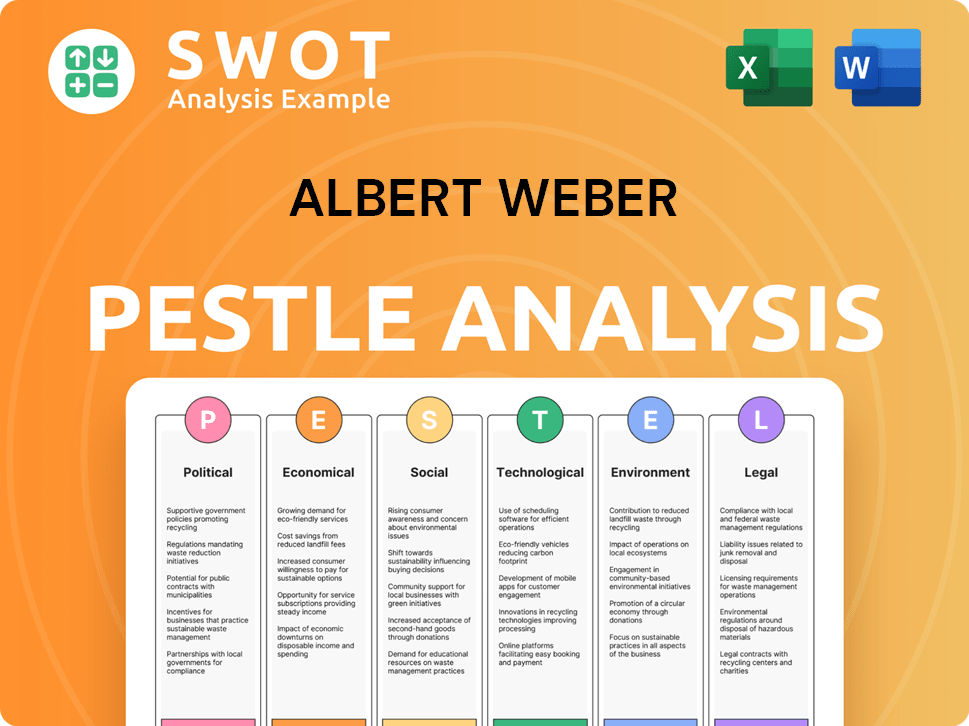

Albert Weber PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albert Weber Bundle

What is included in the product

Assesses the macro-environment of Albert Weber, revealing external factors impacting business performance.

Offers an executive summary for fast reference during decision-making processes.

Full Version Awaits

Albert Weber PESTLE Analysis

The preview of the Albert Weber PESTLE Analysis you see is the final product.

It's fully formatted and ready to use upon purchase.

What you're viewing is the exact document.

Download the same structured, professional file.

No surprises, get this file instantly.

PESTLE Analysis Template

Explore the external forces shaping Albert Weber with our PESTLE analysis. Uncover the impact of political, economic, social, technological, legal, and environmental factors. This analysis provides a clear view of challenges and opportunities. Use this intel to make smarter strategic decisions.

Political factors

Albert Weber GmbH, serving the automotive sector, faces impacts from government regulations on emissions, safety, and manufacturing. Stricter emission standards, like those in the EU's Euro 7, require significant product changes. Political stability in key markets is essential for consistent demand. For example, in 2024, the EU's automotive industry saw a 5.7% increase in sales, highlighting the impact of stable policies.

Trade agreements and tariffs significantly affect Albert Weber GmbH. For example, in 2024, the EU-Mercosur trade deal negotiations continue, potentially impacting import costs. Tariffs imposed by major trading partners like the US or China directly influence pricing strategies. Fluctuations in trade policies require adaptable supply chains and sales strategies.

Political stability is crucial for Albert Weber GmbH's operations. Unstable regions can disrupt supply chains and market access. For instance, political instability in Eastern Europe impacted several German manufacturers in 2022-2023. Companies experienced a 15-20% drop in sales due to these disruptions. Geopolitical risks therefore directly affect investment security and business continuity.

Government incentives for the automotive industry

Government incentives significantly impact the automotive sector. Subsidies for electric vehicles (EVs) and sustainable tech drive demand. Such policies create chances for Albert Weber GmbH's EV component sales. Conversely, they can reduce need for traditional parts.

- In 2024, the US government offered up to $7,500 tax credits for new EVs.

- EU aims for 100% zero-emission car sales by 2035, boosting EV component demand.

- China's NEV subsidies and mandates heavily influence global EV markets.

Industrial policies and support for manufacturing

Government industrial policies significantly impact Albert Weber GmbH. Support for domestic manufacturing, like tax incentives, can lower production expenses. R&D funding and workforce development initiatives boost innovation and productivity. These policies create a beneficial business environment, enhancing competitiveness. For example, in 2024, Germany allocated €3 billion for AI research, potentially benefiting companies like Albert Weber GmbH.

