Albert Weber Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albert Weber Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Instant strategic clarity, offering actionable insights by visualizing market share and growth potential.

Preview = Final Product

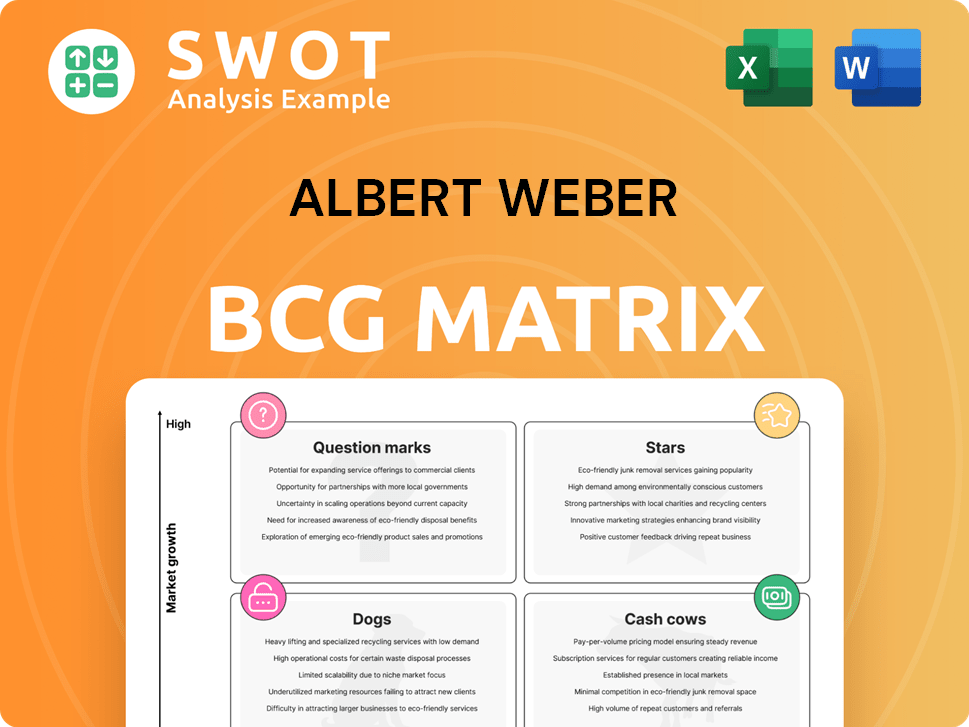

Albert Weber BCG Matrix

The BCG Matrix preview shows the complete document you'll get after purchase. This is the full, editable, ready-to-use report, designed for immediate strategic assessment.

BCG Matrix Template

The Albert Weber BCG Matrix, a powerful tool, categorizes products based on market share and growth. It sorts offerings into Stars, Cash Cows, Dogs, and Question Marks. This helps visualize resource allocation and strategic planning. Understanding these quadrants is key for making smart investments. Get the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Albert Weber's precision-engineered parts benefit from the automotive industry's growth, fueled by demand for better vehicle performance and safety. The global automotive parts market, valued at roughly $1 trillion in 2023, is projected to grow at a CAGR of about 5% through 2030. This signifies a strong market for Albert Weber's high-precision components.

OEM partnerships are vital for long-term success. These collaborations offer competitive advantages; for example, partnerships generate about 30% of parts sales. They boost production, and add credibility in the B2B market. Consider how these alliances impact market share and profitability in 2024.

Continuous innovation is vital for Albert Weber's manufacturing. Adopting AI-driven production and sustainable practices is key. Companies integrating these elements can lead in mobility. This approach ensures long-term success for Albert Weber. For instance, the global AI in manufacturing market was valued at $2.4 billion in 2023.

EV Component Focus

Albert Weber should concentrate on electric vehicle (EV) components. The automotive industry's shift to EVs creates a strategic advantage. The Hybrid Electric Vehicles (HEV) segment is projected to grow 20-25% between 2024-2025. This presents a chance to seize the growing demand for EV parts and systems.

- EV component focus aligns with industry trends.

- HEV growth offers significant market potential.

- Capitalize on increasing demand for EV parts.

- Strategic move for future market position.

