Taiwan Semiconductor Bundle

Who Does Taiwan Semiconductor Company Serve?

To truly grasp the power of the semiconductor industry, one must understand the core of its leading player: Taiwan Semiconductor Company (TSMC). This deep dive into Taiwan Semiconductor SWOT Analysis will reveal the intricacies of its customer base. Understanding the customer demographics and target market is key to unlocking TSMC's continued success and dominance in the global market.

TSMC's success hinges on its ability to understand and cater to a diverse range of clients. This exploration will delve into TSMC's customer base analysis, examining its geographic distribution and market share by industry. We'll uncover who TSMC's main customers are, including its target audience in automotive, mobile, and high-performance computing sectors. Furthermore, we'll explore how TSMC identifies its target market and its strategies for customer acquisition and retention within the dynamic semiconductor industry.

Who Are Taiwan Semiconductor’s Main Customers?

Understanding the Growth Strategy of Taiwan Semiconductor involves a close look at its customer demographics and target market. As a Business-to-Business (B2B) entity, TSMC primarily serves a global network of technology companies. This focus shapes its market analysis and customer base analysis, making it a key player in the semiconductor industry.

In 2024, TSMC had 522 customers and produced 11,878 distinct products. These clients span various sectors, including consumer electronics, automotive, telecommunications, and healthcare. The company's approach to its target market segmentation is crucial for its continued success.

The company's focus on high-performance computing (HPC) and smartphones is evident in its revenue breakdown. HPC and smartphones accounted for 51% and 35% of total wafer revenue, respectively, in 2024. This highlights the significance of these segments for TSMC's financial performance.

TSMC segments its customers based on the end-market applications of the chips they design. This approach helps the company tailor its services and technologies to meet specific industry demands. The main customer groups are segmented by the end-market applications of the chips they design.

The revenue breakdown in Q4 2024 shows the importance of different sectors. IoT, automotive, and digital consumer electronics each represented 5%, 4%, and 1% of revenue, respectively. The company's market share by industry is constantly evolving.

Advanced technologies are critical to TSMC's strategy. In 2024, advanced technologies (7nm and more advanced) made up 69% of total wafer revenue. The increasing use of 3nm process technology, which accounted for 18% of revenue, shows TSMC's commitment to innovation.

A significant portion of TSMC's revenue comes from its top clients. The top 10 clients accounted for 76% of its revenue in 2024. Major players such as Apple, NVIDIA, AMD, Broadcom, and Qualcomm are among TSMC's key customers.

TSMC's focus on advanced technologies, such as 3nm, reflects its commitment to meeting the needs of its target market. The company’s customer acquisition strategy involves targeting companies that require cutting-edge semiconductor solutions. This includes a deep understanding of the demographic profile of TSMC clients.

- The growth in HPC is largely driven by surging demand for AI applications.

- AI-related revenue at TSMC tripled in 2024 and is projected to double again in 2025.

- The company continues to adapt its marketing to specific customer segments.

- TSMC's customer retention strategies are focused on technological leadership and strong partnerships.

