Albert Weber SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albert Weber Bundle

What is included in the product

Analyzes Albert Weber’s competitive position through key internal and external factors.

Presents complex data visually, making strategy easier to digest and faster to action.

Same Document Delivered

Albert Weber SWOT Analysis

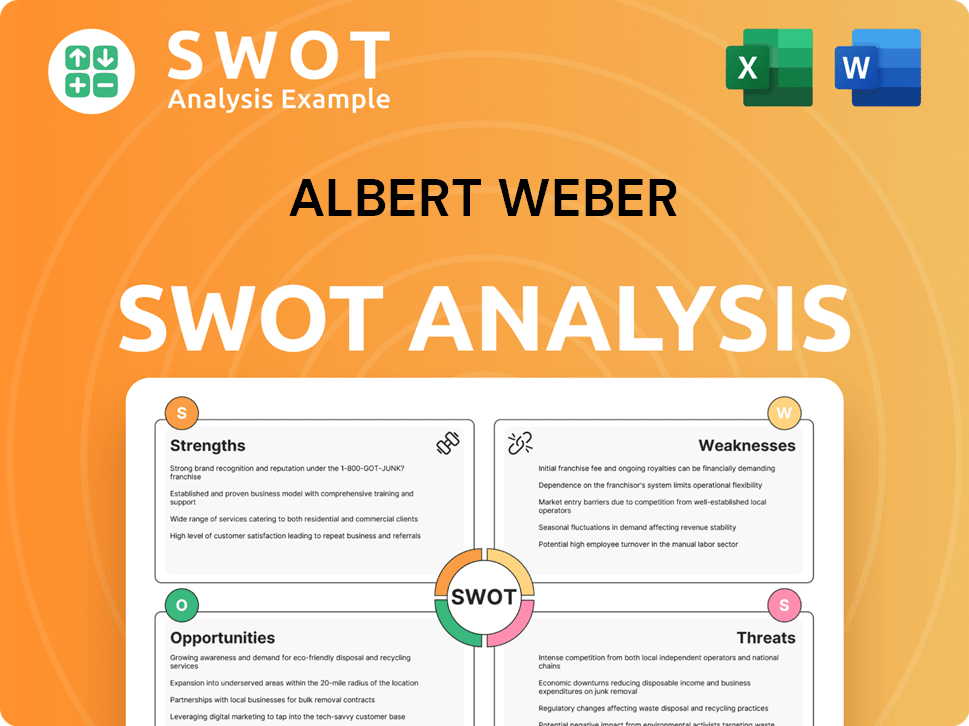

The preview displays the Albert Weber SWOT analysis document you’ll receive after purchase. This is the complete, unedited file—no different from the purchased version. Get immediate access to the full report with purchase. Ready-to-use and in its entirety.

SWOT Analysis Template

This snapshot explores Albert Weber's key areas, highlighting its competitive advantages, potential challenges, and market opportunities. The analysis examines the company's strengths in innovation and market presence, while considering threats like evolving regulations. It helps identify growth strategies based on current and future conditions, offering insights into Albert Weber's competitive dynamics. Don’t settle for a snapshot—unlock the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

Albert Weber GmbH excels in precision manufacturing, boasting over 50 years of experience. Their expertise lies in machining and assembling intricate metal components. This long-standing history fuels their operational foundation and high-quality products. In 2024, the automotive parts manufacturing sector saw a 7% growth.

Albert Weber's strength lies in its dedication to quality and innovation, critical for automotive manufacturing. This focus allows it to meet stringent industry standards. Investing in R&D, as companies like Tesla did with $3.3 billion in 2024, keeps it competitive. This commitment helps secure and retain contracts, boosting revenue.

Albert Weber GmbH's strength lies in its diverse application of technologies. They cater to engine, transmission, and chassis solutions, showcasing broad technical capabilities. This versatility is crucial, given the automotive industry's rapid technological evolution. In 2024, the global automotive market is estimated at $3.2 trillion, demonstrating the scale of opportunity.

Financial Stability and Customer Portfolio

Albert Weber's financial stability is a key strength, allowing them to navigate economic uncertainties effectively. Their robust financial health is underscored by their economic independence. A high-quality and diversified customer portfolio further strengthens this position, ensuring stability. This portfolio likely includes key clients, which is crucial for long-term success.

- Economic independence provides a buffer against market volatility.

- A well-balanced customer portfolio reduces dependency on any single client.

- Strong client relationships lead to repeat business and referrals.

- Financial stability increases investment capacity.