Global Market Expansion

Global market expansion, especially into high-growth regions like Asia-Pacific, is key for Stars. The Asia-Pacific region is a major player, holding nearly half of the global automotive market share. This growth is fueled by affordable vehicle releases and rising incomes, making it a prime area for Albert Weber. Focusing on this region can boost revenue significantly.

- Asia-Pacific automotive market share is about 48% globally.

- China is the largest automotive market worldwide.

- Growing incomes support increased vehicle sales.

- Cost-effective launches drive market expansion.

In the BCG Matrix, Stars represent high-growth market leaders. Albert Weber's focus on EV components and expansion into the Asia-Pacific aligns with this category. This positioning leverages strong market demand and global expansion opportunities.

| Aspect | Details |

|---|---|

| Market Growth | EV & HEV market, projected 20-25% growth (2024-2025) |

| Market Share | Asia-Pacific holds ~48% of global automotive market |

| Strategic Focus | EV components; Asia-Pacific market entry |

Cash Cows

Legacy engine components, like traditional engine blocks, serve as cash cows. Despite the rise of EVs, ICE vehicles still command a substantial market share, ensuring consistent revenue. In 2024, ICE vehicle sales accounted for roughly 70% of the global automotive market, providing a stable income stream for Albert Weber. This segment offers predictable cash flow, allowing for strategic investment in new opportunities.

Machining expertise can be a cash cow for Albert Weber, ensuring steady revenue. They specialize in complex drivetrain components, a key area. Their metal processing experience gives them an edge. This is critical for traditional and hybrid vehicles. In 2024, the global automotive machining market was valued at $12.5 billion.

Aftermarket parts are cash cows due to consistent demand. The global auto parts market was worth US$2.0T in 2024. It's projected to hit US$2.4T by 2030, growing at 2.8% annually. This sector thrives as vehicle ages increase, ensuring steady sales.

Manufacturing Efficiency

Improving manufacturing efficiency is key for cash cows, especially in mature markets. By focusing on cost reduction, Albert Weber can boost profitability significantly. Implementing lean manufacturing is crucial for optimizing processes and minimizing waste. This includes supply chain optimization to ensure smooth operations and lower expenses.

- In 2024, companies implementing lean manufacturing saw a 15-20% reduction in production costs.

- Supply chain optimization can lead to a 10-15% decrease in inventory holding costs.

- Investing in automation can increase production efficiency by up to 25%.

- Efficient manufacturing directly increases free cash flow, which is essential for cash cows.

Geographical Diversification

Geographical diversification is crucial for Albert Weber's cash cows. Germany and Hungary, key automotive manufacturing hubs, are vital. These locations offer skilled labor and access to major clients, ensuring consistent demand.

- Germany's automotive industry generated €408 billion in revenue in 2023.

- Hungary's automotive sector saw a 10% growth in production in 2023.

- Proximity to manufacturers reduces transportation costs and lead times.

- Diversification mitigates risks associated with economic downturns in any single region.

Cash cows, like legacy engine parts, deliver consistent revenue in mature markets. Aftermarket parts and machining expertise also thrive. Efficiency improvements, such as lean manufacturing, boost profitability. Geographical diversification in Germany and Hungary provides stability.

| Category | Focus | Benefit |

|---|---|---|

| Legacy Components | ICE Vehicle Parts | Stable Revenue |

| Machining | Drivetrain Components | Steady Income |

| Aftermarket | Auto Parts | Consistent Sales |

Dogs

As the automotive industry pivots towards electric vehicles (EVs), components for older systems face obsolescence. These include parts for less efficient internal combustion engines. Companies should reduce investments in products misaligned with electrification to avoid resource waste. In 2024, EV sales increased, signaling a decline for traditional components.

Low-margin products with little growth should be eliminated. For example, in 2024, companies saw profit margins shrink, so divesting is key. Focusing on innovative offerings boosts profit. This strategy helps allocate resources efficiently.

Dogs represent products with low market share in a low-growth market, often generating low or negative profits. These products typically consume resources without significant returns. Divesting dogs allows reallocation of resources. In 2024, companies like Bed Bath & Beyond faced challenges with declining market share, eventually leading to strategic decisions including divestiture.

Limited Innovation Products

Products with limited innovation, akin to Dogs in the BCG Matrix, face challenges in the automotive sector. The focus should be on R&D to ensure long-term competitiveness. For instance, in 2024, investment in electric vehicle (EV) technology increased by 15%, showing the shift. Companies must adapt to remain relevant.