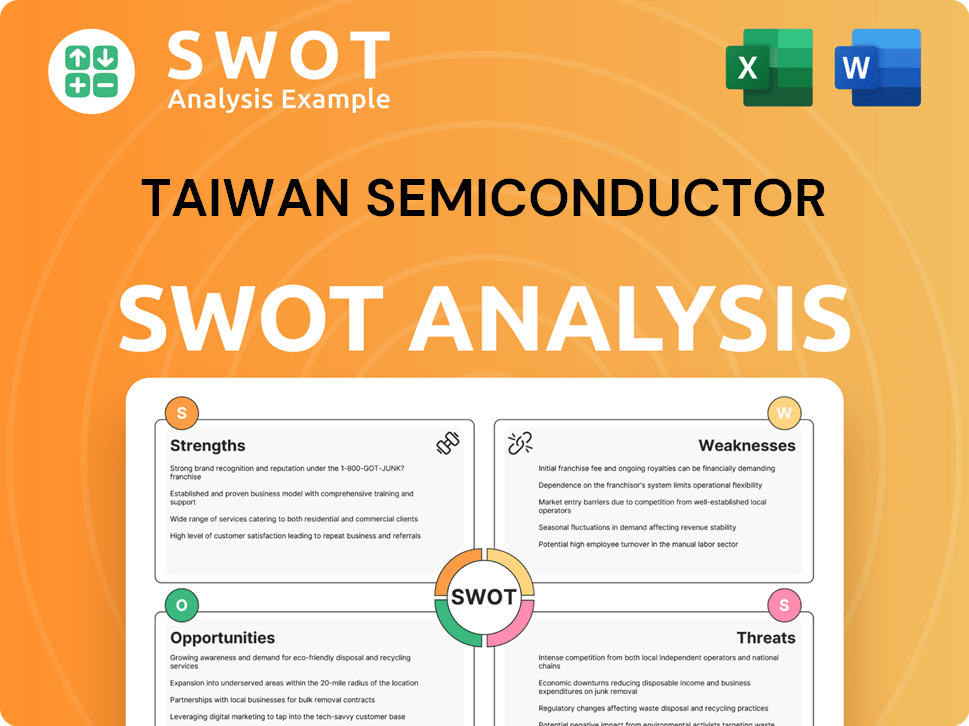

Taiwan Semiconductor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Taiwan Semiconductor’s Customers Want?

Understanding the customer needs and preferences is crucial for companies like Taiwan Semiconductor Company (TSMC) to maintain their competitive edge. The customer demographics for TSMC are primarily business-to-business (B2B), focusing on companies that design and sell electronic products. These customers operate across various sectors, including mobile devices, high-performance computing, and automotive electronics. A deep dive into the target market reveals a focus on companies requiring advanced chip manufacturing capabilities.

TSMC's customers are driven by the need for cutting-edge technology, high manufacturing quality, and a reliable supply chain. They seek integrated circuits that are smaller, more efficient, and faster. This is a critical aspect of the semiconductor industry. TSMC's ability to offer advanced process technologies, such as 3nm and 5nm, which are essential for AI accelerators and flagship smartphones, is a key factor in attracting and retaining these customers. The purchasing behavior is heavily influenced by the need for innovation and the ability to meet evolving market demands.

TSMC's customers prioritize access to the latest process technologies, high production yields, and the ability to customize solutions for various applications. They look for partners who offer comprehensive solutions beyond manufacturing, including design support, testing, and packaging services. TSMC addresses common pain points by investing heavily in research and development to stay at the forefront of chip-making technology. The company also focuses on building strong, long-term relationships with its clients, recognizing that their success is intertwined with TSMC's ability to deliver.

Customers demand access to the most advanced chip-making technologies to stay competitive. This includes the latest process nodes like 3nm and 5nm, crucial for high-performance applications.

Reliable production with high yields is essential to ensure a consistent supply of chips. This minimizes risks and supports efficient product launches.

Customers require the ability to customize solutions to meet specific application needs, whether it's for mobile devices, high-performance computing, or automotive electronics.

Beyond manufacturing, customers seek partners who provide design support, testing, and packaging services. This simplifies the product development process.

A dependable supply chain is critical to avoid disruptions. Customers value partners who can consistently deliver on time and in the required quantities.

Customers look for partners who continuously invest in research and development to stay ahead of technological advancements. This ensures access to the latest innovations.

TSMC addresses its customers' needs through strategic investments and tailored solutions. By focusing on innovation and customer relationships, TSMC aims to meet the demands of its diverse client base. For instance, TSMC's CoWoS production capacity, essential for AI chips, is targeted to double from 330,000 wafers in 2024 to 660,000 wafers in 2025. This expansion demonstrates TSMC's commitment to meeting the growing demand for advanced chips.

- Advanced Technology: TSMC invests heavily in R&D to offer leading-edge process technologies.

- High-Quality Manufacturing: TSMC focuses on high production yields and rigorous quality control.

- Customization: TSMC provides specialized technology platforms and IP to meet specific customer needs.

- Comprehensive Support: TSMC offers design support, testing, and packaging services.

- Reliable Supply: TSMC focuses on building a robust supply chain and expanding production capacity.

- Customer Relationships: TSMC emphasizes building strong, long-term relationships with its clients.