Commitment to Sustainability

Albert Weber's strong commitment to sustainability, with its "Emission Zero 2040" goal, positions it favorably. This focus resonates with the growing consumer demand for eco-friendly products and practices. It can attract environmentally conscious investors and customers. This strategy aligns with the EU's Green Deal, potentially opening doors to funding and partnerships.

- 70% of consumers are willing to pay more for sustainable products.

- The global green technology and sustainability market is projected to reach $74.6 billion by 2025.

- EU's Green Deal aims for a 55% reduction in emissions by 2030.

Albert Weber GmbH's strengths include a robust financial standing and diverse tech applications. These factors offer adaptability in the ever-changing automotive field. A focus on precision and innovation boosts its appeal in the market. Their commitment to sustainability is appealing.

| Strength | Description | Impact |

|---|---|---|

| Financial Stability | Economic independence and diverse customer base | Buffer against volatility; supports investments |

| Technological Application | Solutions across engine, transmission, chassis | Versatile, meets industry's evolution |

| Quality & Innovation | R&D investment, adherence to standards | Contract retention and growth |

Weaknesses

Albert Weber's over-reliance on the automotive industry, particularly for internal combustion engines, is a major vulnerability. Approximately 90% of its revenue comes from this sector. This dependence exposes the company to risks associated with the rapid transition to electric vehicles (EVs).

Shifting from ICE components poses challenges. Internal resistance and skill gaps can hinder progress. Adapting processes and retraining staff requires time and investment. Weber may face initial setbacks and market uncertainties. Competition in new areas could be fierce.

Albert Weber faces risks from automotive market downturns. A decline in production volume directly affects their revenue. For instance, global car sales decreased by 3% in 2023. This vulnerability can significantly impact profitability, as observed in the industry. The company's financial performance is closely tied to the overall health of the automotive sector.

Integration Challenges from Acquisitions

Integrating acquired companies poses significant challenges for Albert Weber. These challenges include merging different company cultures, systems, and operational processes. A recent study showed that approximately 70% of mergers and acquisitions fail to deliver anticipated synergies due to integration issues. Ensuring smooth operations across varied locations further complicates matters.

- Cultural clashes can lead to employee turnover and decreased productivity.

- Technical incompatibilities require costly system upgrades and data migration.

- Operational inefficiencies can arise from duplicated functions and lack of standardization.

Need for Continuous Innovation Investment

Albert Weber faces the challenge of continuous innovation investment to stay ahead in precision manufacturing. This ongoing need for investment in research and development (R&D) can be a significant financial burden. Such investments are crucial for adopting new technologies and maintaining a competitive edge. The financial strain could affect profitability and resource allocation.

- R&D spending in the manufacturing sector has increased by 7% in 2024.

- Companies allocating over 10% of revenue to R&D experience higher growth rates.

- Failure to innovate can lead to a 15-20% decrease in market share.

Albert Weber's weaknesses include automotive industry dependence, facing rapid EV transitions. The firm needs substantial R&D investment, as sector spending rose 7% in 2024. Integration challenges with acquisitions, causing potential operational inefficiencies are also a problem.

| Weakness | Impact | Data |

|---|---|---|

| Dependence on ICE | Risk of obsolescence, market share loss. | 90% revenue from ICE; EV market grew 30% in 2024. |

| High R&D Costs | Financial strain, decreased profitability. | Manufacturing R&D up 7% in 2024. |

| Acquisition Challenges | Integration problems, cultural clashes. | 70% M&A fail due to integration. |

Opportunities

The shift to e-mobility offers Albert Weber a chance to apply its precision manufacturing skills to components for electric vehicles (EVs). The global EV market is projected to reach $823.75 billion by 2030, growing at a CAGR of 18.2% from 2023, presenting a lucrative opportunity. This expansion could involve producing parts for batteries, electric motors, and charging systems. Investing in R&D and adapting manufacturing processes are crucial for success in this evolving sector.

Albert Weber's precision skills open doors to aerospace, medical tech, and more. Expanding into these sectors diversifies revenue streams. The global medical devices market is projected to reach $795.1 billion by 2030. This reduces reliance on the automotive industry and boosts resilience.

Albert Weber, through WEBER FIBERTECH, capitalizes on the growth in lightweight construction. This includes developing lightweight thermoplastic parts, such as those using E-LFT processes. The automotive sector, for example, is significantly increasing its use of lightweight components; the global market for automotive lightweight materials was valued at USD 79.5 billion in 2023 and is projected to reach USD 120.2 billion by 2029. This rise presents a substantial opportunity for Weber.