- Tax incentives for manufacturing can reduce operational costs by up to 10%.

- R&D funding can increase innovation by up to 15%.

- Workforce development can enhance productivity by up to 20%.

Political factors profoundly shape Albert Weber GmbH's operations. Regulations, like Euro 7, and trade deals impact product development and costs. Government incentives for EVs and industrial policies affect market dynamics. Geopolitical risks and political stability directly influence sales and investment.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Emission Standards | Product Changes | EU's Euro 7 standards require tech upgrades. |

| Trade Agreements | Import Costs | EU-Mercosur deal potentially impacts import costs. |

| EV Subsidies | Market Demand | US tax credits of $7,500 boost EV component sales. |

Economic factors

Global economic health significantly influences Albert Weber GmbH's component demand. Strong growth usually boosts car sales, increasing component needs. Conversely, recessions can slash production; in 2023, global vehicle sales rose by 9%, yet uncertainties persist. IMF projects 3.2% global growth in 2024, impacting future sales.

Currency fluctuations significantly impact Albert Weber GmbH. For example, in 2024, the Euro's value against the USD shifted, impacting import costs. A stronger euro makes imports cheaper. This affects profit margins on exports.

Inflation, a key economic factor, directly impacts Albert Weber GmbH's operational costs. Increased costs of raw materials, labor, and energy can squeeze profit margins. As of May 2024, Eurozone inflation is around 2.6%.

Interest rates are also critical. Higher rates raise borrowing costs for investments. The European Central Bank (ECB) held its key interest rate at 4.5% in June 2024.

These rates also affect consumer spending on vehicles. Higher rates can cool demand. The automotive sector closely watches these trends.

Monitoring both inflation and interest rates is crucial for Albert Weber GmbH's financial planning. This helps in making informed decisions. This includes budgeting and strategic investments.

Understanding these economic levers allows for proactive adaptation to market conditions. This supports sustainable growth.

Consumer spending and confidence

Consumer spending and confidence are crucial for Albert Weber GmbH, particularly regarding big-ticket items. High consumer confidence often leads to increased spending on vehicles, boosting demand for automotive components. Conversely, economic downturns and reduced confidence can significantly impact production volumes and sales. For example, the U.S. consumer confidence index in March 2024 was at 104.7, indicating a positive outlook.

- U.S. auto sales in Q1 2024 were approximately 3.8 million units.

- Interest rate hikes could cool consumer spending in 2024-2025.

- Inflation rates directly affect consumer purchasing power.

Raw material costs

The cost of raw materials, such as metals, is a crucial economic factor for manufacturers of high-precision metal components. Fluctuations in commodity prices directly affect production costs, influencing pricing decisions and profit margins. For instance, in 2024, the price of aluminum, a common material, varied significantly, impacting manufacturers. Companies need to manage these risks effectively. This includes hedging strategies or diversified sourcing.

- Aluminum prices in 2024 saw fluctuations, impacting manufacturing costs.

- Hedging and diversified sourcing are key risk management strategies.

- Commodity market volatility directly influences pricing and profitability.

Economic factors shape Albert Weber GmbH’s operational landscape. Global growth, projected at 3.2% in 2024 by IMF, fuels component demand, contrasting with potential downturns. Inflation, at 2.6% in the Eurozone as of May 2024, affects costs and profit. Interest rates, like the ECB’s 4.5% key rate in June 2024, impact borrowing and consumer spending.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Global Growth | Component demand | IMF: 3.2% growth |

| Inflation | Operational costs | Eurozone: 2.6% |

| Interest Rates | Borrowing Costs, Spending | ECB: 4.5% key rate (June) |

Sociological factors

Consumer vehicle preferences are shifting, impacting automotive component demand. Electric vehicles (EVs), autonomous driving, and shared mobility are rising. In 2024, EV sales grew, with a 14% market share in Europe. Albert Weber GmbH must adapt its offerings to align with these trends, e.g., battery components.

Albert Weber GmbH's success hinges on a skilled workforce. Currently, the manufacturing sector faces a skills gap. Data from 2024 shows a 10% increase in demand for skilled machinists. Labor costs are rising. In 2025, projections show a 5% increase in manufacturing wages.

Consumer attitudes increasingly favor sustainability, impacting purchasing choices. Ethical sourcing is crucial; companies must demonstrate responsibility. In 2024, 70% of consumers prefer sustainable brands. Albert Weber GmbH must adapt to these expectations. Failure may lead to decreased market share.

Urbanization and mobility trends

Urbanization and mobility trends are reshaping the automotive industry. As cities grow, demand for private vehicles could shift due to ride-sharing and public transit. This impacts component needs and overall vehicle demand. For example, global urban population is projected to reach 6.7 billion by 2050.