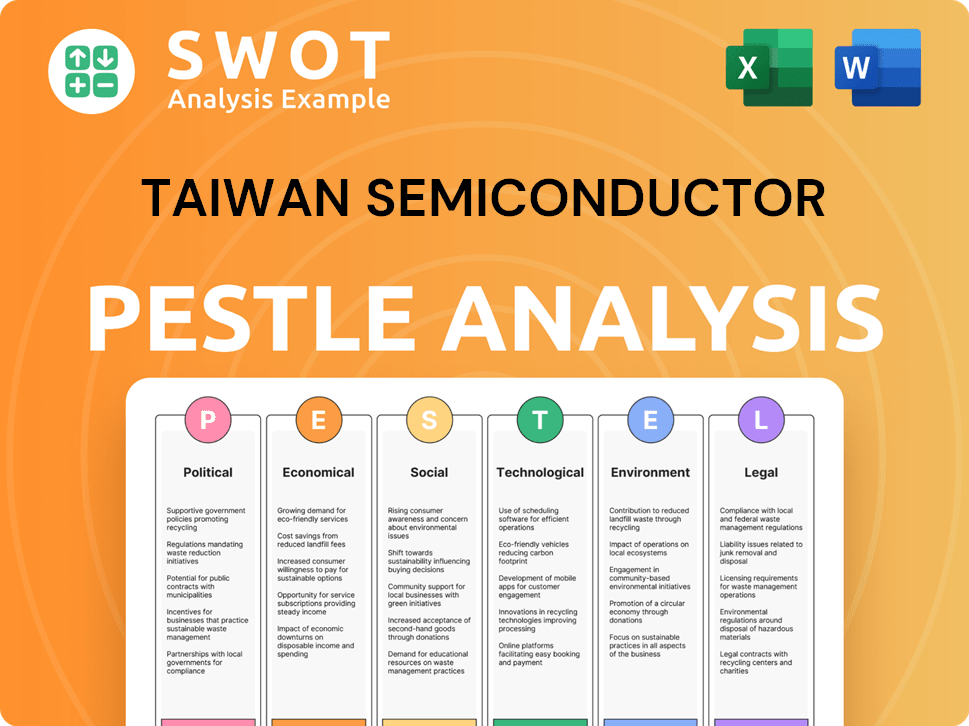

Taiwan Semiconductor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Taiwan Semiconductor operate?

Understanding the geographical market presence of the Taiwan Semiconductor Company is crucial for a comprehensive market analysis. TSMC's customer demographics are spread across the globe, with a significant concentration in specific regions. The company's strategic approach to its target market involves a blend of serving established markets and expanding its footprint to mitigate risks and cater to diverse client needs within the semiconductor industry.

TSMC's global market presence is characterized by a strong focus on North America, which consistently represents its largest customer base. This concentration highlights the importance of the U.S. market for TSMC's revenue generation. Beyond North America, TSMC strategically serves other key regions to diversify its customer base and reduce reliance on any single market.

The company's revenue distribution across different geographical segments provides insights into its market dynamics and strategic priorities. This analysis is essential for understanding TSMC's position within the semiconductor industry and its ability to adapt to changing market conditions.

North America is consistently TSMC's largest market. In Q4 2024, North America accounted for 75% of total wafer revenue. This highlights a heavy reliance on U.S. clients, which is a key aspect of TSMC's customer base analysis.

Revenue from China accounted for 11% of total net revenue in 2024. This is a decrease from 20% in 2019, reflecting the impact of geopolitical tensions on TSMC's market share by industry in China.

The Asia Pacific region contributes significantly to TSMC's revenue. In 2024, this region accounted for 10% of total net revenue, showcasing the importance of this market segment within the semiconductor industry.

Japan and EMEA (Europe, Middle East, and Africa) are also key markets for TSMC. In 2024, Japan accounted for 5%, and EMEA for 4% of total net revenue, demonstrating the company's global reach.

To mitigate geopolitical risks and enhance its global presence, TSMC is expanding its manufacturing facilities worldwide. This strategic move aims to diversify its supply chain and enhance production capacity for its multinational clients, impacting its customer demographics and target market.

TSMC commenced construction of a specialty technology fab in Dresden, Germany, in 2024. This fab will produce mature chips for the automotive and industrial sectors, expanding TSMC's global reach.

JASM (Japan Advanced Semiconductor Manufacturing) in Kumamoto, Japan, began commercial operations in December 2024. It focuses on 12-, 22-, and 28-nanometer processes, with plans to enhance capabilities.