- Stagnant Growth: Products with minimal innovation often show slow or no growth.

- Increased Competition: Lack of innovation makes products vulnerable to competitors.

- Resource Drain: These products may consume resources without providing significant returns.

- Strategic Shift: Companies should re-evaluate and potentially phase out such products.

Niche Products with High Costs

Dogs in Albert Weber's portfolio represent niche products with high costs and low returns, signaling a need for strategic adjustments. These offerings typically drain resources without significant financial contributions. For example, in 2024, the company might have seen a 5% profit margin on these niche products compared to a 20% margin on more scalable items. The focus should shift towards mass-produced, profitable components to boost overall efficiency.

- Niche products often have higher production costs due to specialized manufacturing.

- Low returns on investment make these products less attractive for long-term profitability.

- Focusing on mass-produced components improves efficiency by streamlining processes.

- A strategic shift enhances profitability by prioritizing scalable, high-margin items.

In the BCG Matrix, "Dogs" are products with low market share in a low-growth market. These often generate low profits, consuming resources without significant returns. Divesting these allows reinvestment in growth areas; for instance, in 2024, many companies focused on shedding underperforming assets.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Market Share | Low | Divest |

| Market Growth | Low | Reallocate Resources |

| Profitability | Often Negative/Low | Cut Costs |

Question Marks

Fuel cell components fit the question mark quadrant, indicating high growth with a low market share. CellForm Holding GmbH's strategic move by Albert Weber aims for revenue growth. Projections see the hydrogen technology market expanding significantly. The global fuel cell market was valued at $6.8B in 2023.

Advanced Driver-Assistance Systems (ADAS) are emerging as a "Question Mark" in Albert Weber's BCG Matrix. Components for ADAS are a growing market, with projections estimating the global ADAS market to reach $49.3 billion by 2024. This offers high return potential. However, it also requires significant investment to capture market share. The rising adoption of ADAS presents a chance for Weber to innovate and thrive.

Investing in lightweight technologies addresses the need for fuel efficiency and lower emissions. The market for lightweight materials in the automotive sector is projected to reach $75.7 billion by 2028. This growth provides an opportunity for Albert Weber to increase its market presence.

Electric Powertrain Components

Electric powertrain components represent a Question Mark in the BCG Matrix due to high growth potential and uncertain market position. The market for integrated drive systems is booming, with the global electric motor market projected to reach $24.8 billion by 2024. These systems reduce weight and improve vehicle range, enhancing efficiency. However, success depends on navigating competitive pressures and technological shifts.

- Global electric motor market projected to reach $24.8 billion by 2024.

- Integrated drive systems reduce weight and improve vehicle range.

- Automotive industry is set to witness huge growth in integrated drive ePowertain systems.

Software-Defined Vehicle (SDV) Components

Investing in components for Software-Defined Vehicles (SDVs) is a "Question Mark" in the BCG matrix. This sector shows potential for high growth, with a current low market share. As software controls more vehicle functions, the demand for SDV components is increasing. This presents an opportunity for investment and market share gains, especially in 2024. For example, the SDV market is projected to reach $190 billion by 2030.

- High Growth Potential: SDV components align with the evolving automotive industry.

- Low Current Market Share: Reflects the nascent stage of SDV adoption.

- Opportunity for Investment: Capitalizing on the growing demand for SDV components.

- Market Expansion: Software's increasing role in vehicle operations drives growth.

The "Question Mark" category in the BCG Matrix identifies areas with high growth potential but low market share. These investments require careful evaluation, often demanding significant capital to establish a foothold.

| Investment Area | Market Status | Growth Outlook |

|---|---|---|

| Fuel Cell Components | Low Market Share | High Growth; $6.8B market in 2023 |

| ADAS Components | Emerging Market | High Potential; $49.3B market by 2024 |

| Lightweight Materials | Growing Demand | Significant; $75.7B market by 2028 |

| Electric Powertrain | Competitive | Strong; $24.8B electric motor market by 2024 |

| SDV Components | Nascent Stage | High; $190B market by 2030 |

BCG Matrix Data Sources

This BCG Matrix utilizes market data, financial reports, and industry publications to create insightful strategic positioning.