- Ride-sharing market is expected to reach $117.5 billion by 2025.

- Public transport usage saw an increase of 15% in major cities in 2023.

- EV adoption rates are rising in urban areas.

Corporate Social Responsibility (CSR) expectations

Albert Weber GmbH faces rising pressure to demonstrate Corporate Social Responsibility (CSR). This impacts its brand image and stakeholder relationships. Customers increasingly favor ethical companies; for example, 77% of consumers prefer brands committed to sustainability. Employee satisfaction also rises with CSR; companies with strong CSR see a 50% increase in employee engagement.

- Reputation: CSR boosts brand value.

- Customer Loyalty: Ethical practices drive sales.

- Employee Relations: CSR improves morale.

- Community Impact: Positive local engagement.

Sociological factors heavily influence Albert Weber GmbH. Shifting consumer preferences towards electric and sustainable options drive change; in 2024, sustainable brands saw 70% consumer preference. Urbanization and mobility trends reshape vehicle demand, as ride-sharing projected to reach $117.5B by 2025. Corporate Social Responsibility (CSR) is key; 77% favor ethical brands.

| Sociological Factor | Impact | 2024-2025 Data |

|---|---|---|

| Consumer Preferences | Demand for EVs & sustainable components. | EV market share: 14% in Europe (2024). |

| Urbanization | Alters vehicle demand & component needs. | Ride-sharing market: $117.5B (2025 projection). |

| CSR | Affects brand image and stakeholder relationships. | 77% consumers favor sustainable brands. |

Technological factors

Advancements in automotive manufacturing, like automation and robotics, are vital for Albert Weber GmbH. These innovations boost efficiency, quality, and reduce costs. By 2024, the automotive robotics market reached $12.5 billion, showing significant growth. Staying current with these technologies is key for competitiveness.

The automotive sector witnesses innovation in materials, impacting manufacturing. Lightweight and strong materials like carbon fiber and advanced polymers are emerging. In 2024, the global automotive composites market was valued at $7.4 billion.

Progress in electric vehicle (EV) tech significantly affects demand for traditional components. Albert Weber GmbH needs to adjust its product line, focusing on EV powertrain solutions. The global EV market is projected to reach $823.8 billion by 2030. Sales of EVs increased by over 30% in 2024.

Integration of artificial intelligence and data analytics

Albert Weber GmbH can leverage AI and data analytics to revolutionize its operations. Implementing these technologies in manufacturing processes, quality control, and supply chain management can boost efficiency. The global AI in manufacturing market is projected to reach $17.2 billion by 2025, growing at a CAGR of 26.5% from 2020. This will lead to better decision-making across the business.

- Enhanced Efficiency: AI-driven automation in manufacturing.

- Improved Quality: Real-time data analysis for quality control.

- Optimized Supply Chain: Predictive analytics to streamline logistics.

- Data-Driven Decisions: Enhanced insights for strategic planning.

Developments in connectivity and autonomous driving

The automotive industry is experiencing significant technological advancements. Increasing vehicle connectivity and the move towards autonomous driving are reshaping the demand for components. Albert Weber GmbH should assess how its precision metal components can adapt to these changes. The global autonomous vehicle market is projected to reach $65.3 billion by 2024. This presents both challenges and opportunities for the company.

- Growing demand for high-precision components.

- Opportunities in sensor and control systems.

- Need for investment in R&D.

- Potential for strategic partnerships.

Technological factors critically affect Albert Weber GmbH. Robotics in manufacturing boosts efficiency; the automotive robotics market was $12.5B in 2024. EV technology shifts demand; global EV market to $823.8B by 2030. AI and data analytics optimize operations, with the AI in manufacturing market projected at $17.2B by 2025.

| Technology | Market Size (2024) | Projected Market (2025/2030) |

|---|---|---|

| Automotive Robotics | $12.5 billion | N/A |

| Automotive Composites | $7.4 billion | N/A |

| Electric Vehicles (EV) | Sales increased by over 30% in 2024 | $823.8 billion by 2030 |

| AI in Manufacturing | N/A | $17.2 billion (by 2025) |

Legal factors

Product liability laws are crucial, especially in the automotive sector. Strict regulations demand high safety and quality for all components. Albert Weber GmbH must comply to avoid legal troubles. Failure could lead to recalls or lawsuits. In 2024, recalls cost the industry billions.

Albert Weber GmbH, like all manufacturers, faces stringent environmental regulations. Compliance with these regulations, covering manufacturing, waste, and emissions, is crucial. Non-compliance can lead to hefty fines, potentially impacting profitability. For 2024, environmental compliance costs averaged 8% of operational expenses for similar German firms.