TSMC's Arizona fab started 4nm wafer production in April 2024. Volume production is expected to launch in early 2025, increasing TSMC's capacity to serve its target market.

These global operations aim to diversify the supply chain and enhance production capacity. This expansion supports TSMC's customer acquisition strategy and strengthens its position in the semiconductor industry.

In Q1 2025, North America's contribution to TSMC's net revenue rose to 77%, up from 62% in 2018. This highlights the increasing importance of the U.S. market for TSMC.

TSMC's revenue exposure to China has been declining due to geopolitical tensions. In Q1 2025, China's contribution to net revenue further decreased to 7%, reflecting the impact of market dynamics.

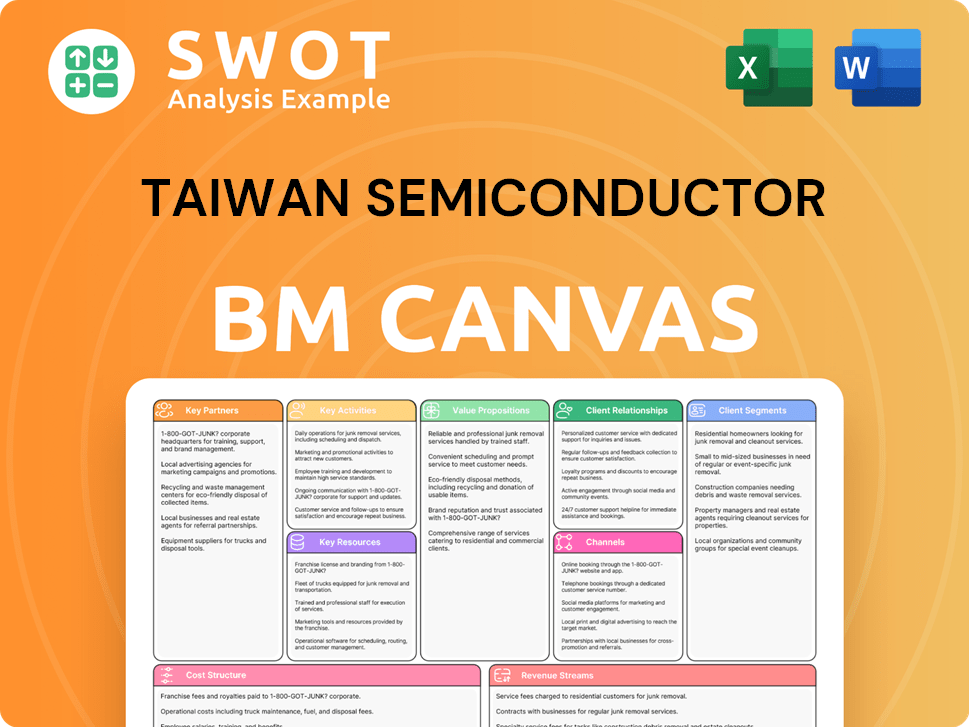

Taiwan Semiconductor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Taiwan Semiconductor Win & Keep Customers?

Customer acquisition and retention strategies for the Taiwan Semiconductor Company (TSMC) are built on its business-to-business (B2B) model. This model focuses on technological leadership, collaborative partnerships, and operational excellence. TSMC's approach is distinct because it doesn't engage in direct sales to individual consumers.

As a pure-play foundry, TSMC directly engages with other businesses. The sales process involves high-level technical discussions and in-person meetings. Deals often start at significant amounts, requiring a deep understanding of clients' needs. The sales cycle can take from 3 to 18 months, reflecting the complexity of the semiconductor industry.

TSMC's main goal is to attract and keep clients by being a trusted provider and tech leader. They invest heavily in research and development to offer advanced process technologies. This attracts major clients such as Apple, NVIDIA, and Qualcomm. TSMC's 'Open Innovation Platform®' supports a global ecosystem, with around 85% of worldwide semiconductor start-up product prototypes enabled by TSMC, fostering innovation and customer loyalty.

TSMC's acquisition strategies hinge on its reputation and technological prowess. They focus on attracting clients who need cutting-edge chips. The company's investments in R&D are key to staying ahead in the semiconductor industry. TSMC's 'Open Innovation Platform' is a key tool for attracting new customers, especially startups.