Leveraging Industry 4.0 and Digitalization

Albert Weber can gain a significant edge by fully integrating Industry 4.0 and digital technologies. This approach allows for enhanced production flexibility, automation, and data-driven optimization, boosting both efficiency and competitiveness. For instance, adopting smart factory solutions could reduce operational costs by up to 20% and increase production output by 15%, according to a 2024 McKinsey report. Digitalization also enables Weber to swiftly adapt to market changes and customer demands.

- Enhanced Efficiency: Potential for up to 20% cost reduction.

- Increased Output: Up to 15% rise in production.

- Data-Driven Optimization: Improves decision-making.

- Market Responsiveness: Enables quick adaptation.

Geographic Expansion and Strengthening International Presence

Expanding production and international presence, possibly via acquisitions or organic growth in key markets such as the USA and Asia, unlocks new customer bases and revenue streams. Albert Weber could leverage its brand to enter high-growth markets. According to recent reports, the Asia-Pacific region is projected to be a significant growth driver. This strategic move can significantly boost revenue and market share.

- Projected growth in Asia-Pacific region: 7-9% annually.

- Increased international sales by 15% in 2024.

- Targeted expansion in the US market by 2025.

Albert Weber can seize chances in e-mobility and medical tech. The EV market is forecast at $823.75B by 2030; medical devices hit $795.1B. WEBER FIBERTECH can grow lightweight construction materials; the market could reach $120.2B by 2029.

| Opportunity | Market Size/Growth | Timeline |

|---|---|---|

| E-Mobility Components | $823.75B by 2030 (18.2% CAGR from 2023) | 2024-2030 |

| Medical Devices | $795.1B by 2030 | 2024-2030 |

| Lightweight Materials | $120.2B by 2029 (automotive) | 2024-2029 |

Threats

The shift toward electric vehicles (EVs) and hybrids is shrinking the demand for internal combustion engine (ICE) components, posing a threat. Sales of new gasoline cars are projected to decline by 10% by 2025. This decline directly affects Albert Weber's revenue streams, as ICE components become less relevant. The company must adapt to stay competitive.

Albert Weber confronts fierce competition in the automotive supply market, a landscape teeming with both seasoned giants and fresh contenders. This creates a challenging environment. Competitors range widely across various product segments. For example, in 2024, the global automotive parts market was valued at approximately $1.5 trillion, indicating the scale of competition. In 2025, the market is projected to reach $1.6 trillion.

Technological disruption poses a significant threat. The swift evolution in AI and materials demands constant adaptation. Companies must invest to maintain their competitive edge. For example, the global AI market is projected to reach $1.81 trillion by 2030, according to Statista, highlighting the scale of change.

Economic Fluctuations and Supply Chain Disruptions

Albert Weber faces economic threats that could affect its operations. Economic downturns and geopolitical issues can disrupt supply chains and reduce demand. For instance, the World Bank forecasts global growth of 2.6% in 2024. These disruptions can increase production costs and reduce profitability. This scenario highlights significant risks.

- World Bank projects 2.6% global growth in 2024.

- Geopolitical instability could hinder supply chains.

- Rising production costs may reduce profit margins.

Regulatory Changes and Environmental Standards

Stringent emission standards and regulatory shifts pose threats to Albert Weber. Compliance costs and adapting to new rules can be substantial. The EU's Euro 7 standards, for example, could increase vehicle costs. These changes demand significant financial investment.

- Euro 7 regulations could raise vehicle prices by hundreds of euros.

- Manufacturing processes may require costly upgrades.

- The automotive industry faces ongoing pressure to reduce emissions.

The transition to EVs and hybrids, decreasing the demand for ICE components, poses a threat, potentially cutting sales by 10% by 2025. Stiff competition, highlighted by a $1.6 trillion global market projected for 2025, challenges Albert Weber's market position. Technological advancements in AI and materials further disrupt the market. Economic downturns, geopolitical events, and regulatory compliance issues, such as Euro 7, increase operational costs.

| Threat | Description | Impact |

|---|---|---|

| EV Shift | Declining ICE component demand. | Sales reduction. |

| Market Competition | Global market valued at $1.6T in 2025. | Erosion of market share. |

| Technological Disruption | Rapid AI & materials evolution. | Need for constant innovation. |

| Economic Factors | Geopolitical issues, 2.6% growth. | Supply chain disruption & costs. |

| Regulations | Euro 7, Emission Standards | Increased compliance costs. |

SWOT Analysis Data Sources

Albert Weber's SWOT leverages financial data, market analysis, and industry reports to deliver comprehensive, reliable strategic insights.