Labor laws dictate working conditions, employee rights, and union relations, affecting Albert Weber GmbH's HR and costs. In Germany, the minimum wage is €12.41 per hour as of 2024, and this can influence wage structures. Union density in Germany is around 17%, impacting collective bargaining. Compliance with these laws is crucial for avoiding penalties and legal issues.

Intellectual property laws

Albert Weber GmbH must safeguard its innovations through patents and trademarks to stay ahead. Protecting its brand and unique products is crucial to ward off copycats. The company must also be careful not to infringe on others' intellectual property rights. Legal actions related to IP saw about 2,800 cases filed in Germany in 2024. This is important for Albert Weber GmbH.

- Patent filings in Germany increased by 1.5% in 2024.

- Trademark applications also rose by 2% in the same period.

- Infringement lawsuits can cost companies millions.

- Compliance with IP laws is essential.

Contract law and commercial regulations

Albert Weber GmbH's activities are subject to contract law and commercial regulations. Compliance in contracts with suppliers and customers is essential. In 2024, the average contract dispute cost for businesses was around $150,000. Adhering to these laws minimizes legal risks and maintains operational integrity. This ensures fair practices and safeguards against potential liabilities.

- Contract disputes can cost companies an average of $150,000.

- Commercial regulations ensure fair business practices.

- Compliance reduces legal risks and liabilities.

Legal factors shape Albert Weber GmbH's operational landscape. IP protection through patents and trademarks is critical, as patent filings in Germany rose by 1.5% in 2024. Adhering to contract and commercial laws minimizes legal risks; average dispute costs were ~$150,000. Compliance ensures fair business practices.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Product Liability | Safety & Quality Standards | Recalls cost billions |

| Environmental Regs | Compliance Costs | 8% of OPEX |

| Labor Laws | Wage and Rights | Min. Wage €12.41/hr |

| IP Protection | Brand Protection | Patent filings +1.5% |

| Contract Law | Operational Integrity | Dispute costs ~$150k |

Environmental factors

Stricter vehicle emission standards boost demand for cleaner engine parts and alternative powertrains. In 2024, the EU updated its Euro 7 emission standards, impacting vehicle manufacturers. Manufacturers must invest in emissions control to comply with regulations. For example, in 2023, the global market for catalytic converters reached $30 billion, reflecting the impact of emission standards.

Resource scarcity and material sustainability are critical. The rising demand for materials like lithium for batteries and rare earth elements poses challenges. For example, the global lithium market is projected to reach $9.8 billion by 2025. Companies are adopting sustainable practices. The circular economy is also gaining traction.

Waste management and recycling regulations are crucial for Albert Weber GmbH. The company must adhere to rules on byproducts disposal. Germany's recycling rate was about 67% in 2023, showing the importance of these practices. They must ensure proper handling and recycling. This directly affects production costs.

Climate change and its physical impacts

Climate change presents significant physical risks for Albert Weber GmbH, potentially disrupting operations. Extreme weather events, like floods and droughts, can damage facilities and halt production. According to the IPCC, global temperatures have already risen by approximately 1.1°C since the pre-industrial era. These events can also impact the supply chain, increasing costs and delaying deliveries. Companies like Albert Weber GmbH must assess climate-related risks to their business continuity.

- Increased frequency of extreme weather events.

- Potential for supply chain disruptions.

- Rising operational costs due to damage and mitigation efforts.

- Need for adaptation and resilience strategies.

Energy consumption and renewable energy adoption

Energy consumption significantly impacts Albert Weber GmbH's environmental footprint. Manufacturing processes often demand substantial energy, leading to emissions. Embracing renewable energy can cut costs and boost the firm's image. This shift aligns with global sustainability goals, enhancing competitiveness.

- In 2024, manufacturing accounted for roughly 25% of global energy use.

- Renewable energy's share in the EU's electricity mix reached 44% by the end of 2023.

- Companies adopting renewables often see a 10-20% reduction in energy expenses.

Emission standards and their compliance, particularly Euro 7 in 2024, mandate investment in emissions control tech, reflected in a $30B catalytic converter market in 2023. Scarcity of resources and need for material sustainability are crucial with lithium market projections reaching $9.8 billion by 2025, prompting sustainable practice adoption. Waste management, such as Germany's 67% recycling rate in 2023, affects costs and adherence, while climate change presents operational risks.

| Factor | Description | Impact |

|---|---|---|

| Emission Standards | Euro 7 (EU) impacts vehicle makers. | Compliance investment, boosts clean tech demand. |

| Resource Scarcity | Lithium for batteries; rare earth materials | $9.8B lithium mkt. by 2025; drive sustainability. |

| Waste Management | Compliance w/recycling rules (67% in Germany, '23). | Production costs, compliance adherence. |

PESTLE Analysis Data Sources

Albert Weber's PESTLE relies on governmental databases, market research firms, and industry-specific publications. This includes data from both global institutions and local regulatory bodies.