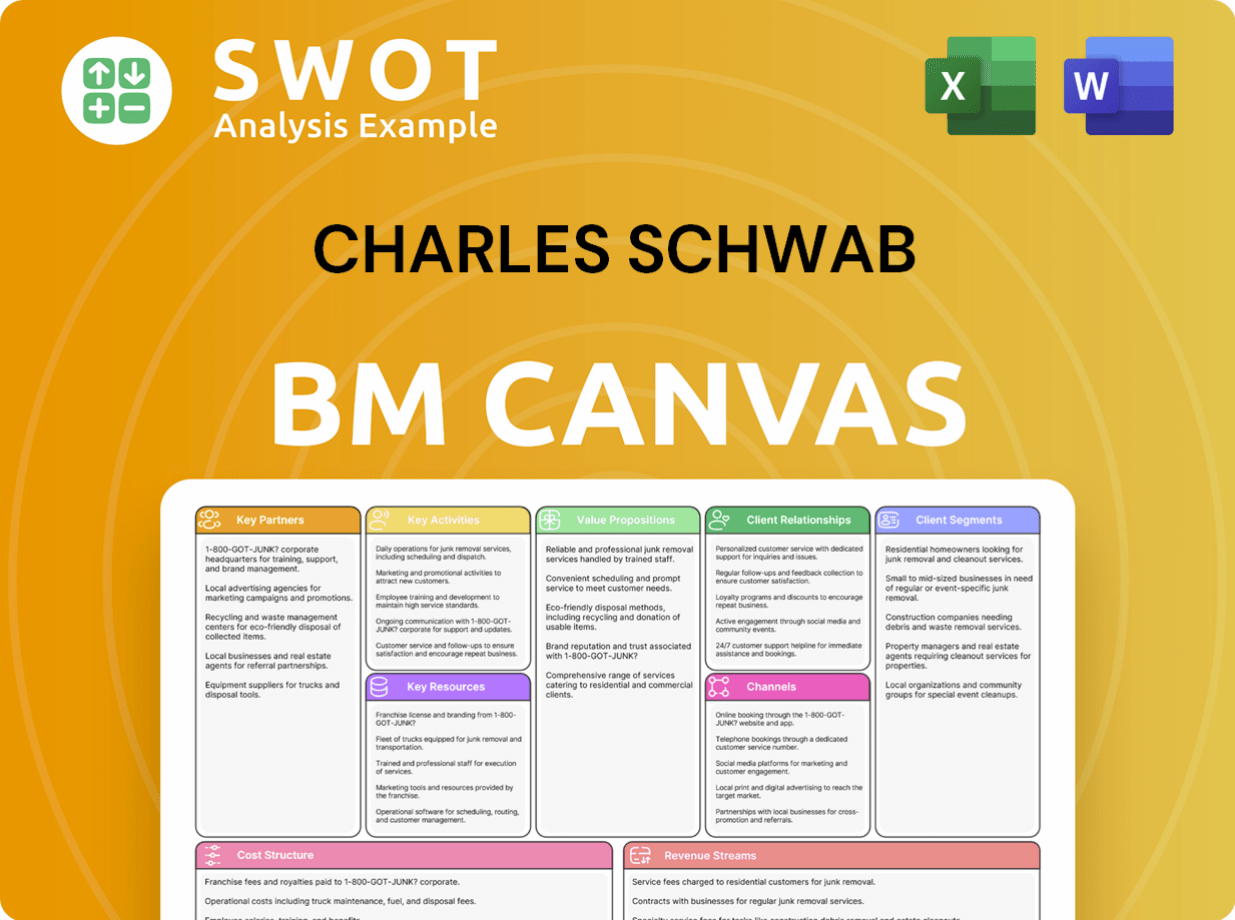

Charles Schwab Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Charles Schwab Win & Keep Customers?

Customer acquisition and retention strategies at Charles Schwab are multifaceted, combining digital and traditional marketing with competitive pricing and a strong focus on client service. Digital marketing, including search engine marketing, social media, and online advertising, is used to reach a broad audience of potential individual investors. Traditional advertising, like television and print media, helps build brand awareness. The company also leverages referral programs, particularly within its Advisor Services segment, where independent advisors refer clients for custodial services.

Sales strategies include competitive pricing, such as commission-free stock and ETF trading, which attracts younger investors. Loyalty programs are implemented through financial planning services, personalized advice, and a range of investment products. The focus on holistic wealth management solutions, including financial planning and retirement services, helps retain clients by addressing their long-term financial goals. Customer data and CRM systems are crucial for targeted campaigns, allowing segmentation and personalized communications.

A significant acquisition strategy was the integration of TD Ameritrade, adding millions of new client accounts and billions in assets under management, significantly boosting market share. This move focused on both acquisition and retention, with Schwab working to seamlessly transition TD Ameritrade clients and offer them an expanded suite of services. Ongoing retention efforts include enhancing digital platforms, providing financial education, and offering responsive customer support. These strategies aim to increase customer lifetime value and reduce churn rates by fostering long-term relationships built on trust and value. For more insights, consider reading the Brief History of Charles Schwab.