- Leveraging technological leadership to attract high-profile clients.

- Utilizing the 'Open Innovation Platform®' to enable start-up prototypes.

- Building a strong reputation as a trusted provider.

- Focusing on direct sales and technical engagements.

TSMC focuses on building strong, long-term relationships with its customers. They view their customers' success as their own. This approach fosters loyalty and repeat business. This is crucial in the B2B model, where relationships drive sales.

TSMC provides a wide range of manufacturing options. They tailor their processes to meet specific customer needs. This flexibility helps solidify customer relationships. This approach helps TSMC retain clients by meeting their diverse needs.

The 'Foundry 2.0' strategy expands TSMC's offerings to include packaging, testing, and non-memory manufacturing. This aims to provide comprehensive solutions. This strategy helps to retain customers by offering complete solutions.

Operational efficiency and consistent delivery of high-quality chips are critical. TSMC's focus on efficiency contributes to customer lifetime value. This approach minimizes customer churn and maintains satisfaction.

TSMC proactively responds to market trends, like the increasing demand for AI. They adapt their strategies to meet evolving customer needs. This helps them stay relevant and retain clients in a dynamic market.

TSMC prioritizes long-term relationships over short-term gains. This approach builds trust and loyalty. This strategy ensures that TSMC remains a key player in the semiconductor industry. To understand the company's origins, you can read a brief history of Taiwan Semiconductor.

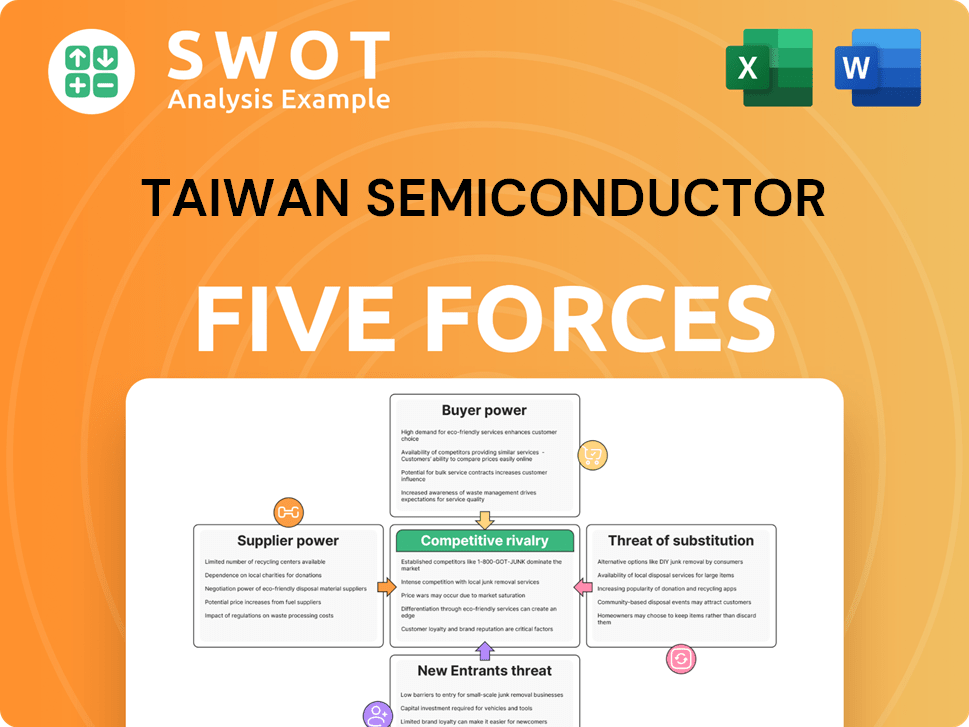

Taiwan Semiconductor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Taiwan Semiconductor Company?

- What is Competitive Landscape of Taiwan Semiconductor Company?

- What is Growth Strategy and Future Prospects of Taiwan Semiconductor Company?

- How Does Taiwan Semiconductor Company Work?

- What is Sales and Marketing Strategy of Taiwan Semiconductor Company?

- What is Brief History of Taiwan Semiconductor Company?

- Who Owns Taiwan Semiconductor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.