Digital marketing is a key customer acquisition strategy, using search engine marketing (SEM), social media campaigns, and online advertising. This approach helps reach a wide audience of potential individual investors. These strategies are designed to drive traffic to their platforms and generate leads.

Offering competitive pricing, such as commission-free trading, is a major acquisition driver, especially for younger investors. This strategy attracts price-sensitive customers and those new to investing. This approach has helped Schwab gain a significant market share.

Referral programs, particularly in Advisor Services, are crucial for acquiring new clients. Independent advisors refer clients to Schwab for custodial services. This approach leverages existing networks and builds trust through recommendations.

Providing comprehensive financial planning and retirement services helps retain clients by addressing their long-term financial goals. This approach creates a stickier relationship, as clients rely on Schwab for multiple financial needs. This strategy enhances customer lifetime value.

Customer data and CRM systems are used to segment the client base and deliver personalized communications. This allows Schwab to tailor its services and product recommendations to specific customer needs. This targeted approach improves engagement and satisfaction.

Continuous enhancement of digital platforms is a key retention strategy. This includes improving user experience and providing access to educational resources. Enhancements help keep clients engaged and informed about their investments.

Offering responsive customer support is crucial for retaining clients. This includes providing timely and helpful assistance through various channels. Excellent customer service builds trust and encourages long-term relationships.

The integration of TD Ameritrade was a significant acquisition strategy, adding millions of new accounts. Schwab worked to seamlessly transition TD Ameritrade clients and offer them an expanded suite of services. This strategic move boosted market share.

Providing access to financial education helps clients make informed decisions and stay engaged. Educational resources include webinars, articles, and tools to support their investment journey. This empowers clients and builds loyalty.

These strategies aim to increase customer lifetime value and minimize churn rates. By fostering long-term relationships built on trust and value, Schwab ensures client retention. This approach focuses on long-term profitability.

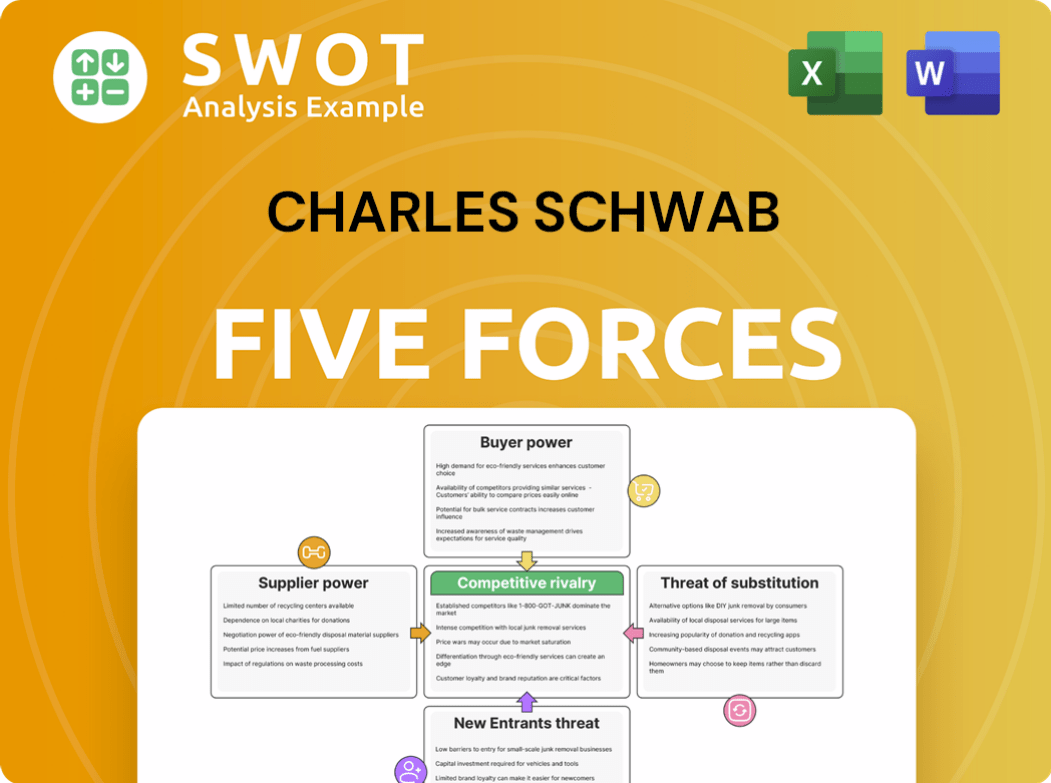

Charles Schwab Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Charles Schwab Company?

- What is Competitive Landscape of Charles Schwab Company?

- What is Growth Strategy and Future Prospects of Charles Schwab Company?

- How Does Charles Schwab Company Work?

- What is Sales and Marketing Strategy of Charles Schwab Company?

- What is Brief History of Charles Schwab Company?

- Who Owns Charles Schwab Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.